QUOTE(fartbrat @ Jun 26 2024, 09:57 PM)

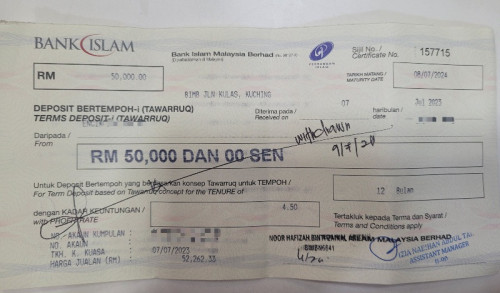

my 4.5% fd in bank islam from last year due soon, if i want to renew with them for the latest 4%, do they accept it? Or is the promo for new fund only?

existing also no problemFixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jun 26 2024, 10:09 PM Jun 26 2024, 10:09 PM

Return to original view | Post

#41

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

|

|

|

Jun 27 2024, 11:03 PM Jun 27 2024, 11:03 PM

Return to original view | Post

#42

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

Jul 4 2024, 11:40 AM Jul 4 2024, 11:40 AM

Return to original view | Post

#43

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

Jul 10 2024, 12:07 AM Jul 10 2024, 12:07 AM

Return to original view | Post

#44

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(kplaw @ Jul 9 2024, 11:58 PM) Got a 12m fd at bi, made on 7-7-23 n matured on 8-7-24. 7-7-24 was sunday n at the same time muharram so the maturity date fell on 8-7-24 (?). But 8-7-24 was a replacement public holiday, so only today I could go to the bank, hoping to renew the fd at the 4% promo rate n with start date on 8-7-24. But was told that they could only break the fd which had been renewed on 8-7-24 at board rate n start a new one today. I argued with them on the starting date as it was public holiday yesterday but to no avail so I lost a day of interest. Don't understand how their system work.. what is there to argue? bank is closed how you want/expect to do placement for OTC FD?? Some people really funny.. |

|

|

Jul 11 2024, 03:38 PM Jul 11 2024, 03:38 PM

Return to original view | Post

#45

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(weidasdnbhd @ Jul 11 2024, 03:19 PM) How come you can open bsa with BI without fee? Mine here need to pay annual fee for debit card. According to their fee and charges on deposit account table, need to pay RM8 for ATM charges (BSA option 1 customer with ATM and GIRO facilities). Which branch are you going? my BI SA no-debit card, only got savings book. No fees.Downside, i dont think can use internet banking. I'm interested to know as well whether got 0 fees SA that can use internet banking |

|

|

Jul 11 2024, 04:45 PM Jul 11 2024, 04:45 PM

Return to original view | Post

#46

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

|

|

|

Aug 3 2024, 03:42 PM Aug 3 2024, 03:42 PM

Return to original view | Post

#47

|

Senior Member

1,260 posts Joined: Sep 2021 |

CommodoreAmiga liked this post

|

|

|

Aug 25 2024, 03:12 PM Aug 25 2024, 03:12 PM

Return to original view | Post

#48

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(plantcloner @ Aug 25 2024, 11:01 AM) BeU of Bank Islam digital bank = 4% beU is FD got lock in 12 months right.. Not comparable to HYSAThe app is reasonably well designed. What makes BeU different is that its Customer Service people are efficient. I hit a problem while opening up a term deposit (4% interest), submitted my complaint and received a reply soon after telling me that they are fixing the problem. Then a hour later, the same CS guy called to tell me that things had been fixed and to see if I needed help. My wife (iOS) installed BeU a few days later and sailed through all the procedures.... it means their tech guys at BeU solved all the issues I faced a few days earlier. At 4% FD, I think BeU is not bad at all. And the accounts are PIDM covered too. |

|

|

Aug 27 2024, 10:38 PM Aug 27 2024, 10:38 PM

Return to original view | Post

#49

|

Senior Member

1,260 posts Joined: Sep 2021 |

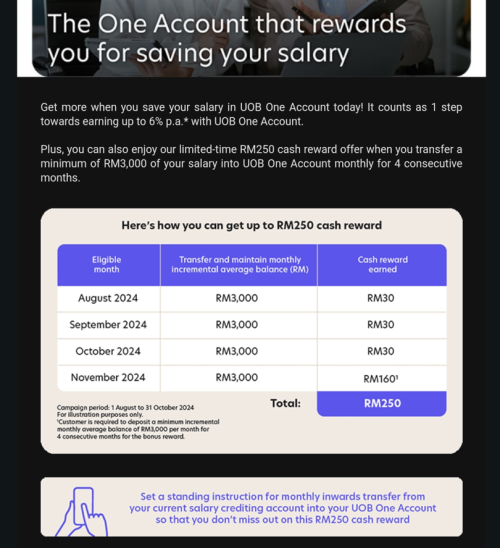

anyone participated in this? seems good

RM0 UOB: Get up to RM250 cash reward when you credit min RM3k into One Account. https://www.uob.com.my/personal/promotions/...-aug24-1sa.page  This post has been edited by Optizorb: Nov 27 2024, 05:00 PM |

|

|

Sep 1 2024, 07:25 PM Sep 1 2024, 07:25 PM

Return to original view | Post

#50

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(koja6049 @ Sep 1 2024, 09:07 AM) Yes, just increase your MAB by 3k every month very easy to do, but must do it consecutively. So far I have already achieved 3 months. But the crediting is only done 2 months after you achieved each target (e.g. my achievement is June is credited in August for RM 30). yup, just deposited 3k and also set recurring 3k for next 3 months.. |

|

|

Sep 2 2024, 07:11 PM Sep 2 2024, 07:11 PM

Return to original view | Post

#51

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(aeiou228 @ Sep 2 2024, 05:57 PM) yes, need receive either sms and/or email |

|

|

Sep 2 2024, 11:07 PM Sep 2 2024, 11:07 PM

Return to original view | Post

#52

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

Sep 2 2024, 11:59 PM Sep 2 2024, 11:59 PM

Return to original view | Post

#53

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(rocketm @ Sep 2 2024, 11:55 PM) so it tracks out.. you DO have BR before..thats why i specifically brought it up.. cause i had a feeling you might've forgotten bout it. rocketm liked this post

|

|

|

|

|

|

Sep 6 2024, 05:54 PM Sep 6 2024, 05:54 PM

Return to original view | Post

#54

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(HolyCooler @ Sep 6 2024, 04:25 PM) why not go straight for BeU 4% or Muamalat 4.1%? No negiotations neededThis post has been edited by Optizorb: Sep 6 2024, 05:54 PM |

|

|

Sep 10 2024, 12:27 AM Sep 10 2024, 12:27 AM

Return to original view | Post

#55

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(ericlaiys @ Sep 9 2024, 06:24 PM) Plus fed rate cut rate this week, so rate will confirm drop. Some people prefer well known bank rather than sign up another one. actually i dont understand this part.Did that last time on MBSB, but rate dont high long enough. end up waste time and go terminate the account. why ppl keep saying fed cut rates or whatever will affect our FD rates.. because when feds (USA) raised their interest rates multiple times, we did not go along.. That's why MYR was suffering for quite sometime... So our FD rates did not rise when the feds raised theirs.. Right now our interest rates is same as pre-covid level.. So how to lower our own interest rates further when we never raise it in the first place? This post has been edited by Optizorb: Sep 10 2024, 12:27 AM |

|

|

Sep 10 2024, 11:17 PM Sep 10 2024, 11:17 PM

Return to original view | Post

#56

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(Afterburner1.0 @ Sep 10 2024, 10:44 AM) U must be new..... got lar it banks used to offer 4.5 to 4.8% 1.5 years ago..... go do some research on MBSB and Public Bank.... now its lowered to 4.1% best rate...... Most FD players hoping to hit 5% at one point...... so it does have effect but its still up to BNM from my POV. cant take one off promotions from 1 or 2 banks as the de facto FD rates la.. Only PBB that one time CNY promo gave 18 months 4.8% and never again..then the others are MBSB/BI only. While the rest of the banks give very conservative rates.. Mostly 3.5%~3.7% Even right before covid time, banks also got offer 4.2% what.. Same like now la.. OPR also still same same what.. and what you said at the end is exactly my point la. It is up to BNM, and BNM never once raised the rates when feds did it multiple times.. So it is highly unlikely BNM going to lower OPR just because feds lower their rates now.. This post has been edited by Optizorb: Sep 10 2024, 11:23 PM |

|

|

Sep 17 2024, 02:59 PM Sep 17 2024, 02:59 PM

Return to original view | Post

#57

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

Oct 11 2024, 12:13 PM Oct 11 2024, 12:13 PM

Return to original view | Post

#58

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(BWassup @ Oct 11 2024, 09:54 AM) Most supermarkets do the right thing i.e. if the price displayed is lower than the price in the system, they will honour the lower price that is because we have KPDNHEP to help protect us.. As for BNM.. Hmm i dont think they protect us as much as they would protect banks..Otherwise supermarkets have been known to NOT honour it.. Only since KPDNHEP make PSA that sellers can be fined for not honouring shelf prices that we started seeing them honour the prices. Before this they will argue with you back and forth, especially cause staff/cashier level not aware of the laws.. Then you will need to argue and see their supervisors to sort it out.. Funny thing i just experienced this last month, bought something and at checkout price is higher. I told the cashier, cashier went called his supervisor over, and then decided they still cannot honour the prices. I lazy to argue with them i just told them if they dont honour it i will make complaint to KPDN. The supervisor still insisted he couldnt do anything regarding the price in POS. So I told them nvm i still want the item and paid for the higher price. Was gonna make complaint but decided to drop by the customer service first. I told them i paid higher than what is the shelf price (with picture proof of price tag i took earlier) and they just immediately refunded me the difference paid, no questions asked. This post has been edited by Optizorb: Oct 11 2024, 12:19 PM |

|

|

Oct 11 2024, 11:18 PM Oct 11 2024, 11:18 PM

Return to original view | Post

#59

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(joice11 @ Oct 11 2024, 01:58 PM) You are lucky, a few time i came accross the same issue in lotus, the customer service just offer to make refund the goods. never honour the lower price even i say will complain to KPDN. The lotus i buy stuffs from got honour the shelf-price for me before. I managed to get a refund from customer service after showing them price i paid on receipt higher than advertised shelf-price..anyway, just purchase the item with higher price and also make sure you have proof of the lower shelf-price.. then just make a complaint to KPDN saying the store REFUSE to honour shelf price. KPDN takes these matters very seriously punya.. Even if i end up paying higher price, the satisfaction knowing KPDN will take action towards the other party is good enough. But so far in my experience, all of them honour the shelf-price in the end. So I haven't got chance to make a complaint with KPDN you just save this link to use as your bullet next time: https://www.kosmo.com.my/2023/10/29/penggun...sistem-berbeza/ https://www.facebook.com/kpdnksh/posts/848778313276936/?_rdr » Click to show Spoiler - click again to hide... « » Click to show Spoiler - click again to hide... « == sorry off-topic== ok lets stop here This post has been edited by Optizorb: Oct 11 2024, 11:26 PM |

|

|

Oct 19 2024, 12:07 AM Oct 19 2024, 12:07 AM

Return to original view | Post

#60

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

| Change to: |  0.0657sec 0.0657sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 08:29 PM |