Outline ·

[ Standard ] ·

Linear+

Credit Cards Standard Chartered Bank Credit Cards V4, Everything About SC Credit Cards

|

ericlaiys

|

Mar 1 2024, 07:08 PM Mar 1 2024, 07:08 PM

|

|

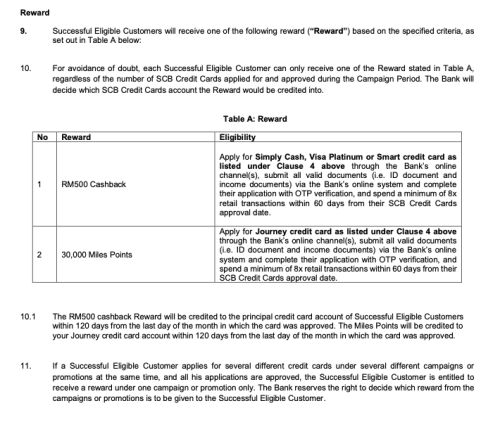

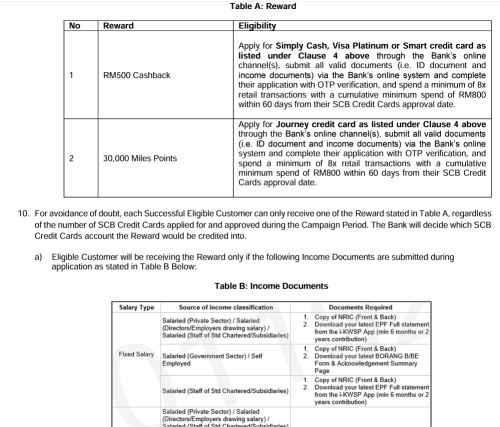

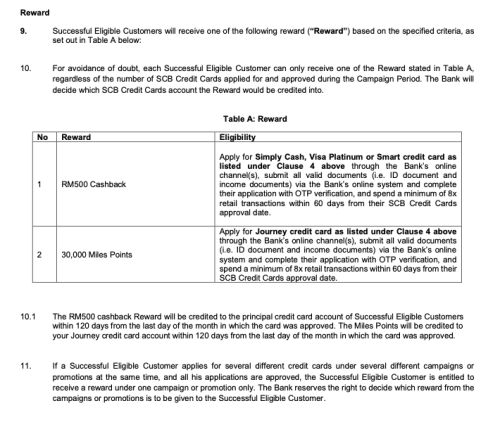

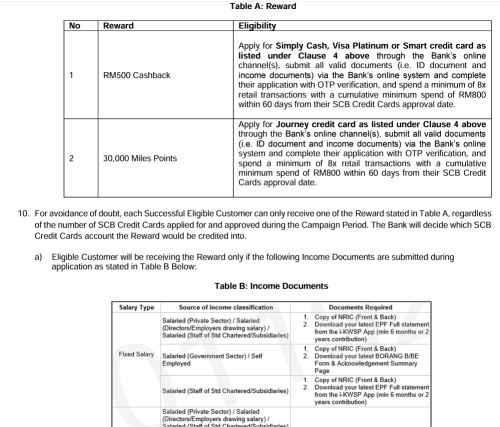

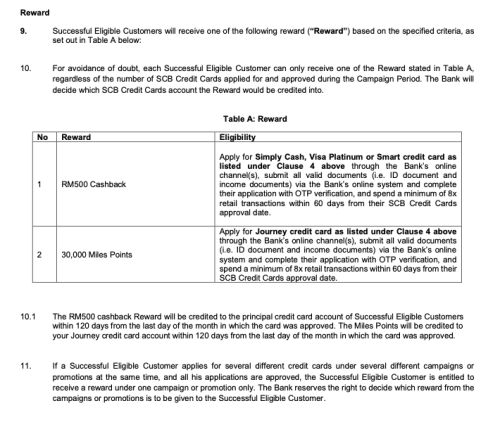

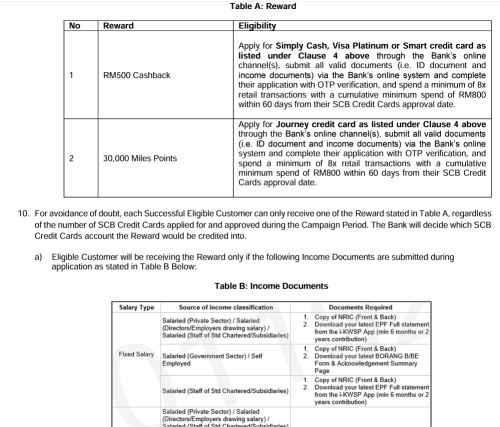

QUOTE(ericlaiys @ Feb 29 2024, 06:50 PM) Sept/Oct 2023 TNC  Feb 2024 TNC  You see this 2 TNC and compare. They use Feb 2024 TNC and tell me that i not entitle for reward. They response is i submitted payslip and bank statement. Not EPF and income tax. They thought i never save old tnc pdf Due to changes on TNC, i got rejected reward. So is this my fault or been sarcastic ? update on my case: SC finally called me to update my case. I won the case. 30k miles will credit into my account in next 3-5 working day. |

|

|

|

|

|

ericlaiys

|

Mar 6 2024, 11:12 AM Mar 6 2024, 11:12 AM

|

|

QUOTE(Secret_Garden @ Mar 6 2024, 08:57 AM) Anyone knew that NSK is not listed under grocery categories for the simply cashback? Anyone encountered this before? Below is the reply from the customer service: Please be advised that NSK transaction is not in the list under grocery and not eligible for Simplycash cashback. You may refer to our SCB website for more information > Credit cards > Simply Cash credit card > Terms & Condition. Nsk not listed as grocery for most of my cc So best is use ewallet or GXBank 1% cash back |

|

|

|

|

|

ericlaiys

|

Mar 7 2024, 11:23 PM Mar 7 2024, 11:23 PM

|

|

QUOTE(Koranshita @ Mar 7 2024, 11:13 PM) I got my new card. Ask me to activate online. But I try to do it state no card need to activate.. call that stupid hotline say I have online no need call them , ask me do online. So.. do I need to do active or it's auto? I try to add into my boost it was rejected Anyone? Standard chartered 100% no human customer service anymore? SC CS- almost zero...lol here the guide: https://www.sc.com/my/credit-cards/activation/This post has been edited by ericlaiys: Mar 7 2024, 11:23 PM |

|

|

|

|

|

ericlaiys

|

Mar 11 2024, 11:49 PM Mar 11 2024, 11:49 PM

|

|

QUOTE(GymBoi @ Mar 11 2024, 10:28 PM) Just got my jumpstart debit card few weeks ago, tested and use in msia last week and enabled overseas transaction ... I'm in Korea since yesterday ... used the card also without problem BUT no transaction record in app ... i thought okay maybe overseas slow, kept using until today also no record at all ... since it's debit card now i don't even recall how much I have left since the app is not updated ... so I just simply top up few hundred la just in case suddenly run out of money then tada notification come in for the top up ... but still nothing for the spending ... so ... free spending for me or what? lol ... my balance is still = 2 days ago before i go overseas + today top up .... wtf? lol Debit card -3 days |

|

|

|

|

|

ericlaiys

|

Mar 12 2024, 05:22 PM Mar 12 2024, 05:22 PM

|

|

QUOTE(Wolgie @ Mar 12 2024, 05:19 PM) Hahaha. i also just do it after see ur forum here. use 8month no statement received. time to cut this card soon. before charges annual fee. i heard cannot waive? right? Simply Cash CC *** so what in apps is useless... nothing can see.....   at the end. back to webbased depend on luck. some waive 50% |

|

|

|

|

|

ericlaiys

|

Mar 12 2024, 06:33 PM Mar 12 2024, 06:33 PM

|

|

QUOTE(ben3003 @ Mar 12 2024, 05:56 PM) The annual fee will show in statement right? My justone visa platinum macam no annual fee since they give me when i apply loan Problem now email no give estatement, very toublesome la wan to go app and see. Why they dont straight email the statement easier to track in email. i think the problem on your side. u need to set send statement by email. i received my statement every month to my email |

|

|

|

|

|

ericlaiys

|

Mar 13 2024, 06:23 AM Mar 13 2024, 06:23 AM

|

|

QUOTE(kakalaku @ Mar 13 2024, 01:33 AM) how far in advance should I request for annual fee waiver for SCB Journey Card? I got my card at around July/Aug last year 1 month. If you got 60k spending , then easy to request |

|

|

|

|

|

ericlaiys

|

Mar 14 2024, 08:29 PM Mar 14 2024, 08:29 PM

|

|

QUOTE(sg8989 @ Mar 14 2024, 08:18 PM) The scb 360rewards point seem sucks Can't display properly in web and apps. Cannot redeem my cash back. no problem when i convert airlines. tested twice last month and last week |

|

|

|

|

|

ericlaiys

|

Apr 15 2024, 11:30 AM Apr 15 2024, 11:30 AM

|

|

QUOTE(ah_Keng @ Apr 15 2024, 09:45 AM) Hi, I have SC journey card, does anyone know how to double check the worldmiles they credited per transaction? they provide total every month. u need to keep track yourself. based on my observation, only useful when use at oversea [other currency]. local usage- not worth it |

|

|

|

|

|

ericlaiys

|

Apr 30 2024, 11:18 AM Apr 30 2024, 11:18 AM

|

|

QUOTE(thinkhappy @ Apr 30 2024, 10:20 AM) anyone receive RM50 JumpStart Savings Account-i debit card cash back? mar cash back yet to be seen. normally it appear 28 - 29th of the month this month slow |

|

|

|

|

|

ericlaiys

|

Apr 30 2024, 11:18 AM Apr 30 2024, 11:18 AM

|

|

QUOTE(Wolgie @ Apr 30 2024, 10:53 AM) Manage to get cash back 50-30 = left 20 inside.  Thinking cut the card or gamble the annual fee coming, can rebate/waive or not  debit card - cannot waive |

|

|

|

|

|

ericlaiys

|

May 1 2024, 08:41 AM May 1 2024, 08:41 AM

|

|

QUOTE(Wolgie @ May 1 2024, 08:33 AM) u can submit request from app. it is up to them to decide. if u lucky may be 50% waive or 100% (if u use a lot and within their req annual based on cc) |

|

|

|

|

|

ericlaiys

|

May 18 2024, 02:05 PM May 18 2024, 02:05 PM

|

|

-deleted

This post has been edited by ericlaiys: May 18 2024, 02:05 PM

|

|

|

|

|

|

ericlaiys

|

May 18 2024, 06:00 PM May 18 2024, 06:00 PM

|

|

QUOTE(Kelvin8998 @ May 18 2024, 04:59 PM) Anyone knows whether SCB accepts FD pledge for their cards? Also, has anyone successfully gotten AF waiver for the SCB Journey card 2nd year onwards? spend 60k to waive |

|

|

|

|

|

ericlaiys

|

Jun 11 2024, 08:38 AM Jun 11 2024, 08:38 AM

|

|

QUOTE(patrickthissen @ Jun 11 2024, 08:01 AM) I cancel my SimplyCash card last friday via apps.. Then the bank charged me RM250 annual fees follow my cancellation date. I click apps to waive the annual fees but was denied. Anyone face this before? (Cancel the card and immediate charge annual fees) it is best to cancel card 1 month before due. i already send notification to cancel since last week. pending them to call me |

|

|

|

|

|

ericlaiys

|

Jun 12 2024, 10:38 AM Jun 12 2024, 10:38 AM

|

|

QUOTE(stormaker @ Jun 12 2024, 10:22 AM) Is there anyway / possible to speed up the CC cancellation process ? Submitted cancellation request in app on 5 June, till now still processing. i also waiting. same date. they say 7 working day. so by 14 june they will call |

|

|

|

|

|

ericlaiys

|

Jun 14 2024, 12:08 PM Jun 14 2024, 12:08 PM

|

|

update:

after 7 working days, retention team called and offered me rm100 cashback with 200 spending and will get it by sept.

However i say no & got the card terminated. Within 1hour , the cc remove from SC app.

This post has been edited by ericlaiys: Jun 14 2024, 12:08 PM

|

|

|

|

|

|

ericlaiys

|

Jun 16 2024, 11:45 PM Jun 16 2024, 11:45 PM

|

|

QUOTE(adibyusoff @ Jun 16 2024, 10:23 PM) Hi guys. Just got my journey card today. Wanted to ask is it worth utilizing? I am currently on ambank visa infinite and uob visa infinite as my daily driver in and out country. Read from previous posts many said it's not really good to keep. only good for access lounge. -unlimited. just terminate it before one year. |

|

|

|

|

|

ericlaiys

|

Jun 17 2024, 02:36 AM Jun 17 2024, 02:36 AM

|

|

QUOTE(stephanieKingsley @ Jun 17 2024, 01:01 AM) SC offered me RM100 cashback for min spend RM200 after I applied for card cancellation via the app. Anyone knows if I top up ewallet RM200 then eligible for the RM100 cashback? CS just told me must spend RM200 and I don't know if ewallet category counts. They offered same but I decline as I no longer trust them. Some more they told me will know status after 3 month. U already got tricked to retain cc. My previous experience is they don’t honor their word on sign up benefit for cc and jumpstart. After fighting so long and I showed them proof on TNc, only admit their mistaken. However damage done on cc even they return welcome gift. My 2nd incident is they told me , promo end after 10k users and cannot give cash back. I already tired of dealing with this bank. Now I understand why their turnover are so high. it is no trustworthy bank even they offered rm100 by spend 200. Good luck and hope they fulfill yours. You can read previous post on those that face same fate. This post has been edited by ericlaiys: Jun 17 2024, 02:41 AM |

|

|

|

|

|

ericlaiys

|

Jun 21 2024, 09:54 AM Jun 21 2024, 09:54 AM

|

|

QUOTE(prescott2006 @ Jun 21 2024, 09:50 AM) Currently I have RM24 in Online Rewards account, I am waiting RM6 from May spending. My AF will charged in July statement, if I cancel the card now, can I still redeem the RM30 to my Standard Chartered saving account afterwards? redeem first before cancel. else all gone |

|

|

|

|

Mar 1 2024, 07:08 PM

Mar 1 2024, 07:08 PM

Quote

Quote 0.0572sec

0.0572sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled