QUOTE(Vanguard 2015 @ Apr 26 2016, 04:21 PM)

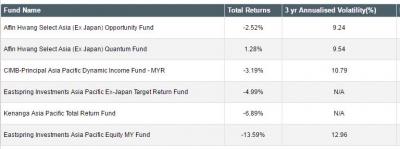

Macam mana ni? Buy equity fund. Die. Buy bond fund. Die. I know, I know. We all buy ASM ok?

I got Libra Asnita Bond Fund and Eaststpring Bond Fund in my portfolio already. Looking for other exotic bond funds.

Ouch... dunno what to read into the ASM line pulakI got Libra Asnita Bond Fund and Eaststpring Bond Fund in my portfolio already. Looking for other exotic bond funds.

Affin Hwang select bond? At least it's partially hedged. Won't swing as much as RHB ATR. As for sales charge, boss has lots of credits anyway right?

Apr 26 2016, 04:50 PM

Apr 26 2016, 04:50 PM

Quote

Quote

0.0900sec

0.0900sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled