QUOTE(Zhik @ Apr 2 2025, 04:58 PM)

Term Deposit-i Campaign | MBSBhttps://www.mbsbbank.com/sites/default/file...28upload%29.pdf

This post has been edited by cybpsych: Apr 3 2025, 04:03 PM

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Apr 3 2025, 04:02 PM Apr 3 2025, 04:02 PM

Return to original view | Post

#1381

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(Zhik @ Apr 2 2025, 04:58 PM) Term Deposit-i Campaign | MBSBhttps://www.mbsbbank.com/sites/default/file...28upload%29.pdf    This post has been edited by cybpsych: Apr 3 2025, 04:03 PM |

|

|

|

|

|

Apr 4 2025, 06:24 PM Apr 4 2025, 06:24 PM

Return to original view | Post

#1382

|

All Stars

65,332 posts Joined: Jan 2003 |

|

|

|

May 5 2025, 05:09 PM May 5 2025, 05:09 PM

Return to original view | Post

#1383

|

All Stars

65,332 posts Joined: Jan 2003 |

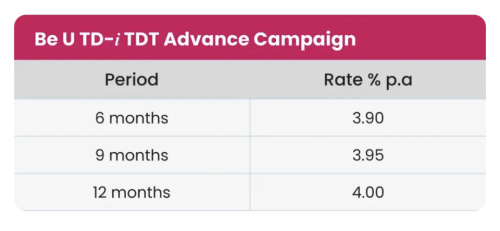

QUOTE(ikanez @ Apr 11 2025, 05:51 PM) Be U / Bank Islam has new TD campaign out . Now up to 4% for 12 month tenure. More details at https://getbeu.com/campaigns/BeU-TDT-Advance  QUOTE(InstantNoodles @ May 5 2025, 01:56 PM) ikanez liked this post

|

|

|

May 7 2025, 08:34 PM May 7 2025, 08:34 PM

Return to original view | Post

#1384

|

All Stars

65,332 posts Joined: Jan 2003 |

|

|

|

May 21 2025, 03:22 PM May 21 2025, 03:22 PM

Return to original view | Post

#1385

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(diehard1979 @ May 21 2025, 02:59 PM) https://www.cimb.com.my/en/personal/promoti...paign.html#casa already asked you to do in cimb app/web onlyThis only for eFD? if go to branch can get this rate? obviously not for OTC/branch you can try calling your preferred branch and see if they got any OTC offer available |

|

|

May 26 2025, 08:21 AM May 26 2025, 08:21 AM

Return to original view | Post

#1386

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(bbgoat @ May 24 2025, 02:27 PM) They have improved. Few years ago have to asked them to credit the weekend add'l days of interest. actually, to be safe, transfer 1k for the day of renewal is better. lesser dispute here and there. Also for the add'l 1k for FD renewal, over heard the branch mgr talking to one customer. The 1k has to be deposited on the day of renewal. Other banks allowed "fresh" funds to be few days into the acct. But not 100% sure as I just overheard this. also, the add-on 1k is per placement. eg if you split you rollover fd (large chunk) into >1 placement (smaller chunks), then must addon 1k into each placement. |

|

|

|

|

|

May 26 2025, 11:56 AM May 26 2025, 11:56 AM

Return to original view | Post

#1387

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(chadavox @ May 26 2025, 09:42 AM) Not true. To rollover, you just add in RM1K and you can split into a few smaller amount placments. I just did that last week. i know what's written on the websiteActually, you guys can read up the information of the additional RM1K for the rollover in MBSB website. Don't be lazy. You can even call up the branch for info. my mbsb branch was the one "requiring" rm1k topup per placement. |

|

|

May 26 2025, 02:12 PM May 26 2025, 02:12 PM

Return to original view | Post

#1388

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(chadavox @ May 26 2025, 01:43 PM) Sorry to hear that. i believe diff branch have diff way of interpreting it Actually, staff's training is very important. It is very important for them to know the bank's product offered and the required terms. Once, I went to a Hong Leong bank to place a FD on the counter. It was a new promo the bank was offering. The staff who served me told me there was no such promo, and turned me away. Confused, I called up the customer service for confirmation and they told me the promo was available. anyway, i'll be dropping by another mbsb branch later this week. will observe their rollver topup policy. |

|

|

Jun 19 2025, 08:40 AM Jun 19 2025, 08:40 AM

Return to original view | Post

#1389

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(diehard1979 @ Jun 18 2025, 09:21 PM) let say FD withdraw to saving account and it is RM80k. Then transfer from bank A to bank B RM50k (as daily limit) then transfer back from bank B to bank A RM50k. Then this fresh 50k funds +old RM30k in bank A will consider all RM80k as fresh funds? or that RM30k must also go out then go back to make all RM80k fresh funds? try read the t&c on the "freshness" acceptance criteriausually, "freshness" is not to use the fd fund and immediately make a new placement, back-2-back. yes, this is one stupid t&c set by bank, as if the fund is "smelly". the fund came from their own bank system and yet they claimed it's not "fresh" for new placement. your example, should be "fresh" since it has gone outside of Bank A's system and "rinsed" already another way, dont make it identical amount lor. make it 81k placement. |

|

|

Jun 27 2025, 08:09 AM Jun 27 2025, 08:09 AM

Return to original view | Post

#1390

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(bbgoat @ Jun 26 2025, 11:42 AM) BI FD matured on Friday which is a public holiday. Can only withdraw on Monday. my mbsb otc fd also got adjusted its maturity to next working day (30/6), which is additional 3 days First time encounter it in BI. Do BI pay extra interest for FD matured over public holidays ? Anyway will ask them on Monday. FD slip printed on 27/6/2024 stated maturity falls on 27/6/2025; but seems the system auto-adjusted it (good and reasonable logic to extend to next working day) i guess will get extra interest. gotta check next Monday then.  |

|

|

Jul 1 2025, 10:44 AM Jul 1 2025, 10:44 AM

Return to original view | Post

#1391

|

All Stars

65,332 posts Joined: Jan 2003 |

|

|

|

Jul 1 2025, 12:13 PM Jul 1 2025, 12:13 PM

Return to original view | Post

#1392

|

All Stars

65,332 posts Joined: Jan 2003 |

|

|

|

Jul 3 2025, 01:43 PM Jul 3 2025, 01:43 PM

Return to original view | Post

#1393

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(kplaw @ Jul 1 2025, 11:46 PM) *🎉 MBSB Bank Term Deposit / Term Investment Account Promotion* ✨Both TDi and TIA rate effective from *July 1 to July 15* as below: Tenure TDi TIA 🔥3 Months 3.70% 3.72% 🔥6 Months 3.75% 3.75% 🔥9 Months 3.95% 3.97% 🔥12 Months 3.93% 3.95% QUOTE(guy3288 @ Jul 3 2025, 01:23 PM) same as abovejust moved fund out from mbsb to bimb |

|

|

|

|

|

Jul 4 2025, 09:02 AM Jul 4 2025, 09:02 AM

Return to original view | Post

#1394

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(brandonkl @ Jul 3 2025, 09:19 PM) Has anyone checked out Bank Muamalat's Atlas? It states 5% profit rate. ATLAS by Bank Muamalat Malaysia Berhad (“ATLAS”) is a digital banking that is brought to you by Bank Muamalat MalaysiaFound the FAQ for the 5% Profit Rate. https://atlasmuamalat.com.my/faqs/ Click on Hi-5! Campaign in FAQ. - 3 month campaign from 3 July to 3 Oct 2025 or if the campaign portfolio reached RM25 million, whichever comes first. - 5% profit/interest for maximum RM50k deposit only. - Interest credited daily. Berhad (BMMB). just like Be U by Bank Islam or Rize by Al-Rahji (now absorbed back) it's a savings product, not fixed deposit anyhow, just registered, done ekyc. but cannot deposit anything yet. got 12hr cooling off period after registration ikanbilis liked this post

|

|

|

Jul 4 2025, 03:25 PM Jul 4 2025, 03:25 PM

Return to original view | Post

#1395

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(mamamia @ Jul 4 2025, 03:08 PM) today withdraw my BI FD online, wan to transfer out, but, keep showing transaction limit exceeded, check the transaction limit is already set at 50k, dunno y keep showing transaction limit exceeded, can only transfer 5k out.. no issue for me though. can transfer out 50k lumpsum (50sen fee) wanted to place bimb eTDT but it doesnt accept fund from OWN SA fund moved from mbsb sa > bimb sa > maybank sa > bimb tdt placement |

|

|

Jul 4 2025, 04:25 PM Jul 4 2025, 04:25 PM

Return to original view | Post

#1396

|

All Stars

65,332 posts Joined: Jan 2003 |

|

|

|

Jul 7 2025, 01:11 PM Jul 7 2025, 01:11 PM

Return to original view | Post

#1397

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(KOEL @ Jul 7 2025, 12:17 PM) Did you try to transfer money into it? I tried transferring money into the AC but it rejected for reason " Transaction declined by receiving bank due to issues with recipient account". I opened my Atlas on July 4th; so already passed the cooling off period. atlast topic here https://forum.lowyat.net/topic/5530476 |

|

|

Jul 9 2025, 11:36 AM Jul 9 2025, 11:36 AM

Return to original view | Post

#1398

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(thenuts15 @ Jul 9 2025, 08:15 AM) sure got...PB eFD Via FPX Campaign PB Special Fixed Deposit Campaign Term Deposit-i and eTerm Deposit-i Campaign | Personal Banking | PIBB Announcements | Personal Banking | PIBB |

|

|

Jul 10 2025, 11:41 AM Jul 10 2025, 11:41 AM

Return to original view | Post

#1399

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(voc8888 @ Jul 4 2025, 05:18 PM) Any one here did a FTA-1 Bonus Booster placement with Bank Muamalat with Monthly Interest ? Did Bank Muamalat called to notify that they've actually made a mistake for allowing monthly interest for this FTA-1 Bonus Booster promotion, and would like to terminate it with immediate effect, honoring whatever interest that had already been credited to the saving account for the past few months, but to end the previous placement with immediate effect, converting to new placement for a new tenure of another 12 months but interest payable on maturity. I have officially rejected their above proposal, requesting them to honor what has been agreed at time of placement ie continue with the monthly profit payment till maturity. The bank officer said they will notify and refer to higher authority for further actions. Bank Muamalat rectification action is very wrong, and I believe we could refer and file in case with Bank Negara if Bank Muamalak is taking the action of terminating and changing their T&C half way through by force. QUOTE(brandonkl @ Jul 4 2025, 06:16 PM) Me! Yeah, they called me this afternoon and said some technical mistake in that one particular FD (with monthly interest). They said something like will extend my FD for 2 mths with same 4% interest. I didn't catch them saying no more monthly interest. I was not really paying attention as I was having lunch. That's fine with me as my other FDs with them no monthly interest. I already suspected this monthly profit is too good to be true because what if the FD is cancelled and funds withdrawn before the maturity? I told her to send me an email and she said okay. QUOTE(BoomChaCha @ Jul 10 2025, 10:16 AM) 3.9 BMMB reserves the right to cancel, terminate or suspend this Campaign with prior notice at least 21 calendar days prior to the cancellation / termination or suspension of this Campaign. For avoidance of doubt, cancellation, termination or suspension by BMMB of the Campaign shall not entitle the accountholders to any claim or compensation against the BMMB for any and all losses or damages suffered or incurred by the accountholders as a direct or indirect result of the act of cancellation, termination or suspension unless such losses or damages are attributable by BMMB’s gross negligence, willful misconduct or fraud. https://www.muamalat.com.my/wp-content/uplo...nus-Booster.pdf Depositors who participate this Bonus Booster can be terminated by Bank Mumualat suddenly? Just called MBSB Recent FD promo is still available until 15 of July 2025 9 months 3.95% 12 months 3.93% |

|

|

Jul 15 2025, 09:03 AM Jul 15 2025, 09:03 AM

Return to original view | Post

#1400

|

All Stars

65,332 posts Joined: Jan 2003 |

QUOTE(nexona88 @ Jul 15 2025, 08:40 AM) https://www.muamalat.com.my/wp-content/uplo...nus-Booster.pdf nexona88 liked this post

|

| Change to: |  0.0615sec 0.0615sec

0.45 0.45

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 12:00 AM |