QUOTE(Kyan0411 @ Sep 28 2020, 03:57 PM)

dengar khabar tomorrow Affin will match RHB 12m @2.45% tomorrow. We shall see.Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Sep 28 2020, 08:55 PM Sep 28 2020, 08:55 PM

Return to original view | Post

#41

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

|

|

|

Nov 5 2020, 02:30 AM Nov 5 2020, 02:30 AM

Return to original view | Post

#42

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(cybpsych @ Nov 4 2020, 06:15 PM)  Save and grow your money with convenient eFixed Deposit-i placements online [ HLB | T&Cs ] 04 NOVEMBER 2020-31 DECEMBER 2020 3 months @ 2.30% p.a. 6 months @ 2.35% p.a. 12 months @ 2.25% p.a. FPX Transfer | Min placement: RM10,000 | Max placement: RM2,000,000 The maximum deposit amount per transaction via FPX transfer is Ringgit Malaysia Two Hundred Thousand (RM200,000), subject to such prescribed maximum amount/limit of transfer in the Entitled Customers’ individual internet banking maintained with the relevant bank Which bank will allow 200k FPX transfer in 1 transaction oh???? |

|

|

Nov 7 2020, 04:22 PM Nov 7 2020, 04:22 PM

Return to original view | Post

#43

|

Junior Member

800 posts Joined: Mar 2009 |

..

This post has been edited by sweetpea123: Nov 7 2020, 04:23 PM |

|

|

Nov 7 2020, 04:25 PM Nov 7 2020, 04:25 PM

Return to original view | Post

#44

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(GrumpyNooby @ Nov 5 2020, 07:07 AM) QUOTE(cybpsych @ Nov 5 2020, 07:29 AM) QUOTE(BoomChaCha @ Nov 5 2020, 10:09 AM) Yes, can. Thanks SifusAM Bank's FPX max limit is RM 200K. But you have to download AM Bank APP from Play Store to you hand phone to verify this RM 200K FPX. |

|

|

Jan 9 2021, 02:00 AM Jan 9 2021, 02:00 AM

Return to original view | IPv6 | Post

#45

|

Junior Member

800 posts Joined: Mar 2009 |

just checking, if putting 1M in a single receipt, have tax ? Because I remembered long long time ago , there is additional tax for FD receipt of 1M and abv

|

|

|

Jan 10 2021, 02:03 PM Jan 10 2021, 02:03 PM

Return to original view | IPv6 | Post

#46

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

|

|

|

Jan 15 2021, 02:03 AM Jan 15 2021, 02:03 AM

Return to original view | Post

#47

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(Deal Hunter @ Jan 15 2021, 12:09 AM) Current top 2 deals. So i rentas my fd from bank A to HLB , so can do 1 piece, much more convenient that way. MBSB e-Prime TD-i Campaign from 16 Nov 2020 to 16 Feb 2021, p0m6 at 2.4 % p.a. ending early on 3 Feb 2021. Minimum RM 500, no maximum. With PIDM. HLIslamic investment TIA-i still running, p0m6 at 2.4 % p.a., p0m3 at 2.35 %. Minimum 2k, max 5m. No PIDM. Both can only be done online by transfer from existing account. Not OTC. HLB TIA-i, hopefully unlike CIMB TIA-i, last time put 2.6% , next day check online change to 2.45% This post has been edited by sweetpea123: Jan 15 2021, 02:04 AM |

|

|

Jan 15 2021, 02:26 PM Jan 15 2021, 02:26 PM

Return to original view | Post

#48

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(cclim2011 @ Jan 15 2021, 08:50 AM) havent been doing efd from HLB for so long, was playing around with it just now. I can only place efd via OTHER banks ???? Can I deposit efd from my OWN HLB savings? Cant find that option |

|

|

Jan 15 2021, 03:40 PM Jan 15 2021, 03:40 PM

Return to original view | Post

#49

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Jan 15 2021, 03:46 PM Jan 15 2021, 03:46 PM

Return to original view | Post

#50

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Jan 15 2021, 04:07 PM Jan 15 2021, 04:07 PM

Return to original view | Post

#51

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(cclim2011 @ Jan 15 2021, 03:59 PM) i am not sure. i surveyed last week and it was already 2.35, 6mth. i think one of the better deals already with efd. noted with thanks. Cos I saw previous pages mentioned 2.4% for 6 months, anyway, would like to add that this Islamic FD isnt TIA, therefore I think the rate is fixed.the fpx worked pretty well for me. |

|

|

Jan 16 2021, 03:03 PM Jan 16 2021, 03:03 PM

Return to original view | Post

#52

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Jan 25 2021, 03:29 PM Jan 25 2021, 03:29 PM

Return to original view | IPv6 | Post

#53

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

|

|

|

Jan 25 2021, 03:53 PM Jan 25 2021, 03:53 PM

Return to original view | IPv6 | Post

#54

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(cclim2011 @ Jan 25 2021, 03:46 PM) ha? just updated last week by someone here for branch. I just checked on Affin website, it's on e-FD still. Apparently the officer wasnt aware it's STILL on e-FD, better hurry and grab before it's gone. But Affin e-FD sucks a little, need 2 days before it takes effect if I remember correctly.i think ur branch officers are not updated? not usre though, please report back. thanks. |

|

|

Jan 25 2021, 04:14 PM Jan 25 2021, 04:14 PM

Return to original view | IPv6 | Post

#55

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(??!! @ Jan 25 2021, 04:00 PM) QUOTE(GrumpyNooby @ Jan 25 2021, 04:05 PM) It will only show in Affin Online on the next day. oh, the effective date on the same day as well now. Cos the last i deposited couple of years back, effective date is 2-3 days later. If it's immediate, then it's good enough for me. Doesnt matter when it shows on Affin Online. Thanks for the input.You will receive email to acknowledge about the placement almost immediately. This post has been edited by sweetpea123: Jan 25 2021, 04:17 PM |

|

|

Jan 25 2021, 09:06 PM Jan 25 2021, 09:06 PM

Return to original view | IPv6 | Post

#56

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(GrumpyNooby @ Jan 25 2021, 04:43 PM) Nice, thanksQUOTE(cclim2011 @ Jan 25 2021, 08:10 PM) No, it wasnt weekend, in fact I placed twice and it was the same, effective date 2 days later. I guessed they changed their SOP now. I have to show her this. aduh, the officer damn blur, she said, my branch is still doing it manually (meaning still 2 days later), I will try to place one now and show her. Update : OK tried, yes, effective date starts today and appeared automatically in system, but for some reason, I couldnt choose conventional, dont know why This post has been edited by sweetpea123: Jan 25 2021, 10:18 PM |

|

|

Jan 26 2021, 07:55 PM Jan 26 2021, 07:55 PM

Return to original view | IPv6 | Post

#57

|

Junior Member

800 posts Joined: Mar 2009 |

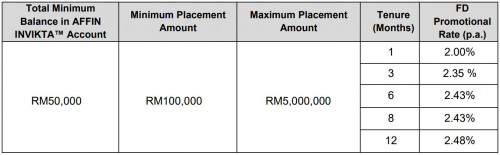

QUOTE(??!! @ Jan 26 2021, 05:11 PM) I kena before many,many moons ago, Affin's so called eFD was just a mechanism for one to 'lock-in' the rate and amount online.( eg we cannot/don't want go to branch for some reason). After online placement, money will be deducted from CASA immediately, but no show no FD online , even the next day. Branch will be alerted to view the 'online' placement ( 2-3 working days later). Depositor has to go to the branch and sign their stack of forms and collect the physical cert. So, it's not eFD placement as what it is now. However , it serves its purpose for one to lock in the FD placement effective date on the day it is 'locked-in' via Affin online. And we lose 2-3 days interest in the process. Anyway, i withdrew the efd today, it was immediately credited back into my savings acc. Test completed. 😁 QUOTE(GrumpyNooby @ Jan 26 2021, 06:08 PM) Poster and T&C are out: INVIKTA. It's their Preferred Banking I guess https://www.affinonline.com/affin_invikta Usher in an Oxpicious CNY with Fixed Deposit/Term Deposit-i (FD/TD-i). Campaign Period: 21 January – 15 February 2021 This is also applicable via eFixed Deposit (eFD)/eTerm Deposit-i (eTD-i). FD/TD-i/eFD/eTD-i and AFFIN INVIKTA Account/Account-i are protected by PIDM up to RM250,000 for each depositor. Higher FD rate for AFFIN INVIKTA™:  Click here for Oxpicious Chinese New Year (CNY) with Fixed Deposit Campaign’s full terms and conditions.. https://www.affinonline.com/AFFINONLINE/med...ampaign-ENG.pdf Click here for Oxpicious Chinese New Year (CNY) with Term Deposit-i Campaign’s full terms and conditions. https://www.affinonline.com/AFFINONLINE/med...ith-TD-i_EN.pdf C. AFFIN INVIKTA FD Promotional Rates 7. To be eligible for AFFIN INVIKTA™ FD promotional rates, Eligible Customer must open AFFIN INVIKTA™ Account and maintain RM50,000 in the account during the tenure of FD. 8. For AFFIN INVIKTA™ FD promotional rates, the Eligible Customer will be entitled for FD promotional rates as per table below: Promotional Rate (p.a.) RM50,000 RM100,000 RM5,000,000 1 2.00% 3 2.35 % 6 2.43% 8 2.43% 12 2.48% This post has been edited by sweetpea123: Jan 26 2021, 08:24 PM Deal Hunter liked this post

|

|

|

Jan 26 2021, 11:11 PM Jan 26 2021, 11:11 PM

Return to original view | IPv6 | Post

#58

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Apr 21 2021, 01:28 AM Apr 21 2021, 01:28 AM

Return to original view | IPv6 | Post

#59

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

May 7 2021, 10:10 PM May 7 2021, 10:10 PM

Return to original view | IPv6 | Post

#60

|

Junior Member

800 posts Joined: Mar 2009 |

Deposited AMBANK today,

2.85% for 24 months, 10K in CASA. MUST OPEN SAVINGS ACC for monthly crediting of interest. *Cannot opt for collection of interest at maturity. Paid RM12 for a compulsory debit card. *apparently applies to all who wants the promo rate below (dunno the staff there bluff me or not 9m-2.5% 18m-2.7% 24m - 2.85% This post has been edited by sweetpea123: May 7 2021, 10:26 PM |

| Change to: |  0.0593sec 0.0593sec

0.65 0.65

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 04:29 PM |