Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Oct 1 2020, 07:43 AM Oct 1 2020, 07:43 AM

Return to original view | Post

#441

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Oct 1 2020, 10:56 AM Oct 1 2020, 10:56 AM

Return to original view | Post

#442

|

All Stars

12,387 posts Joined: Feb 2020 |

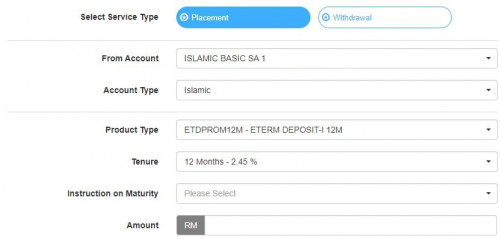

Affin updated the eFD campaign:

Promotion Rate: 5 months @ 2.35% 9 months @ 2.38% 12 months @ 2.45% Promotion Period: 1 October to 15 October 2020 Minimum Placement Amount For Each Certificate RM10,000 Maximum Placement Amount For Each Certificate RM200,000 Click here for full Terms and Conditions. https://www.affinonline.com/AFFINONLINE/med...paignTnCEng.pdf Terms and Conditions apply. |

|

|

Oct 1 2020, 12:37 PM Oct 1 2020, 12:37 PM

Return to original view | IPv6 | Post

#443

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 1 2020, 01:37 PM Oct 1 2020, 01:37 PM

Return to original view | Post

#444

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(GrumpyDiver @ Oct 1 2020, 01:34 PM) 2% for PB e-FD (with FPX). GrumpyDiver liked this post

|

|

|

Oct 1 2020, 01:50 PM Oct 1 2020, 01:50 PM

Return to original view | Post

#445

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 1 2020, 01:53 PM Oct 1 2020, 01:53 PM

Return to original view | Post

#446

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Oct 1 2020, 02:01 PM Oct 1 2020, 02:01 PM

Return to original view | Post

#447

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 2 2020, 09:55 AM Oct 2 2020, 09:55 AM

Return to original view | Post

#448

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(rocketm @ Oct 2 2020, 12:59 AM) I think CIMB online fd rate drop already 2.25% for 12m is similar to last month previous campaign right?https://www.cimbclicks.com.my/efd-oct20.htm...0October%202020 cimb efd (01.10.20-03.11.20) 3 mth - 2.10% 6 mth - 2.20% 12 mth - 2.25% |

|

|

Oct 4 2020, 08:33 AM Oct 4 2020, 08:33 AM

Return to original view | IPv6 | Post

#449

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 4 2020, 09:41 AM Oct 4 2020, 09:41 AM

Return to original view | IPv6 | Post

#450

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Neontetra @ Oct 4 2020, 09:36 AM) Thanks Grumpy. Sorry stupid question as i have been based in Australia for the last 15 years and very unfamiliar with Msia Banking products at all. It's just term deposit for Islamic banking arm.https://www.rhbgroup.com/245/index.html Is this for everyone with new funds? or Murabahah means for Muslims only? Thanks. No necessary means that only Muslim can open such account. |

|

|

Oct 6 2020, 09:58 AM Oct 6 2020, 09:58 AM

Return to original view | Post

#451

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 7 2020, 04:20 PM Oct 7 2020, 04:20 PM

Return to original view | IPv6 | Post

#452

|

All Stars

12,387 posts Joined: Feb 2020 |

[SHARING]Are you using fixed deposits properly?

Article link: https://www.stashaway.my/r/using-fixed-depo...DlHUcKsMux99h6o |

|

|

Oct 8 2020, 10:26 AM Oct 8 2020, 10:26 AM

Return to original view | Post

#453

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(chiwawa10 @ Oct 7 2020, 10:59 PM) QUOTE(BoomChaCha @ Oct 8 2020, 10:21 AM) Terms and conditions apply.1. Fresh funds required. Fresh funds are defined as funds from a third party bank which means any licensed bank in Malaysia, other than OCBC Bank and OCBC Al-Amin, which are deposited or transferred into an Eligible Customer’s account with OCBC Bank or OCBC Al-Amin, not more than 7 days from the date of participation in this Promotion. 2. Placement of the Fixed Deposit/-i under this Premier Deal shall be made one month from the application for OCBC Premier Banking membership and is valid for a one-time placement only. 3. The interest/profit payment will be credited monthly into your Premier Booster Account/-i. You will therefore need to have an active Premier Booster Account/-i for as long as you maintain theFixed Deposit/-i placement. 4. The funds deposited into the Premier Booster Account/-i will be earmarked for the duration of the Fixed Deposit/-i tenure, i.e. 3 months from the Fixed Deposit/-i placement date. The earmarking shall automatically cease upon maturity of the 3-month Fixed Deposit/-i tenure, or upon withdrawal of the Fixed Deposit/-i placement. 5. The minimum balance of RM20 must be maintained in the account.. https://www.ocbc.com.my/personal-banking/pr...tion/index.html BoomChaCha liked this post

|

|

|

|

|

|

Oct 9 2020, 05:43 PM Oct 9 2020, 05:43 PM

Return to original view | IPv6 | Post

#454

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Kyan0411 @ Oct 9 2020, 05:42 PM) This is pathetic. Guess HLB no longer hunting for funds to grow loan amid slow loan growth in the industry. HLB has been hunting funds for past years with higher rates than peers It is still higher than board rate right?https://www.hlb.com.my/en/personal-banking/...ed-deposit.html |

|

|

Oct 9 2020, 05:53 PM Oct 9 2020, 05:53 PM

Return to original view | IPv6 | Post

#455

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 9 2020, 11:17 PM Oct 9 2020, 11:17 PM

Return to original view | IPv6 | Post

#456

|

All Stars

12,387 posts Joined: Feb 2020 |

#SaveMoneyWithHann: Saving Smart While Interest Rates (and OPR) Are Low

It’s been a while since I’ve posted, but it’s been a busy time here at RinggitPlus. We’ve got a few really exciting things going on, namely the launch of myRinggitHealth as well as our annual RinggitPlus Malaysian Financial Literacy Survey 2020 (if you haven’t done the survey, please do so. It will help us get a sense of how things are going financially with Malaysians, this is especially important this year!) In recent weeks, I’ve been asked this important question in various forms, which is “Hey Hann, now that BNM’s OPR is so low (1.75% at the time of writing), how should I best save my money? Are fixed deposit (FD) accounts still good?” https://ringgitplus.com/en/blog/save-money-...FPVLKegAJgcNL4Y |

|

|

Oct 12 2020, 12:32 PM Oct 12 2020, 12:32 PM

Return to original view | Post

#457

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 14 2020, 03:07 PM Oct 14 2020, 03:07 PM

Return to original view | Post

#458

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(chinkw1 @ Oct 14 2020, 03:05 PM) oh, next Monday I go Affin Bank, 2.45% is quite OK for now. But this promo rate is ending tomorrow (15/10/2020) unless they extend it.This post has been edited by GrumpyNooby: Oct 14 2020, 03:07 PM chinkw1 liked this post

|

|

|

Oct 15 2020, 10:02 AM Oct 15 2020, 10:02 AM

Return to original view | Post

#459

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE RM0.00 StanChart: Talk to us now on how to earn up to 4.8% p.a. on your FD/TD-i. Offer ends 31 Oct 2020. T&C apply. https://bit.ly/34QglyM |

|

|

Oct 16 2020, 08:06 AM Oct 16 2020, 08:06 AM

Return to original view | Post

#460

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(kelsem @ Oct 16 2020, 08:03 AM) https://ringgitplus.com/en/savings-account/...filter=Citibank It is still available at Citibank Malaysia portal:Hi, Does anyone know anything about this Citibank AcceleRate Saving account? Is it still ongoing? Thanks https://www.citibank.com.my/english/deposit...SavingsAccounts Yes, it still available! |

| Change to: |  0.0525sec 0.0525sec

0.82 0.82

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 02:21 PM |