Outline ·

[ Standard ] ·

Linear+

Credit Cards Standard Chartered Bank Credit Cards V4, Everything About SC Credit Cards

|

victorian

|

Jan 19 2021, 11:50 PM Jan 19 2021, 11:50 PM

|

|

QUOTE(lovingforyou @ Jan 19 2021, 11:18 PM) So Feb 2021 (Month 2) started from 01 Feb - 28 Feb? or month 1 20 Jan - 19 Feb month 2 20 Feb - 19 Mar Didn't mentioned in T&C Calendar month |

|

|

|

|

|

victorian

|

Jan 20 2021, 12:07 AM Jan 20 2021, 12:07 AM

|

|

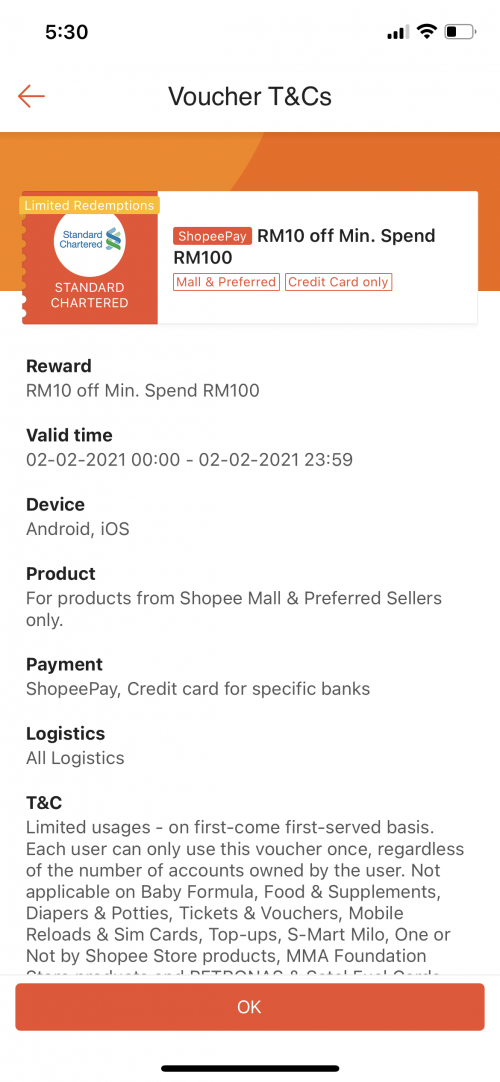

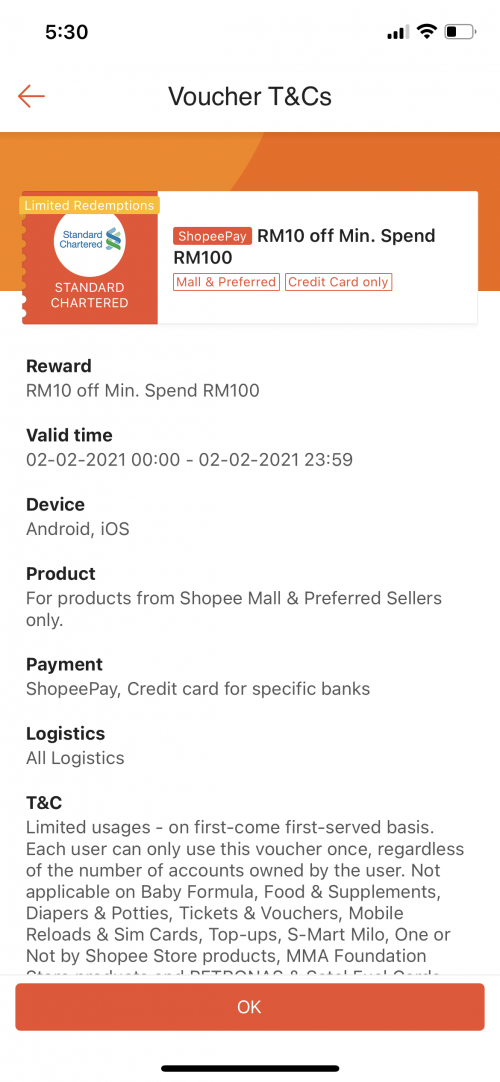

Received rm10

|

|

|

|

|

|

victorian

|

Feb 1 2021, 12:16 AM Feb 1 2021, 12:16 AM

|

|

Reloaded 200 and got my RM10 voucher. Clawback game also got rm5. Can I know where can we redeem the rm5 ?

|

|

|

|

|

|

victorian

|

Feb 1 2021, 05:48 PM Feb 1 2021, 05:48 PM

|

|

QUOTE(cucikaki @ Feb 1 2021, 05:31 PM) Shopee voucher in!  How to get this? |

|

|

|

|

|

victorian

|

Apr 25 2021, 02:23 PM Apr 25 2021, 02:23 PM

|

|

Anyone know why my SC credit card is charged RM24.04 for Spotify auto billing ?

The payment used to be RM23.80 per month for Spotify Family, but when I switched auto billing to SC CC, I was charged RM24.04

|

|

|

|

|

|

victorian

|

Apr 25 2021, 03:46 PM Apr 25 2021, 03:46 PM

|

|

QUOTE(Daenthylin @ Apr 25 2021, 03:37 PM) There’s a 1% cross border fee charged by SC. Happened to me too before. Switched the auto billing to my Maybank CC instead. Yup thanks . Gonna change to other cc |

|

|

|

|

|

victorian

|

Jun 7 2021, 09:26 AM Jun 7 2021, 09:26 AM

|

|

Anyone here managed to get SST rebate from SC ? I asked customer service they offer me rm25 only if I take cheque on call plus

|

|

|

|

|

|

victorian

|

Jul 12 2021, 09:04 PM Jul 12 2021, 09:04 PM

|

|

QUOTE(syaaron @ Jul 12 2021, 09:03 PM) Manage to get annual fee waiver only for my LFC SST tried HUCA 3 times but still not success , got offered 3.88% cash advance only able to waived Good enough for me Is the cash advance worth it for rm25 sst? |

|

|

|

|

|

victorian

|

Sep 1 2021, 11:25 AM Sep 1 2021, 11:25 AM

|

|

Protip, you can actually auto reload rm200 to get both RM10 and 500 points

|

|

|

|

|

|

victorian

|

Sep 1 2021, 11:35 AM Sep 1 2021, 11:35 AM

|

|

QUOTE(enterthefatdragon @ Sep 1 2021, 11:27 AM) 500 pts is the Air Selangor?? Nope is the auto reload campaign by SC |

|

|

|

|

|

victorian

|

Nov 24 2021, 04:14 PM Nov 24 2021, 04:14 PM

|

|

Got this offer from SC,

Loan Amount: up to RM16000

Repayment Tenure: up to 60 months

Flat Interest Rate: 1.99% p.a. (3.80% p.a. EIR*)

Indicative Monthly Instalment Amount: RM293.2

Considered low right?

|

|

|

|

|

|

victorian

|

Nov 24 2021, 04:22 PM Nov 24 2021, 04:22 PM

|

|

QUOTE(STEVE75 @ Nov 24 2021, 04:19 PM) i got offer 2.99% upto 70k & 60 mths yr consider very attractive rate. Yes 1.99% is shockingly low. However the offer is only until end of the month |

|

|

|

|

|

victorian

|

Dec 1 2021, 12:39 AM Dec 1 2021, 12:39 AM

|

|

Anyone received rm10 from grab reload ?

|

|

|

|

|

|

victorian

|

Dec 1 2021, 01:09 AM Dec 1 2021, 01:09 AM

|

|

QUOTE(ChiaW3n @ Dec 1 2021, 01:04 AM) Reload rm200 |

|

|

|

|

|

victorian

|

Jul 16 2022, 12:10 AM Jul 16 2022, 12:10 AM

|

|

QUOTE(Jack&Guild @ Jul 14 2022, 03:00 PM) Its the cheapest w/o collaterate. unless there is other kind of cash out like 0%. yea i am thinking of what sort of investment instrument is best to absorb tis 3% and get some profit. It’s also 5.6% effective interest rate. FD only pays 3% now |

|

|

|

|

|

victorian

|

Sep 26 2022, 02:43 PM Sep 26 2022, 02:43 PM

|

|

I'm considering cancelling my SC card due to lack of promotions.

Card already idle for few months now.

|

|

|

|

|

|

victorian

|

Sep 26 2022, 03:03 PM Sep 26 2022, 03:03 PM

|

|

QUOTE(beLIEve @ Sep 26 2022, 03:02 PM) #define lack Usually it is Mid Year and Year End game only. Mid Year just ended on Sept 15, the photograph one. Shopee/Lazada bank voucher, TNG or Grab top up voucher, or any meaningful promotion. The only thing good is the dining campaign. |

|

|

|

|

|

victorian

|

Sep 26 2022, 05:50 PM Sep 26 2022, 05:50 PM

|

|

QUOTE(enterthefatdragon @ Sep 26 2022, 04:58 PM) recently not much vouchers ...used to top tup rm 100-rm 150 into shopee can get rm 10 voucher for 9.9, 10,10, 11,11 the grab rm 250 top up for rm 10 CB also ending...not sure will be renewed or not.... 250 get RM10 is too little imo. Others giving RM 30 or rm20 for RM200 top up |

|

|

|

|

|

victorian

|

Oct 7 2022, 05:32 PM Oct 7 2022, 05:32 PM

|

|

Requested to cancel my SC card.

Retention team called and offer rm50 cashback and 6 months 0% BT.

Happily accepted.

|

|

|

|

|

|

victorian

|

Feb 9 2023, 10:21 PM Feb 9 2023, 10:21 PM

|

|

QUOTE(cybpsych @ Feb 9 2023, 10:12 PM) Why is SCB clarifying this? The merchants are self imposing minimum charge because there is a fix fee for every transaction. SCB will be happier if there is more small transactions |

|

|

|

|

Jan 19 2021, 11:50 PM

Jan 19 2021, 11:50 PM

Quote

Quote

0.0606sec

0.0606sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled