QUOTE(abcn1n @ Jan 30 2021, 12:08 AM)

Why post this portion of GME in this thread instead of GME thread? Is it you hoping more sympathy/understanding here since you may have felt you weren't making progress in the other thread? Just wondering aloud.

Honestly, the broker could have asked the short sellers to stop short selling and increase their margin. And/or put a halt to all trading for the time being while working on a better solution (instead of prohibiting buying from the common folks, some of which are buying 100% using their own cash while allowing them to sell their existing position). Wouldn't this be a fairer alternative.

By the brokerages doing what they are doing, they are aiding the short sellers, allowing them to buy cheaper and kill the buying momentum. In the process also, angering millions of people which would cause them to want to hold for higher prices or buy more when they are angered.

If we were to replace the large hedge funds who shorted recklessly with the common folk (collectively holding as much short interest as the hedge funds), would the brokerage behave the same way. I doubt it. Most likely the brokerage would suspend the short seller account, disallowed any more short selling from them and ask them to top up their margin etc, thus reducing the collateral problem thingy.

Not all of us who buy GME are against hedge funds etc or unable to think rationally. None of us want a repeat of LTCM or MFGobal. Don't let fear of LTCM /MFGlobal /anger or other reasons cloud your ability to think or really find out a best solution (instead of trying to avoid the problem by just caving in to the biggies as its an easier way out).

With technology, faster internet, smartphones etc--more and more existing hidden issues/problems will surface and people power will be more obvious--this is unavoidable (unless the country want to get more dictatorial)--so stay ahead of the curve by putting our brains to find better solution instead of taking the easy way out by caving in to the biggies. Peace.

PS: When one choose to be fair and focus on finding an equitable solution for all, we'll get better and better at problem solving. However, if one choose to not rock the boat as it will affect our rice bowl, then don't put it as something else and just admit it as it is or choose not to say anything. 2nd option is always easier and I believe most if not all of us do it at one point or another. Only the brave, optimistic , stubborn ones will choose the 1st option.

Seriously mateHonestly, the broker could have asked the short sellers to stop short selling and increase their margin. And/or put a halt to all trading for the time being while working on a better solution (instead of prohibiting buying from the common folks, some of which are buying 100% using their own cash while allowing them to sell their existing position). Wouldn't this be a fairer alternative.

By the brokerages doing what they are doing, they are aiding the short sellers, allowing them to buy cheaper and kill the buying momentum. In the process also, angering millions of people which would cause them to want to hold for higher prices or buy more when they are angered.

If we were to replace the large hedge funds who shorted recklessly with the common folk (collectively holding as much short interest as the hedge funds), would the brokerage behave the same way. I doubt it. Most likely the brokerage would suspend the short seller account, disallowed any more short selling from them and ask them to top up their margin etc, thus reducing the collateral problem thingy.

Not all of us who buy GME are against hedge funds etc or unable to think rationally. None of us want a repeat of LTCM or MFGobal. Don't let fear of LTCM /MFGlobal /anger or other reasons cloud your ability to think or really find out a best solution (instead of trying to avoid the problem by just caving in to the biggies as its an easier way out).

With technology, faster internet, smartphones etc--more and more existing hidden issues/problems will surface and people power will be more obvious--this is unavoidable (unless the country want to get more dictatorial)--so stay ahead of the curve by putting our brains to find better solution instead of taking the easy way out by caving in to the biggies. Peace.

PS: When one choose to be fair and focus on finding an equitable solution for all, we'll get better and better at problem solving. However, if one choose to not rock the boat as it will affect our rice bowl, then don't put it as something else and just admit it as it is or choose not to say anything. 2nd option is always easier and I believe most if not all of us do it at one point or another. Only the brave, optimistic , stubborn ones will choose the 1st option.

I'm looking for sympathy... jeez

I am not going to entertain speculation and rumour mongering that is going on and I'm not going to come up with solutions when I have never worked on the brokerage side nor do the programming for all the risk models.

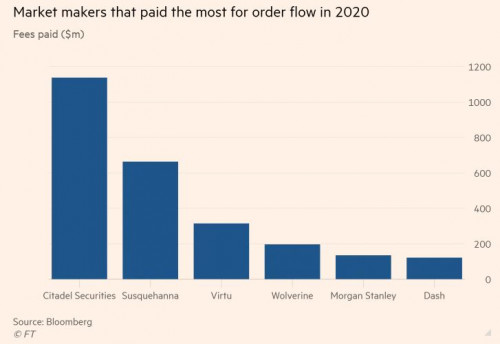

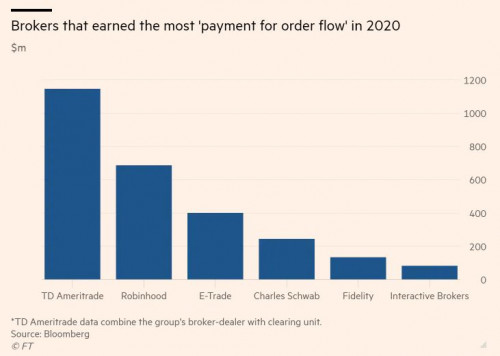

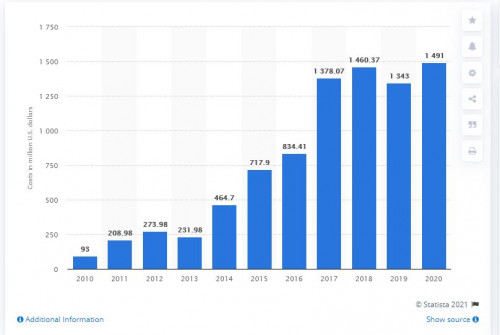

There should have been investigations into Citadel a long time ago but nothing has happened same like Roth Capital and all the manipulation they have done yet they still exist today.

Not going to defend them as I was holding options in those instruments and I couldn't trade but to say outright they were only protecting certain people is making the issue simplified.

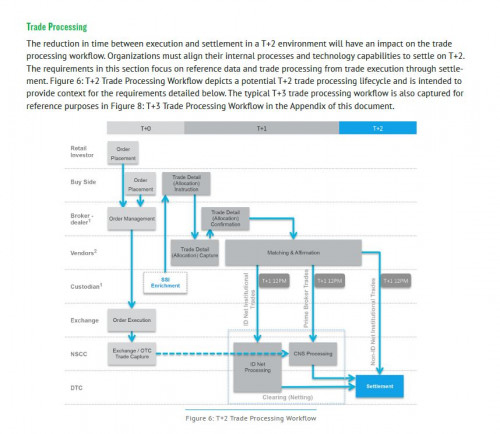

Trade settlement isn't as easy as people make it out to be

http://www.ust2.com/pdfs/ssc.pdf

https://www.dtcc.com/news/2014/april/22/sho...ment-cycle.aspx

A certain administration in the past didn't do much to address this issue and now we are facing the consequences.

Lastly, don't need to listen to me but a former programmer on Wall Street wrote this article

GameStop madness isn't David vs Goliath. It's Goliath vs. Goliath, with David as a fig leaf

https://marketsweekly.ghost.io/what-happened-with-gamestop/

This post has been edited by zacknistelrooy: Jan 30 2021, 12:47 AM

Jan 30 2021, 12:47 AM

Jan 30 2021, 12:47 AM

Quote

Quote

0.4087sec

0.4087sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled