QUOTE(ozak @ Jul 5 2021, 12:31 PM)

For the 1st half of 2021, S&P 500 up +14.41%. Most of the company strong earning growth and beat expectations.

For the 1st 5 month, DJI out performed the Nasdaq. But cyclical been change late this 2 month to Nasdaq.

The sector that out perform S&P 500 this 1st half is Energy, Financials and Industrial. It is not that there are grow, but catching up from the last yrs under perform. Where Nasdaq occupy the market.

But for long term usual US market, it is about technology. Sector like Technology, Discretionary and health care out perform S&P. (2011-2021)

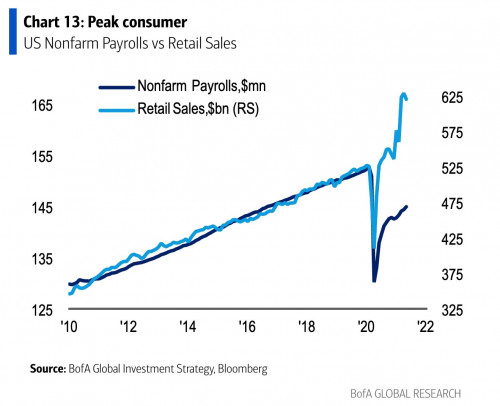

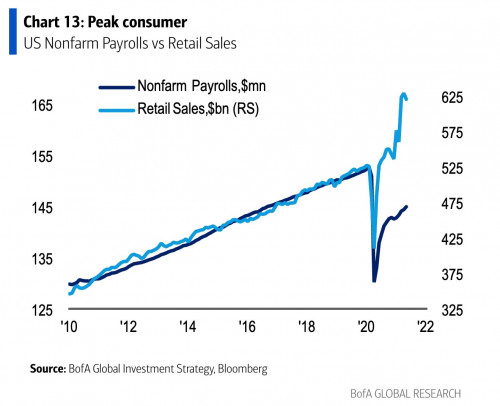

2nd half yrs, US market continue to grow. But might be slow down lesser compare to 1st half.

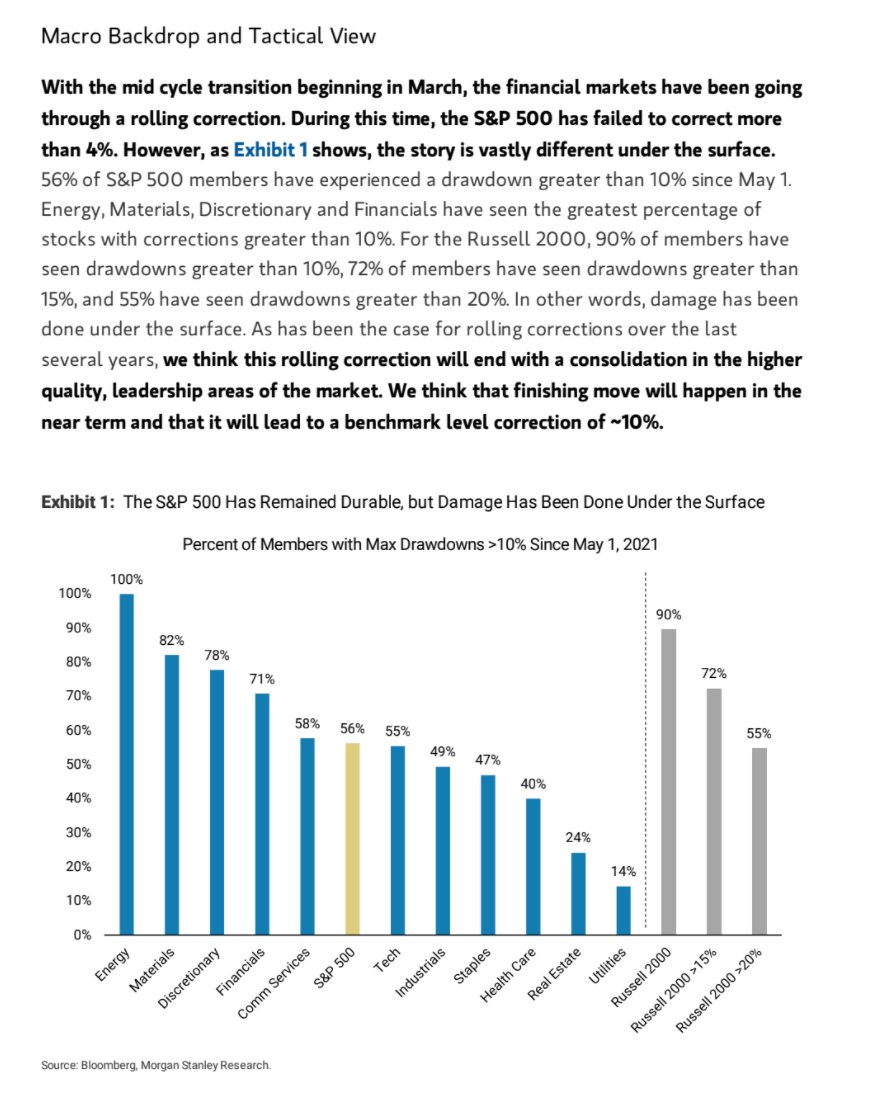

The market has been a rotation binge since April last year and one the main reason it hasn't meaningfully corrected since last year October.

I will always advocate for tech stocks because largely that has been the only sector I have held long term but one needs be realistic for the future.

This much demand pull forward has consequences.

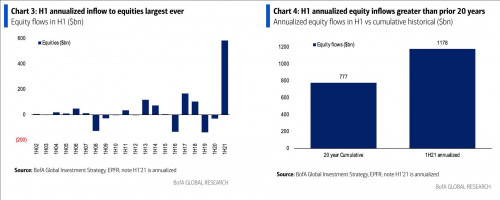

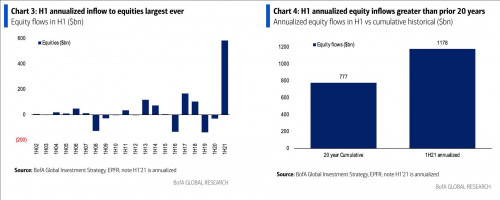

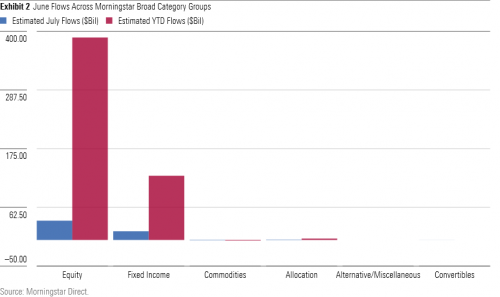

Then you have one is unprecedented flow into stocks which wasn't the case for the past 12 years

QUOTE(joeblow @ Jul 5 2021, 12:34 PM)

What is discretionary? Surprise to see health care outperform S&P. I bet they never count those upcoming biotechs or pharma that failed during the decade. ie big enough to be counted like S&P.

Largely driven by Amazon and Tesla

Tesla accounts for 25% of the returns for the past year and is followed by Amazon accounting for 11.7% of the returns.

Then you have your usual suspects which are Home Depot, Nike, Target and Starbucks that accounted for 6%, 5%, 4.8% and 3.7% respectively.

Health Care sector for S&P 500 isn't only about Biotechs and only makes up around 15% of that index.

There is Health Care Equipment, Insurance and Pharmaceuticals which are much more important to that index.

QUOTE(yehlai @ Jul 6 2021, 12:47 AM)

Didi really DDD

first is Ant now Didi.. who still dare touch China IPO

The fault this time around is on the company and the US bankers.

https://www.wsj.com/articles/chinese-regula...ipo-11625510600QUOTE

Weeks before Didi Global Inc. DIDI -23.28% went public in the U.S., China’s cybersecurity watchdog suggested the Chinese ride-hailing giant delay its initial public offering and urged it to conduct a thorough self-examination of its network security, according to people with knowledge of the matter.

But for Didi, waiting would be problematic. In the absence of an outright order to halt the IPO, it went ahead.

The company, facing investor pressure to list after raising billions of dollars from prominent venture capitalists, wrapped up its pre-offering “roadshow” in a matter of days in June—much shorter than typical investor pitches made by Chinese firms. The listing on the New York Stock Exchange raised about $4.4 billion, making it the biggest stock sale for a Chinese company since Alibaba Group Holding Ltd. BABA -2.25% ’s IPO in 2014.

Back in Beijing, officials, especially those at the Cyberspace Administration of China, remained wary of the ride-hailing company’s troves of data potentially falling into foreign hands as a result of greater public disclosure associated with a U.S. listing, the people said.

Soft warning but they still wanted to go ahead of it and now this has open the door for more things to come.

Jun 23 2021, 09:12 PM

Jun 23 2021, 09:12 PM

Quote

Quote

0.0464sec

0.0464sec

0.96

0.96

7 queries

7 queries

GZIP Disabled

GZIP Disabled