[/quote]

Which company/index does this chart belongs to? Doesn't seem to be S&P500 nor Nasdaq.

[/quote]

btc

USA Stock Discussion v8, Brexit: What happens now?

|

|

Jun 26 2022, 03:02 PM Jun 26 2022, 03:02 PM

Return to original view | Post

#221

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

|

|

|

Jun 26 2022, 04:35 PM Jun 26 2022, 04:35 PM

Return to original view | Post

#222

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

Jun 27 2022, 02:22 PM Jun 27 2022, 02:22 PM

Return to original view | Post

#223

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Jun 27 2022, 01:19 PM) The March bottom is the gauge for me... but then such statement doesn't really hold .... as you know some bottoms cannot be trusted ones.... yeah... bottom finding new bottom is quite common... we can buy the dip but must sell the rally in bear market... for me, some teh tarik money is good enough... but as you have found... ppl here likes to maximize their risk, maximum time in market and dca... is fine lah its only their money... hahaha... they still got day jobs wont go homeless...» Click to show Spoiler - click again to hide... « i believe we haven't found intermediate bottom yet... let alone final bottom... but anyways... |

|

|

Jun 27 2022, 03:15 PM Jun 27 2022, 03:15 PM

Return to original view | Post

#224

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(RayleighH @ Jun 27 2022, 02:31 PM) At the end of the day, I think it depends on what your goal is. For some, it is to maximize their gain. For others, they might be satisfied with a modest return. For me, as long as I can get 10% p.a. on my investment, I am satisfied with that. Anything extra is a bonus to me. If I get less than 10% but higher than EPF or FD, that is less desirable, but it is something I live with it. our goal is the same... but our experience, skills and methods to achieve said goal are different...and learned to protect our capital and profits better...So if your and the other person goal is different, I think it's kind of like chicken and duck talking. Both operating on different frequencies. i've said before dca is ok... at appropriate levels... |

|

|

Jun 27 2022, 03:30 PM Jun 27 2022, 03:30 PM

Return to original view | Post

#225

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

Jun 27 2022, 06:13 PM Jun 27 2022, 06:13 PM

Return to original view | Post

#226

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(sgh @ Jun 27 2022, 05:36 PM) Yes thank you and also indirectly for RayleighH too. But I got two questions. huat 1 good month can goyang kaki 1 yr... Qn 1 With such strategy during this long wait you survive on what har? Bread and water? Or before you become a trader you actually have some income from other jobs to use this as starting capital. Qn 2 What if that one shot missed cue how? How sure are you in that one shot? So far you 100% accurate never miss before? Just in case if you miss the losses will be great since you accumulate for this one kill correct? Unless your strategy of one shot one kill applies to multiple stocks and not just one single stock? rest of the time play here play there for KFC or McD... but noob starting out... small account have to trade more... practice... blow up never mind... start again... grow account first... important is keep day job... target 0.5-1% profit a day average... 4-6 months can double account... |

|

|

|

|

|

Jun 27 2022, 07:30 PM Jun 27 2022, 07:30 PM

Return to original view | Post

#227

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(sgh @ Jun 27 2022, 06:49 PM) This strategy come both ways. Huat yes 1 year shake leg but confirm 100%? if sway no huat means how? Wait so long accumulate so long sure firepower a lot cheong and miss target then the remaining 1 year eat what? Bread and water? Such strategy is not for everyone. This kind of strategy to me is like go Genting casino play big small one time settle why wait so long? you're assuming such trader doesn't know what he/she is doing... and is more like gambling... and years of experience building a sizeable account to be able to huat big big is to be discounted?of course trading is not for everyone... takes a lot to manage emotions, to have patience waiting for right entry, to identify high probability trades, to get high win rates and high reward to risk ratios, etc... more importantly, discipline in knowing when to get out, preserve capital and profits... there are lots of professional and home traders making good money... just like any profession like doctors, engineers, teachers, accountants,... trading is a skill that you can learn and develop... and like everything else... some are better than others... This post has been edited by dwRK: Jun 27 2022, 08:52 PM |

|

|

Jun 28 2022, 08:38 AM Jun 28 2022, 08:38 AM

Return to original view | Post

#228

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(TOS @ Jun 27 2022, 09:19 PM) It's interesting to see how companies hedge against rising commodity prices. i read airasia hedged also long time ago...Southwest Airlines Co ‘We will humble them’: four fuel traders took on Wall Street and saved $1.2bn Few airlines hedge against surging oil prices but Southwest’s small team has shown the benefit by Steff Chávez in Chicago (9 HOURS AGO) » Click to show Spoiler - click again to hide... « |

|

|

Jun 28 2022, 09:26 AM Jun 28 2022, 09:26 AM

Return to original view | Post

#229

|

Senior Member

6,248 posts Joined: Jun 2006 |

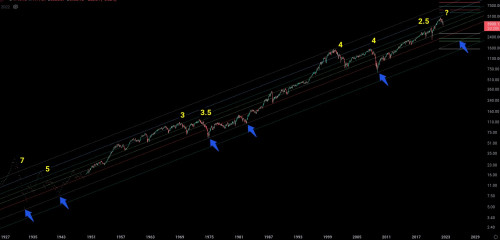

for spx and dca lovers... fib channel on log scale  blue arrows show the zero line, touched a few times in the past... yellow numbers are how many fib levels dropped from high... and generally it takes twice as long to recover vs the drop... soft landing could bottom in 2024 @2800 points... trump wins and pump market ath again... or ww3... lol... TOS liked this post

|

|

|

Jun 28 2022, 11:31 AM Jun 28 2022, 11:31 AM

Return to original view | Post

#230

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(square2 @ Jun 28 2022, 10:45 AM) this chart shows us that it will happen but we never know when will it happen. Sitting down doing nothing also not a solution unless we are like someone here who could wait until.... like forever didn't bother with fibonacci time... that can give some indication when bottom... chart just shows where it has been... we can speculate where it might go next is all... charting is a planning/observation tool... not crystal ball...that's why many traders have this motto: get rich, or die trying anyways... your money your choice... i'm firm believer in learning hands-on good or bad... as long as don't get injured or dead... after all money is only money... |

|

|

Jun 28 2022, 11:38 AM Jun 28 2022, 11:38 AM

Return to original view | Post

#231

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

Jun 28 2022, 12:07 PM Jun 28 2022, 12:07 PM

Return to original view | Post

#232

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Jun 28 2022, 11:41 AM) Yes to learning but most of the learning to find what I am not good at was done for a very long time and with no money involved. But again that's me. Better said that before ppl jump jump whatever conclusion..... you got different skill mah... hahahaWaiting for the right setup where kills are easy always seem like a no brainer. Investors also uses no brainer investing, yes? Better do nothing is always better doing something for the sake of doing something. i think you enough cucuk them already lah... a lot already bleeding -20% down... lol |

|

|

Jun 29 2022, 09:35 AM Jun 29 2022, 09:35 AM

Return to original view | Post

#233

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

|

|

|

Jun 29 2022, 09:42 AM Jun 29 2022, 09:42 AM

Return to original view | Post

#234

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

Jun 29 2022, 02:59 PM Jun 29 2022, 02:59 PM

Return to original view | Post

#235

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(RiriRuruRara @ Jun 29 2022, 01:55 PM) Guys, do you see Amazon share price going to up 1000 again? If yes, how long do your think it will take to reach 1000 again? 2035-2040 RiriRuruRara liked this post

|

|

|

Jun 29 2022, 03:00 PM Jun 29 2022, 03:00 PM

Return to original view | Post

#236

|

Senior Member

6,248 posts Joined: Jun 2006 |

|

|

|

Jun 29 2022, 03:17 PM Jun 29 2022, 03:17 PM

Return to original view | Post

#237

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(RayleighH @ Jun 29 2022, 10:45 AM) Sometimes I wonder, is the market reacting as such because it is overpriced/underpriced or just because maybe majority of the traders are using the same analysis method (in this case, Fibonacci retracement) where it end up becoming a self fulfilling prophesy. market will zigzag up and down... to "magnetic" points... in price and time...long-term moves are driven by values and forecasts... short-term moves are driven by fear and greed... all painted by market makers to serve their objectives... TOS liked this post

|

|

|

Jul 1 2022, 08:56 AM Jul 1 2022, 08:56 AM

Return to original view | Post

#238

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(Lon3Rang3r00 @ Jul 1 2022, 08:13 AM) » Click to show Spoiler - click again to hide... « So in short, DCA more like a bearish strategy that you average down when it's on bearish market. While lump sum is bullish. ? fact is a lot of ppl can only dca because waiting for payday... and must buy something... and not financial savvy enough... anyways... "Although averaging down offers some aspects of a strategy, it is incomplete. Averaging down is really an action that comes more from a state of mind than from a sound investment strategy. Averaging down allows an investor to cope with various cognitive or emotional biases. It acts more as a security blanket than a rational policy. The problem with averaging down is that the average investor has very little ability to distinguish between a temporary drop in price and a warning signal that prices are about to go much lower. Proponents of the technique view averaging down as a cost-effective approach to wealth accumulation; opponents view it as a recipe for disaster. This strategy is often favored by investors who have a long-term investment horizon and a value-driven approach to investing. Investors that follow carefully constructed models they trust might find that adding exposure to a stock that is undervalued, using careful risk-management techniques, can represent a worthwhile opportunity over time." y'all can read it all here... https://www.investopedia.com/terms/a/averagedown.asp This post has been edited by dwRK: Jul 1 2022, 08:57 AM |

|

|

Jul 1 2022, 12:15 PM Jul 1 2022, 12:15 PM

Return to original view | Post

#239

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Jul 1 2022, 11:00 AM) ooo... many moons passed liao.... better investopedia than random yt guy lah...Rational policy. The first and utmost rational policy should address the issue of why is the share down so much that one feels the need to average down? Say.. One buy XXX at 200. Stock is now only 140. The urge of course if to average down..... However, BEFORE that, isn't the rational policy is to ask why? Why the stock jatuh la.... 1. Is the stock fundamentals or earnings going down? And the biggest danger to address is did one buy the stock at peak earnings? If peak earning is 60% above it's average yearly earnings, when earnings slide... earnings could slide a lot. When it does, stock price could really plunge to way, way below. So averaging down now, it's suicidal if the stock could even plunge to below 100 (from the above example). And of course, the need to address and ask ownself, if that stock's peak earnings was a once off, like recent glove earnings. And even before all this... before one buy the stock, did one even address this issue? Address the risk of buying into a growth stock whose earnings might peak? There are literally tons of data showing the grave danger buying into a growth stock whose earnings has peaked, which always results in plunging share prices. That needed to be address before the buying. and once, the sign of peak earnings is there, get out. That's called admitting to the mistake of buying into a stock with declining earnings/peak earnings. 2. Buying the good stock but at the wrong price. Isn't this what most are seeing now? They bought XXX. It's not that XXX suddenly has gone bad or what not. Fundamentals are sill strong. But... they over paid for it. For example, paying over 200 times earnings for XXX. When market goes bad... naturally XXX could only fall to below 100 times earnings or even 80 or lower.... which means the stock price could really fall. Again... addressing this issue from day one is much better than contemplating to average down that earlier mistake. 3. Buying but refusing to admit the stock selection to buy XXX was poor. It was a mistake from day one. XXX was never ever a good company. Just average. And naturally, caught in a bear market, XXX will really plunge. Yet once more, isn't addressing the issue of whether one has made or not is more important than the idea of simply averaging down and doubling down on the poor initial decision. 4. When the stock falls, it's undervalued? Hey, whatever happen to the initial buy decision? Doesn't this mean that XXX was not undervalued in the first place? Averaging down, again meant doubling down of our initial mistake. But then, how many admits to their own mistakes? Their stock selection cannot be wrong meh? If fall means, the stock is undervalued? 5. Stock was good but was caught in the current bear market? Again... initial decision... did one not consider the inflation risk early this year? Wasn't there signs? or maybe one bought the stocks way earlier. But if one had bought way earlier, shouldn't there any review of investment and review of whether one should have sold their stocks for a profit? Paper profits are not profits until we sell. 6. Buy the dip! oh.... lastly ..... recent years.... market was in a hell of bull market la. Hence, all dips were sapu-ed cow cow. Buy the dip, buy the dip, buy the dip..... now? market has turned. Some dips, had no bounce at all. Some even turned into big deeper! Of course, buy the dip, was nothing but a market trend which happens during strong bull markets. To assume and adopt such strategy NOW is so very risky. Oh...sidetrack.... from a gambling perspective. Haven't we seen this gamblers sitting on the table with piles and piles of chips. Winning streaks. Many a times, they don't understand why it's good to take profit. They keep on riding the luck, hoping the streaks continues. It doesn't. Chips go down in a hurry. Yet they don't take profit. They sit and believe the hot winning streak will come again..... but sadly it doesn't. Hence the earnings turn into losses. There.... my ... err.... 28*1.1 = 31 sen opinion la.... addressing the stock is more important. Did we make mistake or not? If make mistake and then, don't admit, you think die or no die? eh reply so long to me for what???... you can continue public education series... no need tag me... haiya now make me read... problem #1 is just buying wrong... wrong company, wrong timing, whatever... problem #2 is not selling right... anyways... welcome back... |

|

|

Jul 1 2022, 12:37 PM Jul 1 2022, 12:37 PM

Return to original view | Post

#240

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(prophetjul @ Jul 1 2022, 12:16 PM) he also does this... 5 stocks warren buffett aggressively sold since 2022 began prophetjul liked this post

|

| Change to: |  0.1593sec 0.1593sec

0.66 0.66

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 12:23 AM |