Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v14, Happy 牛(bull!) Year

|

T231H

|

Jun 25 2016, 11:07 AM Jun 25 2016, 11:07 AM

|

|

QUOTE(_azam13 @ Jun 25 2016, 10:39 AM) I also don't plan to hold on to it for long.. It's just that I think that its a waste if I don't take advantage of it if I think its going to perform, even in the short term.. I only put about 17% of my asset in it. The rest is in bonds. I'm comfortable with the current risk profile. Not much great news for gold to go down from now on. I'm thinking that the potential for upside is greater than downside. good option....17% in am precious : 83% in Bond....(80% defenders 20% attacking commandos) but some people would say t is a waste of opportunity, for not taking FULL opportunity if one were to know that the potential outcome for upside is greater than downside with just 17%...if the ROI is 10% up...it just add 1.7% in the ROI of the portfolio  |

|

|

|

|

|

T231H

|

Jun 27 2016, 05:34 PM Jun 27 2016, 05:34 PM

|

|

QUOTE(Kaka23 @ Jun 27 2016, 11:17 AM) When la FSM will do the raya promo... You asked in the morning... now FSM gives you......for just a few days till 30 June ...some funds at 0.5% SC.... i guess many are still too spooked to take advantage of this..... Brexit Promotion: 0.5% Sales Charge For A Limited Time Only! https://www.fundsupermart.com.my/main/resea...-Only!-7222 |

|

|

|

|

|

T231H

|

Jun 27 2016, 08:41 PM Jun 27 2016, 08:41 PM

|

|

QUOTE(aoisky @ Jun 27 2016, 08:28 PM) while waiting for taikor ramjade to response, if you want you may check their respective website to see the SC charges.... most of the times it varies....some time it has promotional discounted SC charges depending on how much one wanted to invest..... example... https://www.eunittrust.com.my/fundInfo/promotions.aspThis post has been edited by T231H: Jun 27 2016, 08:44 PM |

|

|

|

|

|

T231H

|

Jun 27 2016, 09:35 PM Jun 27 2016, 09:35 PM

|

|

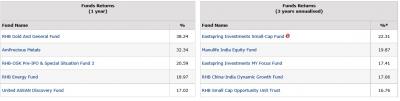

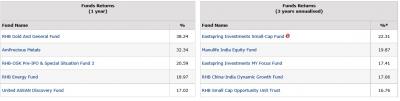

QUOTE(filage @ Jun 27 2016, 09:26 PM) Newbie here. Just curious: Is there any fund on FSM that has been able to reap like 20% or more minus sales charge within 1 year? found some.....more when you use the FSM MY/ Funds info/ Fund returns tool... This post has been edited by T231H: Jun 27 2016, 09:40 PM Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

Jun 27 2016, 10:04 PM Jun 27 2016, 10:04 PM

|

|

QUOTE(planet@123 @ Jun 27 2016, 09:58 PM) Thanks your reply. I already got FSM account. But I notice eUT sales charges cheaper then FSM. I am thinking open account for eUT. https://www.eunittrust.com.my/fundInfo/promotions.asp after you have opened the eunitrust a/c and after you had used BOTH of them....can you please come back and tell us what you think about the 1) ease of customer contact 2) ease of monitoring and analyzing one portfolio 3) ease of investment advises 4) and others..... tell us what you think is better.... This post has been edited by T231H: Jun 27 2016, 10:04 PM |

|

|

|

|

|

T231H

|

Jun 28 2016, 09:55 AM Jun 28 2016, 09:55 AM

|

|

QUOTE(iamoracle @ Jun 28 2016, 09:42 AM) Any comment on this fund? Thought of diving into this one. Kamikaze? Eastspring Investments Global Leaders MY Fund why this and not GTF? almost same regions composition, but GTF has better ROI & lower 3yrs annualised fund volatility % This post has been edited by T231H: Jun 28 2016, 09:56 AM |

|

|

|

|

|

T231H

|

Jun 28 2016, 01:25 PM Jun 28 2016, 01:25 PM

|

|

QUOTE(Avangelice @ Jun 28 2016, 01:04 PM) roi? it made a freaking lost for most of us and lucky I made 1% over it for a year keeping it.  then why Eastspring Investments Global Leaders MY Fund? isn't it almost same composition? |

|

|

|

|

|

T231H

|

Jun 28 2016, 08:44 PM Jun 28 2016, 08:44 PM

|

|

QUOTE(JinXXX @ Jun 28 2016, 08:38 PM) just curious those that top up GFT .. how much do you guys actually top up ? 1k plus ? 10k plus ? just just few hundred here and there ?  I think it should be in % in relation to the existing value of the fund in the portfolio. b'cos different people's portfolios have different amount in RM. |

|

|

|

|

|

T231H

|

Jun 28 2016, 09:11 PM Jun 28 2016, 09:11 PM

|

|

recommended funds list 2016/17 is out for FSM HK......

FSM MY....should be coming soon.....

|

|

|

|

|

|

T231H

|

Jun 29 2016, 04:43 PM Jun 29 2016, 04:43 PM

|

|

QUOTE(TakoC @ Jun 29 2016, 03:03 PM) ...... Next, Asia Pacific Dynamic Income. It benchmark against 8% p.a. I'm not sure how they derive 8% but since it should be better than EPF return. Fine, looking at the fund performance relative to benchmark graph in the fundsheet since 2011.. It looks nice. But I invested since August 2014 and only gotten 2% so far. So I'm not sure how accurate is the graph. http://www.fundsupermart.con.my/main/admin...etMYCIMB007.pdf have you missed the dividend qty? or calculation error? from the graphs......seems like Aug 2014 till now is about > 10% wor... Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

Jun 29 2016, 04:55 PM Jun 29 2016, 04:55 PM

|

|

QUOTE(TakoC @ Jun 29 2016, 04:50 PM) If I excluded all my subsequent top up after my dividend (for easy calculation since all subsequent top up since July 2015 there was no dividend), my ROI increased to 7%. I averaged up it seems.  i guess so....new top up will dilutes the earlier gains...and it will also average down the losses occurred  thus i guess the graphs did not lie....  |

|

|

|

|

|

T231H

|

Jun 30 2016, 09:32 AM Jun 30 2016, 09:32 AM

|

|

QUOTE(Kaka23 @ Jun 30 2016, 09:05 AM) Why I cannot purchase few funds in FSM... there is no "buy" icon at the side already!!! did you "hutang" them?  (joke) i think most probably is a technical compliance glitch.....most probably their prospectus had expired / not updated thus AUTO shut off......i think it will be ok a few hours after being notified... you wanna make that call? |

|

|

|

|

|

T231H

|

Jun 30 2016, 10:38 AM Jun 30 2016, 10:38 AM

|

|

QUOTE(Kaka23 @ Jun 30 2016, 09:05 AM) Why I cannot purchase few funds in FSM... there is no "buy" icon at the side already!!! FSM rectified it already can buy liao... who informed them? |

|

|

|

|

|

T231H

|

Jun 30 2016, 02:08 PM Jun 30 2016, 02:08 PM

|

|

QUOTE(nexona88 @ Jun 30 2016, 12:03 PM) the moment u post anything here, they would know about it.. have staff monitoring FSM thread in lyn    monitoring ONLY? or participating too?  |

|

|

|

|

|

T231H

|

Jun 30 2016, 05:41 PM Jun 30 2016, 05:41 PM

|

|

QUOTE(Avangelice @ Jun 30 2016, 03:50 PM) Fundsupermart is slow in releasing their recommended funds. want to see if their recommendations are good or just plain tak boleh pakai  i think their recommendations are based & evaluated as at March.......so may not be as to current happenings..... |

|

|

|

|

|

T231H

|

Jun 30 2016, 10:42 PM Jun 30 2016, 10:42 PM

|

|

QUOTE(ssajnani @ Jun 30 2016, 10:23 PM) this is a generally focused thread about investing in FSM MY unit trusts.... I am not sure about other UTs investors, but as for me,...I would leave the USD correlation stuffs to the FMs. I think you might reap a better response if you post your question on a new thread.....which would present it self to a wider audience. This post has been edited by T231H: Jun 30 2016, 11:40 PM |

|

|

|

|

|

T231H

|

Jul 5 2016, 11:50 AM Jul 5 2016, 11:50 AM

|

|

QUOTE(juniorsia @ Jul 5 2016, 11:35 AM) Which PRS funds have good performance? try this?... PRS FUND PERFORMANCE http://www.ppa.my/getting-started/funds-re...nd-performance/ |

|

|

|

|

|

T231H

|

Jul 10 2016, 10:22 PM Jul 10 2016, 10:22 PM

|

|

QUOTE(bizklguy @ Jul 10 2016, 10:18 PM) Thank you all for the replies. I also found the following article which I think is worth sharing: https://www.fundsupermart.com.my/main/resea...l?articleNo=201 In general, I am looking for bond(s) with risk as low as government bond, yet offers at least 6% ROI return over at least the last 5 years. I am in the midst of restructuring my wealth portfolio to investments that "guarantee" predictable annuity incomes. good luck in finding it,..maybe you can try research in ASX Fixed price funds or self contribute into EPF? |

|

|

|

|

|

T231H

|

Jul 11 2016, 08:04 AM Jul 11 2016, 08:04 AM

|

|

QUOTE(bizklguy @ Jul 10 2016, 11:58 PM) Thank you T231 for the suggestions. I currently own Public Bond (PBond) which has been giving me steady return (i.e., >67% for the last 10 years but unfortunately Pbond has ceased accepting new investment. found some FI funds that have this 6.7% too for the last 10 years.... btw, most FI funds including PBond had been getting lesser ROIs too, with the exception of Affin hwang select bond & RHB Islamic .... This post has been edited by T231H: Jul 11 2016, 08:09 AM Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

Jul 11 2016, 10:57 PM Jul 11 2016, 10:57 PM

|

|

QUOTE(Vanguard 2015 @ Jul 11 2016, 10:52 PM) Sold down 1/2 of my holdings today in Ponzi 2. Started investing in a 'junk bond' fund last week; made 1.25% profit in one week. May diversify later into REIT and gold fund. Currently heavily loaded in Libra Asnita Bond Fund. My alternative investment fund is still making losses; should be ripe for harvesting in 4Q. EISC and KGF still steady; profits at 19.54% and 12.25%. do you track portfolio IRR? what is your IRR currently? |

|

|

|

|

Jun 25 2016, 11:07 AM

Jun 25 2016, 11:07 AM

Quote

Quote

0.0764sec

0.0764sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled