Outline ·

[ Standard ] ·

Linear+

USA Stock Discussion v8, Brexit: What happens now?

|

dwRK

|

Feb 22 2023, 09:23 AM Feb 22 2023, 09:23 AM

|

|

QUOTE(Boon3 @ Feb 16 2023, 01:28 PM) And my 3 sen question: For a 3 month scorecard, buying 3 selling 8, whatever happened to his Warren Buffett's own advice of not over trading?  https://www.fool.com/investing/2023/01/15/t...in-2023-accord/ https://www.fool.com/investing/2023/01/15/t...in-2023-accord/ less than 1% of total value in 3 months... very low normal maintenance lah... where got over trading... simply say only... hahaha... |

|

|

|

|

|

dwRK

|

Mar 7 2023, 07:42 AM Mar 7 2023, 07:42 AM

|

|

QUOTE(danmooncake @ Mar 7 2023, 04:23 AM) INTC finally gets a sell call by JP Morgan. They finally decided to give up on it. https://www.barrons.com/articles/intel-stoc...ing-51668173488It's crazy, sometimes dunno what these analysts are drinking. Only have the stock has dropped over 50%, then, they telling their investors to sell. It had a price target of 64.. now 25. Like that anybody can do it..how to lose your shirts fast.  they get paid to influence / manipulate the market...  |

|

|

|

|

|

dwRK

|

Mar 10 2023, 08:48 AM Mar 10 2023, 08:48 AM

|

|

QUOTE(cedriclee @ Mar 10 2023, 05:57 AM) Again the rules is "when everyone sees blood, you...................." ...sit back n chill...  |

|

|

|

|

|

dwRK

|

Mar 10 2023, 07:49 PM Mar 10 2023, 07:49 PM

|

|

QUOTE(Ramjade @ Mar 10 2023, 06:59 PM) I long time never shop at shitpee already. Due to their insincere free shipping. What the hell give give free shopping and still need to pay for shipping? Better I use Lazada where free shipping = really free shipping. some things only available at shopee...  |

|

|

|

|

|

dwRK

|

Mar 11 2023, 09:24 AM Mar 11 2023, 09:24 AM

|

|

QUOTE(ozak @ Mar 11 2023, 09:13 AM) I see people dare to trade before halt. brainwash... see the blood... buy the dip... but sometimes can be lucrative  This post has been edited by dwRK: Mar 11 2023, 09:24 AM This post has been edited by dwRK: Mar 11 2023, 09:24 AM |

|

|

|

|

|

dwRK

|

Mar 11 2023, 09:26 AM Mar 11 2023, 09:26 AM

|

|

QUOTE(TOS @ Mar 11 2023, 08:14 AM) Wow we have just witnessed the second biggest bank failure in US history. Banks can fail after all. (Including Malaysian ones...) Depositors and borrowers ought to be careful with their counterparties. many big US banks and firms would have failed if not for Feds pumping in money... |

|

|

|

|

|

dwRK

|

Mar 11 2023, 11:18 AM Mar 11 2023, 11:18 AM

|

|

QUOTE(Boon3 @ Mar 11 2023, 10:47 AM) Haha... Will they ever, ever learn? Buying the dip or deep (and of course average down) was a misaligned strategy made brilliantly smart and successful during the past incredible bull run. Many times a stock crashes for very valid fundamental reason... but in a long bill run, how many really care? i know you cannot resist... hahaha... |

|

|

|

|

|

dwRK

|

Mar 13 2023, 07:49 AM Mar 13 2023, 07:49 AM

|

|

QUOTE(Cubalagi @ Mar 13 2023, 07:38 AM) So another bank, Signiture bank, has been closed down. That makes 3 in a week if u include Silvergate Bank! bank run for sure tonight... Feds no bail out for svb... svb bank run caused by hedge fund... haiz.. This post has been edited by dwRK: Mar 13 2023, 07:52 AM |

|

|

|

|

|

dwRK

|

Mar 13 2023, 08:54 AM Mar 13 2023, 08:54 AM

|

|

QUOTE(ozak @ Mar 13 2023, 08:42 AM) Everything back to normal. Nothing to see. haiyah... was looking forwards to further meltdown... hahaha... QUOTE(adam1190 @ Mar 13 2023, 08:12 AM) the futures are in green and bitcoins has went up by 10% since Friday ahaha sad... was thinking good time to buy some... |

|

|

|

|

|

dwRK

|

Mar 13 2023, 11:59 AM Mar 13 2023, 11:59 AM

|

|

QUOTE(Ramjade @ Mar 13 2023, 11:40 AM) Govt bailout again. At this rate all banks just default and govt always there to bail them out. bail out the customers... but not the bank as i understands it... but customers >250k need to contact fdic... |

|

|

|

|

|

dwRK

|

Mar 13 2023, 12:14 PM Mar 13 2023, 12:14 PM

|

|

QUOTE(Ramjade @ Mar 13 2023, 12:05 PM) yup... like i said... QUOTE The rescue plans rekindled memories of the financial crisis, but Yellen said Sunday morning that there would be no SVB bailout.

“We’re not going to do that again. But we are concerned about depositors and are focused on trying to meet their needs,” Yellen said on CBS’ “Face the Nation.” but we may see the start of more companies collapsing... This post has been edited by dwRK: Mar 13 2023, 12:23 PM |

|

|

|

|

|

dwRK

|

Mar 13 2023, 12:33 PM Mar 13 2023, 12:33 PM

|

|

QUOTE(Ramjade @ Mar 13 2023, 12:23 PM) It's basically bailout/psudobailout. Cause even those above FDIC 250k can still get their money. i think its ok depositors get back their money... svb have many corporate accounts... a lot of people would have been indirectly affected... |

|

|

|

|

|

dwRK

|

Mar 13 2023, 08:40 PM Mar 13 2023, 08:40 PM

|

|

QUOTE(swiss228 @ Mar 13 2023, 05:34 PM) US futures have a strong rebound this morning, but now all negative. US mkts open today at 9.30 pm (daylight saving hrs), should be interesting. Maybe today will give a good opportunity for those who wish to "buy the dip". Get your money ready! lol... daytime futures is ppl gambling... no basic one... only nighttime will track real market... always ready but this type of dip not interested  |

|

|

|

|

|

dwRK

|

Mar 13 2023, 10:20 PM Mar 13 2023, 10:20 PM

|

|

QUOTE(Cubalagi @ Mar 13 2023, 09:26 PM) Some other regional banks under pressure. https://www.cnbc.com/2023/03/13/first-repub...ks-decline.htmlDepositor bailouts for those as well? Whats the point then for FDiC USD250k limit.? Just say all deposits in US banks will be guaranteed 😆 cover backside mah... give themselves option to cut you off at 250k... |

|

|

|

|

|

dwRK

|

Mar 15 2023, 11:32 PM Mar 15 2023, 11:32 PM

|

|

QUOTE(danmooncake @ Mar 15 2023, 10:56 PM) US Fixed Deposits (aka CDs) now at 5.25% for 12-18 months. Better than many risky equities now. put in bank... but bank go bust... hmmmm.... you'll find mostly small small banks give you this... most big banks are still very very low... This post has been edited by dwRK: Mar 15 2023, 11:48 PM |

|

|

|

|

|

dwRK

|

Apr 5 2023, 08:30 AM Apr 5 2023, 08:30 AM

|

|

QUOTE(Boon3 @ Apr 5 2023, 08:09 AM) simple business logic when price deliveries increase < selling lower selling prices = lower earnings. not forgetting that price cut had already created price wars .... plus with higher interest rates now, how many will dive in and get a brand new car (unless necessary) ? from that article... Lower margins this year will even offset the profit impact of continued growth in deliveries, according to analysts’ forecasts. The current consensus according to FactSet is for a slight fall in net income this year, the first decline since Tesla became profitable in 2019. The forecast cuts started last fall, but continued in the first quarter even as Tesla shares jumped 68%.

The result is that Tesla’s stock has become once again very expensive compared with its profit and its peers. The forward price-earnings ratio is now 45 times, up from about 20 at the start of the year. Its market value is $616 billion, well over three times that of Toyota, the world’s largest car maker by sales. Including the dilutive impact of stock options, which are a real cost to shareholders, the gap is even wider, with Tesla’s market value at $692 billion.

The only world in which this makes sense is one where the EV maker will take a lion’s share of industry profit, following the pattern of Apple and mobile phones. The competitive battles in China, the world’s most developed EV market, show that the road to this potential future, which was never wide, continues to narrow.Yup, selling more cars and delivering more cars does not equate to more profits when the selling price is lowered. Yup, with lower earnings, this would probably mark the end of Tesla as a high growth stock ...... and if that's the case, how can Tesla command the high forward p/e multiples? End of growth stocks is usually devastating .... just think out loud ya........  p/s TOS, took out your name.  I'm sure you do not want me quoting your name all the time.  ok... so you advice... short it?...  |

|

|

|

|

|

dwRK

|

Apr 5 2023, 10:42 AM Apr 5 2023, 10:42 AM

|

|

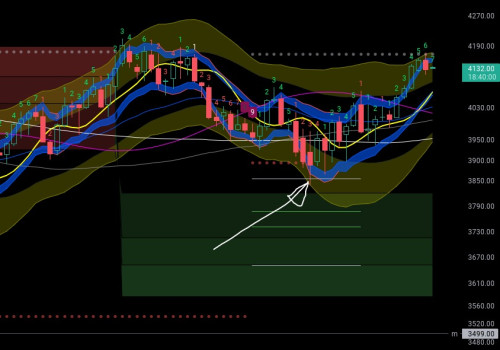

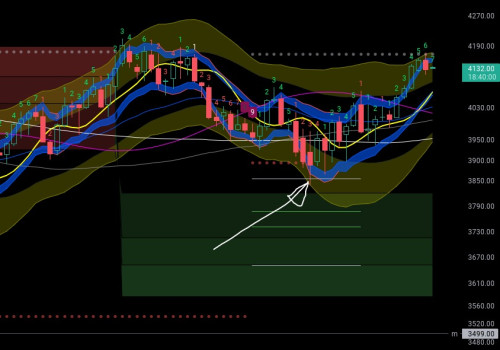

QUOTE(Boon3 @ Apr 5 2023, 08:43 AM) Hahahaha.... how are you? back from long holiday...  this Smart #1 car nice looking feel like buying... so this month maybe restart trading to fund it...  saw all the trend reversals 2-3 weeks back but going on holiday so dun wanna risk sour face on holidays nanti wifu ketuk... now come back fomo liao... hahaha... » Click to show Spoiler - click again to hide... « breakout of 200ma, retest, golden cross... and stoploss hunt on my first day on vacation... hit my usual first level... so nice man... hahaha...  to the paper trading guy.... take note now THIS is a proper chart... hahahaha.... |

|

|

|

|

|

dwRK

|

Apr 5 2023, 12:52 PM Apr 5 2023, 12:52 PM

|

|

QUOTE(Boon3 @ Apr 5 2023, 11:01 AM) Funniest thing in Msia is that I see a lot of ev owners talking and talking how cheap to drive outstation... Mind blowing for me.... Cos these cars aren't cheap in the first.... All these savings.. for even 10 years... does it justify the price they paid for their fancy cars? ... but yeah....lots of squeezes here and there... playing them squeezes might be an idea for u.... Cheers quite sure early adopters know these are not cheap cars lah... most probably havent even done 1st service... but we as a whole like to talk fc/maintenance... so its just one of the common talking points... 2nd maybe where to find charging stations and dumbass ppl parking their spot... lol cost conscious pp best served by new axia and alza... i actually quite impressed with the new alza... maybe i get this... |

|

|

|

|

|

dwRK

|

Apr 5 2023, 12:55 PM Apr 5 2023, 12:55 PM

|

|

QUOTE(Boon3 @ Apr 5 2023, 12:40 PM) eh... so buy european cement, steel and construction stocks?....   This post has been edited by dwRK: Apr 5 2023, 12:55 PM This post has been edited by dwRK: Apr 5 2023, 12:55 PM |

|

|

|

|

|

dwRK

|

Apr 19 2023, 09:33 AM Apr 19 2023, 09:33 AM

|

|

divergence is developing past 2 weeks... hope to see roll over soon...  dun think will see big recession dump... nvm... soft landing is good for the ppl... hope to get back into oil/energy... waiting for small pullback and lift off...  |

|

|

|

|

Feb 22 2023, 09:23 AM

Feb 22 2023, 09:23 AM

Quote

Quote

0.0390sec

0.0390sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled