Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

Optizorb

|

Nov 27 2024, 04:56 PM Nov 27 2024, 04:56 PM

|

|

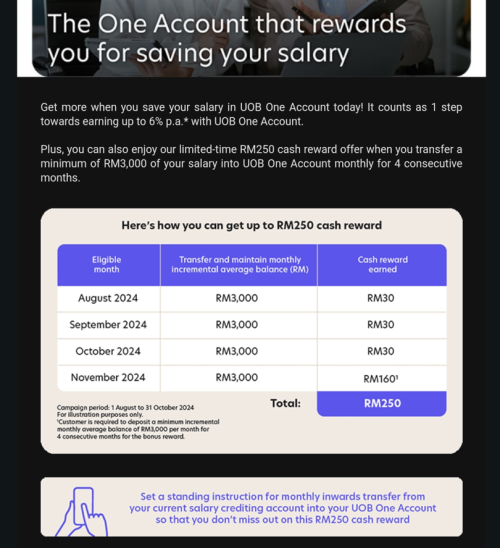

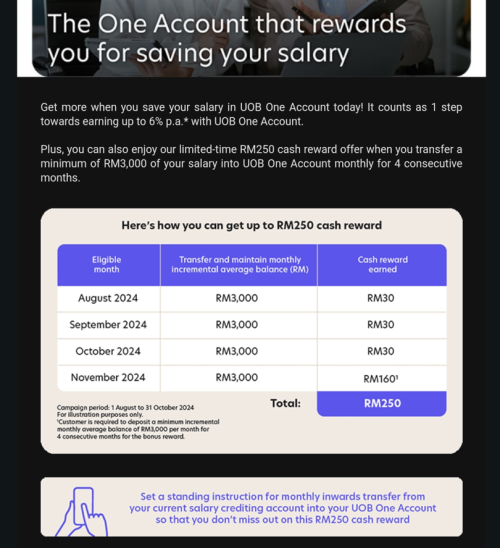

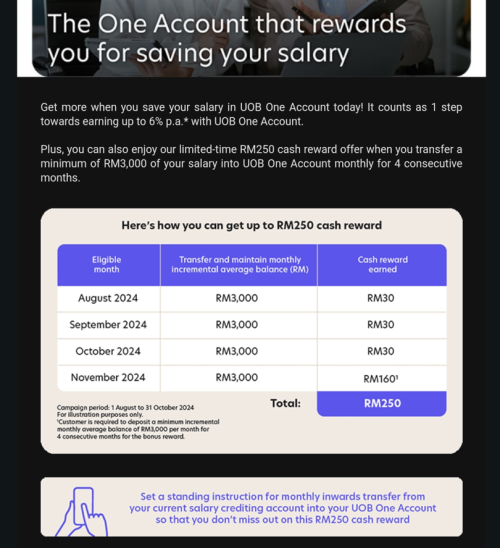

QUOTE(Optizorb @ Aug 27 2024, 10:38 PM) anyone participated in this? seems good RM0 UOB: Get up to RM250 cash reward when you credit min RM3k into One Account. https://www.uob.com.my/personal/promotions/...-aug24-1sa.page QUOTE(koja6049 @ Sep 1 2024, 09:07 AM) Yes, just increase your MAB by 3k every month very easy to do, but must do it consecutively. So far I have already achieved 3 months. But the crediting is only done 2 months after you achieved each target (e.g. my achievement is June is credited in August for RM 30). i just received my 1st month payout.  Started on 1st September, so what koja said is true, only credited after 2 months++. Was beginning to wonder when will it be credited and whether need to call them up to chase for it lol This post has been edited by Optizorb: Nov 27 2024, 04:59 PM |

|

|

|

|

|

Optizorb

|

Jan 6 2025, 11:42 AM Jan 6 2025, 11:42 AM

|

|

QUOTE(kuanhoong @ Jan 6 2025, 10:25 AM) Want to ask, if want to put a large sum of money (>300K++) in FD, what is the best way to transfer the money to another bank? Buy bank cheque? Sorry noob, bank cheque should be under my name? or bank's name? rentas if you already have a bank acc to transfer out to. if not banker's cheque under your name |

|

|

|

|

|

Optizorb

|

Jan 24 2025, 07:56 PM Jan 24 2025, 07:56 PM

|

|

QUOTE(BladeRider @ Jan 24 2025, 02:51 PM) 4 8 is good number. 4.08, 4.18 😁 rinduuu pbb cny fd promo 4.8% for 24 months   |

|

|

|

|

|

Optizorb

|

Jan 28 2025, 11:36 AM Jan 28 2025, 11:36 AM

|

|

mbsb min placement = 1k fresh/top up from rollover 12 months = 4% 6 months = 3.8% 3 months = 3.65% 3/6 months: https://www.mbsbbank.com/sites/default/file...n-3.0-ENG_0.pdf12 months: https://www.mbsbbank.com/sites/default/file...month-ENG_0.pdf  This post has been edited by Optizorb: Jan 28 2025, 06:48 PM This post has been edited by Optizorb: Jan 28 2025, 06:48 PM |

|

|

|

|

|

Optizorb

|

Jan 28 2025, 06:44 PM Jan 28 2025, 06:44 PM

|

|

QUOTE(Chuffling @ Jan 28 2025, 06:37 PM) untrue. Min is 1k. |

|

|

|

|

|

Optizorb

|

Feb 13 2025, 05:54 PM Feb 13 2025, 05:54 PM

|

|

QUOTE(sweetpea123 @ Feb 13 2025, 05:31 PM) 6 months only, plus the returns is 3.88% monthly interest KDI will take many days for me cos I dont like the idea of issuing a cheque under their name, plus I am not familiar with depositing that way. And only 3.5% jeez, how misinformed are you.. KDI is 4% EAR, or 3.925% DAILY, for first 50k. and you deposit into KDI by FPX, not by cheques wtf. |

|

|

|

|

|

Optizorb

|

Mar 3 2025, 08:07 AM Mar 3 2025, 08:07 AM

|

|

QUOTE(ikanez @ Mar 3 2025, 06:11 AM) finally Be U's latest TD campaign is up! more details at https://getbeu.com/campaigns/BeU-TermDeposit-i-Extra-2 too bad not attractive at all |

|

|

|

|

|

Optizorb

|

Mar 6 2025, 02:20 PM Mar 6 2025, 02:20 PM

|

|

QUOTE(babyevil82 @ Mar 6 2025, 01:01 PM) Hi is that any promotion on maybank recently? For MBSB found that 12mths interest rate was 4.1%, trustable?  term investment =/= term deposit.. returns not guaranteed and no pidm protection. MBSB term deposit still same as below QUOTE(Optizorb @ Jan 28 2025, 11:36 AM) This post has been edited by Optizorb: Mar 6 2025, 02:21 PM |

|

|

|

|

|

Optizorb

|

Apr 17 2025, 09:52 AM Apr 17 2025, 09:52 AM

|

|

QUOTE(Tanxy @ Apr 17 2025, 09:00 AM) Wondering if the sifus here know the difference between MBSB's TD-i and TIA-i campaigns? The 12 month FD rates are 4% and 4.1% respectively, but I noticed that for the TIA-i the 4.1% is listed as "indicative" and also that the amount is not protected under PIDM. td = fd.. guaranteed returns tia = not fd. not guaranteed returns |

|

|

|

|

|

Optizorb

|

Apr 22 2025, 05:40 PM Apr 22 2025, 05:40 PM

|

|

quick question.

can you withdraw the FD on its maturity date? Or need wait the day after

|

|

|

|

|

|

Optizorb

|

May 2 2025, 06:38 PM May 2 2025, 06:38 PM

|

|

QUOTE(Ethan @ May 2 2025, 06:00 PM) Bank of China  huh.. talk about rare lol  |

|

|

|

|

|

Optizorb

|

May 7 2025, 06:25 PM May 7 2025, 06:25 PM

|

|

QUOTE(iGamer @ May 7 2025, 06:04 PM) Anyone can confirm HLBB is having 6% FD promo for 12mth? Idk, you tell me? |

|

|

|

|

|

Optizorb

|

May 8 2025, 04:59 PM May 8 2025, 04:59 PM

|

|

QUOTE(jhleo1 @ May 8 2025, 04:51 PM) I just googled only. https://www.hlisb.com.my/en/personal-i/mana...-account-i.htmlHowever when i login to check it is only 3.70% 12 months. that is not FD |

|

|

|

|

|

Optizorb

|

May 18 2025, 02:15 PM May 18 2025, 02:15 PM

|

|

QUOTE(fartbrat @ May 18 2025, 01:12 PM) if bringing banker/personal cheque to deposit fd, can extra cash be added in one fd account? for example if the cheque is 83k, can i add 17k by cash to round up 100k in a single slip? of course can, why cannot. but the banker cheque may take up to 1 day to clear. clarify with the bank whether if you do placement it will count as 17k today and tomorrow when clear only it will become 100k FD or whether its instantaneous and it will count as 100k FD today.. some banks will count it instantly meaning no need do verification, some say may take few hours for verification to complete, and some will say up to 1 day This post has been edited by Optizorb: May 18 2025, 02:16 PM |

|

|

|

|

|

Optizorb

|

May 21 2025, 08:50 PM May 21 2025, 08:50 PM

|

|

QUOTE(kyleen @ May 21 2025, 08:27 PM) Banker cheque is as good as cash. It should be accepted immediately. For large amount I always use bank cheque. I also use to pay car deposit large amount, when the dealer see a bank cheque, they issue resit immediately. not true. some banks will need to do verification, could range from couple of hours to next day. some banks allow the FD to start on the same day while some bank insist the banker's cheque to clear first then only the FD will start.. Best to clarify upfront with the bank you placing FD with i rmb last 2 years when i placed at Bank Islam, SA account opening and everything done on same day, but the FD had to come back the next day while waiting for the banker's cheque to clear verification. This post has been edited by Optizorb: May 21 2025, 08:52 PM |

|

|

|

|

|

Optizorb

|

May 22 2025, 11:04 PM May 22 2025, 11:04 PM

|

|

QUOTE(jkngo2003 @ May 22 2025, 09:22 PM) If enough 250k, direct be premier customer and can get more gift. Like travel adaptor. Coz I not free at working hours, the relationship manager bring thumb print machine for me to apply premier customer and bring all free gift to my house. I think this is best relationship manager I meet before. Rhb and Ambank RM never visit me at all before how to qualify as premier customer? i been placing 500k FD with BI the past 2 years already. The staff never mentioned anything about it before |

|

|

|

|

|

Optizorb

|

May 27 2025, 03:00 PM May 27 2025, 03:00 PM

|

|

QUOTE(garbanicus @ May 27 2025, 02:56 PM) Bro can share where you got this? Went to BI Sec 14 PJ, they didn't mention this promo. you got ask them about it? and they said dont have? or just that they didnt mention about it This post has been edited by Optizorb: May 27 2025, 03:01 PM |

|

|

|

|

|

Optizorb

|

May 27 2025, 06:07 PM May 27 2025, 06:07 PM

|

|

QUOTE(brandonkl @ May 27 2025, 05:21 PM) I was at Bank Muamalat yesterday and they asked me if I wanted the profit (interest) to be credited monthly or upon maturity. I didn't even ask for it. I told them upon maturity. may i know which branch BM you went? |

|

|

|

|

|

Optizorb

|

May 28 2025, 04:30 PM May 28 2025, 04:30 PM

|

|

so BI 12m 4.1% upon maturity vs BM 12m 4% monthly crediting..

anyone wanna do the maths which is better?

EDIT: Guess 4.1% will be better, even with 4% pa re-investment of the monthly compounding profit

This post has been edited by Optizorb: May 28 2025, 05:27 PM

|

|

|

|

|

|

Optizorb

|

May 29 2025, 12:50 PM May 29 2025, 12:50 PM

|

|

QUOTE(CommodoreAmiga @ May 29 2025, 12:45 PM) BI FD done over the counter must uplift/withdraw from counter. I don't know about BM. MBSB FD done over counter can be uplift online via your phone. So this is something to consider. im ok with OTC only. i dont like eFD anyway cause of the 50k limit. In case wanna switch bank that offer better promo will be troublesome |

|

|

|

|

Nov 27 2024, 04:56 PM

Nov 27 2024, 04:56 PM

Quote

Quote

0.0634sec

0.0634sec

0.40

0.40

7 queries

7 queries

GZIP Disabled

GZIP Disabled