QUOTE(kit2 @ Sep 1 2020, 04:16 PM)

Extension of CIMB e-FD as per rate shown in the picture.I had placed one e-FD this morning.

All links were still working perfectly this morning.

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Sep 1 2020, 04:20 PM Sep 1 2020, 04:20 PM

Return to original view | IPv6 | Post

#401

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Sep 1 2020, 04:25 PM Sep 1 2020, 04:25 PM

Return to original view | IPv6 | Post

#402

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 1 2020, 08:34 PM Sep 1 2020, 08:34 PM

Return to original view | IPv6 | Post

#403

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 2 2020, 12:46 PM Sep 2 2020, 12:46 PM

Return to original view | Post

#404

|

All Stars

12,387 posts Joined: Feb 2020 |

Best Fixed Deposit Promos – September 2020

Monthly Update Here’s a roundup of this month’s updates to the best fixed deposit accounts in Malaysia. 1. Overall, Islamic FD products continue to offer higher interest rates compared to conventional FD products across the board. 2. Kuwait Finance House continues to offer the best rate for FD products with a 12-month tenure. 3. The lowest interest rate recorded in this month’s round-up is 1.70% (Bank of Nova Scotia; 1-month FD). Article link: https://ringgitplus.com/en/blog/fixed-depos...9H2isdYROTsD2nQ |

|

|

Sep 3 2020, 12:19 PM Sep 3 2020, 12:19 PM

Return to original view | Post

#405

|

All Stars

12,387 posts Joined: Feb 2020 |

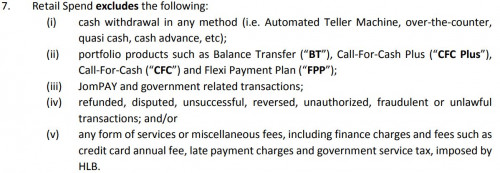

QUOTE(cklimm @ Sep 3 2020, 12:09 PM) It should be eligible based on (7) in T&C: T&C link: https://www.hlb.com.my/content/dam/hlb/my/d...-pledge-tnc.pdf |

|

|

Sep 3 2020, 01:49 PM Sep 3 2020, 01:49 PM

Return to original view | Post

#406

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Sep 3 2020, 03:37 PM Sep 3 2020, 03:37 PM

Return to original view | Post

#407

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(??!! @ Sep 3 2020, 03:35 PM) Don't know if the officer BS me or not. This campaign needs too much efforts.According to her, the FD pledge amount must match the one enjoying the promo rate...ie tak boleh pledge a 3k FD for CC and place another 50k FD with promo rate. 10% Cashback is FCFS , max RM100x3mths For all the pusing-pusing kerja and the lower effective rate, better just park with Affin 2.5%/2.48% . I'll pass! |

|

|

Sep 3 2020, 03:40 PM Sep 3 2020, 03:40 PM

Return to original view | Post

#408

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 3 2020, 04:15 PM Sep 3 2020, 04:15 PM

Return to original view | IPv6 | Post

#409

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(gchowyh @ Sep 3 2020, 04:01 PM) I have a tip, try using cimbclicks mobile app, somehow is still able to go in even though the web site was down. It's rather infuriating as CIMBClicks downtime rather frequent.I was also initially scared that I did not get any notification after transferring some funds to my Cimb account but the funds were there and I was also able to pay my credit card thru the app. Well, they did propose to use Clicks app:  |

|

|

Sep 6 2020, 08:10 PM Sep 6 2020, 08:10 PM

Return to original view | IPv6 | Post

#410

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 7 2020, 08:41 AM Sep 7 2020, 08:41 AM

Return to original view | Post

#411

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(chiwawa10 @ Sep 7 2020, 08:29 AM) How about Bank Rakyat? I remember their FD promo is quite attractive. Although theirs is not protected by PIDM, but they have strong backup. Shouldn't be a problem. BR promo just ended before National's Day.Here's the latest OTC rate: QUOTE(gchowyh @ Sep 6 2020, 02:51 PM) Summary so far (guess will be valid till the next MPC meeting on 10 Sept) : BR otc: 12 mths 2.30% 12 mths 2.40% nego rate for RM50k & above QUOTE(Human Nature @ Sep 6 2020, 02:53 PM) |

|

|

Sep 9 2020, 12:50 PM Sep 9 2020, 12:50 PM

Return to original view | Post

#412

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 10 2020, 12:31 PM Sep 10 2020, 12:31 PM

Return to original view | Post

#413

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(gchowyh @ Sep 10 2020, 12:27 PM) So far in my experience, it has always been +0.1% more if > 50k Your car loan is from the same bank as per your FD? I understand what you mean. The first time I asked after the 2.75% 11 months promo ended, they seem put it as if though is very difficult to get the nego rate. I even had to fill up a letter to authorise the placement since I was not able to get the cert the same day. For subsequent round, it was easier as I asked them a few days before placing the funds. So I guess: 1. Need to confidently ask 2. Need to build some sort of rapport with the bank staff For me, when there's promo rate, no nego rate. Yes, there was a short period of time when there was no nego rate and no promo rate at all. Yes, it is useful. I tried showing FD certs for car loan before but how much is sufficient for X amount of loan, no one could tell me so far. |

|

|

|

|

|

Sep 10 2020, 02:55 PM Sep 10 2020, 02:55 PM

Return to original view | Post

#414

|

All Stars

12,387 posts Joined: Feb 2020 |

Monetary Policy Statement

Ref No : 09/20/02 10 Sep 2020 At its meeting today, the Monetary Policy Committee (MPC) of Bank Negara Malaysia decided to maintain the Overnight Policy Rate (OPR) at 1.75 percent. https://www.bnm.gov.my/index.php?ch=en_pres...ac=5110&lang=en This post has been edited by GrumpyNooby: Sep 10 2020, 03:01 PM |

|

|

Sep 10 2020, 03:34 PM Sep 10 2020, 03:34 PM

Return to original view | Post

#415

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 11 2020, 09:07 AM Sep 11 2020, 09:07 AM

Return to original view | Post

#416

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(nexona88 @ Sep 10 2020, 05:51 PM) BNM unlikely to cut OPR until year end should recovery gain strengthKUALA LUMPUR (Sept 11): Bank Negara Malaysia (BNM) did not cut the overnight policy rate (OPR) in yesterday's Monetary Committee Meeting (MPC), keeping the rate at 1.75% after four consecutive cuts since the start of the year. The central bank's decision was on the ground that there were continued improvements in the global economy given the easing of containment measures across more economies and strong policy support. Economists contacted said BNM is likely to maintain the policy rate at least until year end, should the recovery remain on track. https://www.theedgemarkets.com/article/bnm-...y-gain-strength Premature to conclude that there will not be further rate cuts – AmBank Research KUALA LUMPUR (Sept 11): AmBank Group Research said it remains relatively premature to conclude that there will not be further rate cuts after Bank Negara Malaysia (BNM) decided to leave the policy rate unchanged in the latest MPC meeting, holding the overnight policy rate (OPR) at 1.75%. In a note today, AmBank chief economist and head of research Dr Anthony Dass said as pointed out by BNM, the downside risk remains although the economic activity continues to recover from the trough in April supported by the stimulus measures. “Does this mean that BNM has put the brakes on rate cutting following a cumulative 125bps in 2020 to bring the OPR to a record low of 1.75%? https://www.theedgemarkets.com/article/prem...ambank-research This post has been edited by GrumpyNooby: Sep 11 2020, 09:16 AM |

|

|

Sep 11 2020, 04:31 PM Sep 11 2020, 04:31 PM

Return to original view | IPv6 | Post

#417

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 13 2020, 10:02 PM Sep 13 2020, 10:02 PM

Return to original view | IPv6 | Post

#418

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 14 2020, 03:41 PM Sep 14 2020, 03:41 PM

Return to original view | Post

#419

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 15 2020, 07:27 AM Sep 15 2020, 07:27 AM

Return to original view | Post

#420

|

All Stars

12,387 posts Joined: Feb 2020 |

TheWall: Helping retirees get the best out of their FDs

With interest rates trending lower, Malaysians who rely on fixed deposits (FD) to earn a return may be forced to look elsewhere to fund their retirement. Some banks are aware of this struggle and are offering FD promotions or alternative suggestions. These include higher promotional rates for customers who make FD placements via banks’ online portals or bonus rates for those who invest in unit trusts via the bank. Some banks recommend retirees to consider other products with similar risk levels but which may have higher returns, such as bonds. A quick survey of the banks’ websites in Malaysia show that the FD rates offered roughly range from 1.35% to 2.1% per annum. https://www.theedgemarkets.com/article/thew...SC1NMqxU22dONCs |

| Change to: |  0.0601sec 0.0601sec

0.54 0.54

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 09:05 AM |