QUOTE(cclim2011 @ Dec 7 2022, 10:52 AM)

any update for this table?Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Jan 6 2023, 02:11 PM Jan 6 2023, 02:11 PM

Return to original view | Post

#1

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(cclim2011 @ Dec 7 2022, 10:52 AM) any update for this table? |

|

|

|

|

|

May 20 2023, 06:34 PM May 20 2023, 06:34 PM

Return to original view | Post

#2

|

Senior Member

1,261 posts Joined: Sep 2021 |

got half a mil fd maturing next month. looking somewhere to park it for long term again 18m/24m.. anyone knows the rates for 18m or 24m?

i missed the PB cny 4.8% 24m boat sadly.. looking for something similar or even better since that was pre OPR hike as well. currently best rates is bank islam 4.5% @ 12m? EDIT: if you know something better but non-fd can pm as well. risk tolerance: low-ish. This post has been edited by Optizorb: May 20 2023, 06:43 PM |

|

|

Jun 7 2023, 08:08 PM Jun 7 2023, 08:08 PM

Return to original view | Post

#3

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(hedfi @ Jun 7 2023, 04:37 PM) Pleasantly surprised at BI that issued FD cert on the spot for cheque FD placement. 4.5%/12mths till year end according to the officer. Out in an hour - which is fast for a snail bank 😄 wah yours so fast.today i went to do. they need 2~3 days to clear the banker's cheque.. so today can open savings account only.. once the cheque cleared then have to return back to BI to do fd placement.. This post has been edited by Optizorb: Jun 7 2023, 09:00 PM |

|

|

Jun 7 2023, 09:00 PM Jun 7 2023, 09:00 PM

Return to original view | Post

#4

|

Senior Member

1,261 posts Joined: Sep 2021 |

|

|

|

Jun 7 2023, 11:29 PM Jun 7 2023, 11:29 PM

Return to original view | Post

#5

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(paramdav @ Jun 7 2023, 11:12 PM) Which BI branch is this? @ PJ.In Subang _ Tiapan branch i have issued personal check and i can get the FD cert at the same time, no need to wait for check to clear looks like different branch got different rules does amount play a part on this? cause it was for 500k. they told me they need to do verification with the bank that issued the cheque first. once cleared and money entered savings account then only come back to do fd placement. thats what i was told. |

|

|

Jun 9 2023, 07:29 PM Jun 9 2023, 07:29 PM

Return to original view | Post

#6

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(Optizorb @ Jun 7 2023, 08:08 PM) wah yours so fast. finally done placed fd this morning at BI just before their system went down for "maintenance".. today i went to do. they need 2~3 days to clear the banker's cheque.. so today can open savings account only.. once the cheque cleared then have to return back to BI to do fd placement.. this time round took like 30 mins as others mentioned before.. oh and also yes their fd maturity bring to the earliest working day if fall on weekend.. but when i requested for it the officer told me they cant decide it, it is based on their system.. so it is automated.. |

|

|

|

|

|

Jul 12 2023, 10:33 PM Jul 12 2023, 10:33 PM

Return to original view | Post

#7

|

Senior Member

1,261 posts Joined: Sep 2021 |

|

|

|

Jul 12 2023, 10:44 PM Jul 12 2023, 10:44 PM

Return to original view | Post

#8

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(gamenoob @ Jul 9 2023, 10:21 AM) Not so simple. I believed BNM will freeze such acvt if they aware of such death reported. Maybe others can elaborate if indeed they have been through such. My bankers from uob HSBC say joint account have such issue if one party deceased. Need to settle probate etc etc QUOTE(cybpsych @ Jul 9 2023, 10:43 AM) that is why 'either one to sign' is important, in case of either party is demised. banks won't know the death immediately, even after reported to NRD/JPN. better quickly go to bank and withdraw immediately (maturity and profit is irrelevant now). be calm and withdraw as usual (even when you are grieving at that moment) QUOTE(gamenoob @ Jul 9 2023, 07:05 PM) My comment is clarifying nexona comment that just bring death cert to proceed. trying to clarify here..What you suggested is what all banker recommended to do in any death that involves joint accounts. Either to sign is the "unwritten" rule to address that narrow window of withdrawal opportunity before the system pick it up. Hope and pray bnm system is still not up to the minutes on death reporting ...... so you saying if either 1 to sign there is small window where the surviving person can go withdraw the monies before BNM picks it up and update system to lock everyone out? what happens when that happens? then have to go through a "process" i assume? then only finally the surviving person get to take the money out? and i assume this whole "process" comes with a fee that needs to be paid? does this means that the "either 1 to sign" is a trap when it involves death of either party? because it is not really "either 1 to sign" in the event of death? then have to go through some process and need to pay some fees as well due to said process? what about for joint account that is under both to sign? This post has been edited by Optizorb: Jul 12 2023, 10:57 PM |

|

|

Jul 12 2023, 10:54 PM Jul 12 2023, 10:54 PM

Return to original view | Post

#9

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(nexona88 @ Jul 12 2023, 10:44 PM) thanks will add to my reading for lateri always thought all this asb/asm stuff for bumis only all these while nexona88 liked this post

|

|

|

Jul 13 2023, 12:23 PM Jul 13 2023, 12:23 PM

Return to original view | Post

#10

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(poweredbydiscuz @ Jul 13 2023, 07:51 AM) No it's not a trap. thanks. TIL.Think about it like this, the money in the joint account belongs to two persons equally. Let's say one of them (A) died and bank was notified, legally half of the money in the joint account belongs to A's next of kin, not B. So bank cannot simply let B withdraw the money inside, must wait for the probate/LOA to proceed. To get the probate/LOA need to pay some fee but it's pay to other parties (court/amanah raya/land office), not to the bank. I say it is a trap because for me it is.. Bolded part is not the intention of opening the joint account. As money is solely mine, but opened joint account (all to sign actually) for the purposes of "responsibly" managing the money and not spending it as i like.. If based on bolded part, say if i joint account with my parent, does that mean upon my parent death, the next of kin which say would be other parent/siblings can get their hands on the cookie jar? Well mine is all to sign anyway, did recently thought of changing it to either to sign.. But upon learning this, i guess both types would still end up having to go through legal process to claim the money if one of the party died. Guess I have to rethink all this, probably from next fd move it to sole account. QUOTE(sirius2017 @ Jul 13 2023, 09:35 AM) Some banks now include "survivorship clause" in their TnC. In the event of death of one of the joint account holders, the surviving joint account holder is entitled to the monies in the joint account. Bank will pay the account balance to the surviving account holder(s) and Bank is indemnified against any proceeding, claims etc. do you know about BI? whether they have any such clauses? cause recently placed with BISo if you have joint-account in these banks, the surviving party will get account balance. https://forum.lowyat.net/topic/4154481/+27768 |

|

|

May 10 2024, 10:28 PM May 10 2024, 10:28 PM

Return to original view | Post

#11

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(Vickyle @ May 10 2024, 09:53 PM) Doesn't mean much cause the bonus will only be credited after the campaign ends.Not like gx where you can see the daily bonus credited and then immediately know whether you qualified for it. So you can only put trust that HLB not doing any hanky panky. Would also be good if they would make announcement when quota cap reached, like what gx did.. But they don't have any obligation to do this as expressly stated. So depends on their goodwill. Like gx tnc also said they not obliged, but they still did inform people. For reference, gx 1 billion capping reached in 12~13 days. And that's for 20,000 users, assuming each maximizes. This HLB 200mil quota, if everyone maximizes, then only first 2000 people would qualify. |

|

|

May 10 2024, 11:00 PM May 10 2024, 11:00 PM

Return to original view | Post

#12

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(ericlaiys @ May 10 2024, 10:52 PM) but i think still a lot people received the offer.everyone i know who have HLB SA received this offer. Doesn't matter active or inactive account. and it seems most people have low balances in their HLB. So they going to be able to fully maximize the 100k quota for this promo. Also spoke to 1 friend who works at HLB, he say a lot of his friends/family/customers also got receive this offer. Cause a lot of them find him and kept asking about this today. Its an online promo, so counter staff not briefed/aware about this campaign. My personal opinion: If those missed first 2 days (today and tmr), better dont go for this anymore. High chance the capping reached This post has been edited by Optizorb: May 10 2024, 11:14 PM Medufsaid liked this post

|

|

|

May 13 2024, 07:52 PM May 13 2024, 07:52 PM

Return to original view | Post

#13

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(LoTek @ May 13 2024, 04:14 PM) yup rather take a lower rate with no risk. savings/fd are supposed to be sleep well at night not wonder if you qualified for the promo lol. exactly this.unless you can get black and white confirmation from hlb that you are still eligible for it.. or you willing to argue with them later on when promo ends.. for those who didnt get the invitation first 2 days of promo.. my own opinion is better not to go for it now la.. today is the 4th day dy for 50k, 4.5% hlb vs 3.8% rize, difference around RM51 only.. This post has been edited by Optizorb: May 13 2024, 07:55 PM LoTek liked this post

|

|

|

|

|

|

May 15 2024, 12:03 PM May 15 2024, 12:03 PM

Return to original view | Post

#14

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(Joe Yuan @ May 15 2024, 11:48 AM) QUOTE(guy3288 @ May 15 2024, 12:00 PM) Yes i have mentioned that here my BI maturing end of the month..So easy Even on1.5.24 i could take the money out earn interest in rice when i placed the time and opened bank account, i didnt opt for debit card. can still do online withdrawal kah? or need to have debit card then only have online banking |

|

|

May 15 2024, 12:15 PM May 15 2024, 12:15 PM

Return to original view | Post

#15

|

Senior Member

1,261 posts Joined: Sep 2021 |

|

|

|

May 15 2024, 02:29 PM May 15 2024, 02:29 PM

Return to original view | Post

#16

|

Senior Member

1,261 posts Joined: Sep 2021 |

|

|

|

May 20 2024, 03:58 PM May 20 2024, 03:58 PM

Return to original view | Post

#17

|

Senior Member

1,261 posts Joined: Sep 2021 |

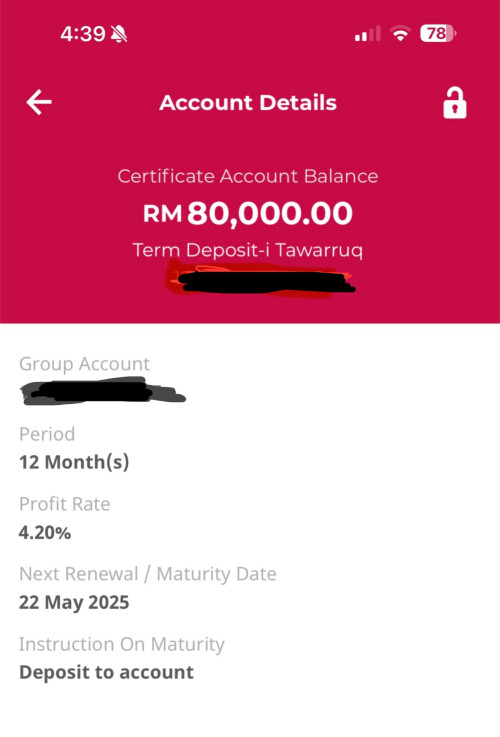

hopefully by june got someone come up with 4.2% promo

|

|

|

May 20 2024, 07:29 PM May 20 2024, 07:29 PM

Return to original view | Post

#18

|

Senior Member

1,261 posts Joined: Sep 2021 |

|

|

|

May 22 2024, 04:49 PM May 22 2024, 04:49 PM

Return to original view | Post

#19

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(McMatt @ May 22 2024, 04:46 PM) For those complaining about BI, I was pleasantly surprised today. Had 3 certs matured today. Logged in and checked that they auto renewed all 3 at 4.2% pa. And to think I just went to MBSB to open an account yesterday to transfer from BI for the 4% tomorrow 😅 Guess I don’t need to do that already. anybody wanna tell him?  EDIT: nvm on second thought, no need. let him find out himself in few days time This post has been edited by Optizorb: May 22 2024, 04:51 PM |

|

|

May 29 2024, 07:44 PM May 29 2024, 07:44 PM

Return to original view | Post

#20

|

Senior Member

1,261 posts Joined: Sep 2021 |

QUOTE(Imsexyandiknowit @ May 29 2024, 05:23 PM) Would appreciate if you could share which other banks apply such calculation.Theoretically the bank should pay 1 day extra for interest on leap year and not lesser ( than usual) to the DEPOSITOR.Per annum means 365 days.Thanks in advance. it is very common for banks to follow calendar days in a year. so if leap year have 366 days hence interest also divided by 366. not 365.it is PER ANNUM. No where it is specified that per annum means 365 days only, unless strictly stated so.. also, if your interest is RM100 PA. then that is your max interest possible already. If you have 400 days in a year also the max you getting is still RM100. The bank wont be owing you extra 35 days of interest This post has been edited by Optizorb: May 29 2024, 07:49 PM |

| Change to: |  0.0613sec 0.0613sec

0.30 0.30

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 03:58 PM |