Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

kplaw

|

May 5 2023, 02:33 PM May 5 2023, 02:33 PM

|

Getting Started

|

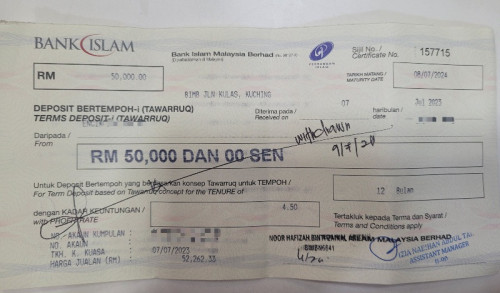

QUOTE(joeblow @ May 5 2023, 11:50 AM) I am in bank Islam now, yes 4.5% 12 months. Only this promotion nothing else, longer duration don't have promotion. May I know which branch got 4.5%? I'm now at kuching kulas branch, the person in change told me the promo rate is up to 4.25% only despite increase in opr but will drop accordingly if opr drops 😅 |

|

|

|

|

|

kplaw

|

Aug 9 2023, 03:41 PM Aug 9 2023, 03:41 PM

|

Getting Started

|

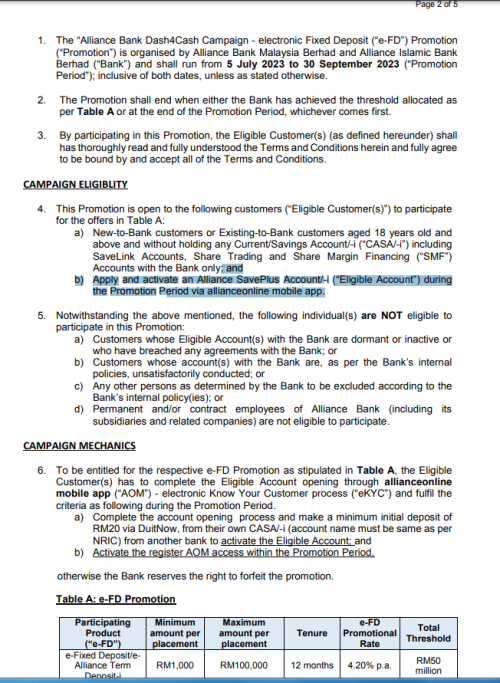

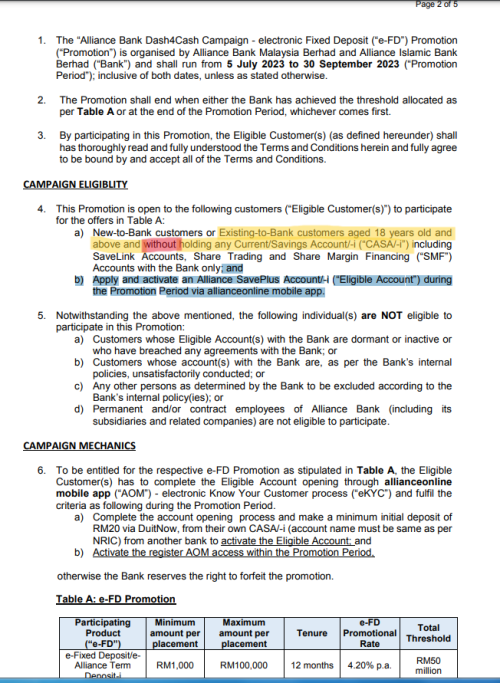

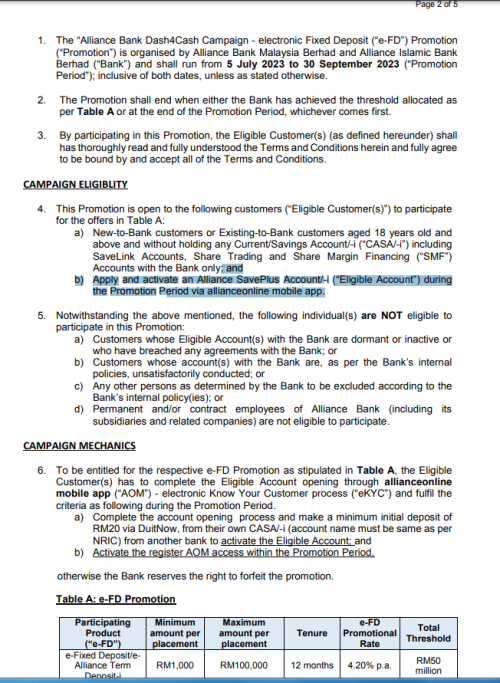

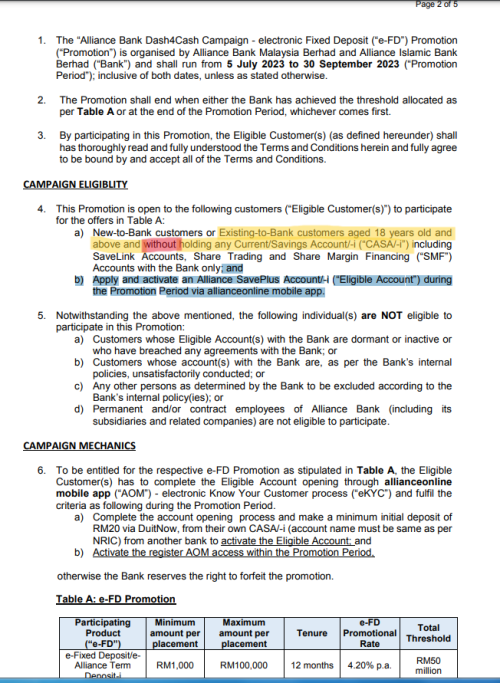

QUOTE(Ichitech @ Aug 5 2023, 10:34 PM) This one need apply new account and have threshold ? Anyone can shed some experience ? I had Basic Savings Account only.. but no mobile banking yet...  from my understanding, the 1st condition for existing customer is without holding any casa  |

|

|

|

|

|

kplaw

|

Oct 2 2023, 11:08 PM Oct 2 2023, 11:08 PM

|

Getting Started

|

Went to mbsb n ambank today in kuching. No promo for the time being at mbsb but can request for approval for 12m 4%. At ambank, only got 4% for 10m if I remember correctly. But they have an interest rate-linked investment product. Interest is at 4.6%pa for 3yr, pay out every quarter. Invested amount is min rm50k n is protected by the bank only. Tomorrow's the last day to take up the investment. I think it's not a bad alternative! (sorry not fd related product)

This post has been edited by kplaw: Oct 3 2023, 01:53 AM

|

|

|

|

|

|

kplaw

|

Oct 5 2023, 02:03 PM Oct 5 2023, 02:03 PM

|

Getting Started

|

At mbsb kuching branch now, renewed fd at requested rate of 4.15% for 13m. My amount is rm135k. Was at bank islam, their maxcash fd bundle promo is still available, expected effective rate is 4.145%

|

|

|

|

|

|

kplaw

|

May 15 2024, 11:05 PM May 15 2024, 11:05 PM

|

Getting Started

|

Alliance bank fd promo 3.9% for 12m otc is on going. I've done 2 deposits as don't want to put all eggs in one basket at mbsb.

|

|

|

|

|

|

kplaw

|

Jun 27 2024, 02:14 PM Jun 27 2024, 02:14 PM

|

Getting Started

|

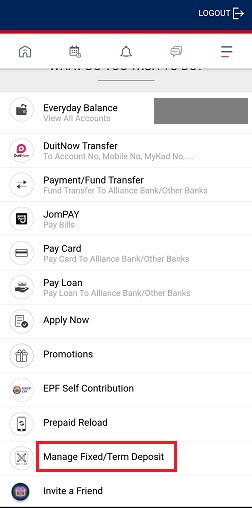

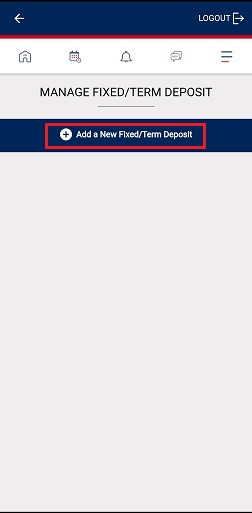

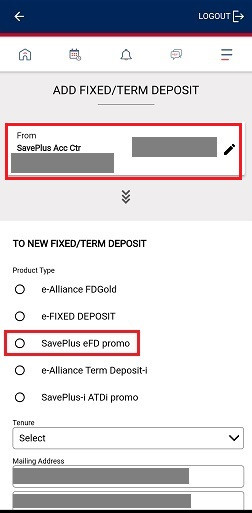

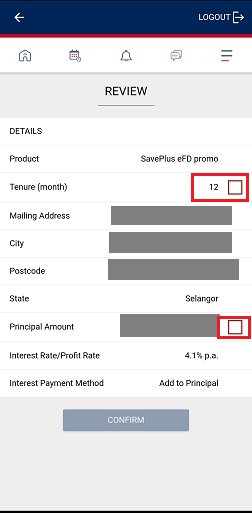

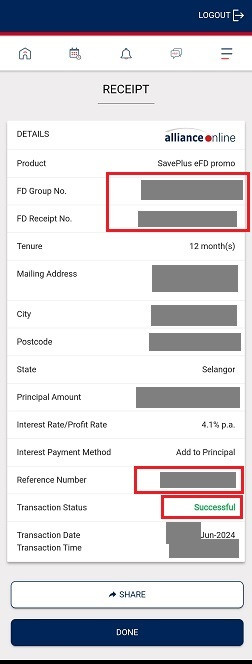

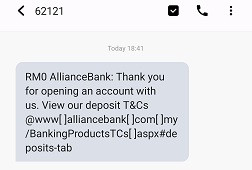

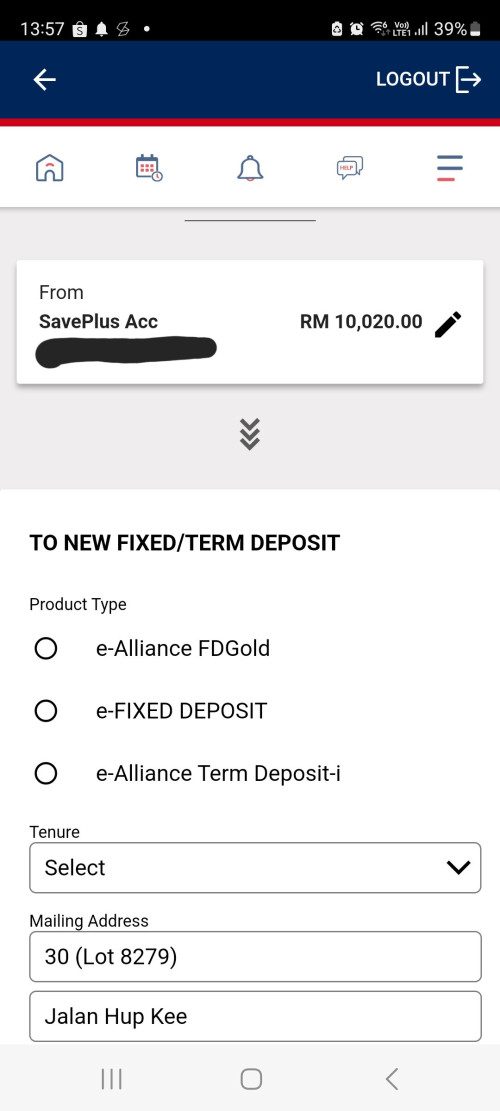

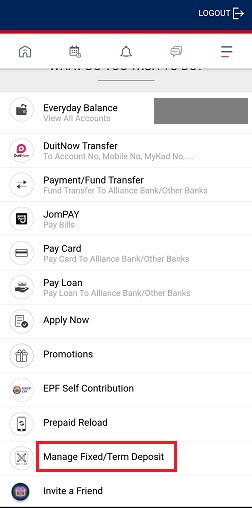

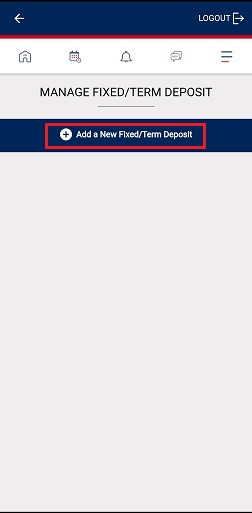

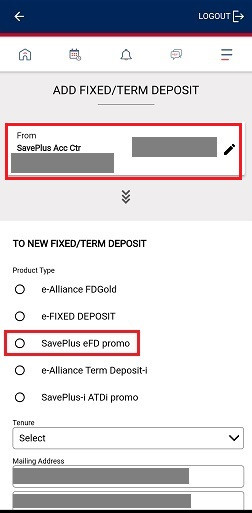

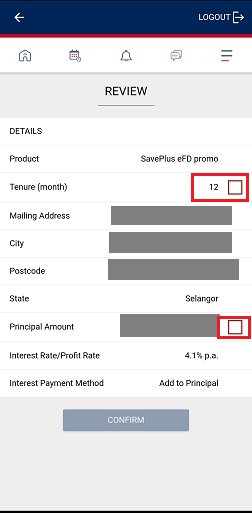

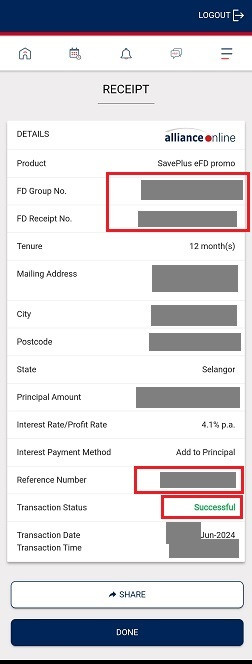

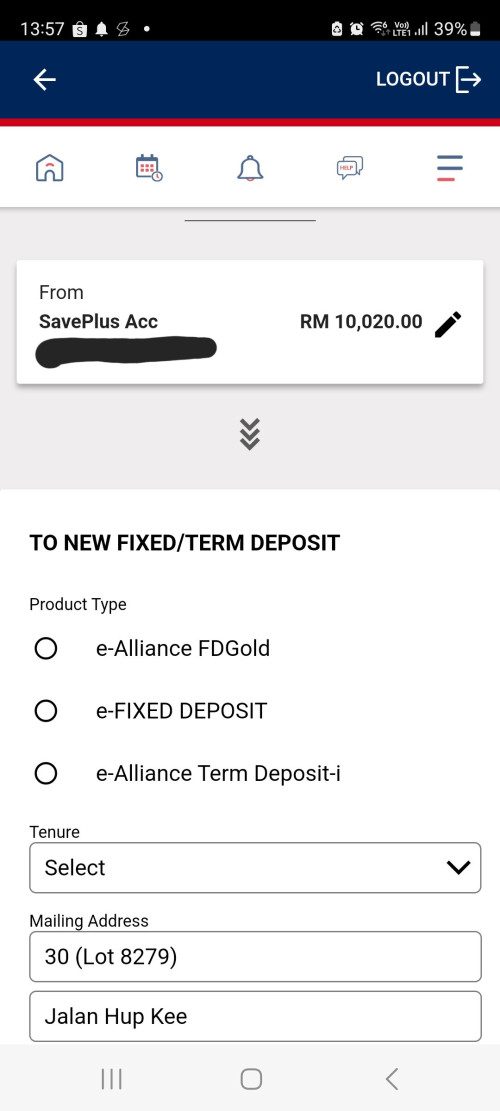

Didn't work for me. I'm an existing customer with hybrid account and its mobile app user. There's nowhere to enter any promo code (if required) and the saveplus account was created straight away after entering basic info in the first page and confirming entered info on 2nd page then clicking on the proceed button. I do not see any SavePlus eFD promo option when trying to add new fd under the created saveplus account. Or maybe the quota is full already.. QUOTE(tALEz @ Jun 14 2024, 08:17 PM) I forgot about the IC/verification part. You're right, was really troublesome now that I try to recall. Not forgetting the depositing, waiting, depositing again, and waiting again. This bank really ma-lan-fan IYKWIM. :lol2: The app is really non-intuitive, I was unsure which was the correct way. And usually certain parts of the app will take some time to load. Occasionally will even fail to load. Anyway:   Can choose the funds from which of your acc within Alliance (also means you have to transfer the funds to the acc first):  Confirm all info:  Then finally will get receipt and SMS confirmation:    This post has been edited by kplaw: Jun 27 2024, 02:17 PM This post has been edited by kplaw: Jun 27 2024, 02:17 PM |

|

|

|

|

|

kplaw

|

Aug 5 2024, 05:06 PM Aug 5 2024, 05:06 PM

|

Getting Started

|

Installed BEU app n made 2 fd deposits. Think it's still kind of half-baked, maybe still depending on users complaints for improvement. When I called for help because there's no cancellation button for trial fd creation, surprisingly the machine greeting was in english only! The support then told me the solution was either to wait for 3 days if I wanted it to be escalated to the relevant team or wait for the process to expire by itself in 10 days time 😅 I couldn't wait for so long so proceeded with the fd creation n made another one with the actual desired amount.

This post has been edited by kplaw: Aug 5 2024, 07:24 PM

|

|

|

|

|

|

kplaw

|

Oct 14 2024, 12:28 PM Oct 14 2024, 12:28 PM

|

Getting Started

|

Just sharing my experience here. A fd at bank islam was due recently n i only managed to transfer it to beu after a few hiccups. These are the things that I realised or learnt during the process. The fd was actually bundled with al awfar account, it isn't a saving account but actually an investment account, so can only be found under investment category in the go app. Although beu belong to bank islam but the account is considered a 3rd party account in bank islam. We can't transfer funds from bank islam to beu using go app but need to use the website to do it. I tried to transfer rm45k, the go secure approved it n said successfully done but the website logged me out automatically n said unable to process my request. The bank islam help center said the problem was at beu side. Called beu help center, she said would send me guidelines on the transfer n asked me to report it if facing problem. I was already facing problem n she wasn't listening.. Called back bank islam but no answering, guessed he was trying to avoid me (around 845pm n the 1st call was kind of immediately connected). Anyway I later tried transfering smaller amounts n they went through without problem. Other lessons I learned were it needs 12 hours cooling period for both online access activation (I changed phone n the activation had to be done at atm) n online transaction limit changing.

|

|

|

|

|

|

kplaw

|

Oct 14 2024, 02:55 PM Oct 14 2024, 02:55 PM

|

Getting Started

|

Max 3rd party transfer is 50k, I managed to transfer a total of 45k to beu n another 2k+ to rize on the same day. According to what u said, I really should have used the atm instead of online for the transfer, wasted me two days for the cooling period (the FD matured on Fri). QUOTE(userA123 @ Oct 14 2024, 01:31 PM) Transfer from BI to BeU limit is 30K per day. Even though both acc under same name, they are considered third party transfers. You can set/see the limits in your BI settings. The have the intention to link Beu to BI at a later date, I was told. The funny thing is you can access Beu at their ATM, deposit/withdraw is possible without atm card or debit card. I have tried deposit but withdraw haven't tried yet. The even funnier thing is at the BI counter, they cannot see/access Beu accounts. |

|

|

|

|

|

kplaw

|

Nov 5 2024, 04:19 PM Nov 5 2024, 04:19 PM

|

Getting Started

|

Got one fd matured today at mbsb, I shifted the fund to their term investment account-i for 1 year at 4.1%. According to the assistant bm, it's their first such product so will be very committed to achieve the projected rate at maturity. The opening of the account can be done online, I did it in front of her. Actually initially wanted to transfer to muamalat for the attractive monthly interest payout FD (but with the need to re-issue debit card for online banking as I cancelled the card last year to avoid annual fee) Btw, the mbsb 12m 4% FD promo is still available.

This post has been edited by kplaw: Nov 5 2024, 04:24 PM

|

|

|

|

|

|

kplaw

|

May 16 2025, 12:05 PM May 16 2025, 12:05 PM

|

Getting Started

|

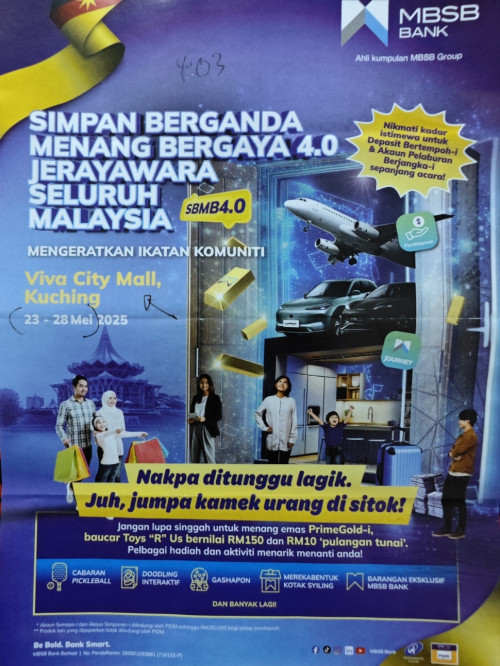

QUOTE(coolng @ May 16 2025, 11:25 AM) The roadshow at kuching is from 23-28 may 25. My RM told me they should be able to offer the special rate at kuching branch also during that time but with fresh fund only. They will give out free gift if it's done at vivacity. "We do accept account opening and term deposit/ term investment placement (thru debiting of Current Account / Savings Account) at Vivacity during the event. For placement thru cheque / cash, shall only accept over the counter at branch." |

|

|

|

|

|

kplaw

|

May 16 2025, 11:52 PM May 16 2025, 11:52 PM

|

Getting Started

|

For beu fd placement, better wait for the fd application to be approved first before transferring money into the saving account for the fd placement because the approval may not be on the same day. I believe the app also won't notify u when the application is approved, u have to keep checking it yourself!

|

|

|

|

|

|

kplaw

|

Jul 1 2025, 11:46 PM Jul 1 2025, 11:46 PM

|

Getting Started

|

*🎉 MBSB Bank Term Deposit / Term Investment Account Promotion*

✨Both TDi and TIA rate effective from *July 1 to July 15* as below:

Tenure TDi TIA

🔥3 Months 3.70% 3.72%

🔥6 Months 3.75% 3.75%

🔥9 Months 3.95% 3.97%

🔥12 Months 3.93% 3.95%

|

|

|

|

|

|

kplaw

|

Jul 11 2025, 02:15 PM Jul 11 2025, 02:15 PM

|

Getting Started

|

4% 12m at muamalat is still available. But according to the staff, they may revise the rate next week (16th?) because of the lower opr.

|

|

|

|

|

|

kplaw

|

Jul 11 2025, 03:56 PM Jul 11 2025, 03:56 PM

|

Getting Started

|

Booster fd won't be affected once locked. Tia maybe affected. A staff said change on monday but another more senior n relevant one said on 16th.. QUOTE(Human Nature @ Jul 11 2025, 02:43 PM) Will it affect placement before revision? Have maturing FD at BIMB on Monday, hope the revision is not too soon |

|

|

|

|

|

kplaw

|

Aug 10 2025, 12:02 AM Aug 10 2025, 12:02 AM

|

Getting Started

|

QUOTE(sweetpea123 @ Aug 8 2025, 11:22 AM) hi sifus, any banks have birthday promo for FD? Thanks in advance   |

|

|

|

|

|

kplaw

|

Oct 13 2025, 03:08 PM Oct 13 2025, 03:08 PM

|

Getting Started

|

QUOTE(7498 @ Oct 2 2025, 03:29 PM) Ahh.okay thanks! The word "early" made me hesitate at first. Hi didn't get the update here, did anyone else try the "early withdrawal" button and getting the profit? I've one fd due today and the money is still not in my saving yet, and i wish to transfer it to bmm before the bank closes today. I did contact the beu support n the feedback is wait until 11pm, saying that 11pm is still today as stated in the contract! |

|

|

|

|

May 5 2023, 02:33 PM

May 5 2023, 02:33 PM

Quote

Quote

0.0731sec

0.0731sec

0.75

0.75

7 queries

7 queries

GZIP Disabled

GZIP Disabled