QUOTE(T231H @ Oct 11 2016, 12:02 AM)

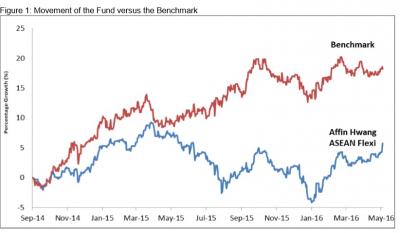

from the annual report......saw this.....

Every fund has different benchmark to measure, like CIMB APDIF using 8% p.a. as benchmark, the comparison can mean something and mean nothing depending on the context and target.

For Thailand equity double digit allocation compilation:

CIMB-Principal ASEAN Total Return Fund -Class MYR (launched 1.5 years) (13.6% Thailand Equity)

AFFIN HWANG ASEAN FLEXI FUND - MYR CLASS (launched 2 years) (28% Thailand Equity)

AMASEAN EQUITY (launched around the same time with APDIF) (19.46% Thailand Equity)

Kenanga ASEAN Tactical Total Return Fund (launched 1.25 years ago) (17.3% Thailand Equity)

RHB ASEAN FUND (launched 7 years ago) (14.3% Thailand Equity)

YTD performance comparison with APDIF, kinda in sync, but each fund have different other allocation, just take it as a grain of salt

But from the graph, you can see that, as you and many said, if you got steel balls and DCA/RSP all the way, APDIF will net you higher return

This post has been edited by AIYH: Oct 11 2016, 12:10 AM Attached thumbnail(s)

This post has been edited by AIYH: Oct 11 2016, 12:10 AM Attached thumbnail(s)

Oct 10 2016, 09:55 PM

Oct 10 2016, 09:55 PM

Quote

Quote

0.0180sec

0.0180sec

0.62

0.62

6 queries

6 queries

GZIP Disabled

GZIP Disabled