QUOTE(cclim2011 @ Feb 5 2020, 03:25 PM)

placed affin for 3.7 (13mths & above). at first bank wants earmarked 20% but i insist dont want. got approved.

I just asked the branch manager. She told me got 100k limit per account, for your case also got?Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Feb 5 2020, 05:28 PM Feb 5 2020, 05:28 PM

Return to original view | Post

#21

|

Senior Member

1,144 posts Joined: Dec 2015 |

|

|

|

|

|

|

Feb 7 2020, 10:17 AM Feb 7 2020, 10:17 AM

Return to original view | Post

#22

|

Senior Member

1,144 posts Joined: Dec 2015 |

QUOTE(bbgoat @ Feb 7 2020, 09:03 AM) Just heard that one of my relative has nego with CIMB for FD renewal for 6 mths to 3.6%. FYI fresh fund for big amount cimb my rm got 3.65% for 12 months. However I will still put at Bangkok Bank for 3.85% 12 months. So if amount is high enough like hundred's k, do nego with CIMB. For CIMB fans. |

|

|

Feb 7 2020, 02:54 PM Feb 7 2020, 02:54 PM

Return to original view | IPv6 | Post

#23

|

Senior Member

1,144 posts Joined: Dec 2015 |

Hi all, just went Bangkok Bank placed 12 months fd at 3.85% FF. Be warned opening new account takes at least 1 hour, so if amount not big then maybe need to reconsider.

|

|

|

Feb 7 2020, 09:41 PM Feb 7 2020, 09:41 PM

Return to original view | Post

#24

|

Senior Member

1,144 posts Joined: Dec 2015 |

QUOTE(super aloha @ Feb 7 2020, 05:05 PM) I went Johor branch at Molek. Yes no CASA all into FD. BTW one hour plus is opening account, doesn't include waiting time for your turn. If your documents not in full or money not able to explain clearly, I think will take more than 1 hour... |

|

|

Feb 21 2020, 11:33 PM Feb 21 2020, 11:33 PM

Return to original view | Post

#25

|

Senior Member

1,144 posts Joined: Dec 2015 |

QUOTE(BoomChaCha @ Feb 21 2020, 09:45 PM) Yes, EPF's RM 60K per year is maximum. I think the highest rate for FD now is Alliance, other banks seem to hit a blank. I just placed Alliance's 3.8% FD for 6 months. I will withdraw RM 10K from Alliance Bank's saving next monday then deposit to EPF... Since you guys mention this EPF self contribution, can I check if self contribution can be deducted against our income tax especially if we are self employed without epf contribution. |

|

|

Mar 3 2020, 06:06 PM Mar 3 2020, 06:06 PM

Return to original view | Post

#26

|

Senior Member

1,144 posts Joined: Dec 2015 |

Hmm, I can understand the upset here. But the world's trend is lowering interest rate. Hard for Malaysia not to keep up. Anyway I have a FD due soon, so I will update the thread with latest rate. I think hard for banks to come out with new promotion now with the political uncertainties and world trend of interest rate going down...

|

|

|

|

|

|

Mar 4 2020, 03:57 PM Mar 4 2020, 03:57 PM

Return to original view | Post

#27

|

Senior Member

1,144 posts Joined: Dec 2015 |

Bros who bought TIA either from cimb or HL, the returns affected? Previous I bought cimb TIA at 4% maturing in April and June. Will update if I do get the 4%...

|

|

|

Jul 14 2020, 05:00 PM Jul 14 2020, 05:00 PM

Return to original view | Post

#28

|

Senior Member

1,144 posts Joined: Dec 2015 |

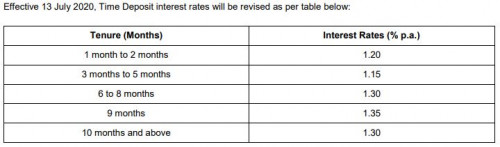

QUOTE(BoomChaCha @ Jul 14 2020, 09:54 AM) So strange. 5 months higher than 6 months...QUOTE(GrumpyNooby @ Jul 14 2020, 11:39 AM) Revision of BR, BLR/ BFR, and Time Deposit Interest Rates [for Citibank] Citibank can go 2.4% for 12 months. But maybe only Citigold. Still 2.4% too low unless you love Citibank.  https://www.citibank.com.my/global_docs/pdf...TimeDeposit.pdf Nowadays with such low interest rate I really don't know what to do, put UT also got risk. Put in gold? |

|

|

Aug 27 2020, 08:50 PM Aug 27 2020, 08:50 PM

Return to original view | Post

#29

|

Senior Member

1,144 posts Joined: Dec 2015 |

Delete. Found the links. Thanks.

This post has been edited by joeblow: Aug 27 2020, 08:51 PM |

|

|

Aug 28 2020, 10:22 PM Aug 28 2020, 10:22 PM

Return to original view | Post

#30

|

Senior Member

1,144 posts Joined: Dec 2015 |

|

|

|

Aug 31 2020, 08:35 PM Aug 31 2020, 08:35 PM

Return to original view | Post

#31

|

Senior Member

1,144 posts Joined: Dec 2015 |

QUOTE(Human Nature @ Aug 31 2020, 08:02 PM) I am hoping for UOB and BR to come out with something tomorrow. Both their FD expired today. OCBC expired today too but it is already at a low rate. Else, tomorrow will just renew my BR at base rate. 2.30% 12m but still higher than CIMB eFD 2.25% I could be wrong. But I think highest now is Affin 5 months at 2.5%. I just put last Fri. But I put 6 months 2.48%. |

|

|

Sep 23 2020, 02:38 PM Sep 23 2020, 02:38 PM

Return to original view | Post

#32

|

Senior Member

1,144 posts Joined: Dec 2015 |

|

|

|

Sep 25 2020, 03:32 PM Sep 25 2020, 03:32 PM

Return to original view | Post

#33

|

Senior Member

1,144 posts Joined: Dec 2015 |

Quick update, just went RHB 1 year at 2.45%. I think super sad only 2.45%, I still cannot believe it. Effectively income less around 40%.

|

|

|

|

|

|

Sep 30 2020, 01:05 PM Sep 30 2020, 01:05 PM

Return to original view | Post

#34

|

Senior Member

1,144 posts Joined: Dec 2015 |

QUOTE(David_Yang @ Sep 30 2020, 10:42 AM) Eastspring is one of the big and serious companies. None of their products are "like a FD" and no returns are guarateed. All products come with sales charges (sometimes can be reduced or avoided when buying via special channels) and management fees (cannot be avoided). So a blank figure of 2.9% means nothing. And never forget, if they made 2.9% in 2019 that does not mean they will make it in 2020. To add on, I have bought similar close ended bond fund before. As pointed out return not guaranteed, at the end of the period of 3 to 5 years, you might get a surprise when the capital return is less than original amount due to some failed investments etc. Also need to wait for several weeks without interest for the fund to credit back to account. So if you go for such UT, make sure the writing is clear on guaranteed return pls guaranteed capital return. Oh if you can find such UT, please share it here. Only bad thing is you have to hold to maturity. |

|

|

Oct 8 2020, 02:11 PM Oct 8 2020, 02:11 PM

Return to original view | Post

#35

|

Senior Member

1,144 posts Joined: Dec 2015 |

QUOTE(frozz@holic @ Oct 8 2020, 11:28 AM) thanks good to know and yet to see as I have 1 maturing on this 17th, will try it out. Ok time to contribute. On the issue of weekend interest rate for Affin, say your FD matures on Sat or Sun or public holiday, do note this the following:yes affin are infamous for their terms inconsistency, experience before. 1. If your FD maturity instruction is credit the Principal to your account, you will not get the additional interest. 2. If your FD maturity instruction is auto rollover for the Principal, and you withdraw the immediate next working day after Sat, Sun or public holiday, only then you will get the additional interest. So make sure your maturity instructions are auto rollover. Affin is one of the banks that still insist you have the FD cert when you withdraw, hence some people like myself prefer to auto credit everything so that we can withdraw without presenting the FD cert. |

|

|

Oct 12 2020, 11:43 AM Oct 12 2020, 11:43 AM

Return to original view | Post

#36

|

Senior Member

1,144 posts Joined: Dec 2015 |

Just back from affin, their 2.45% 12 months fd no need fresh fund expiring 15th Oct 2020.

|

|

|

Oct 16 2020, 01:08 PM Oct 16 2020, 01:08 PM

Return to original view | Post

#37

|

Senior Member

1,144 posts Joined: Dec 2015 |

Hi all, just back from affin. They extended the promotion to end of Oct. Added 18 and 24 months 2.5%. Good chance interest rate will recover 2021, just don't know when. No need fresh fund, I didn't take up the offer though. Planning to use the money to buy shares...

|

|

|

Oct 16 2020, 04:57 PM Oct 16 2020, 04:57 PM

Return to original view | Post

#38

|

Senior Member

1,144 posts Joined: Dec 2015 |

|

|

|

Oct 26 2020, 02:19 PM Oct 26 2020, 02:19 PM

Return to original view | Post

#39

|

Senior Member

1,144 posts Joined: Dec 2015 |

Just back from affin, renewed 18 months fd at 2.5%.

|

|

|

Nov 27 2020, 02:15 AM Nov 27 2020, 02:15 AM

Return to original view | Post

#40

|

Senior Member

1,144 posts Joined: Dec 2015 |

I got called by cimb, above 100k 12 months fresh fund, subject to approval and availability, can get 2.5%.

So do call your branch and RM if you have. Also apparently that gold fish promotion already over. Not sure if they smoke me... |

| Change to: |  0.0519sec 0.0519sec

1.10 1.10

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 05:24 PM |