QUOTE(ycktech @ May 15 2024, 02:07 PM)

5 years i guess. i ok with that lock period for the amount i just put. 😂Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

May 15 2024, 02:10 PM May 15 2024, 02:10 PM

Return to original view | IPv6 | Post

#421

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

|

|

|

May 15 2024, 03:20 PM May 15 2024, 03:20 PM

Return to original view | IPv6 | Post

#422

|

Senior Member

1,709 posts Joined: Feb 2011 |

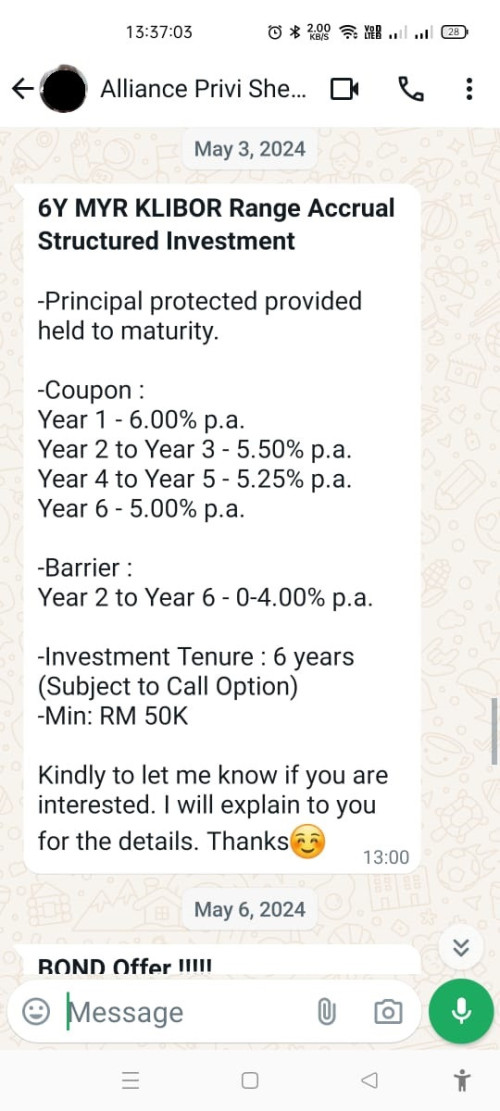

QUOTE(guy3288 @ May 15 2024, 02:26 PM) no debit card no ATM susah oh ya kah. nanti i ask the banker. i think still can withdraw out online.no online banking interest keep sampai maturity rugi lah. wah bro, Klibor now already 3.59, sekali it hit 4.00 you get ZERO interest At least Alliance bank guaranteed 1st year 6% no matter Klibor hit 4 or not... For me both also no good upper limit 4.00 too close, margin 0.41 static and not increasing i bought one from CIMB coupon 5.5% x 5 yrs, Klibor then 2.86 , upper limit 3.75 = 0.89 margin that limit increasing yearly 4.05, 4.25, 4.35, 4.50 Bank issued such product betting you would hit the upper limit and get ZERO interest. if they bet wrongly and klibor did not hit they can call back and return your money If their bet is right Klibor hit limit, you get Zero interest they wont call back tied you down till the end with zero interest In my case above CIMB betted wrong got to pay me 5.5% every 3months... after 18months they saw no chance for Klibor to touch its limit they called back.   |

|

|

May 15 2024, 03:37 PM May 15 2024, 03:37 PM

Return to original view | IPv6 | Post

#423

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

May 15 2024, 03:58 PM May 15 2024, 03:58 PM

Return to original view | IPv6 | Post

#424

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

May 15 2024, 05:05 PM May 15 2024, 05:05 PM

Return to original view | IPv6 | Post

#425

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

May 22 2024, 08:44 AM May 22 2024, 08:44 AM

Return to original view | IPv6 | Post

#426

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

|

|

|

May 22 2024, 10:50 AM May 22 2024, 10:50 AM

Return to original view | IPv6 | Post

#427

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

May 22 2024, 05:05 PM May 22 2024, 05:05 PM

Return to original view | IPv6 | Post

#428

|

Senior Member

1,709 posts Joined: Feb 2011 |

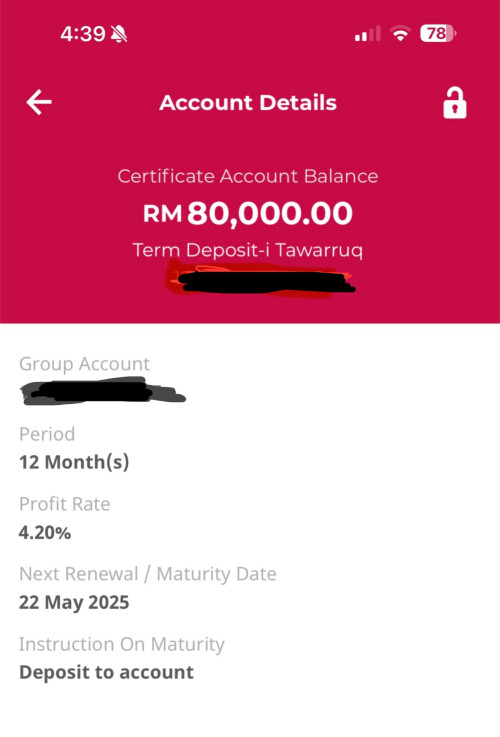

QUOTE(McMatt @ May 22 2024, 04:46 PM) For those complaining about BI, I was pleasantly surprised today. Had 3 certs matured today. Logged in and checked that they auto renewed all 3 at 4.2% pa. And to think I just went to MBSB to open an account yesterday to transfer from BI for the 4% tomorrow 😅 Guess I don’t need to do that already. please transfer out asap 😂 |

|

|

May 22 2024, 10:58 PM May 22 2024, 10:58 PM

Return to original view | IPv6 | Post

#429

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(McMatt @ May 22 2024, 05:45 PM) Much appreciated for sharing it again. Will be checking it out again daily. Now that you mentioned it, I do have some recollection reading something similar but have forgotten it was BI. The above few responses shows how toxic sometimes a forum can be to those who don’t stalk the thread often enough. And to think we are all here to help one another hello i asked you to transfer out asap. coz i not sure when the % will change as i didnt follow up. that shld be your job. i dont think that's anything bad. |

|

|

Jun 12 2024, 01:35 PM Jun 12 2024, 01:35 PM

Return to original view | IPv6 | Post

#430

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(Imsexyandiknowit @ Jun 12 2024, 01:16 PM) Do your research before commenting.Also do not put words in my mouth..did I ever say cheating by Mbsb?Dont be irresponsible.It is so easy to quote others' previous comment.(It has to be factual)You can refer my earlier post30628 page 1532.Who doesn't know how many days in a year?You must be kidding. shortchangecheat (someone) by giving insufficient money as change. "I'm sure I was short-changed at the bar" |

|

|

Jun 12 2024, 02:47 PM Jun 12 2024, 02:47 PM

Return to original view | IPv6 | Post

#431

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

Jun 12 2024, 06:16 PM Jun 12 2024, 06:16 PM

Return to original view | IPv6 | Post

#432

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(CommodoreAmiga @ Jun 12 2024, 06:02 PM) What is all these complaining...haiz...enough lah. MBSB 4% or 3.99% still highest in market right now. Tak suka can put 3.7% everywhere else. well some other principal amounts may yield more than 20, may be 200 or much moreSave your energy complaining can make back that RM20 starbucks drink already. this has to be clear. i really thought mbsb will give 0.01% less than advertised. |

|

|

Jun 13 2024, 09:58 AM Jun 13 2024, 09:58 AM

Return to original view | IPv6 | Post

#433

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(CommodoreAmiga @ Jun 13 2024, 08:23 AM) Actually, i did check my previous MBSB FDs calculations. More or less seems there. I don't bother liao. thanks for confirming. my first fd with mbsb not yet matured so cant be sure. got confused earlier with the messages. CommodoreAmiga liked this post

|

|

|

|

|

|

Jun 13 2024, 11:19 AM Jun 13 2024, 11:19 AM

Return to original view | IPv6 | Post

#434

|

Senior Member

1,709 posts Joined: Feb 2011 |

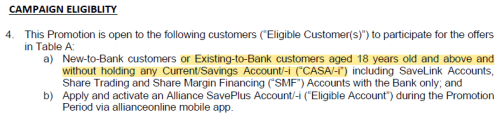

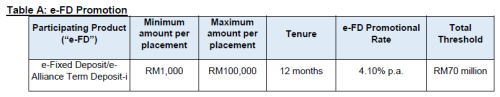

QUOTE(tALEz @ Jun 13 2024, 10:59 AM) Not so accurate bros, it seems. May be just write New to SavePlus Acct eligible betterThe campaign here, and at the bottom the e-FD T&C here. Shows existing customers also can:  I asked at the counter, thought I wasn't eligible because I'm an Existing-to-Bank customer and already have a Hybrid checking account. But counter said eligible, the T&C means customers new to the campaign's SavePlus account can apply. I went through their shitty & long process in the app and successfully placed the FD. RM1,000  Yes still available until 30 June 2024 according to their T&C, or until RM70 million total threshold. So this Allliance e-FD campaign at 4.1% 12mths is technically still among the highest so far. Just need to note: - Max. 100k. - Existing-to-Bank customers can apply. Their T&C confusing ppl. - Must open the SavePlus savings acc. - All done via app only, which can be good for some ppl. - It is troublesome AF! Must deposit min. RM20 at first, takes few days verification, must deposit another min. RM20 again, app interface not intuitive, etc. If anyone needs I can share the process on how to do the FD placement, with screenshots. Anyway, alliance doesnt seem to want to retain previously New customers. uplifted fd (4.2 earlier last year?) and rentas, and no question asked, no attempt to sell other products.😬 |

|

|

Jun 13 2024, 01:50 PM Jun 13 2024, 01:50 PM

Return to original view | IPv6 | Post

#435

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(joeblow @ Jun 13 2024, 12:14 PM) Initially I thought you are trolling, now I realize you really want to know. Kind of strange. Your MBSB FD Cert should have the profit amount, aka interest accured at maturity. Use that to divide against your principle and you will get 3.99xx%, unless your old MBSB cert doesn't have that. i think i have the cert but mine even more complicated. some 70% 30% thingy and i think no numbers on expected profit.yeah, i was considering mbsb. well less than 200k and will yield only less than rm20. but it is important principally. the distance from myplace of stay and daily transfer limit of 30k were the two bigger factors though. so for your fd certs, expected interest amount / principal = 3.99 %? This post has been edited by cclim2011: Jun 13 2024, 01:52 PM |

|

|

Jun 13 2024, 02:42 PM Jun 13 2024, 02:42 PM

Return to original view | IPv6 | Post

#436

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(joeblow @ Jun 13 2024, 02:30 PM) Yes. Since the 4% promotion is direct full FD. i want to know it's 3.99 or 4 based on actual numbers and dates.Why do I need to calculate again? I accept the fact 3.99% is based on the leap year 366 days. And what mistake did I make? I never reply to your post but to cclim because he wants to know why it is 3.99%. The fact is MBSB for this promotion gives only 3.99% nett and if their calculation is correct so be it. Most people would assume to get the full 4% since the placement date is after Feb 29th. I don't see why this thread has to be so argumentative. And why do I have to use your cert to make a point? I don't care if you get 4.4% or whatever. i did not say it is 3.99 and wanted to know why. i am not arguing. i just want to know if mbsb pay me 399 or 400 next year this date, if i placed 10k today. guy3288 liked this post

|

|

|

Jun 13 2024, 04:02 PM Jun 13 2024, 04:02 PM

Return to original view | IPv6 | Post

#437

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(joeblow @ Jun 13 2024, 03:44 PM) What are you talking about? What favour I bring them. Initially I find it funny cclim doesn't know how to calculate that's why I thought he is trolling. So I am telling him how to calculate why people got the 3.99% that's based on 365 days. Clearly MBSB is using 366 days hence only 3.99% (based on 365 days). Why is it such a big issue? i dont want to get into this weird argument. i just want to know if mbsb pay me 399 or 400 next year this date if i place 10k today. if you dont have the answer it is really fine. Bank Islam offers 4.0% to those who successfully requested like myself, they pay me the FULL 4.0% based on 365 days and even paying me the weekend days if maturity falls on a weekend. Thus all my money now goes to Bank Islam. In case you don't understand the logic, if I place on FD with BI and MBSB (both 4% same amount same maturity date), I will get more money back with BI. So now do you understand or in more distress after my post? Or still confused due to the lengthy arguments in this thread? If you still do not understand, let me help you. If Bank Islam can offer you 4.0% then go for it. Because you get the full 4.0% based on 365 days calculation plus additional weekend days if maturity falls on them. BI will make the maturity date to the next working day, MBSB for this promotion will just credit everything to your CASA on maturity day. Still don't understand or in more "distress" like what the guy3288 is saying, then I stop posting and let other experts explain. Seriously toxic. |

|

|

Jun 13 2024, 04:55 PM Jun 13 2024, 04:55 PM

Return to original view | IPv6 | Post

#438

|

Senior Member

1,709 posts Joined: Feb 2011 |

|

|

|

Jun 13 2024, 10:46 PM Jun 13 2024, 10:46 PM

Return to original view | Post

#439

|

Senior Member

1,709 posts Joined: Feb 2011 |

just for record. i placed 22500 (75% of 30k) with mbsb. at 5.8500% profit rate in Jan 2024 for 12mth. deferred selling price is 23816.43.

22500 * 1.0585 = 23816.25. i dont know where the x.43 come from. term deposit-i |

|

|

Jun 14 2024, 12:00 AM Jun 14 2024, 12:00 AM

Return to original view | Post

#440

|

Senior Member

1,709 posts Joined: Feb 2011 |

QUOTE(sirius2017 @ Jun 13 2024, 11:46 PM) FD Amt = 22,500 ya 19th. very accurate and scientific. 😁 tqRate = 5.85% If placement was done on 19/1/2024 19/1/2024 to 31/12/2024 = 348 days Profit = 22,500 * 5.85% * 348/366 = 1,251.53 1/1/2025 to 19/1/2025 Profit = 22,500 * 5.85% * 18/365 = 64.91 Total Profit = 1,316.43 Deferred selling price = 22,500 + 1,316.43 = 23,816.43 Assumption is placement was done on 19/1/2024 for 12 mth, maturing on 19/1/2025 Calculation done for days in 2024(leap year) use divisor 366. Calculation done for days in 2025 use divisor 365. Hope I get this correct. |

| Change to: |  0.0623sec 0.0623sec

0.94 0.94

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 02:37 PM |