QUOTE(TakoC @ May 8 2016, 09:56 PM)

Bro, so with the declining in Ponzi 2 performance. Has some of the guys here change to other fund already?

Haven't lurk around here in awhile. Hoping to get some update on some fund changes people make around here.

Ponzi 2.0 still abit better than other and FSM indice ..worHaven't lurk around here in awhile. Hoping to get some update on some fund changes people make around here.

holding it for diversification......letting it ride...

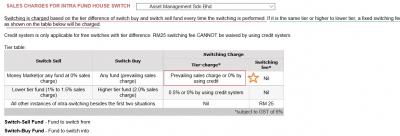

Attached thumbnail(s)

May 8 2016, 10:09 PM

May 8 2016, 10:09 PM

Quote

Quote

0.0906sec

0.0906sec

0.85

0.85

7 queries

7 queries

GZIP Disabled

GZIP Disabled