Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

dannyw

|

Jan 2 2021, 03:57 PM Jan 2 2021, 03:57 PM

|

|

QUOTE(Chrono-Trigger @ Jan 2 2021, 01:51 PM) T&C says it may take up to 2 days for them to process the placement of eFD , of which no interest will be paid during the process. Has anyone tried putting eFD with HL bank before? does it really take 2 days or immediately? No problem. I place it on 1 Jan yesterday. Immediately reflect on system. |

|

|

|

|

|

dannyw

|

Jan 8 2021, 08:26 AM Jan 8 2021, 08:26 AM

|

|

QUOTE(kinwawa @ Jan 8 2021, 08:18 AM) New promo by HLB eFD 3months @2.3%, 6months@2.35% and 12 months@2.3%  Good sign! Just the make previous 1~7 Jan promo nothing special. |

|

|

|

|

|

dannyw

|

Jan 8 2021, 10:01 PM Jan 8 2021, 10:01 PM

|

|

QUOTE(cclim2011 @ Jan 8 2021, 07:33 PM) ok thanks for the info. gonna try maybank... If i remember correctly MBB limit to 50K daily FPX. No longer like those day can be unlimited as long not more than 30k per FPX. |

|

|

|

|

|

dannyw

|

Jan 13 2021, 11:55 AM Jan 13 2021, 11:55 AM

|

|

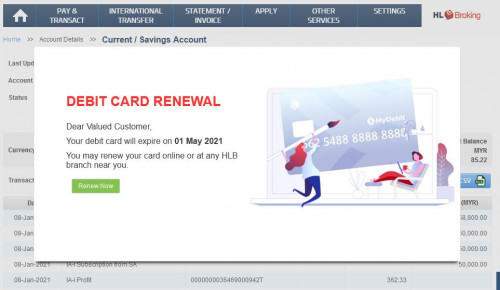

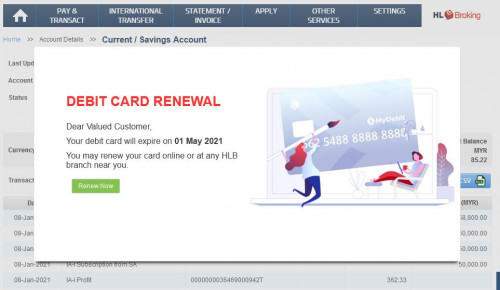

QUOTE(kplaw @ Jan 13 2021, 10:27 AM) can't get rid of that debit card expiry reminder window and can't do anything except to click on the "renew now" or close the whole browser tab  Try different browser? Yours still have so long to go. My until last expired month still ok. Just remind once or twice only. |

|

|

|

|

|

dannyw

|

Jan 15 2021, 03:44 PM Jan 15 2021, 03:44 PM

|

|

QUOTE(sweetpea123 @ Jan 15 2021, 03:40 PM) alamak, so those who wants to use their HLB money to place HLB eFD will have to transfer out to other banks and fpx from there ?  Yes. Just use instant transfer to other bank, then FPX in for eFD. |

|

|

|

|

|

dannyw

|

Jan 17 2021, 08:42 AM Jan 17 2021, 08:42 AM

|

|

QUOTE(??!! @ Jan 16 2021, 05:36 PM) I also have this red words indicating my HOng Leong Debit card has expired. However, I can still view and make transactions with the account. I am wondering if I can get away without renewing the debit card since I have no use of it. It's sole purpose was to access online banking back then. Will Hong Leong block my online banking access if I don't renew the debit card  Anyone knows? Fyi, i have cancel the debit card. Now it prompt 'Apply new Debit Card' I also hardly use the card, even ATM also lesser & lesser. So i just cancel it. At least no need pay annual fee. |

|

|

|

|

|

dannyw

|

Jan 17 2021, 10:41 AM Jan 17 2021, 10:41 AM

|

|

QUOTE(??!! @ Jan 17 2021, 10:30 AM) Is your online banking linked to your debit card at Hong Leong? Only function of debit card was to gain access to online banking. I worry if I cancell it.. my online banking also kena blocked. I don't have HL credit card as alternative to gain access to online banking This was what happened to my Ambank account some years back. Yes for sure. Else ATM won't work. For initial stage need the card to activate online banking only. Right after is just Debit Card & ATM function. No worry for internet banking. I have cancel it last month. This month i still able to uplift and place the new efd promo. |

|

|

|

|

|

dannyw

|

Jan 17 2021, 12:44 PM Jan 17 2021, 12:44 PM

|

|

QUOTE(bbgoat @ Jan 17 2021, 12:13 PM) For CIMB, I have asked about cancelling their debit card. Was told since it is linked to the online account, if I cancel the debit card, then online account will also be cancelled. Anyone has the same "advice" from CIMB ? If they make such policy, then no choice. Luckily HLB is good for this. And the staff even told me, if you want it back, can just apply the debit card anytime. |

|

|

|

|

|

dannyw

|

Feb 11 2021, 09:36 AM Feb 11 2021, 09:36 AM

|

|

QUOTE(Mattrock @ Feb 11 2021, 09:22 AM) The t&c says the funds must be transferred via FPX from another bank. Can the FPX money come from another person's account (e.g. family member) or does the account need to be in same name as HL account? In other words, someone else who does not have a HL account wants to take advantage of this promo. Yes. You can. I did that for my wife. |

|

|

|

|

|

dannyw

|

Mar 5 2021, 10:11 AM Mar 5 2021, 10:11 AM

|

|

QUOTE(tuboflard @ Mar 5 2021, 09:31 AM) With the OPR rbeing maintained, what are the best current rates for FD for 3/6/9/ months? Hong Leong eFD 6 & 12 months at 2.35% p.a. Any better rates? Only 6 months is 2.35% p.a. 3 months & 12 months is 2.30% p.a. This post has been edited by dannyw: Mar 5 2021, 10:11 AM |

|

|

|

|

|

dannyw

|

May 12 2021, 08:00 PM May 12 2021, 08:00 PM

|

|

HLB efd promo 12 May to 28 May 6 months 2.4% p.a. 12 months 2.4% p.a. https://www.hlb.com.my/en/personal-banking/...3a4ROtEQ0n-yHWM |

|

|

|

|

|

dannyw

|

Jun 1 2021, 07:56 AM Jun 1 2021, 07:56 AM

|

|

HLB e-FD promo extened to 30 June 2021. https://www.hlb.com.my/en/personal-banking/...fd-i-promo.htmlThis post has been edited by dannyw: Jun 1 2021, 07:59 AM |

|

|

|

|

|

dannyw

|

Jul 1 2021, 07:59 AM Jul 1 2021, 07:59 AM

|

|

HLB eFD promo 01 July 2021-31 July 2021 3 months 2.35% p.a. 6 months 2.40% p.a. 12 months 2.45% p.a. https://www.hlb.com.my/en/personal-banking/...fd-i-promo.html  |

|

|

|

|

|

dannyw

|

Sep 16 2021, 10:43 AM Sep 16 2021, 10:43 AM

|

|

QUOTE(chiwawa10 @ Sep 15 2021, 11:41 PM) HLB always require fresh fund. My funds are already there. Hahaha.. Just transfer out then FPX in to place eFD. No cost incurred. |

|

|

|

|

|

dannyw

|

Nov 30 2021, 05:14 PM Nov 30 2021, 05:14 PM

|

|

QUOTE(Chrono-Trigger @ Nov 30 2021, 04:00 PM) has anyone tried to put eFD in Maybank through FPX from other bank? I got my eFD placement failed at Maybank but money has been deducted from the other bank. Maybank said they will investigate and escalate, and usually FPX will refund back the amount to the bank where the money is deducted from. anyone experienced this problem before? I place this morning. No problem. My mistake is did not set the FPX limit from the transfer bank, after that no problem. |

|

|

|

|

|

dannyw

|

Nov 30 2021, 06:10 PM Nov 30 2021, 06:10 PM

|

|

QUOTE(Chrono-Trigger @ Nov 30 2021, 05:36 PM) any idea when the money will be reverted back to the originating bank? Maybank told me to wait 24 hours...and said if not they will take 3-7 working days to investigate zzzz  Money now in FPX ?? Should be within 1 or 2 days. Try search the post here. I remember discussed before. Is both your bank account name same? |

|

|

|

|

|

dannyw

|

Dec 9 2021, 11:15 AM Dec 9 2021, 11:15 AM

|

|

For MBB e-FD campaign, no need to try already.

Today place 6 months already back to 1.8% p.a. I guess it reach the campaign target.

|

|

|

|

|

|

dannyw

|

Jan 1 2022, 08:18 AM Jan 1 2022, 08:18 AM

|

|

HLB e-FD, 01 January 2022-31 March 2022 (Min 10k) 3 months - 2.25% p.a. 6 months - 2.30% p.a. 12 months - 2.40% p.a. 24 months -2.45% p.a. https://s.hongleongconnect.my/rib/app/fo/ma...=e2s1&locale=enI thought it will increase, but short term 3,6 months drop 0.5% p.a. |

|

|

|

|

|

dannyw

|

Mar 4 2022, 08:36 AM Mar 4 2022, 08:36 AM

|

|

QUOTE(cybpsych @ Mar 4 2022, 06:33 AM) hlb revised their efd Fixed Deposit (FD) Promotion, EFD Promotion - Hong Leong Bank3 mths - 2.15% 6 mths - 2.25% 12 mths - 2.35% 18 mths - 2.50% 24 mths - 2.75% OPR maintains and they drop  |

|

|

|

|

|

dannyw

|

Mar 4 2022, 10:38 AM Mar 4 2022, 10:38 AM

|

|

QUOTE(c64 @ Mar 4 2022, 09:51 AM) Most people in this thread have little debt or no debt, i think...interest shoots up, everyone tepuk tangan.  If got money dump into mortgage to reduce loan instead of FDs. Is about the age.  During my max debts those day, BLR is > 6.5%, FD interest also >4% |

|

|

|

|

Jan 2 2021, 03:57 PM

Jan 2 2021, 03:57 PM

Quote

Quote

0.0695sec

0.0695sec

1.37

1.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled