HLB E-FD 6m @ 3.6%

vs

HLB Term Investment 6m @3.9% ,

Sifus, any advice which to go for ?

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Feb 6 2020, 10:24 PM Feb 6 2020, 10:24 PM

Return to original view | IPv6 | Post

#21

|

Junior Member

800 posts Joined: Mar 2009 |

HLB E-FD 6m @ 3.6%

vs HLB Term Investment 6m @3.9% , Sifus, any advice which to go for ? |

|

|

|

|

|

Feb 7 2020, 01:26 AM Feb 7 2020, 01:26 AM

Return to original view | IPv6 | Post

#22

|

Junior Member

800 posts Joined: Mar 2009 |

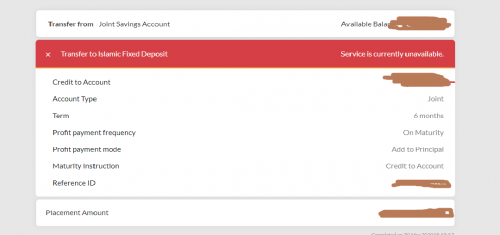

QUOTE(jonoave @ Feb 6 2020, 11:15 PM) Thanks for responding 1) can only be done via online right ? 2) and has to be from HLB account , not FPX , right ? 3) meaning can put more than 30K(my FPX limit) each receipt? 4) there's a survey to be done before depositing ? there was a clause there that scares me ... something about not capital protected and can lose everything (cant copy paste it now since under maintenance). was checking how it can be done earlier, am new to TIA |

|

|

Feb 7 2020, 06:14 PM Feb 7 2020, 06:14 PM

Return to original view | IPv6 | Post

#23

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(jonoave @ Feb 7 2020, 05:49 PM) 1. I did it online. Don't know if can do OTC, but I only do my transactions online. THANKS A MILLION FOR THE DETAILED REPLY . 2. Yes, from an existing HLB account. I FPX the amount from my other bank first. 3 I'm only small fish, my transactions are within the daily FPX limit. You can also try adjusting the max FPX limit allowed 4. Yes, you need to complete a survey for financial risk. I guess you've never tried Islamic banking before, but it forbids GUARANTEED profits and giving out INTEREST. It's a long story of how and why but basically it boils down to this transaction is considered for as a "joint business venture" between you and the bank putting money together and sharing both profit (if I'm not miskaen, it's called hibah) and risk. Hence the profit sharing ratio. In real world equivalent, this is analogous to the conventional banking FD. FYI, even regular islamic savings account they don't give INTEREST in percent. They will say give out hibah based on profit earned (which is typically quite standard). The islamic banking system is devised in a way to create similar (but not nearly identical) aspets of the conventional banking system. If you're still uneasy then you can choose the regular eFD. Done placement 3.9% @ 6mths This post has been edited by sweetpea123: Feb 7 2020, 10:24 PM |

|

|

Feb 21 2020, 09:23 PM Feb 21 2020, 09:23 PM

Return to original view | IPv6 | Post

#24

|

Junior Member

800 posts Joined: Mar 2009 |

a quick check...self contribution to EPF remains at RM5000 x 12 = RM60k per annum ??????? Thanks in advance

|

|

|

Feb 21 2020, 10:00 PM Feb 21 2020, 10:00 PM

Return to original view | IPv6 | Post

#25

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Feb 21 2020, 10:12 PM Feb 21 2020, 10:12 PM

Return to original view | IPv6 | Post

#26

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(MUM @ Feb 21 2020, 10:03 PM) many had mentioned that FD does not have that long locked period condition.... I am nearly half a century old. Been doing self contribution for the past years. To me it's 'forced savings' as it's a hassle to withdraw. So it's all good, at least for those nearing retirement age. |

|

|

|

|

|

Feb 22 2020, 02:43 PM Feb 22 2020, 02:43 PM

Return to original view | IPv6 | Post

#27

|

Junior Member

800 posts Joined: Mar 2009 |

5.45%

EPF declares 5.45% dividend for 2019. KUALA LUMPUR (Feb 22): The Employees Provident Fund (EPF) declares 5.45% dividend for 2019, which is 2.95% above what is mandated under the EPF Act 1991 that requires the provident fund to declare a minimum of 2.5% nominal dividend every year.1 hour ago |

|

|

Mar 16 2020, 10:15 PM Mar 16 2020, 10:15 PM

Return to original view | IPv6 | Post

#28

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Mar 30 2020, 06:24 PM Mar 30 2020, 06:24 PM

Return to original view | IPv6 | Post

#29

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(cybpsych @ Mar 28 2020, 11:54 AM) if you have mbb casa, can use the fund directly. just remember to choose Islamic Fixed Deposit (eIFD-i) Sifu, why cannot one?note: just tried FPX, it can do placement, but rate is just 2.55% @ 6 month. better do placement from m2u casa.   |

|

|

Jul 22 2020, 04:31 PM Jul 22 2020, 04:31 PM

Return to original view | IPv6 | Post

#30

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Jul 23 2020, 12:58 AM Jul 23 2020, 12:58 AM

Return to original view | IPv6 | Post

#31

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Jul 23 2020, 11:41 PM Jul 23 2020, 11:41 PM

Return to original view | IPv6 | Post

#32

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Jul 27 2020, 09:52 PM Jul 27 2020, 09:52 PM

Return to original view | IPv6 | Post

#33

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

|

|

|

Jul 28 2020, 12:38 AM Jul 28 2020, 12:38 AM

Return to original view | IPv6 | Post

#34

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(Human Nature @ Jul 28 2020, 12:25 AM) No question asked usually for BR and yes effective same day but may need to collect cert after 2 days Thanks for your reply. I am new to bank customer, hopefully no questions asked. But I will be going to 'atas place' branch, guess they wouldnt bat an eyelid at my sum since millionaires there are a dime a dozen. |

|

|

Jul 29 2020, 06:08 PM Jul 29 2020, 06:08 PM

Return to original view | IPv6 | Post

#35

|

Junior Member

800 posts Joined: Mar 2009 |

anyone has Bank Rakyat Bangsar branch number? cos their CS (1-300 number) KNOWS nothing. Dont know what it is for cos everything need to refer to the branch. But, cannot give branch number or get someone to call me. Stupid really.

|

|

|

Jul 30 2020, 12:49 AM Jul 30 2020, 12:49 AM

Return to original view | IPv6 | Post

#36

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(??!! @ Jul 29 2020, 06:25 PM) I tried calling a branch using the tel number which i had previously. Hopeless, I said "everything you have to crosscheck with the branch , you are wasting my time and your time". Her answer : " Thank you for calling " It gets diverted automatically to the call centre (the same 1300 number) Yes..their CS is quite clueless QUOTE(Human Nature @ Jul 29 2020, 07:30 PM) Actually just wanna check if I bring a cheque, can I get the receipt on the spot or come back 2 days later? And effective date? IIRC, some branch practised different SOP . I sort of get confused by Bank Rakyat n Bank Islam, so just wanna confirm again. QUOTE(MUM @ Jul 29 2020, 07:38 PM) Thanks Mum, I did try before, machine ask me to call 1300QUOTE(Deal Hunter @ Jul 29 2020, 07:52 PM) If want to place for their p1m11 at 2.75 % or p1m7 at 2.55 % OTC last day 15 Nov 2020, just simply go with at least 10k cheque. Or better still, tranfer into your Bank Rakyat casa account. The only catch is whether the branch at Bangsar Baru is open. If closed, then use their HQ nearby Brickfields. I just placed a 2.75 % today at Section 14 PJ. Of course they may simply revise down the rate if OPR changes down earlier. Very incompetent indeed. Makes me think twice before placing with them. Dread going through the process of opening FD with them, dunno how many hours it will take. Calling them already left a bad taste in the mouth That bank landline phone diversion problem with Bank Rakyat - that is one of the ancient problem I also had before but even with handphone number can have problem. Some other banks are OK with branch telephone numbers, others like to go through some hassle or simply impossible. From my personal survey and checking experience, in general call centre staff are usually dependent on their online updates and hence usually clueless about actual situation on the ground especially anything specifically special operationally or implied in badly worded or inaccurate generic or badly updated and confused documents. Clueless or consistently inconsistent or having no real expereince or speaking wrongly about accounts/promos they do not have is normal. Do not ever believe whatever you read or hear but crosscheck for inconsistencies/contradictions and impossibilities in as many documents as possible with understanding how errors are made and neglected normally. The number of times played out cannot even be counted. Don't talk about eating more salt than rice, should talk about being rubbed with salt on wounds. THANKS ALL SIFUS FOR YOUR REPLIES. REALLY APPRECIATE IT . Was hoping that someone liasing with Bangsar branch can give me their RM's/BM's number. Do they have RMs btw? |

|

|

Jul 30 2020, 03:28 AM Jul 30 2020, 03:28 AM

Return to original view | IPv6 | Post

#37

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(Deal Hunter @ Jul 30 2020, 03:03 AM) DON'T JUST SIMPLY MOAN & GROAN, U CAN CAUSE CHANGES It's really up to the bank to 'change' and 'improve' . Me as a potential customer can only air my "grievances" here. I tried telling CS but what did she say? lol. After experiencing a lot of inconsistencies, it is fairly reasonable to conclude that various grades of bank branches and HQs normally DO NOT practice a standard SOP even if there is such a thing or have very definite minimum time performance standards. As a human interaction activity, this requires active and close observation and corrective discussion by the supervisors and bank managers to overcome the daily problems and solve them better. If you can spare the time to observe the various customer requests/dilemmas and listen to bank staff, you will find that it is not only the staff but also some distant operative/decider who is also screwing things up. Since it is quite unlikely to always meet enlightened staff who are a delight to deal with, your best course is to make it a delight for them to deal with you in the hope that it be reciprocated. If you want the banks to change, you need to act to make that change - something which purposeful discussion, sharing, comparisons and positive good examples here can also do indirectly. If many readers share the same thoughts and voice them, eventually some of the more committed, ambitious and internet savvy bank staff and managements may learn something good for their own careers/business here especially from the customer point of view. For this to happen faster and better, try to introduce this thread as something different from usual dry FD sites to their staff and management. Yes I admit frankly as an ex-administrator and an implementor, that there are little and big things that can be done better and in more sensible ways. Somebody commented that I had my own purpose here in this thread. Yes it is true, one of my hopes is that local banking ways can change encouraged by a more educated, sharing and positively critical readership in this thread. My other purpose here, is to leave answers/analysis, methods to various banking real life situations and calculations and terminology needed as future references as a learning guide for my children when they have to take over fund management. Anyway, common sense arent really common these days. I used to work in HLB decades ago. We have urgency in things we do, sadly work attitudes are different these days. Might just stick to the bank I am comfortable with even though the difference in rates do make quite a difference. Cons outweigh the pros here. |

|

|

Aug 14 2020, 06:01 PM Aug 14 2020, 06:01 PM

Return to original view | IPv6 | Post

#38

|

Junior Member

800 posts Joined: Mar 2009 |

|

|

|

Aug 18 2020, 04:19 PM Aug 18 2020, 04:19 PM

Return to original view | IPv6 | Post

#39

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(gvr @ Aug 18 2020, 10:19 AM) So for those TIA account that was placed before last Friday, the rate will automatically be revised to 2.3% from what I understand, right? that can happen I guess. So far all my Tia with other banks honored the rate stated on the FD receipts, but I cant say for sure this time around. Gotta pray for the best. |

|

|

Sep 23 2020, 02:52 AM Sep 23 2020, 02:52 AM

Return to original view | Post

#40

|

Junior Member

800 posts Joined: Mar 2009 |

QUOTE(bbgoat @ Sep 21 2020, 07:42 PM) Today in Affin to withdraw FD which matured on Sat. even when I asked, they said NO SUCH PRACTICE in AFFIN BANK , Different branch, diff SOP? Can complain to BNM ?Without asking, the counter girl added in the 2 days interest, good ! No need customer to ask. Moreover it was at the 4.23% rate of that FD. She however tried to ask me to continue FD there. The rate mentioned was 2.28% for 12 mths, for OTC rate. With RM500 earmarked in SA ? Anyway has other intentions for that fund. Still not sure to go to MBSB, buy UT or what. Place in MBB GIAi first. |

| Change to: |  0.0618sec 0.0618sec

0.50 0.50

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 11:56 AM |