Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

CommodoreAmiga

|

May 19 2023, 10:51 AM May 19 2023, 10:51 AM

|

|

QUOTE(weidasdnbhd @ May 19 2023, 10:36 AM) Hi, So do you mean you have SA with BI, you just transfer fund from another bank to BI, and you go to BI to place a FD at 4.5% without bringing any cash or cheque as the fund was deducted from your SA? Yes. That's what i do for most banks including BI. |

|

|

|

|

|

CommodoreAmiga

|

May 19 2023, 01:12 PM May 19 2023, 01:12 PM

|

|

QUOTE(sirius2017 @ May 19 2023, 12:15 PM) Yes, the fund was deduct from my SA account. My fund was transferred in to my SA on the SAME day as the FD placement. It was specified in their Terms and Conditions for this promotion for the fund to be consider "fresh fund". BI TDT Extra Campaign Term & Condition Bro, the fresh fund definition is 14 days from creditting, not same day. Vege also not stale so fast mah...just put in fridge....still fresh....lol. But it says Debit Account needs to be same day....what is Debit Account???  This post has been edited by CommodoreAmiga: May 19 2023, 01:14 PM This post has been edited by CommodoreAmiga: May 19 2023, 01:14 PM |

|

|

|

|

|

CommodoreAmiga

|

May 20 2023, 07:55 PM May 20 2023, 07:55 PM

|

|

QUOTE(datolee32 @ May 20 2023, 07:41 PM) Hey all sifus, sorry out of topic. The MBSB FD interest is quite attractive, I have bank Islam account but currently not in Malaysia. A quick question, can I open MBSB account online as I am staying at overseas currently? If yes, what type of account you will suggest to minimize the annual fee? Cannot. Last last have to go there open account and make FD OTC. |

|

|

|

|

|

CommodoreAmiga

|

May 21 2023, 07:20 PM May 21 2023, 07:20 PM

|

|

QUOTE(ronnie @ May 21 2023, 03:22 PM) DuitNow can do over the counter ? Is it free ? Any limit per day ? Duitnow is online...anytime. You can sit in the bank, do your transfer on your phone, then go to counter do OTC FD...that what I did sometimes...lol |

|

|

|

|

|

CommodoreAmiga

|

May 22 2023, 06:30 PM May 22 2023, 06:30 PM

|

|

QUOTE(X_hunter @ May 22 2023, 04:26 PM) don't have SA can place FD? I thought must open SA only can? Because I went today but their system got problem so can't do anything. No need. System down, so can't make FD lor. |

|

|

|

|

|

CommodoreAmiga

|

May 24 2023, 10:22 AM May 24 2023, 10:22 AM

|

|

QUOTE(McMatt @ May 24 2023, 09:09 AM) I can never fathom why an ATM card is necessary for activating online banking. I find it absurd and a way just for banks to make money. And the annual fee is like I'm paying to use their online services. Pfftttt! Some banks have Basic SA account which is free. Someone posted that actually all Banks suppose to provide this as required by Bank Negara but they diam diam don't tell customer this option. For example, my CIMB SA Basic no fees. |

|

|

|

|

|

CommodoreAmiga

|

May 24 2023, 11:08 AM May 24 2023, 11:08 AM

|

|

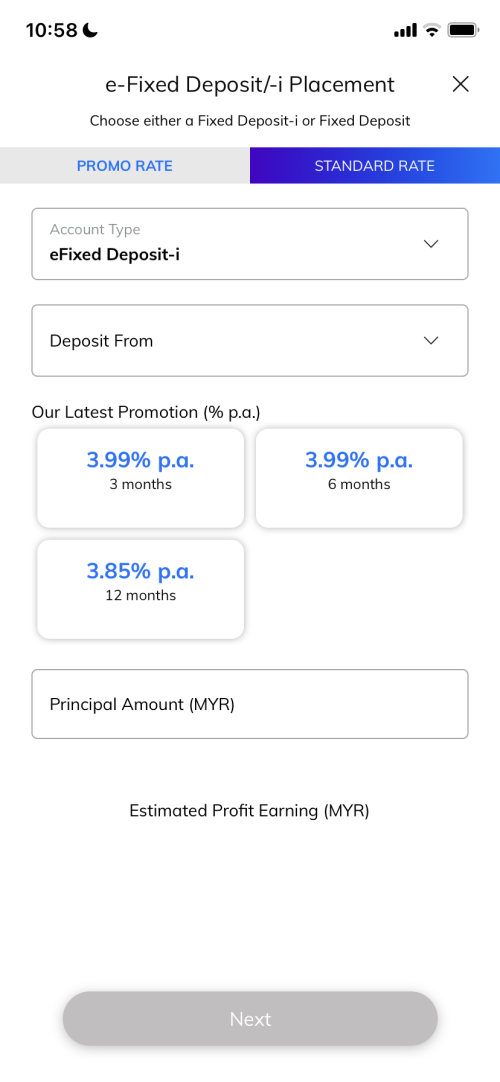

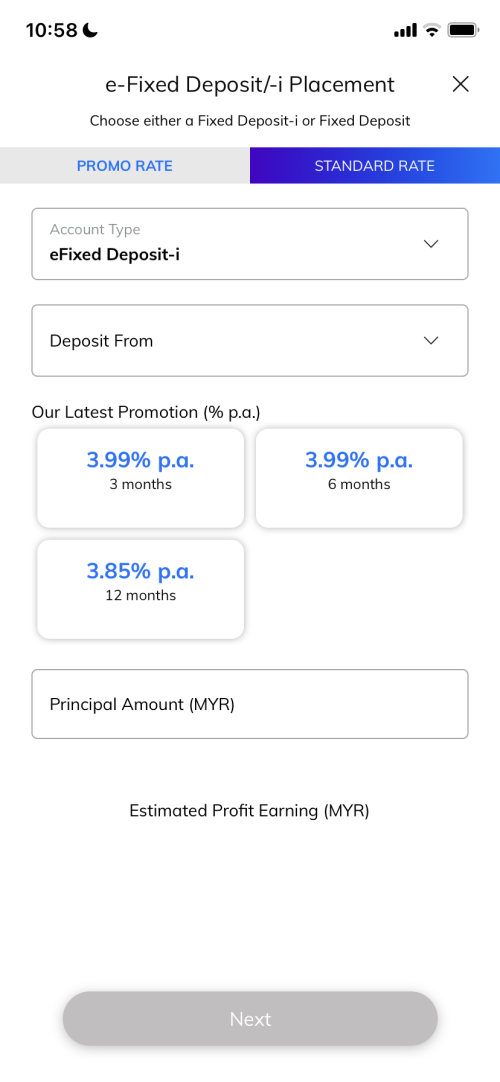

QUOTE(bcombat @ May 24 2023, 10:59 AM) HLB e-FD  so kiasu...0.01% also no gip to make it 4% definitely more attractive. |

|

|

|

|

|

CommodoreAmiga

|

May 24 2023, 01:27 PM May 24 2023, 01:27 PM

|

|

QUOTE(harmonics3 @ May 24 2023, 12:49 PM) I got basic CIMB SA with free debit card required for internet banking, but they disable withdrawal function so practically no use. I only use for internet banking, no need to use for ATM. |

|

|

|

|

|

CommodoreAmiga

|

May 24 2023, 08:02 PM May 24 2023, 08:02 PM

|

|

QUOTE(download88 @ May 24 2023, 07:39 PM) Until further notice as informed by the branch manager 3m - 3.9% 6m - 4.00% 12m - 4.30% 15m - 4.35% MBSB? Lots of us here got auto renew 6 mths for 4.25% just last week....Loyalty promo rates???  This post has been edited by CommodoreAmiga: May 24 2023, 08:02 PM This post has been edited by CommodoreAmiga: May 24 2023, 08:02 PM |

|

|

|

|

|

CommodoreAmiga

|

May 24 2023, 09:02 PM May 24 2023, 09:02 PM

|

|

QUOTE(nexona88 @ May 24 2023, 08:17 PM) Huh? 6m only 4%??? Those auto-renew gotten 4.25% Good luck attracting new $$$ Existing customers might keep 🙏 Next round auto renew 4.5%....🙏🙏🙏 |

|

|

|

|

|

CommodoreAmiga

|

May 25 2023, 08:39 AM May 25 2023, 08:39 AM

|

|

QUOTE(virtualgay @ May 25 2023, 08:35 AM) i never faham economics topic why FD rate higher can attract foreign investor? Imagine if Singapore FD rates now is 10%. Confirmed everyone here will take their money and run there. |

|

|

|

|

|

CommodoreAmiga

|

May 25 2023, 08:59 AM May 25 2023, 08:59 AM

|

|

QUOTE(ManutdGiggs @ May 25 2023, 08:44 AM) Singapore FD rate soften also for the past 2 mths from 4.0 to 3.5. GBP FD also down from 5.4 to 4.8 to now 4.3. USD FD stil at 4.8 eventhough soften also. All the above are average ya from few banks. Whatever the local FD is very disappointing. I know. I am just giving an example to the other poster who's asking the questions of FD rates in relation to foreign investors. |

|

|

|

|

|

CommodoreAmiga

|

May 25 2023, 12:24 PM May 25 2023, 12:24 PM

|

|

QUOTE(paramdav @ May 25 2023, 12:21 PM) Hi All With MBSB, they renew the FD at 4.25% for 6 mths but when I am trying to do a new FD online with the bank it only shows 3.2% Anyone tried doing eFD and got 4.25% for 6 mths?  AFAIK, promo rates only OTC. |

|

|

|

|

|

CommodoreAmiga

|

Jun 4 2023, 11:51 AM Jun 4 2023, 11:51 AM

|

|

QUOTE(nexona88 @ Jun 4 2023, 09:42 AM) Maybank? 5.3% Yeah right.... They the one always give lowest rate in market.... Probably it's 4.3% or just 3.3% 😄 If Maybank gives real flat 5.3%, pigs can not only fly but go intergalatic warp travel already. |

|

|

|

|

|

CommodoreAmiga

|

Jun 4 2023, 03:50 PM Jun 4 2023, 03:50 PM

|

|

QUOTE(nexona88 @ Jun 4 2023, 02:44 PM) If the rate like 4.3% Probably it's correct but 5.3% is wayyyy over & higher..... Than rest of the banks... They not doing charity 😁 Those did the placement.... Wish good luck on claiming the 5.3% 🤞 Saw like 3.x% earliar. No way Maybank will give over 4%. It's against the law of nature. |

|

|

|

|

|

CommodoreAmiga

|

Jun 5 2023, 01:47 PM Jun 5 2023, 01:47 PM

|

|

QUOTE(samsungXP @ Jun 5 2023, 10:11 AM) u mean if i put 1 month then only 26 days i take back then no interest at all ? If 1 mth, why don't go for KDI Save or similar? |

|

|

|

|

|

CommodoreAmiga

|

Jun 6 2023, 11:26 AM Jun 6 2023, 11:26 AM

|

|

QUOTE(ALEX_L1M @ Jun 6 2023, 10:59 AM) Hi guys, The BI 4.5% for 12 months FD, is it safe to put more than 250k as PIDM only protected up to 250k. First time use BI, so feel a bit insecure. Anyone put more than 250k? If scare don't put lah more than RM250k, what so susah. Nobody can guarantee you anything. |

|

|

|

|

|

CommodoreAmiga

|

Jun 6 2023, 12:47 PM Jun 6 2023, 12:47 PM

|

|

QUOTE(fabu8238 @ Jun 6 2023, 12:15 PM) Report to members: my online FD placement by FPX in MBB for 7 months failed to be reflected in MBB. Funds already debited by paying bank in FPX but MBB REPORT INSUFFICIENT FUNDS AND TRANSACTION FAILED. Again another MBB fiasco Wow. Did you call them to check? Money disappeared into Cyber space? Usually if FPX insufficient fund, sender bank will prevent already. Do you mean sent successful but received failed?? This is first time I hear....  Transaction failed at FPX sender bank should not be debitted. Can't trust Harimau bank.... This post has been edited by CommodoreAmiga: Jun 6 2023, 12:48 PM |

|

|

|

|

|

CommodoreAmiga

|

Jun 6 2023, 01:15 PM Jun 6 2023, 01:15 PM

|

|

QUOTE(fabu8238 @ Jun 6 2023, 12:52 PM) Called and reported alrdy. Same fiasco as last MBB promo. Don't trust them again Also, previously they don't show you the rates before you place FDs also. Only show rates AFTER you have deposited FDs....sneaky as hell. But recently I checked again, they have finally put a small link to show the rates, obviously after too many complaints. Will never place another FD with Maybank (and Bank Mualamat) again. Their rates sucks most of the time anyway. This post has been edited by CommodoreAmiga: Jun 6 2023, 01:16 PM |

|

|

|

|

|

CommodoreAmiga

|

Jun 6 2023, 04:50 PM Jun 6 2023, 04:50 PM

|

|

QUOTE(AVFAN @ Jun 6 2023, 04:34 PM) CIMB reduced FD rates! eFD/eFRIA-i Tenure Campaign Rates (% p.a.) before 6 June 2023 New Campaign Rates (% p.a.) effective 6 June 2023 to 10 July 2023 Minimum Deposit Placement Amount Three (3) Months 3.58% p.a. 3.53% p.a. RM1,000 Six (6) Months 3.88% p.a. 3.83% p.a. RM1,000 Twelve (12) Months 3.95% p.a. 3.90% p.a. RM1,000 https://www.cimb.com.my/en/personal/promoti...fd-efria-i.htmlCina,India,Melayu,Bangla all kena conned.  |

|

|

|

|

May 19 2023, 10:51 AM

May 19 2023, 10:51 AM

Quote

Quote

0.0568sec

0.0568sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled