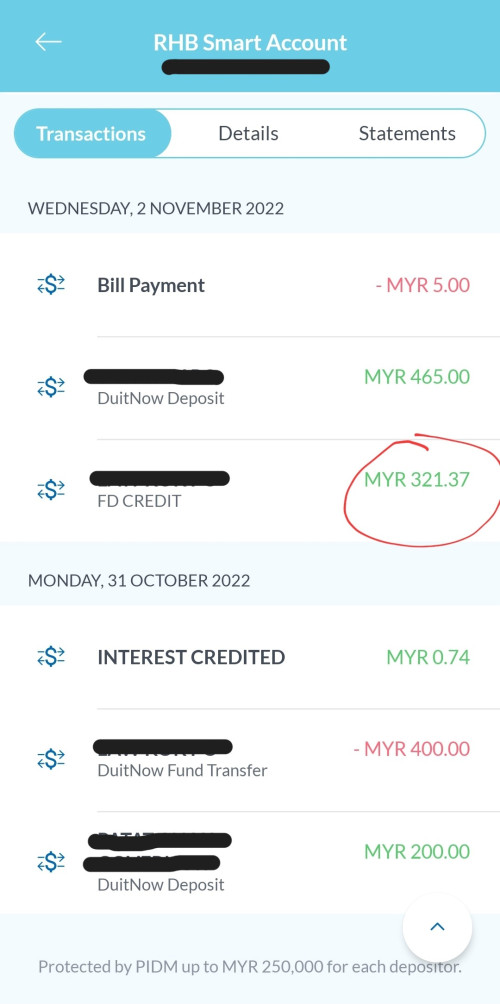

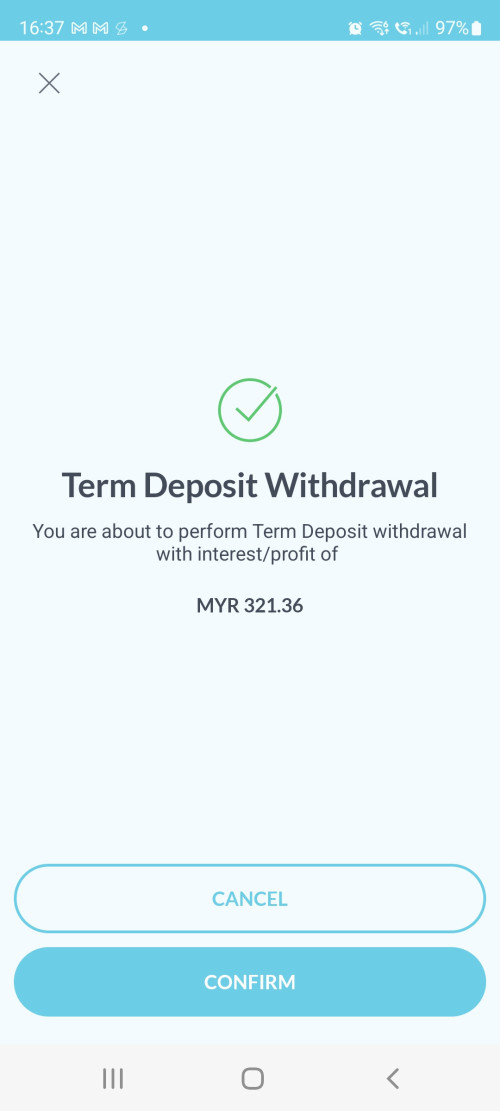

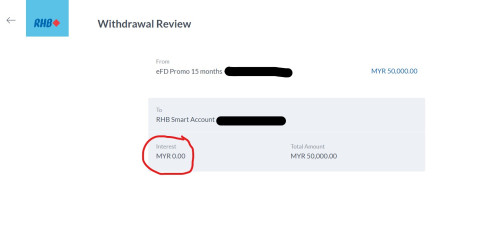

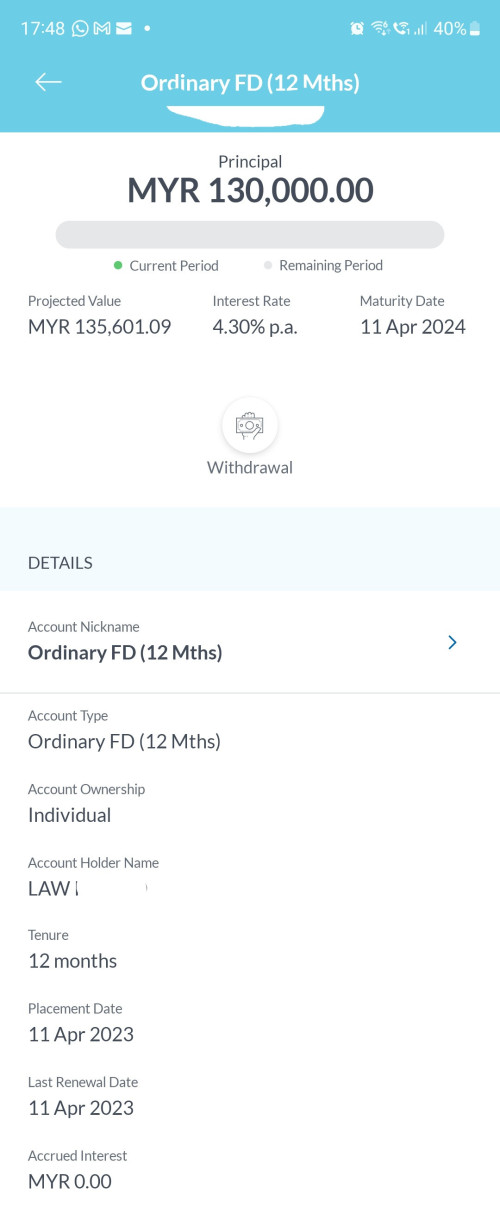

In my case, my interest was not credited to my account until I uplifted the FD. I think the information on the screen displayed at each step depends on what maturity instructions you provided originally when you placed the FD. Mine was to renew P+I, so only when I uplifted on maturity, both the P+I were credited to my account.

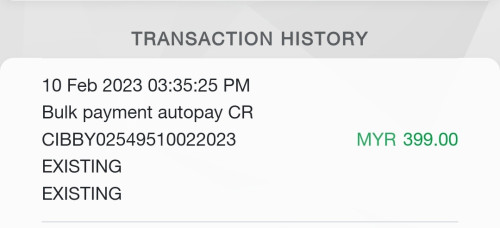

It seems that from what you have shown that you probably selected renew P but I to credit account, that is why your interest is already automatically credited by the system. I am trying to think logically based on what you have provided, since I do not have all your information

If the above is the case with your placement, I believe you can just uplift the P now. The screen you shared previously informed you that you will be getting the P+I due today upon upliftment (In your case, the I has already been credited today based on what you had chosen at the onset of the FD). You are not making a premature upliftment, hence it does not make any sense that the I will be reversed out upon upliftment.

If you are still uncomfortable, can call RHB helpline for confirmation/guidance.

*RHB does make it's upliftment screens seem more complicated than it actually is

thank u for the elaborated clarification! appreciate it! i think u are right that it depends on the renewing instruction. i also called the cs n she said the credited interest wouldn't be taken away, after a long time of checking. then i proceeded to do the withdrawal n it happened as u said. thank u again!

Nov 2 2022, 05:19 PM

Nov 2 2022, 05:19 PM

Quote

Quote

0.0676sec

0.0676sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled