Outline ·

[ Standard ] ·

Linear+

APPLE PAY IN MALAYSIA, Official arrives in Malaysia! Aug 2022!

|

PoisonSoul

|

Dec 22 2021, 12:49 AM Dec 22 2021, 12:49 AM

|

|

QUOTE(RonanGow @ Dec 21 2021, 10:19 PM) Yeah, it depend on the bank decide which type of card can add into AP, so I assume mxxbank will be the one of the bank support AP here, obviously footlocker not accept Amex card now cause they covered with the sticker until available and most of the store don’t accept amex too, if Mxxbank add amex card into AP so those merchant that accept AP one must accept Amex too, it big win for Mxxbank, can gain amax market here, lot of peoples don’t want Amex card cause too few merchant accept it, even a grocery store, if most store adopt AP system then amex is another story No. That’s not how AP works. When you tie your card to AP (assume JCB), it depends IF THE ISSUING BANK OF YOUR JCB CARD allows it to be added into AP. Ok, let’s say your JCB card can be added to AP, IF the merchant shows they accept Visa Master only, it means Visa and Master only. AP is just a bridge btween your card and the merchant’s terminal. If right now you have an Amex card tied to your AP and you would to use AP and choose your Amex card to pay @ 7-11, your payment wont go thru. If you use AP and choose a Visa/Master that’s tied to ur AP to pay, confirm it will go thru. So, if Harimau wants to allow of their Amex card to be added to AP, doesnt matter. It’s still matters if the merchant accepts Amex or not. |

|

|

|

|

|

PoisonSoul

|

Dec 22 2021, 08:55 AM Dec 22 2021, 08:55 AM

|

|

QUOTE(RonanGow @ Dec 22 2021, 07:33 AM) I know how AP work, cause I saw AP and Amex appear and cover at the Same time at footlocker so I ASSUME mxxbank will let user add their Amex card, obviously footlocker don’t accept Amex now that’s why I assume if Amex can add into AP then apple will force all the store that accepted AP system to accept Amex card cause such act is so apple way, maybe apple doesn’t want their user feel inconvenient to use their service so apple make merchant to accept all type of card that support on the AP system, if Amex can add into AP but still not many store accept it what the point to use AP right (for Amex user)? I think this is what apple try to avoid, if the store want Apple Pay payment option u must accept all the card type that support on the AP, no matter visa, master, jcb or Amex, u must accept all otherwise u can’t have AP system. Ok I understand now that you understand how AP works. But one thing, how can harimau force merchant to accept other than Master Visa if merchant decides to take AP? Even my local 99speedmart RIGHT NOW accepts AP because of how AP works. So u are saying that, if next time merchants in MY wants to accept AP as a payment “bridge”, they must accept ALL cards that are addable to AP? Force 99speedmart to take Amex? Force your every single merchant that has a terminal to take Amex? I doubt so. If harimau really does that, i can forsee more merchants moving away from harimau. Maybe that’s why I also start to see merchants changing their terminals from harimau to H bank. |

|

|

|

|

|

PoisonSoul

|

Dec 23 2021, 10:39 PM Dec 23 2021, 10:39 PM

|

|

QUOTE(Sam Leong @ Dec 23 2021, 05:20 PM) unfortunately iOS 15.2 has launched and no sign of Apple Pay coming in Malaysia I don't believe an iOS X.X or even iOS X.X.X is required to launch AP. It all boils down to the JSON file that I shared few pages back. If Apple were to update that JSON file to include MY, then I believe our devices that set to MY region will automatically gain the "+" logo in the Wallet app. |

|

|

|

|

|

PoisonSoul

|

Dec 24 2021, 12:32 AM Dec 24 2021, 12:32 AM

|

|

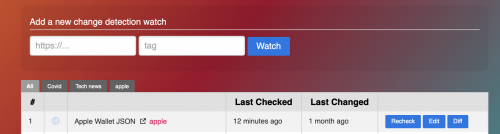

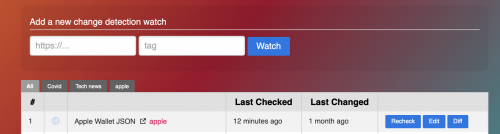

QUOTE(The1stHumanBeing @ Dec 24 2021, 12:20 AM) Yes agreed, the iOS version doesn’t matter when it comes to Apple Pay support in Malaysia. Apple Pay has already been in use for years in other supported countries. It’s a matter when the card issuer (bank in our case), Apple and third parties (like Visa, MC or MyDebit) working together to enable Apple Pay in Malaysia. If all parties don’t work together, then Apple Pay would not be supported in Malaysia. Just curious, PosionSoul has the JSON file included the country code MY when tapping the “+” logo in Apple Wallet. Here lol » Click to show Spoiler - click again to hide... « QUOTE(PoisonSoul @ Sep 7 2021, 05:39 PM) Everytime I see this thread bumped up, I was hoping it’s some good news but it’s always a disappointment. I mean, bumping this thread up for no good reason is really a bummer. Anyways, I found something interesting for those understand JSON. Apparently, this is what your phone will request from Apple every time you launch AP. AP JSON fileWell, continue refreshing this JSON file everyday and hope there’s suddenly MY in there. Sekian. Also, how to find my post » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

PoisonSoul

|

Dec 24 2021, 10:56 AM Dec 24 2021, 10:56 AM

|

|

QUOTE(loonsave @ Dec 24 2021, 10:44 AM) Thanks for the link. I monitor the link and alert me when detect change in the JSON.   What's the last change within a month ago? Can you share the diff? |

|

|

|

|

|

PoisonSoul

|

Dec 24 2021, 07:55 PM Dec 24 2021, 07:55 PM

|

|

Footlocker Sunway Pyramid @ 24/12/2021  |

|

|

|

|

|

PoisonSoul

|

Dec 30 2021, 12:26 AM Dec 30 2021, 12:26 AM

|

|

|

|

|

|

|

|

PoisonSoul

|

Dec 31 2021, 10:09 PM Dec 31 2021, 10:09 PM

|

|

QUOTE(lawrencesha @ Dec 31 2021, 08:29 PM) Fortunately, I hold a Singapore CC and added it to my iPhone and Apple Watch. Every time I pay with my watch, I see the disbelieve in the casher's eyes.  I just used my Watch to pay just now @ a F&B stall. The staff wasn't even amused. Staff was like "k"  |

|

|

|

|

|

PoisonSoul

|

Dec 31 2021, 10:39 PM Dec 31 2021, 10:39 PM

|

|

QUOTE(The1stHumanBeing @ Dec 31 2021, 10:14 PM) If I were to switch my Wise MY to Wise SG account. Would the physical (green) card still work? Don’t want to order another one since after 1st January they will charge RM13.70 for the card and even more for express deilvery. I can 100% tell you, I don't know. If you followed this thread, my account is created "in SG" and therefore, my account is SG since day 1. Then when I got the card already, only I tell CS that I "recently relocated" to MY and then prompted me to have a proper document that I am currently residing in MY. So you can say that, my card is SG issued, so it can be added to AP because SG is listed as a supported country/region. As for your card is issued by Wise MY (no matter where the card is made), I think changing region (no matter Wise acc or iPhone region) will not allow you to add the card into AP because the card has to be SG issued and not MY. The 16 digits of the card, 2-3 numbers on it (not sure which one) is actually the country's reference. You can google and see more on the 16 digits. While typing all that, only realised you did not mentioned AP, rather the physical itself. If so, confirm can work. MY issued card -> chg Wise MY to Wise SG -> physical can still use. |

|

|

|

|

|

PoisonSoul

|

Jan 4 2022, 11:26 AM Jan 4 2022, 11:26 AM

|

|

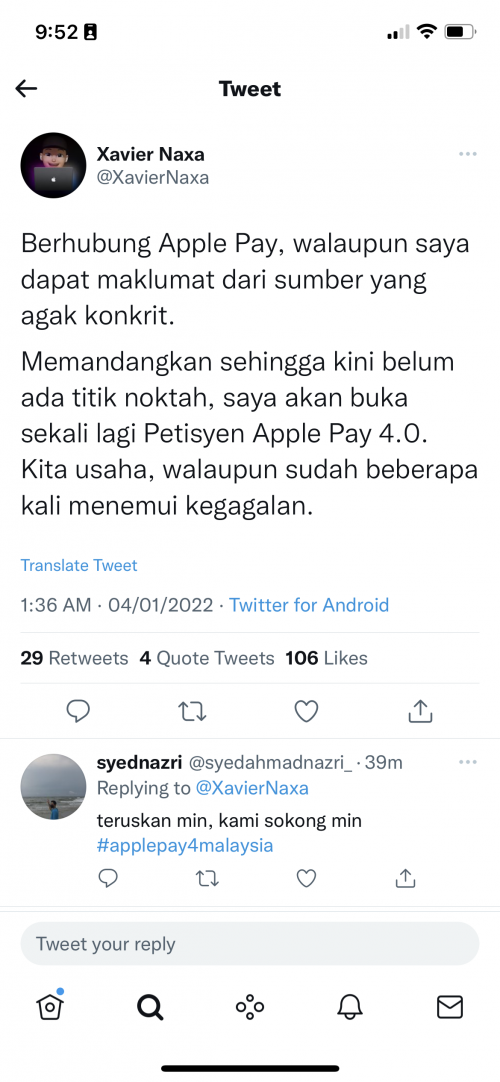

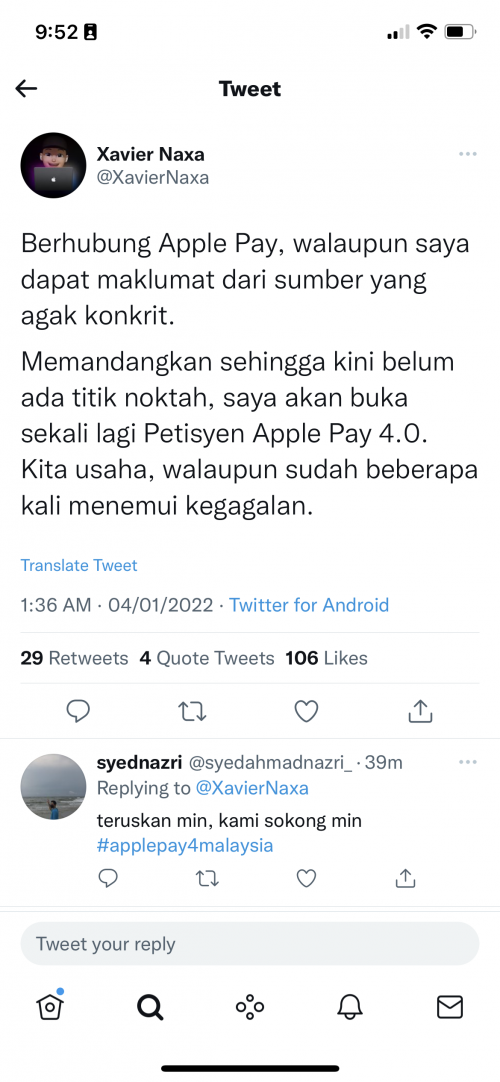

QUOTE(@POTUS @ Jan 4 2022, 09:54 AM)  So being drop out again?😂 This guy, yes I know he cannot share certain things but what the hell for to hype ppl up for something that he can't share? It's like telling ppl "Hey, I got a surprise coming for you, but I cannot tell you what is it about". Potong stim lah. If got concrete news or evidence, share it out. All he always do is just based on his words only. Show la some B&W or some conversation with the ppl involved in the project (of course hiding their name/picture). I got fed up of his news already. Sometimes it's not worth it to get excited over someone that has already potong you many times. |

|

|

|

|

|

PoisonSoul

|

Jan 4 2022, 11:42 AM Jan 4 2022, 11:42 AM

|

|

QUOTE(@POTUS @ Jan 4 2022, 11:31 AM) Well, his action is to start a new petition, so means his source telling him previous decisions was being tossed out? Based on the infos we gotten here, it seems like AP is already more or less ready to deploy but it's only B*M is the one co*kblocking. I don't think it's something to do with Apple now. Apple most likely is like "U wanna use? Use la, just pay us a fee" while the bank(s) involved says "ok sure, nah fee for u. Let me integrate now". |

|

|

|

|

|

PoisonSoul

|

Jan 4 2022, 12:00 PM Jan 4 2022, 12:00 PM

|

|

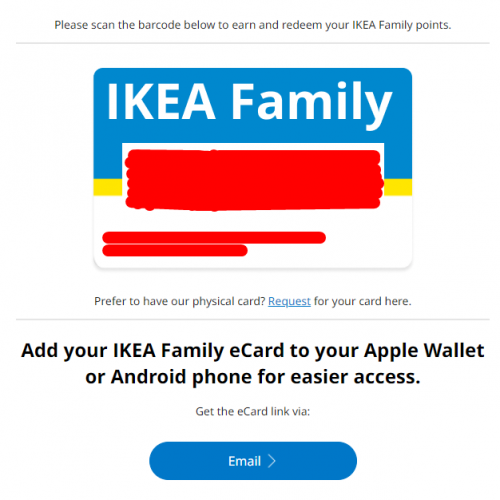

QUOTE(wjleong15 @ Jan 4 2022, 11:46 AM) next is hoping our transport card would consider to support it?  but kind of hopeless One at a time. Let's get AP to be available by MY banks first. Don't be too hopeful on our transport card (TxG). Already when they allow us use their card to pay for parking @ malls, already want to charge us an extra 10% above the parking fee we are already paying. Only now they are removing the 10% at most malls. So imagine if they say, if u use AP with our card, pay extra 10%. Unless there's another transport card (I don't mean KxM's proprietary card) that I'm not aware? But look at the trend for the past few months of eWallets. KiplePay has a prepaid card, Ka$hPlus roll out prepaid card, Wise for some reason suddenly has prepaid card launched here (all regions have Wise prepaid card has AP and GP support), Touch And Go launching prepaid card, Grab has GrabCC. So I think these COULD BE the indicator something is brewing at the back, all getting ready to hop on the AP hype/wave. Or, unfortunately, they just want us to use their card @ more merchants and especially, overseas. |

|

|

|

|

|

PoisonSoul

|

Jan 6 2022, 09:50 PM Jan 6 2022, 09:50 PM

|

|

QUOTE(Mavik @ Jan 6 2022, 09:41 PM) That means whoever seems to be presenting it to Bank Negara seems to not be doing it well to explain the security. 1) Item one, is a lot more secure with the phone and watch as both the iPhone and Apple watch requires a PIN or faceID/Touch ID to be activated first in order to use it. If I were to misplace my credit card, someone can easily use it to its daily transaction limit already. Hence, assigning the physical card to the device is already an additional security add-on. 2) Hogwash, different countries have set different limits where certain transactions above a certain amount based on local currency requires a PIN - https://support.apple.com/en-us/HT207435 3) Again, the person explaining it to BNM definitely didn't do their homework as well as other banks globally usually default the limits and restrictions to the card. Here is an example https://www.westpac.com.au/faq/apple-pay-transaction-limits/Honestly, as someone who has worked in banking before, I can definitely say it isn't Bank Negara's fault. It is always the project manager or the representative of the team who presents it and explains it to Bank Negara is mostly at fault. And yes, I have been in a room explaining new technology to Bank Negara before as well as the underlying processes and how risk is mitigated. pls pass this msg to your project manager or representative to BxM. Maybe it's one of you guy's Project Manager/Representative that is causing AP launch to be slowed. |

|

|

|

|

|

PoisonSoul

|

Jan 11 2022, 02:13 PM Jan 11 2022, 02:13 PM

|

|

QUOTE(Xaphier @ Jan 11 2022, 01:46 PM) March 2022. Likely red bank first. Red. Hmmm interesting from yellow to red now. |

|

|

|

|

|

PoisonSoul

|

Jan 11 2022, 03:20 PM Jan 11 2022, 03:20 PM

|

|

QUOTE(wjleong15 @ Jan 11 2022, 02:18 PM) hmmm red bank in sg not even support  There's alot of red coloured bank.  It could not be the same red that you are thinking right now haha.  |

|

|

|

|

|

PoisonSoul

|

Jan 11 2022, 06:37 PM Jan 11 2022, 06:37 PM

|

|

QUOTE(driftmeister @ Jan 11 2022, 06:14 PM) z3 is spot on on the question by BxM on AP, that's exactly the questioned by them and answered to them verbally late last year and a written response was given last friday. Necessary justification was given like the likelihood a PIN is compromised (000000 until 999999) vs face ID (1 in 1mio probability) and regarding tranx limit also everything is stated in emvco standard and followed through. Up to BxM to accept the justification now. Last Friday was the "bluetick" from BxM to you guys lah? I wonder how long would they take to make assessment again and then give the green light.  So if they reject this justification, can your bank just be like "ah you know what, BxM so mafan, scrap off this project lah. fk this shxt" or you guys will continue to push and push until BxM is satisfied? |

|

|

|

|

|

PoisonSoul

|

Jan 11 2022, 07:47 PM Jan 11 2022, 07:47 PM

|

|

QUOTE(shyan90's @ Jan 11 2022, 07:14 PM) This topic is long enough XD Din expect it cant still survive till 2022. Wow, TS appeared haha. QUOTE(driftmeister @ Jan 11 2022, 07:43 PM) dont think it will be scrap as many banks are pursuing, and money being spent. the project is almost at the last kick. Just matter of testing and sign off. I see. Do you guys know the person that’s is withholding the signing off AP usage in MY inside BxM? If so, is the person a relatively old guy or they are all this cautious upon launching something new that involves money? |

|

|

|

|

|

PoisonSoul

|

Jan 11 2022, 10:26 PM Jan 11 2022, 10:26 PM

|

|

QUOTE(Mavik @ Jan 11 2022, 10:00 PM) Usually the process is this, banks write a paper to BNM for approval (there is a category usually for either approvals or FYI which BNM has a guideline on). BNM has until 21 days to respond back and if the explanation is not clear in the paper that raises more questions, then BNM will raise these questions back to the bank. Questions usually can be in the form of IT security, compliance, risk mitigation actions, processes in place to support, what happens if a customer complains about XYZ and how does it flow and how will it tackle. So we are now looking at the 2nd week of February to hit the 21 days mark. Okay. Cool. Let's hear from our fellow forumers by then. QUOTE(Mavik @ Jan 11 2022, 10:17 PM) Here are some examples of Apple Pay frauds around the globe. TLDR version: The technology itself isn't the cause of fraud but the setup of new cards from issuing banks into Apple Pay. https://www.retaildive.com/ex/mobilecommerc...ds-not-platformhttps://www.cnbc.com/2015/03/04/whos-at-fau...e-or-banks.htmlhttps://www.forbes.com/sites/thomasbrewster...sh=3c1c2127622f1st and 2nd is already 6 years ago. Should be "patched" by now. The 3rd is just a mere 2-3 years ago. Hmmm... |

|

|

|

|

|

PoisonSoul

|

Jan 11 2022, 10:48 PM Jan 11 2022, 10:48 PM

|

|

Rnggt website on using Android device as terminal instead of traditional terminalBut why? Scams will rise I tell you. Scammer sellers/merchants sure to get a fake app and copy all the details when we wave our cards on their phone

|

|

|

|

|

|

PoisonSoul

|

Jan 14 2022, 08:13 AM Jan 14 2022, 08:13 AM

|

|

QUOTE(me076310 @ Jan 13 2022, 07:31 PM) Sorry guys, I can’t divulge the details but definitely not as late as March 2022. If you can, expose this. Your info is coming from BxM or from a bank? |

|

|

|

|

Dec 22 2021, 12:49 AM

Dec 22 2021, 12:49 AM

Quote

Quote

0.0252sec

0.0252sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled