Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

ManutdGiggs

|

Sep 13 2022, 06:17 PM Sep 13 2022, 06:17 PM

|

|

QUOTE(nexona88 @ Sep 13 2022, 05:44 PM) Ahh... Typical tactics by the branch especially the Manager 😁 Hide information from customer... Just for fulfill target HQ approvals is just formality.... Easily can get one.... Only if the branch willing to do extra work to submit your application.... Additional documentation.... Just an email should be sufficient to do the job 🤣 |

|

|

|

|

|

ManutdGiggs

|

Sep 17 2022, 09:54 PM Sep 17 2022, 09:54 PM

|

|

QUOTE(michaelchang @ Sep 17 2022, 09:16 PM) you can see into the future?? decision on 21 Sep also u know? Obviously Google has all the news mentioning this Seems like bnm needs to push a bit harder to hoot it higher once n for all🤣🤣🤣 This post has been edited by ManutdGiggs: Sep 17 2022, 09:55 PM |

|

|

|

|

|

ManutdGiggs

|

Sep 18 2022, 05:39 AM Sep 18 2022, 05:39 AM

|

|

QUOTE(BrookLes @ Sep 18 2022, 12:03 AM) I can pm you on this because I doubt ppl here can handle the truth. Actually inflation has always been transfered across the globe. That is why you do not see much inflation in US despite the fact that they print so much. I have not followed the economy for quite a long time but then do you know that US has a lot of oil and yet the government refused to release the oil and so US are forced to use expensive oil which contributes a lot to their inflation? May I also have your pm pls 🙏 Tqtq |

|

|

|

|

|

ManutdGiggs

|

Sep 18 2022, 01:44 PM Sep 18 2022, 01:44 PM

|

|

QUOTE(15cm @ Sep 18 2022, 12:30 PM) Fd promo rates are everywhere boss RM ll update from time to time. Google ll tell with just a few clicks. A call each to all banks ll know it too. Sometimes uncles aunties in kopitiam can tell it accurately too. |

|

|

|

|

|

ManutdGiggs

|

Oct 24 2022, 02:03 PM Oct 24 2022, 02:03 PM

|

|

QUOTE(fabu8238 @ Oct 23 2022, 09:14 PM) 4.484% is the rate you get if you assume that you invest for 1 year at the rates for the 3 month period. This may or may not be true as the product is for 3 months. Why calculate an annual rate if the rate is based on uncertainty? So I would not rely on an annualised rate in this case Unless u wanna annualise ur investment with the same fund otherwise it should b case to case basis for tis 3 mths. The rest calculate later cos the next investment with the same batch of fund could b sthg else apart fr fd. 😊 |

|

|

|

|

|

ManutdGiggs

|

Oct 24 2022, 10:11 PM Oct 24 2022, 10:11 PM

|

|

QUOTE(guy3288 @ Oct 24 2022, 07:40 PM) confusing Bank FD rate with personal annualised return .......  Fd is a simple game. Dun need to annualise. I was putting up an example if any1 wanna complicate it 🤣🤣🤣 |

|

|

|

|

|

ManutdGiggs

|

Oct 25 2022, 05:09 AM Oct 25 2022, 05:09 AM

|

|

QUOTE(guy3288 @ Oct 24 2022, 10:41 PM) Yeah actually straight forward That's why he couldn't understand despite few replies to explain... but old kiasu has been trying to make FD looks complicated, have you read his long long posts? Dulu dulu ada My apology cos I skipped least dulu dulu 🙊 |

|

|

|

|

|

ManutdGiggs

|

Nov 5 2022, 03:46 PM Nov 5 2022, 03:46 PM

|

|

Re-sealing of Malaysian Grant of Probate in (COUNTRY) High Court is needed instead of 2 WILLS in malai.

Soli off topic. Just sharing.

|

|

|

|

|

|

ManutdGiggs

|

Nov 15 2022, 08:29 PM Nov 15 2022, 08:29 PM

|

|

Changes to UOB rates.

UOB Promotion

Fixed Deposit (Islamic & Conventional)

Offer from

16 Nov to 30 Nov 22

Islamic FD

6 mths @ 3.5% pa

12 mths @ 4% pa

Conventional FD

6 mths @ 3.35% pa

📨12 mths @ 3.85%pa

Terms & Conditions

Strictly FRESH FUNDS only.

Min placement - RM10k

Applicable for FD plus & Islamic FD

|

|

|

|

|

|

ManutdGiggs

|

Nov 15 2022, 09:14 PM Nov 15 2022, 09:14 PM

|

|

QUOTE(CommodoreAmiga @ Nov 15 2022, 09:03 PM) OTC or online? UOB always likes to play the OTC game. Otc de Ok de la go there 6c6c lenglui RM ma |

|

|

|

|

|

ManutdGiggs

|

Nov 15 2022, 10:12 PM Nov 15 2022, 10:12 PM

|

|

QUOTE(CommodoreAmiga @ Nov 15 2022, 09:19 PM) You wade cash to attract the leng lui? 🤪 I dun mind walk into banks tat hav suigals😊 Counter got preferred room got RM room oso got Most importantly rate must b Sui sui. Whichever bank oso can go cos different bank different batch of lenglui😎 |

|

|

|

|

|

ManutdGiggs

|

Dec 14 2022, 07:57 AM Dec 14 2022, 07:57 AM

|

|

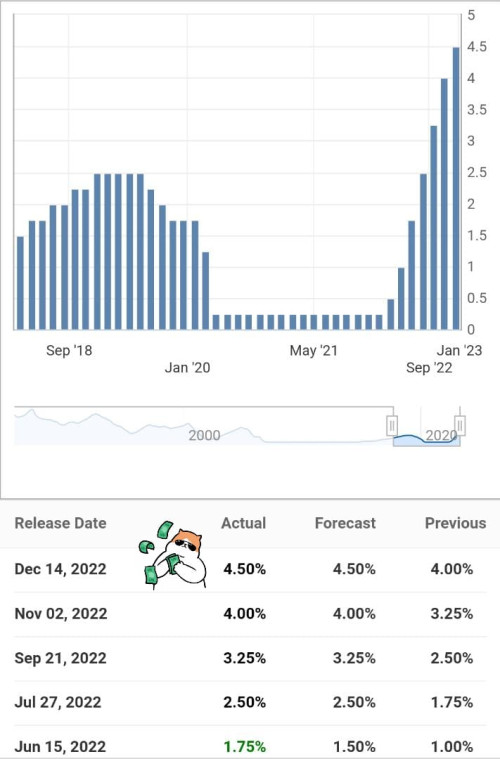

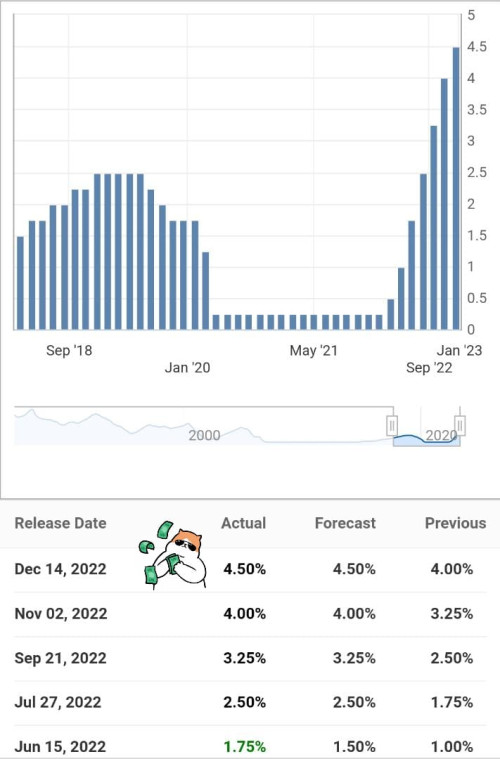

Probably the best today will be history in mid Jan 2023 All eyes on fed tonight? |

|

|

|

|

|

ManutdGiggs

|

Dec 15 2022, 08:46 AM Dec 15 2022, 08:46 AM

|

|

Confirmed up 50bps in US few more wks to know bout local opr |

|

|

|

|

|

ManutdGiggs

|

Dec 15 2022, 10:18 AM Dec 15 2022, 10:18 AM

|

|

QUOTE(Afterburner1.0 @ Dec 15 2022, 10:15 AM) lets see which bank will take the lead now.... Ambank, Bank Islam, PB, should be out as they just launched their FD.... time for MBSB, Bank Rakyat to shine! Pbb can stil change their promo in 1.1.23 for as cny promo prior to opr meeting We shall see new rate on 20.1.23 but too little time to place it b4 cny on 22.1.23. If they hav confidence bnm ll push up by 25bos then no harm to start early to win the race. Anw the real show should b in mar 2023 💪 |

|

|

|

|

|

ManutdGiggs

|

Dec 23 2022, 06:40 AM Dec 23 2022, 06:40 AM

|

|

QUOTE(Kopistall @ Dec 23 2022, 06:30 AM) Any idea uob still got 12months ? Why uob always fresh funds only. Too rich ka this Sinki bank ? Actually many banks oso asking for fresh funds de. Just tat some r lenient to do the magic nia. UOB Promotion Fixed deposit (Islamic & Conventional) offer from Until 31 Dec 22 Islamic FD 6 mths @ 3.5% pa 12 mths @4.05% pa Conventional FD 6 mths @ 3.40% pa 12 mths @ 3.95%pa Terms & Conditions Strictly *FRESH FUNDS* only. Min placement - RM10k Applicable for FD plus & Islamic FD |

|

|

|

|

|

ManutdGiggs

|

Dec 24 2022, 07:57 AM Dec 24 2022, 07:57 AM

|

|

QUOTE(Kopistall @ Dec 24 2022, 05:37 AM) Thanks. Nowadays uob rates no more higher compared to few tears back. Last time their rates among the highest offered. Thanks again. Let me think for few days first. Go to affin if u r invikta If not mistaken they r giving 4.25 for 12mths |

|

|

|

|

|

ManutdGiggs

|

Dec 25 2022, 10:30 AM Dec 25 2022, 10:30 AM

|

|

QUOTE(Kopistall @ Dec 25 2022, 07:00 AM) Affin very good. But to be Invikta need rm200k right ? Yup |

|

|

|

|

|

ManutdGiggs

|

Jan 20 2023, 09:10 AM Jan 20 2023, 09:10 AM

|

|

QUOTE(CommodoreAmiga @ Jan 20 2023, 08:25 AM) Yes, RHB is jalat. I can't remember it's Term Deposit or FD but it's always Maturity+1 day only can uplift. So remember this. As for auto renewal, it's pretty common. Most bank wants you to forget and then auto renew for you at low board rates. Just keep a record of all your FDs and maturity dates. No wo rhb allows renewal or withdrawal on maturity date wan wo. |

|

|

|

|

|

ManutdGiggs

|

Jan 20 2023, 09:40 AM Jan 20 2023, 09:40 AM

|

|

QUOTE(cool-ly @ Jan 20 2023, 09:36 AM) Just went to public bank. Starting today no more 4.8% 24mths 3.8 now 12mths 4.0 now if not mistaken Suddenly kiamsiap |

|

|

|

|

|

ManutdGiggs

|

Jan 20 2023, 09:46 AM Jan 20 2023, 09:46 AM

|

|

QUOTE(CommodoreAmiga @ Jan 20 2023, 09:40 AM) I am pretty sure it doesn't unless you want to lose interest. Is yours FD or Term Deposit? Fd QUOTE(woowoo1 @ Jan 20 2023, 09:41 AM) Actually, RHB do permit uplift on maturity. The only confusing part is the interest will not be shown in your principal b4 you uplift on maturity date. Once you successfully uplift and b4 you press proceed, it will tell you how much you are uplifting and the amount would be principal+interest. So do take note Actually I alwiz do interest to CASA so on maturity day the interest in park into CASA then I do renewal or withdrawal to move to beta rate elsewhere So far so gd |

|

|

|

|

Sep 13 2022, 06:17 PM

Sep 13 2022, 06:17 PM

Quote

Quote

0.0646sec

0.0646sec

0.64

0.64

7 queries

7 queries

GZIP Disabled

GZIP Disabled