QUOTE(vincabby @ Jun 4 2016, 03:33 PM)

things to watch would be 'brexit' and 'grexit', rate hike in june which is this month, opec news which you should be hearing around now. I guess those are the big big things happening right now.

i have no predictions to give, all I can say is, hope i have enough covered for the volatility that will come about.

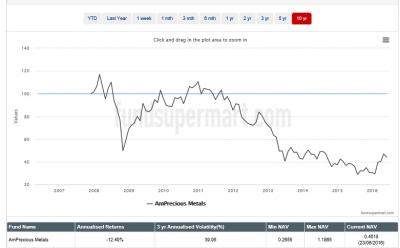

what a coincident ...just found this....(here is a concise)i have no predictions to give, all I can say is, hope i have enough covered for the volatility that will come about.

3 upcoming market events and what investors can possibly do about them.

...... Fundsupermart.com June 3, 2016

A Possible Fed Rate Hike Soon…

The United Kingdom's European Union (EU) Referendum: "Brexit" Or "Bremain"?

MSCI's 2016 Review – China A Shares To Be Included?

What Can Investors Do?

At Fundsupermart, we advocate investors not to speculate or trade too actively in the short term when managing their portfolios in response to headline news and events. As highlighted in last week’s “Idea of the Week”, markets tend to be volatile in the short term, hence making knee-jerk reactions all the time may end up to be detrimental to one’s portfolio. Having adequate diversification is vital as one can minimise concentration risks. Other than remaining diversified across asset classes and geographic markets, investors can also go for defensive strategies (like long short funds) for equity markets that are seeing relatively-stretched valuation levels (like the US and Europe).

With regards to the Fed’s tightening policy, one can go for regions and markets that sport more attractive valuations, as markets that sport lower valuations provide a “margin of safety” for investors, helping to minimise the effect of a rise in the risk-free rate. Doing as such also places a long term investor in a favourable situation of allowing valuation multiples to revert back to where they are deemed fair – as multiples tend to revert to their averages across time. For our take and views of the various markets under our coverage, investors can check out our Star Ratings!

for more details on it....read...

https://secure.fundsupermart.com/main/artic...6-Jun-16--11553

Jun 4 2016, 05:00 PM

Jun 4 2016, 05:00 PM

Quote

Quote

0.0834sec

0.0834sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled