QUOTE(nexona88 @ May 31 2024, 11:12 AM)

i miss PBB 4.8% CNY promo last year Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

May 31 2024, 11:14 AM May 31 2024, 11:14 AM

Return to original view | Post

#21

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

|

|

|

May 31 2024, 10:26 PM May 31 2024, 10:26 PM

Return to original view | Post

#22

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(nexona88 @ May 31 2024, 10:20 PM) Especially in PB 😁 cooling period still ok. the very cb one is ask you go find their atm No matter what... There's always people does FD placement... Trust on the bank is important & very high.... Others non issues... That's why it's called old school bank... Security features tip top... Sikit2 cooling period 😋 |

|

|

Jun 10 2024, 11:58 AM Jun 10 2024, 11:58 AM

Return to original view | IPv6 | Post

#23

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

Jun 10 2024, 12:32 PM Jun 10 2024, 12:32 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

Jun 10 2024, 12:35 PM Jun 10 2024, 12:35 PM

Return to original view | IPv6 | Post

#25

|

Senior Member

1,260 posts Joined: Sep 2021 |

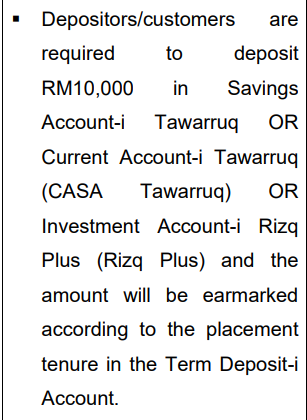

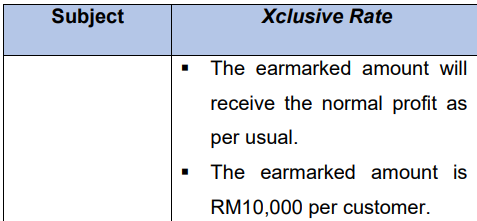

QUOTE(Human Nature @ Jun 10 2024, 12:33 PM) Yes, from branch. Was told min placement 50k and lock 10k in savings, so total min required 60k. 10k need lock until maturity while FD profit can withdraw monthlyThis post has been edited by Optizorb: Jun 10 2024, 05:57 PM Human Nature liked this post

|

|

|

Jun 10 2024, 01:14 PM Jun 10 2024, 01:14 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

1,260 posts Joined: Sep 2021 |

|

|

|

|

|

|

Jun 10 2024, 06:18 PM Jun 10 2024, 06:18 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(whycanot323 @ Jun 10 2024, 04:36 PM) new to negotiation FD... no experience... who to look for the 100k 3.9 ? the front counter always giving standard answer about FD info and no relationship manager for bank islam QUOTE(Human Nature @ Jun 10 2024, 03:30 PM) can confirm i had the same experience as well.when went to BI they say no any promotions, the rate 2%++ only.. so i say wanna withdraw my FD out.. then they process it to savings account and ask me wait and duduk dulu cause they check what new rate they can give me.. after a while told me can get 3.9% only, then i say ok nvm not interested, i wanna withdraw out since i can get higher elsewhere. then again say ok duduk dulu, let us check with HQ again see can get what rate.. finally returned with 4% 12months upon maturity. So i decided to stay with BI instead of going over to MBSB to go through the whole opening account process yada yada. But the manager or asst. manager keep saying this is the only time i can get this rate, after this in future no more dy cannot do like this anymore and this is a one-time thing.. I also dont know what marketing or sales pitch is this kek. As if i should be indebted or grateful to them cause they able to match MBSB lol.. Or like im the one asking BI for a huuuge favour to give me a rate that i can already get elsewhere.. Was just a weird exchange overall with the manager/asst. manager.. The front desk clerk was alright.. |

|

|

Jun 10 2024, 06:23 PM Jun 10 2024, 06:23 PM

Return to original view | IPv6 | Post

#28

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(cybpsych @ Jun 10 2024, 02:36 PM) general customers t&c https://www.bankrakyat.com.my/d/campaigns/c...%20TD%20ENG.pdf faq https://www.bankrakyat.com.my/d/campaigns/c...0FAQ-TD_ENG.pdf  QUOTE(Optizorb @ Jun 10 2024, 12:32 PM) QUOTE(Optizorb @ Jun 10 2024, 12:35 PM) Yes, from branch. Was told min placement 50k and lock 10k in savings, so total min required 60k. 10k need lock until maturity while FD profit can withdraw monthly confirmed then what the Bank Rakyat staff told me just now..  Human Nature liked this post

|

|

|

Jun 10 2024, 07:49 PM Jun 10 2024, 07:49 PM

Return to original view | IPv6 | Post

#29

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(blatant928 @ Jun 10 2024, 07:28 PM) Just checked with the CS, other options available without any RM10K pledge / lock in period: yes there's 2 on-going BR promo as posted by others.3.8% for 12 months or 3.7% for 8 months 1st promo w/ hanky panky: higher rate but lock-in 10k, EIR maybe lower than the 2nd promo even. depends on your total QUOTE(lawr0202 @ Jun 10 2024, 11:01 AM) 2nd promo w/o hanky panky:QUOTE(cybpsych @ Jun 10 2024, 02:36 PM) |

|

|

Jun 10 2024, 08:05 PM Jun 10 2024, 08:05 PM

Return to original view | Post

#30

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(Imsexyandiknowit @ Jun 10 2024, 07:58 PM) Yes you are right MBSB do not give 4% as advertised.They misled and short changed most of the ignorant depositors.Those who make noise and raise the issue will get it amended..otherwise they thought beggars cannot be choosy..(since they are offering the attractive rate in town.)MBSB is tarnishing its reputation if they do not honour they commitment .BI is a better deal and transparent. mind to explain? Im out of the loop. what is this thing about MBSB shortchanging fd depositors?is it the 365 vs 366 days thing? |

|

|

Jun 10 2024, 08:42 PM Jun 10 2024, 08:42 PM

Return to original view | Post

#31

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(Human Nature @ Jun 10 2024, 08:37 PM) means today you place 1 FD. then next week place 1 more FD. that 10k lock will follow your first FD tenure. I'm guessing after your 1st FD tenure you are free to take out that 10k from being locked while waiting your 2nd/3rd FD to mature with BR.. |

|

|

Jun 10 2024, 08:45 PM Jun 10 2024, 08:45 PM

Return to original view | Post

#32

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(Imsexyandiknowit @ Jun 10 2024, 08:31 PM) read it, still dont understand how they only give out 3.99% instead of 4%.Is it because purely a calculation error or is it because they use 366 days instead of 365 days? This post has been edited by Optizorb: Jun 10 2024, 09:35 PM |

|

|

Jun 10 2024, 11:21 PM Jun 10 2024, 11:21 PM

Return to original view | Post

#33

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(Imsexyandiknowit @ Jun 10 2024, 09:57 PM) In the financial industry world wide,4% means 4% no such thing as 3.99%. If it is. A LEAP year they have to pay you even more ..extra 1 day interest.,not less and cannot be compromised.No bank would dare do it except MBSB. hmm ok, since im curious about this. i go and check my previous BI FD, placement 9th june last year, standard maturity supposed to be 9th june this year, but since 9th this year was a sunday, so actual maturity delayed to next working day, monday 10th june. 9th june 23 to 10th june 24, the total days = 367. so got 2 days extra from the usual 365 pa. 1 day being the leap day and 1 more day being sundayUpon checking the interest, they did credited extra 2 days worth of interest at the same rate. So i get your point now that even if 366 days, then should be getting more instead of lesser. Since i have no reference with MBSB, so idk how is it. But if according to what you say happened, then yeah kinda dumb for not getting the full 4% amount.. Like how does it even happen.. |

|

|

|

|

|

Jun 11 2024, 01:13 AM Jun 11 2024, 01:13 AM

Return to original view | Post

#34

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(guy3288 @ Jun 11 2024, 12:16 AM) 1 yr is actually more than 365 days, so every year depositors untung abit. no idea what's the deal with MBSB since i dont have any placement there. so i have no reference what even is the issue.in leap year if bank use 366 as divisor and you insist your 1 year is 365 days, sure you will find bank pay you lesser... did i miss out something? isnt that issue or 365 or 366day as you asked earlier? so the 3.99% instead of 4% is not because of 365 vs 366 days?? but if you say BI, for total maturity of 367 days.. we do get paid 365 + 2 days.. so got no rugi compared to normal 365 day years. This post has been edited by Optizorb: Jun 11 2024, 01:21 AM |

|

|

Jun 13 2024, 08:14 PM Jun 13 2024, 08:14 PM

Return to original view | Post

#35

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(joeblow @ Jun 13 2024, 07:21 PM) Seriously dude, it is either you are a troll or you have issue with that sexandiknowit guy and took it out on my post. I don't need you to explain to me why i am getting effective 3.9925% based on what my FD Cert states. I already replied I know why. If you have a beef with someone else I appreciate you reply that someone instead of me. to be fair.. you cant say you getting 3.99% or whatever also what..This is a FD thread where we try to help each other to get the best deal. I really wanted to help cclim (if he is not trolling) to understand this 3.99% and how we got it. What's wrong with me saying I get only 3.99% based on my cert information? Why do I need to be responsible to explain for MBSB? A lot of guys already put in their analysis on the 366, not enough? I have no beef with that. The effective rate we get is indeed 3.9925%. Nothing wrong with that. Effective rate you understand right? Seriously I am a bit fed up. You seem to want to have the last word yet you don't understand the logic of your rambling should be to someone else and not to my post. Don't you think your argumentative nature is becoming a toxic to this thread? And to make matter interesting, it is someone else who first explained the 366 days calculation. Not you. And you are only unhappy because someone says/infer MBSB is cheating. Enough already man. You don't have to tell me how FD works. Let's keep this FD thread informative and not argumentative please. cause their tnc clearly stated they use either 365 or 366 divisor. and as 2024 is leap year, so they follow 366 divisor.. Whether you want to argue if placement after 29th Feb to the next year is no longer "leap" days cause it will be 365 total days only.. Well too bad, as a whole we still under 2024, which is designated as a leap year already.. So any placements made this year, the bank can still say we are in leap year, thus follow leap year formula.. So if follow 366 divisor, they really give you 4% right.. If you want to say you get 3.99% then clearly its misleading and can even be looked as slander, cause you refuse to acknowledge the calculation stated in TNC.. This post has been edited by Optizorb: Jun 13 2024, 08:20 PM |

|

|

Jun 21 2024, 08:15 PM Jun 21 2024, 08:15 PM

Return to original view | Post

#36

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(Micky78 @ Jun 21 2024, 08:00 PM) the best rate at bank rakyat is to take out from BR and put in BI or MBSB nexona88 liked this post

|

|

|

Jun 21 2024, 09:50 PM Jun 21 2024, 09:50 PM

Return to original view | Post

#37

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(Micky78 @ Jun 21 2024, 08:20 PM) BI only got so called min amount to get 4% rate, mbsb dont have..but if you say very small amount, might as well put in KDI only.. 3.93% or Aeon 3.88% then dont have to waste time/petrol purposely going to BI or mbsb to do fd placement This post has been edited by Optizorb: Jun 21 2024, 09:52 PM |

|

|

Jun 24 2024, 12:18 AM Jun 24 2024, 12:18 AM

Return to original view | Post

#38

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(donkeygg @ Jun 23 2024, 11:56 PM) Hello Sifus, personally. im not bothered so much about pidm coverage... but also depends on the bank's reputation in general..i have a stupid question here, if you have rm1million in a saving account, would you split it into 4 different banks with 250k each bank? since the PIDM covered up to 250k max just in case Bank A goes to bankrupt? and for those high networth sifus who has more than 1million in FD/savings in 1 bank, would you afraid if this really happen? thanks.. i really need to know this just in case if i have 1 million in future so i know it is needed to split since each bank PIDM covered up to 250k only put 1 mil into maybank? cimb? No thanks. 250k max, and even then they would have to be offering something hard to resist for me to even consider them. put 1 mil into HLB? PBB? No problem, I have a lot of confidence in them. Basically, depends on the bank's rep over the course of its history. Another example: MBSB. Heard from banker friends not to put all eggs into this basket, cause its a fairly new bank. Not much good/excellent track record garnered yet, so to speak. donkeygg liked this post

|

|

|

Jun 24 2024, 08:05 PM Jun 24 2024, 08:05 PM

Return to original view | Post

#39

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(Medusakia @ Jun 24 2024, 07:28 PM) QUOTE(ycs @ Jun 24 2024, 07:37 PM) QUOTE(Optizorb @ Jun 24 2024, 12:18 AM) Another example: MBSB. Heard from banker friends not to put all eggs into this basket, cause its a fairly new bank. Not much good/excellent track record garnered yet, so to speak. ohh name keluar dy eh.. Guess what my friends told me correct la then..probably in banking circles they already knew about this case well before the story made it out to public.. that was one of the reasons why i last minute decide not to pull the trigger to place fd there.. even was already there at the branch finishing up the SA opening.. also this reminds me of something, the imsexyandiknowit guy confirm going to be "i told you so" now |

|

|

Jun 26 2024, 04:06 PM Jun 26 2024, 04:06 PM

Return to original view | Post

#40

|

Senior Member

1,260 posts Joined: Sep 2021 |

QUOTE(HolyCooler @ Jun 26 2024, 03:27 PM) One of my BI's FD matured today, and when i checked it out, the new rate given to me is 4.1%. Was planned to move it somewhere else but now i think just keep it inside will do. its a trap, go renew otc 4%This post has been edited by Optizorb: Jun 26 2024, 04:07 PM HolyCooler liked this post

|

| Change to: |  0.0623sec 0.0623sec

0.83 0.83

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 11:57 PM |