QUOTE(TOS @ Oct 20 2022, 02:25 PM)

eh... I cheap... but still got certain standards ok... hahahaUSA Stock Discussion v8, Brexit: What happens now?

USA Stock Discussion v8, Brexit: What happens now?

|

|

Oct 20 2022, 02:49 PM Oct 20 2022, 02:49 PM

Return to original view | Post

#281

|

Senior Member

6,241 posts Joined: Jun 2006 |

|

|

|

|

|

|

Oct 20 2022, 02:56 PM Oct 20 2022, 02:56 PM

Return to original view | Post

#282

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Ramjade @ Oct 20 2022, 01:33 PM) P&G no moat and no pricing power to be honest. That's the reason I sold Unilever and never look back. lucky I only have xom... 'should' break ath soon... and hopefully another 15% up... You increase price too much, people will just buy store brand. You want moat and pricing power, insurance, utilities, gas pipeline electric transmission line, security software, google, Microsoft, Amazon, credit card. That's why I said nowadays I only buy BlackRock, Google, Microsoft. Adobe, BIP, Visa, tsmc, |

|

|

Oct 26 2022, 12:17 PM Oct 26 2022, 12:17 PM

Return to original view | Post

#283

|

Senior Member

6,241 posts Joined: Jun 2006 |

|

|

|

Oct 26 2022, 10:58 PM Oct 26 2022, 10:58 PM

Return to original view | Post

#284

|

Senior Member

6,241 posts Joined: Jun 2006 |

|

|

|

Oct 27 2022, 06:30 AM Oct 27 2022, 06:30 AM

Return to original view | Post

#285

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Ramjade @ Oct 26 2022, 11:17 PM) You bought already or still holding cash? Until the next time Jerome Powell open his mouth and said no pause in rate hike except for xom bought long ago, am still in cash... expect market to turn south again, so just observe first lah... been busy/tired so no trades to avoid mistakes... |

|

|

Oct 27 2022, 08:23 AM Oct 27 2022, 08:23 AM

Return to original view | Post

#286

|

Senior Member

6,241 posts Joined: Jun 2006 |

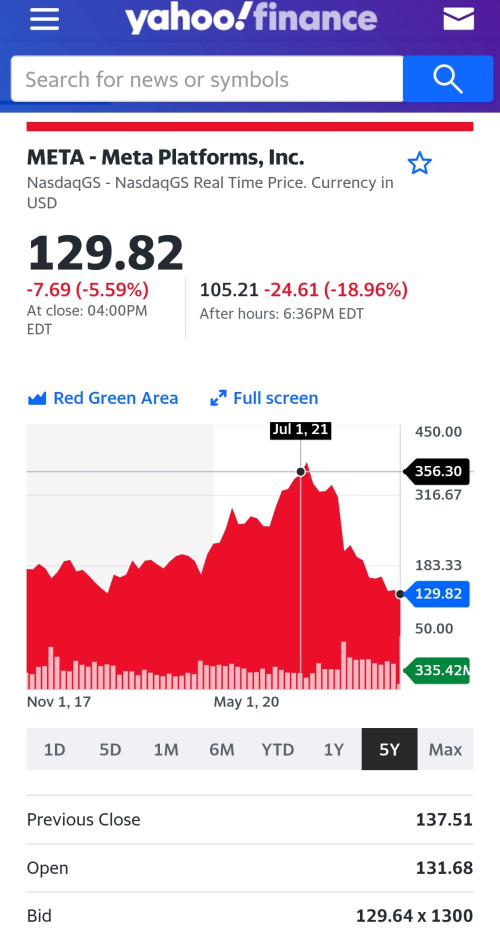

QUOTE(Boon3 @ Oct 27 2022, 06:29 AM) I would rather focus on WHY. the main problem is ppl never taught to sell... mainly just buy, dca n keep for donkey years... sell only when retire or when needed the money... lol... not sell because screw-up... If I had made an investment in a stock. After say 6 months and I find my investment is LOSING money. The most important thing for me to do is to ask if I had made a mistake. Yes? One year later. Still losing money. Clearly I farked up. Yes? So if I STUBBORNLY ignored the due process of reviewing my investment thoroughly and checking if it WAS ME that SCREWED Up and further aggravate the situation by AVERAGING Down, clearly I am stubbornly wrong. Yes? And even worst still... insisting to hold the stock for 15 years. Take Meta (what a shitty new name. Lol). Just a year ago, it was around 350? Now? Average down all the way just because of the global branding of Facebook? Or perhaps one should review if thereecist fundamental weakness in Meta businesss economics? Average down of DCS should not be used as a correction strategy for one POOR initial investment decision...  also... ppl inherently hopeful... tomorrow better day... sell today missed out tomorrow... lol... |

|

|

|

|

|

Oct 27 2022, 11:07 AM Oct 27 2022, 11:07 AM

Return to original view | Post

#287

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Oct 27 2022, 09:07 AM) but yea.. yea.... last 3 words..... 'AM I WRONG' ..... that should always be asked when one is investing or trading. i always assume my every trade is wrong... hahaha... meanwhile... am patiently waiting for the great reset... hope to see s&p another 20-30% down to enter and dca at basement levels... |

|

|

Oct 27 2022, 12:09 PM Oct 27 2022, 12:09 PM

Return to original view | Post

#288

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Oct 27 2022, 11:11 AM) This is the great disconnect isn't it? a lot of ppl here young new investors mah... learn investing by watching yt... never burnt before... also exposure very low... maybe invest 1 share or 1k... got stable job... 50% paperloss not much can stomach... just go 1 veg chapfan for a while... Traders can accept and assume of their potential screwups, while those 'investors' when they see prices fall, they never ever consider they might be wrong earlier. All they see is opportunity to buy more. Yup, like investors never wrong. Maybe they want to wait 15 years or more................ meanwhile you whack megabucks per trade... very painful when wrong... small mistakes 1 myvi gone... old hand at the game... point of view obviously very different already got few ppl regret buying early or dca... quite sure many playing small money... so ok lah let them learn their own way... gotta start somewhere isn't it... anyways you should be happy these investors are around so you can unload your unwanted positions to them... hahaha This post has been edited by dwRK: Oct 27 2022, 12:18 PM wongmunkeong liked this post

|

|

|

Nov 2 2022, 01:46 PM Nov 2 2022, 01:46 PM

Return to original view | Post

#289

|

Senior Member

6,241 posts Joined: Jun 2006 |

|

|

|

Nov 2 2022, 02:10 PM Nov 2 2022, 02:10 PM

Return to original view | Post

#290

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 2 2022, 01:53 PM) Can you include the time axis as well? lower c box is Nov... upper d box is Dec... but i more interested at the levels and the price action/reaction off them... When will we reach point (D) (labelled 4) around 4100? Jan. 2023? potentially we can hit d box in Nov thus bypass c box and invalidating this harmonic scenario... alternately we can start the collapse now... hitting c and gg to 3k... market dont go according to my daydreams ah... see point 3 & point a off by two weeks... hahaha anyways they are same points since june... previous charts have the time axis This post has been edited by dwRK: Nov 2 2022, 02:23 PM TOS liked this post

|

|

|

Nov 2 2022, 02:13 PM Nov 2 2022, 02:13 PM

Return to original view | Post

#291

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Hansel @ Nov 2 2022, 01:59 PM) I was telling some fellow passengers in the plane,....... maybe neutral until after the midterms... what are you betting?1) If Mr Powell gives favourable news tonight, then news have leaked-out all over the world that the Feds is going to adopt a wait-and-see approach after this. 2) If Mr Powell continues to say : "we're going to keep at it" tonight.... then all of us got it wrong !!!!!! 3) And finally, if Mr Powell says,... we'll continue to be data-dependant", then,.. This post has been edited by dwRK: Nov 2 2022, 02:25 PM |

|

|

Nov 2 2022, 08:04 PM Nov 2 2022, 08:04 PM

Return to original view | Post

#292

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Hansel @ Nov 2 2022, 03:23 PM) I still believed in the SGD. I'll continue my campaign there. In the last few days, the major US Indices have closed lower now and then,.. Futures bounced up and down,... BUT the SGX has been climbing. straits time index has been in a range for the past decade... anyways spx sgx can trend somewhat together and doesn't have to be perfectly in sync...The SGX does not seem to be following the US lead,... for now sgd is weak against the dollar... anyways I've started paying attention to SGD n JPY... |

|

|

Nov 2 2022, 08:11 PM Nov 2 2022, 08:11 PM

Return to original view | Post

#293

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 2 2022, 04:40 PM) America’s Refiners Are Running on Premium see now they report what I said early this year... lol... des why don't rely too much on news... you wanna front run them... High natural gas prices in Europe and steeper discounts in sour crude oil are helping U.S. refineries squeeze out more profit https://www.wsj.com/articles/americas-refin...share_permalink --------------------------- Oil and Gas Profits Are an Easy Political Target BP is the latest supermajor to report strong third-quarter earnings that are likely to fuel further calls for higher taxes as well as bumper shareholder returns https://www.wsj.com/articles/oil-and-gas-pr...share_permalink |

|

|

|

|

|

Nov 2 2022, 08:12 PM Nov 2 2022, 08:12 PM

Return to original view | Post

#294

|

Senior Member

6,241 posts Joined: Jun 2006 |

|

|

|

Nov 3 2022, 09:29 AM Nov 3 2022, 09:29 AM

Return to original view | Post

#295

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Hansel @ Nov 3 2022, 08:59 AM) Bros,... I sat up last night and watched everything,... I looked at his face,... and the faces of the media personnel asking questions. Yeah... look at turkey... hyper inflation... high interest rates... yet it's market keeps going up and up... Mr Powell the rates must continue hiking but,.... he too reiterated more than once, there must come a time to stop, and he said he has mentioned this many times earlier. I think,.... some mkts may not fall this momirng even after the falls in the US Indices early this morning. been watching it go up a year liao... hahaha... This post has been edited by dwRK: Nov 3 2022, 09:30 AM |

|

|

Nov 3 2022, 09:58 AM Nov 3 2022, 09:58 AM

Return to original view | Post

#296

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(TOS @ Nov 2 2022, 08:17 PM) pivot b confirmed good... target c looking good now... hehehe... dunno man... lately I'm thinking of getting an electric car... but definitely not tesla... so maybe wait for nio to bottom? or battery techs etc... sustained high oil prices will drive some businesses there... but to be honest I haven't been looking and dunno what's out there... I'm more thinking just play the indices lah no/less research needed... hahaha |

|

|

Nov 4 2022, 12:09 PM Nov 4 2022, 12:09 PM

Return to original view | Post

#297

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Nov 4 2022, 10:43 AM) dun worry... long term in 10 yrs huat ah... now is best time to accumulate... everyone else profit also no good... big discounts don't come often... buy when ppl are fearful... buy when blood on the streets... stay the course... keep dca... diamond hands baby.... hahaha hahaha...This post has been edited by dwRK: Nov 4 2022, 12:11 PM |

|

|

Nov 4 2022, 09:44 PM Nov 4 2022, 09:44 PM

Return to original view | Post

#298

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Nov 4 2022, 12:31 PM) Fuhhh.... in a major recession... the concern is of survival, not valuation... cashflow vs profitability... the danger is the below... during the fantastic growth years... we see profits go 30 > 34 > 40 > 76 which equals the stock to the moon and beyond. now what if it enters the profit recession years? 76 > 66 (trailing numbers indication) > under 50? if and if it does happen what would be Alphabet's valuation then? < 60? and also need to address how long the profit recession would last? and the bigger issue is would earnings growth ever return? Cos if earnings growth does not return, what's the catalyst to drive the stock back higher? that is how I would evaluate this stock risk. for sure majority of company will kena whack... some will not survive... some are immune... the remaining needs to adapt... obviously the better managed will come out stronger... this is the early bet dca folks are placing... |

|

|

Nov 5 2022, 11:22 AM Nov 5 2022, 11:22 AM

Return to original view | Post

#299

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Nov 5 2022, 09:17 AM) Ahhh, but if I was looking at google, I would only be looking at google and won't even making other comparison. so what you wanna see before you buy goog?But you know me, I like to fight a good fight and more importantly, I like to fight an easy fight. Them sure win fights. google at this moment of time, isn't one. too many current headwinds/risk. With google already warning of further ad slowdowns (which makes sense cos which company wants to spend big in a poor economic environment? one of the first few things it will cut down is ad spending), it would make prudent sense to wait (if and if I am interested). But that's just me. ( biggest recent concerning news of course came from Maersk. Massive concern there. ) ( and of course ... I am against what Fed is doing right now. A huge chunk of the inflation issues were created by what Trump did. Tarriff wars inflates prices. Raising 30% tariff on what Americans imports (from China) isn't smart at all, cos it will only end up raising cost of products. Increasing employment wages in hope of bringing jobs back to America has only inflate corporate costs, which corporates will only pass by inflating prices. ) |

|

|

Nov 9 2022, 10:24 AM Nov 9 2022, 10:24 AM

Return to original view | Post

#300

|

Senior Member

6,241 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Nov 9 2022, 10:06 AM) as they say, a leopard never loses its spots... Elon Musk == Lex Luthor https://www.cnbc.com/2022/11/08/elon-musk-s...sla-shares.html so how to trust? How to do business with someone I do not TRUST? and the big picture... that's so clear, no?  |

| Change to: |  0.3858sec 0.3858sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 04:41 AM |