QUOTE(AVFAN @ Nov 10 2022, 04:11 PM)

it possibly implies PBB is quite sure OPR rates will go up by at least another 50bps in the near future.

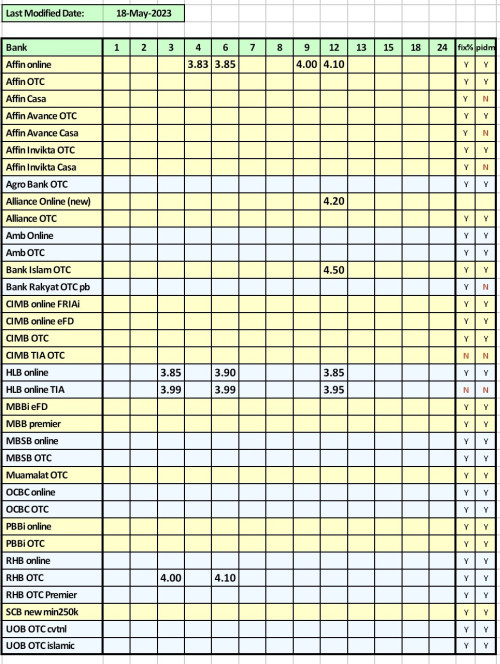

affin 3.83% 18m, 3.40% 24m wud indicate they think rates will peak and then decline in 18-24 months time.

current consenus is BNM will raise 25bps in Jan, Mar, then stop.

assumption is USA continues to hike another 2-3 times, total 75bps:

Is 18 months is too long and 18 months from now, would the efd rate offer by the bank might more than 4.2%, even OPR stop increasing on March 2023?affin 3.83% 18m, 3.40% 24m wud indicate they think rates will peak and then decline in 18-24 months time.

current consenus is BNM will raise 25bps in Jan, Mar, then stop.

assumption is USA continues to hike another 2-3 times, total 75bps:

Nov 10 2022, 03:18 PM

Nov 10 2022, 03:18 PM

Quote

Quote

0.1009sec

0.1009sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled