Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

GrumpyNooby

|

Nov 2 2020, 05:36 PM Nov 2 2020, 05:36 PM

|

|

Best Fixed Deposit Accounts In Malaysia (November)Monthly UpdateHere’s a roundup of this month’s updates to the best fixed deposit accounts in Malaysia. 1. Overall, Islamic FD products continue to offer higher interest rates compared to conventional FD products across the board. 2. Bank Rakyat offers the best rate for most FD products this month (3, 6, 9 and 12-month tenure). However, do take note that Bank Rakyat’s FD products are not protected by PIDM. 3. The highest interest rate recorded in this month’s round-up is 2.40% (Bank Rakyat; 12-month FD), whereas the lowest stood at 1.65% (Bank of China; 1-month FD) https://ringgitplus.com/en/blog/fixed-depos...e6kikB36PUueBuE

|

|

|

|

|

|

GrumpyNooby

|

Nov 3 2020, 10:58 AM Nov 3 2020, 10:58 AM

|

|

QUOTE(idoblu @ Nov 3 2020, 10:57 AM) Affin 12 months now 1.85% only 😢 OPR decision later in the afternoon 3pm. New campaign may be out tomorrow or coming few days. |

|

|

|

|

|

GrumpyNooby

|

Nov 3 2020, 03:06 PM Nov 3 2020, 03:06 PM

|

|

QUOTE(Human Nature @ Nov 3 2020, 03:04 PM) At its meeting today, the Monetary Policy Committee (MPC) of Bank Negara Malaysia decided to maintain the Overnight Policy Rate (OPR) at 1.75 percent.

https://www.bnm.gov.my/index.php?ch=en_pres...ac=5141&lang=enYou use what Internet Service Provider? I can't even load BNM portal since 3pm.  |

|

|

|

|

|

GrumpyNooby

|

Nov 3 2020, 03:08 PM Nov 3 2020, 03:08 PM

|

|

QUOTE(nexona88 @ Nov 3 2020, 03:06 PM) was thinking rate cut... good they maintain  next one I think got cut... to help the economy... Next MPC meeting will be next year January IIRC. This post has been edited by GrumpyNooby: Nov 3 2020, 03:10 PM |

|

|

|

|

|

GrumpyNooby

|

Nov 3 2020, 03:13 PM Nov 3 2020, 03:13 PM

|

|

QUOTE(dannyw @ Nov 3 2020, 03:11 PM) yes, hope bank will start new promo within this few days  My guess is that they just extend whatever campaign that has expired since few days ago. |

|

|

|

|

|

GrumpyNooby

|

Nov 4 2020, 07:17 AM Nov 4 2020, 07:17 AM

|

|

QUOTE(brian889 @ Nov 4 2020, 12:37 AM) Invest is High Pay Dividend Data center Reits Got example? |

|

|

|

|

|

GrumpyNooby

|

Nov 4 2020, 09:20 AM Nov 4 2020, 09:20 AM

|

|

QUOTE(David_Yang @ Nov 3 2020, 04:38 PM) Phew, thank god ... So I think we just need to survive the January meeting and then for the rest of 2021 it should go in the right direction. Here´s the list of nailbiting days 2021  MPC Meeting No 19 and 20 January 2021 (Tuesday and Wednesday) 3 and 4 March 2021 (Wednesday and Thursday) 5 and 6 May 2021 (Wednesday and Thursday) 7 and 8 July 2021 (Wednesday and Thursday) 8 and 9 September 2021 (Wednesday and Thursday) 2 and 3 November 2021 (Tuesday and Wednesday) KUALA LUMPUR (Nov 4): Economists say it is likely that Bank Negara Malaysia (BNM) will not be cutting the overnight policy rate (OPR) throughout 2021, following the central bank's decision yesterday to keep the policy rate at 1.75%. The decision came as no surprise, as economists had largely expected no cut in the November Monetary Policy Committee (MPC) meeting — its last for the year — since the key rate had been cut by 125 basis points (bps) already over the first four meetings this year. https://www.theedgemarkets.com/article/bnm-...ts-till-end2021 |

|

|

|

|

|

GrumpyNooby

|

Nov 4 2020, 06:20 PM Nov 4 2020, 06:20 PM

|

|

QUOTE(David_Yang @ Nov 4 2020, 05:46 PM) For me it is time for short term. I don´t care so much if it is 2.20, 2.30 or even 2.50, I want to have the money available when we go back to FD party mode. So after the last 1y 2.45% Affin FD i just keep spare cash in the high yield savings accounts. Agreed with you! |

|

|

|

|

|

GrumpyNooby

|

Nov 4 2020, 09:21 PM Nov 4 2020, 09:21 PM

|

|

QUOTE(mamamia @ Nov 4 2020, 09:15 PM) For the board rate, is it on tier basis? Mean first 5k is 0.25%, balance is 0.75%? The campaign ends 31/12/2020 4.6 After the Campaign Period, no Bonus Rate will be awarded to the Eligible Customer and the prevailing board rate shall apply. Board/Base Rate: Up to RM5,000 -> 0.25% Above RM5,000 -> 0.75% https://www.ambank.com.my/ambank/SiteAssets...CampaignTnC.pdf |

|

|

|

|

|

GrumpyNooby

|

Nov 4 2020, 09:30 PM Nov 4 2020, 09:30 PM

|

|

QUOTE(mamamia @ Nov 4 2020, 09:25 PM) Ya, bcoz the tnc example didn’t mentioned about the board rate .. so, my understanding is like the bonus interest is only 1% + 0.5% (exclude invest bonus interest), so the effective rate with the tier board rate is less than 2.25%.. n the campaign ending soon.. wonder it will extend For merely 2.25% just to open a new account with few conditions to fulfill, rather just save the time and effort to dump into PB eFD for 2.2% with 3m tenure. This post has been edited by GrumpyNooby: Nov 4 2020, 09:30 PM |

|

|

|

|

|

GrumpyNooby

|

Nov 5 2020, 07:07 AM Nov 5 2020, 07:07 AM

|

|

QUOTE(sweetpea123 @ Nov 5 2020, 02:30 AM) TnC : The maximum deposit amount per transaction via FPX transfer is Ringgit Malaysia Two Hundred Thousand (RM200,000), subject to such prescribed maximum amount/limit of transfer in the Entitled Customers’ individual internet banking maintained with the relevant bank Which bank will allow 200k FPX transfer in 1 transaction oh????  I think FPX limit for PBe is RM 100k  This post has been edited by GrumpyNooby: Nov 5 2020, 07:41 AM This post has been edited by GrumpyNooby: Nov 5 2020, 07:41 AM |

|

|

|

|

|

GrumpyNooby

|

Nov 5 2020, 09:36 AM Nov 5 2020, 09:36 AM

|

|

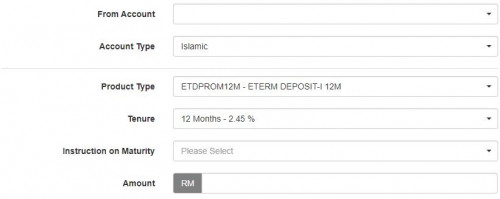

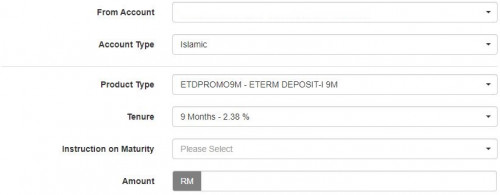

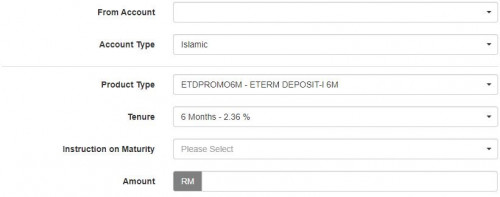

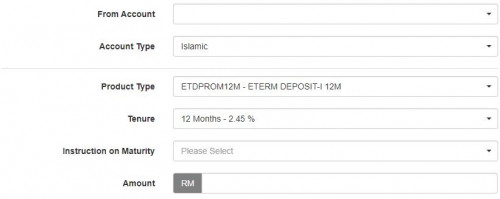

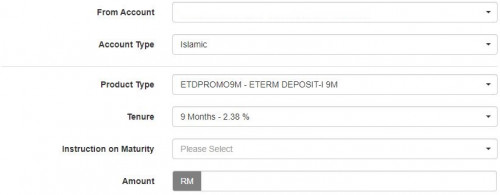

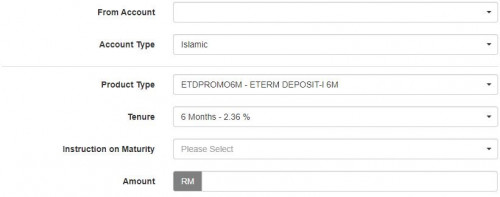

Affin eFD is back (same as previous expired campaign):    QUOTE eFD/eTD-i Campaign

Promotion Period: 5 November 2020 to 31 December 2020

Promotional Rate:

a) 6 months - 2.36% p.a.

b) 9 months - 2.38% p.a.

c) 12 months - 2.45% p.a.

Minimum Placement Amount For Each Certificate RM10,000

Maximum Placement Amount For Each Certificate RM200,000 Poster and T&C are not out yet. This post has been edited by GrumpyNooby: Nov 10 2020, 08:08 PM |

|

|

|

|

|

GrumpyNooby

|

Nov 5 2020, 08:56 PM Nov 5 2020, 08:56 PM

|

|

QUOTE(ANDY66888 @ Nov 5 2020, 08:41 PM) Today i went to CIMB , they said preferred customer can get 2.40% for three month and six month now. HLB sent me whatapp , Priority van get *HONG LEONG FD PROMOTION 4/11/2020 to 31/12/2020* <FD rates> 3months @ 2.5%pa (earmark 3 months, 10% of FD placement amount)

6months @ 2.5%pa (earmark 6 months, 10% of FD placement amount)

<FD without earmark> 3months @ 2.05%pa

6months @ 2.1%pa** Strictly FRESH FUNDS for both conventional and Islamic FD How is the better than eFD rate for non-priority banking rate?  QUOTE(cybpsych @ Nov 4 2020, 06:15 PM)  Save and grow your money with convenient eFixed Deposit-i placements online Save and grow your money with convenient eFixed Deposit-i placements online [ HLB | T&Cs ] 04 NOVEMBER 2020-31 DECEMBER 20203 months @ 2.30% p.a.

6 months @ 2.35% p.a.12 months @ 2.25% p.a. FPX Transfer | Min placement: RM10,000 | Max placement: RM2,000,000 |

|

|

|

|

|

GrumpyNooby

|

Nov 6 2020, 11:13 AM Nov 6 2020, 11:13 AM

|

|

QUOTE(gsc @ Nov 6 2020, 11:11 AM) This one for priority banking customers only? |

|

|

|

|

|

GrumpyNooby

|

Nov 9 2020, 01:25 PM Nov 9 2020, 01:25 PM

|

|

QUOTE(tank82 @ Nov 9 2020, 01:24 PM) cannot find the promotion option yes, only have no. Is it for islamic account only? The Promotion is open to individuals who are the accountholders of a Hong Leong Bank (HLB) Current or Savings Account/HLISB Current or Savings Account-i (“CASA/CASA-i”) and have registered for Hong Leong Connect prior to or during the Promotion Period (“Customers”). The Customers are eligible to open and operate an Online Fixed Deposit-i (“eFD-i”) account (“eFD-i Account”) via their Hong Leong Connect. For the avoidance of doubt, joint CASA/CASA-i holders are NOT eligible to open or operate an eFD-i Account and are NOT eligible to participate in the Promotion |

|

|

|

|

|

GrumpyNooby

|

Nov 9 2020, 03:50 PM Nov 9 2020, 03:50 PM

|

|

QUOTE(legendgod @ Nov 9 2020, 03:48 PM) Noob question What does fresh funds mean? Funds from other financial institution. |

|

|

|

|

|

GrumpyNooby

|

Nov 11 2020, 01:19 PM Nov 11 2020, 01:19 PM

|

|

|

|

|

|

|

|

GrumpyNooby

|

Nov 11 2020, 04:53 PM Nov 11 2020, 04:53 PM

|

|

QUOTE(rocketm @ Nov 11 2020, 04:52 PM) When I want to place online FD in Hong Leong bank via FPX from RHB bank. I need to check which bank FPX limit? Outgoing bank which is RHB. |

|

|

|

|

|

GrumpyNooby

|

Nov 13 2020, 11:18 AM Nov 13 2020, 11:18 AM

|

|

I'm at UOB now:

OTC FD: 9m @ 2.35% pa

*FF needed

This post has been edited by GrumpyNooby: Nov 13 2020, 05:30 PM

|

|

|

|

|

|

GrumpyNooby

|

Nov 13 2020, 02:17 PM Nov 13 2020, 02:17 PM

|

|

QUOTE(gsc @ Nov 13 2020, 02:12 PM) Didn't know UOB closes at 2pm..... They had mentioned it in PIB QUOTE Revised branch operational hoursUpdated 9 November 2020 As part of the recent Conditional Movement Control Order (CMCO), we have revised the operational hours for our branches nationwide except for those in the states of Pahang, Kelantan and Sarawak, effective 10 November 2020 until further notice. These branches will operate between 9.30 am and 2.00 pm, Monday to Friday, with their self-service banking (SSB) facilities available from 6.00 am to 6.00 pm daily. The branches listed below will be opened as usual from 9.30 am to 4.00 pm, Monday to Friday, with their SSB facilities available from 6.00 am to 12.00 midnight daily. https://www.uob.com.my/default/covid-update...e#announcements |

|

|

|

|

Nov 2 2020, 05:36 PM

Nov 2 2020, 05:36 PM

Quote

Quote

0.0738sec

0.0738sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled