QUOTE(Medufsaid @ Jun 17 2022, 04:28 PM)

later I draw you one... you draw me one we compare?USA Stock Discussion v8, Brexit: What happens now?

USA Stock Discussion v8, Brexit: What happens now?

|

|

Jun 18 2022, 11:15 AM Jun 18 2022, 11:15 AM

Return to original view | Post

#181

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

|

|

|

Jun 18 2022, 03:16 PM Jun 18 2022, 03:16 PM

Return to original view | Post

#182

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Lon3Rang3r00 @ Jun 18 2022, 11:50 AM) Got drunk and didn't realize I got two options with same strike price on same expiry date. When I realized it, it is already too late since it's either at the money or in the money with no time value. But I managed to close both and still get profit from it. Praise the Lord! ignoring the stock/cc... the short put short call same strike combo is called a straddle with max profit at the strike price anyways for the put buyer... it depends how much itm as he has to breakeven to make it profitable... so you're still profitable above the breakeven price... QUOTE(Medufsaid @ Jun 18 2022, 11:58 AM) by selling and buying back his stocks (erm more accurately called away + assigned back) at the same price, he hopes to profit from premiums and still have the stocks. if call is itm worth calling away... then the put is otm and practically impossible for assignment right?well this is before he said it was an unintended trade |

|

|

Jun 18 2022, 04:07 PM Jun 18 2022, 04:07 PM

Return to original view | Post

#183

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Medufsaid @ Jun 18 2022, 03:39 PM) have you considered at-the-money / near-the-money where both puts/calls of the same strike price are worth exercising during intraday trading itself? sure... someone might just do it even if not really worth doing... thats why i write 'practically' impossible... and not 100% impossible... but majority of ppl playing options don't wanna get assign anyways...(of course, exception for european-style where you can only exercise at expiry so there's only 1 final price) |

|

|

Jun 18 2022, 11:40 PM Jun 18 2022, 11:40 PM

Return to original view | Post

#184

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Jun 19 2022, 10:53 AM Jun 19 2022, 10:53 AM

Return to original view | Post

#185

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Lon3Rang3r00 @ Jun 19 2022, 08:00 AM) Hmm the odd of a stock stop at the strike price before the trade close is tiny, I believed most of the time only the one falls in-the-money will get assign, not sure what will happen if at the money. I still don't know how to roll my position using IBKR, normal I just buy to close., I'm using mobile version. And yes I'm aiming for premium and won't want my shares to be called away, collecting premium to average down. Haven got time to run the paper trading to buy calls then sell to close there is a 100% chance of price closing at/nearest strike... maybe just not yours if one is good at charting... they can try choose the right strike and strategies to maximize profit/premiums... unlike options buyers that must get the direction right, beauty of options selling is that they can get it a bit wrong but still profit... but choosing the right strategy and strike to give good probability of winning is important... anyways coming back to all this itm/otm/atm... closing atm at/nearest strike for the buyers is really not profitable... they want it far away as possible... buyers also have to add premiums paid and so have a breakeven price to contend with... so whilst our friend's example is somewhat technically correct, nobody in their right mind will exercise, they would roll... but then again never say never to stupid |

|

|

Jun 20 2022, 09:44 AM Jun 20 2022, 09:44 AM

Return to original view | Post

#186

|

Senior Member

6,230 posts Joined: Jun 2006 |

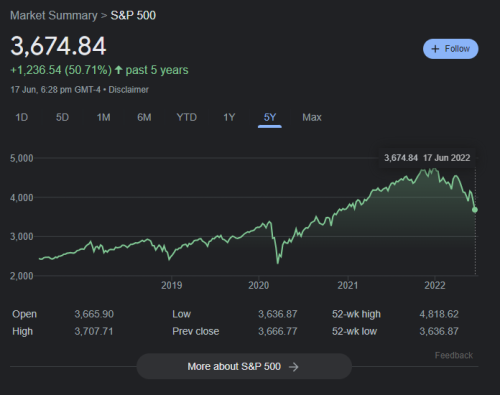

my optimistic outlook... lets see how far wrong... hahaha... ...but prefer a more pessimistic outlook  TOS liked this post

|

|

|

|

|

|

Jun 20 2022, 01:06 PM Jun 20 2022, 01:06 PM

Return to original view | Post

#187

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Cubalagi @ Jun 20 2022, 10:32 AM) its only -35% down... and only a bit lower than .618 fib retrace... don't sweat it... but i'm having problem with the minuette wave setup for impulse wave 3... if minuette waves are done, wave 3 is slightly too short... if not done, then we're starting minuette wave 3 of impulse wave 3 and it needs to go much deeper... will have to see how it plays out day by day... |

|

|

Jun 20 2022, 04:08 PM Jun 20 2022, 04:08 PM

Return to original view | Post

#188

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Jun 21 2022, 03:18 PM Jun 21 2022, 03:18 PM

Return to original view | Post

#189

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Lon3Rang3r00 @ Jun 21 2022, 02:06 PM) As of today, so we will never know what comes after..... who know it skyrocket or it crash landing the next day. But really in limbo. got extra $$ just DCA. SPY still not at 2020 level yet. it will follow my elliott wave chart... but I reserve my rights to adjust as required... |

|

|

Jun 21 2022, 04:05 PM Jun 21 2022, 04:05 PM

Return to original view | Post

#190

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Jun 21 2022, 04:00 PM) martingale = m1 letter even simpler... TOS liked this post

|

|

|

Jun 21 2022, 07:50 PM Jun 21 2022, 07:50 PM

Return to original view | Post

#191

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Jun 21 2022, 11:02 PM Jun 21 2022, 11:02 PM

Return to original view | Post

#192

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Jun 21 2022, 10:41 PM) 3 letter acronyms are more common lah... etc, wtf, iou, otw, lol....I ok with dca... professional sounding... much better than say, aml (add more losers)... This post has been edited by dwRK: Jun 21 2022, 11:17 PM |

|

|

Jun 22 2022, 06:51 AM Jun 22 2022, 06:51 AM

Return to original view | Post

#193

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

|

|

|

Jun 22 2022, 11:39 AM Jun 22 2022, 11:39 AM

Return to original view | Post

#194

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Jun 22 2022, 10:06 AM) The reluctance to admit one was wrong (either wrong decision - wrong stock selection, buying the right stock but at peak earnings or declining earnings etc etc etc etc) leads to the start of Averaging Down and IF LEFT UNCONTROLLED, this ultimately magnifies the losses to extreme proportions. Yup, the biggest risk in one's investment is the reluctance to admit one had screwed up. And they reckon Averaging Down coupled with a forgiving market will help them cover their losses. Seen it way too often. My 18 sen grossly inflated view. if trader, capital preservation #1... manage drawdown risk, live to fight another day... but they mostly investor with steady job, 10-20 yrs longterm outlook, a few starting only this year, buy only 1-2 share at a time, buy liao what to do? admit wrong or stupid won't solve the problem... so if not cut loss, then dca is a viable option but do it smartly... i'm sure a lot are now waiting for market bottoming to dca... anyways...the market is a brutal teacher... |

|

|

Jun 22 2022, 01:16 PM Jun 22 2022, 01:16 PM

Return to original view | Post

#195

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Jun 22 2022, 12:36 PM) It does not matter if trader or investor. Make a mistake, do the right thing by keeping the mistake small and manageable. Admit to it. sure... i got a few since '97 never recover, some bankrupt... leftovers hold as remembrance lesson to never dca... Some stocks, they just do not recover. For example, buy BAT in June 2015? The price then was 60++. Average down? How much money one got? BAT today? How much? Like I said, average down... can die one! but you trying to force ppl confess their mistake a bit much lah... hahaha This post has been edited by dwRK: Jun 22 2022, 01:20 PM |

|

|

Jun 23 2022, 04:06 PM Jun 23 2022, 04:06 PM

Return to original view | Post

#196

|

Senior Member

6,230 posts Joined: Jun 2006 |

alamak... y'all still at it ah... pening...

the problem is not about dca/ad/cbm/whatever... the problem is not selling for profit or cutting loss or hedging it when the time comes... |

|

|

Jun 23 2022, 05:20 PM Jun 23 2022, 05:20 PM

Return to original view | Post

#197

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Lon3Rang3r00 @ Jun 23 2022, 04:25 PM) Those term are for people who wanted to invest until they retired, while those who don't usually is doing stock trading. no lah... if you wanna hold until retirement... then you must hedge it first... otherwise you lose... only buy more when bottomed... It's really a powerful method, except it's good when you do it in the correct stock (Blue chip company, Index Funds) for me is about my capital efficiency... dca is no good and can be very risky in a bear market |

|

|

Jun 23 2022, 07:38 PM Jun 23 2022, 07:38 PM

Return to original view | Post

#198

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Jun 23 2022, 07:01 PM) To be more precise, was thought by this one Auntie b4... she told me that buying correctly most of the problem and the most important one is 'should I buy more if the stock falls'. She reasoned, if the share falls after you buy, it only means one thing Bo, it means I screwed up either with my stock selection or my buying price. That was something I learned. Something which I felt had so much truth in it..... even pros make mistake with entry... solution is stoploss and cutloss... dca is time bomb waiting on margin call and liquidation but good entry is a different conversion let's not digress... |

|

|

Jun 23 2022, 07:48 PM Jun 23 2022, 07:48 PM

Return to original view | Post

#199

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Jun 23 2022, 07:51 PM Jun 23 2022, 07:51 PM

Return to original view | Post

#200

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Jun 23 2022, 07:45 PM) Cut loss is very important but then... remember the law of Aunties... if you keep cutting all the time, what are you gonna cut next? my auntie says... lose small small... win big big... hahaha Davidtcf liked this post

|

| Change to: |  0.3130sec 0.3130sec

0.54 0.54

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 09:03 AM |