QUOTE(djhenry91 @ Jan 19 2017, 07:40 PM)

Nope...

Is the big fish donating it's cancer organ to the small fish.

STOCK MARKET DISCUSSION V150

|

|

Jan 20 2017, 09:23 AM Jan 20 2017, 09:23 AM

Return to original view | Post

#81

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jan 20 2017, 12:08 PM Jan 20 2017, 12:08 PM

Return to original view | Post

#82

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 16 2019, 12:49 PM Jul 16 2019, 12:49 PM

Return to original view | Post

#83

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(silverwave @ Jul 16 2019, 12:36 PM) Hi, if my dad wants to starts playing with the stock market, so should i ask him to start off with REITs or dividend based shares? He has some shares last time (more than 10 years ago and i think it's Airasia and he is just getting the dividends) but he is not so active. Make dunno For me, i'm more towards the dividend based shares and i'm willing to take some risk but i don't know what should i advice him in this situation. Any thoughts? Not advisable thing to do. Winning advise - how? Losing advise - how? I seen one friend advised to sell one stock. Half a year late due to new projects, which company won a lot, the stock rallied 50% ++. Friend got cursed like hell..... |

|

|

Feb 11 2020, 04:21 PM Feb 11 2020, 04:21 PM

Return to original view | Post

#84

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(lfw @ Feb 11 2020, 10:56 AM) The table shows that despite these stocks giving 'high dividend yields', the stock prices fell, giving it a negative return. Or simply put, buyers of these stocks got their 'dividends' but their return is negative because these stocks fell.Some points to consider. 1. After a stock gives out the dividend, the stock price adjusts out the value of dividend. Simpler version. Stock A gives out 20 sen dividend. Once the dividend goes ex-dividend date, 20 sen is minus out from the stock price. 2. Most dividend 'investors' hold their stocks for many, many years. So if you cannot hold the stock for, say 5 or more years, you might get the dividends but the stock price might trade at a much lower price than what you paid for. Why do the stocks go lower after giving out good dividends? Majority of the market prices the stocks based on current earnings performance. Which makes sense if you consider the fact that investor would chase up a stock if the stock is going to earn more money and if the stock earnings is declining, investors might just dump the stock lower. In this perspective, a stock that paid out good dividend yield, would trade lower, if the market sees its earnings declining. (If the earnings is declining, the possibility that the company would be prudent and pay out less dividend). Hope these give you a better understanding and yeah, it would be really helpful to your wallet if you understand the market more first.... |

|

|

Apr 22 2020, 03:57 PM Apr 22 2020, 03:57 PM

Return to original view | IPv6 | Post

#85

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(zstan @ Apr 22 2020, 03:48 PM) Here's what you can do better.... In your watch list... which ones went green first? mark those.... Put those in your good horse section.... The next time............... you should know which one(s)..... just a suggestion.... gl |

|

|

May 4 2020, 02:35 PM May 4 2020, 02:35 PM

Return to original view | Post

#86

|

All Stars

15,942 posts Joined: Jun 2008 |

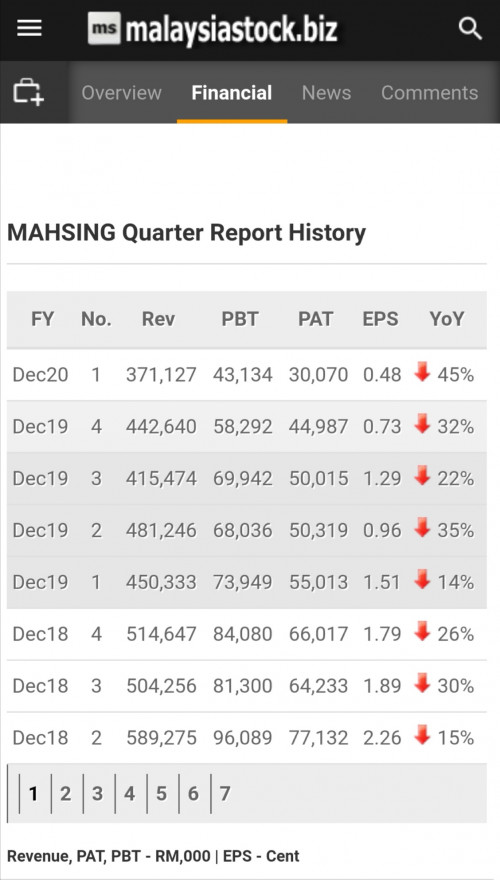

QUOTE(danielcmugen @ May 4 2020, 02:01 PM) Im looking into mahsing, it’s well in its 10 year low. Mahsing’s focus is on mid-affordable residential units. Sounds good for current market. But many of their projects got very high density, wonder if people will be afraid after covid, in view of social distancing. I guess you are seduced by the stock price.Heck at below 50 sen (was whacked down until 30 sen recently) it does seem 'seductive' ..... But here are some risks you should really consider.... 1. Firstly do please google the phrase 'Mah Sing poor quality' ..... the first 3 hits .... says what people are saying over and over again. Shitty, substandard quality from the developer. There's a poll made 'would you buy Mah Sing properties again ...... ' .... see the results.... 2. Now if you look at the chart ... just for the bigger picture.... and if you discount the current year.... and you would see that this stock has been on the killer decline many, many years ago..... i would interpret it as this stock is already in deep shit even before 19. 3. Compare it to the financial results.... just on the quarterlies already show the horror story...8 ..... EIGHT consecutive quarters of DECLINING earnings. Under performing earnings ... and delivering houses of substandard quality.... explains why the stock is in its 10 years low..... (on the long run, the market cannot be wrong... if the stock earnings performance, it reflects on the charts!) .... Lastly..... this one ..... this is a serial rights issue stock..... every few years, without fail, Mah Sing will issue rights issue to raise fund. Problem is simple. If you invested 10k into Mah Sing, you better set aside another 10k just in case Mah Sing do another rights issue. Else, if it raises another rights issue and you do not have funds to participate in the rights issue, you will get burnt! me? deep value stocks usually have deep, deep risks embedded within the stock. I hate to simply take risks which I cannot control. |

|

|

|

|

|

May 5 2020, 04:28 PM May 5 2020, 04:28 PM

Return to original view | IPv6 | Post

#87

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

May 5 2020, 05:32 PM May 5 2020, 05:32 PM

Return to original view | IPv6 | Post

#88

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(abcn1n @ May 5 2020, 05:08 PM) What is PA? Price action? Have been reading up on the stock but not much info. Anyway, went in a very very tiny bit because sometimes these stocks can really shoot up, so potential $ gain vs loss is greater. There is ARB and ARB-PA, where PA stands for preference shares.Can you spot the risk? |

|

|

May 5 2020, 05:48 PM May 5 2020, 05:48 PM

Return to original view | IPv6 | Post

#89

|

All Stars

15,942 posts Joined: Jun 2008 |

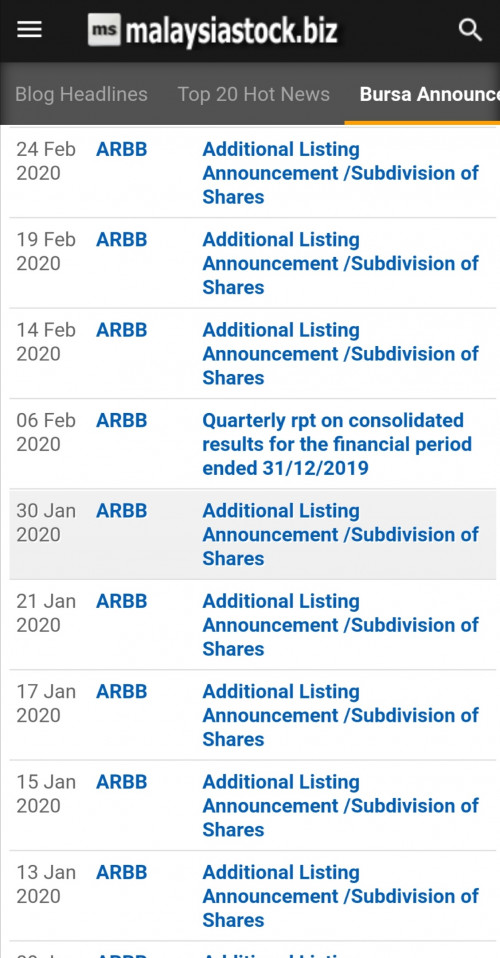

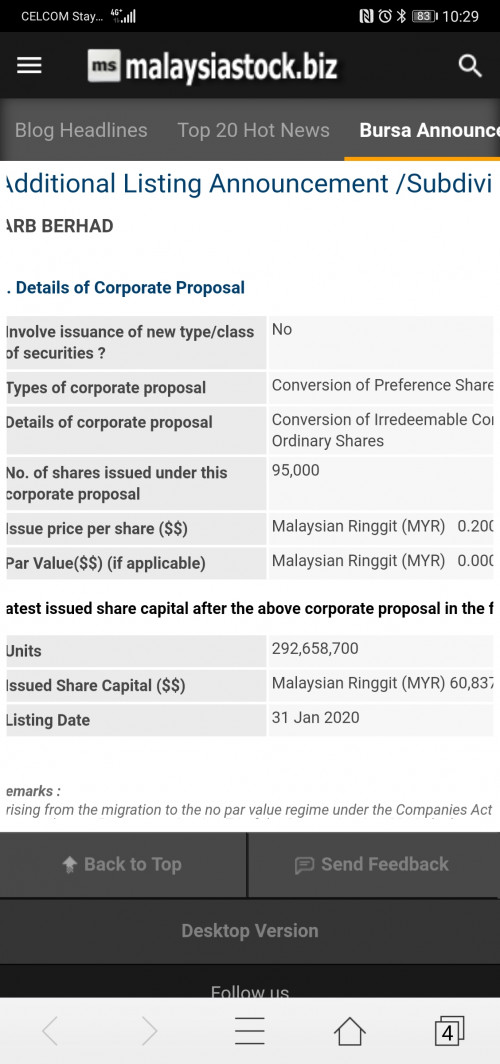

QUOTE(abcn1n @ May 5 2020, 05:37 PM) LOL. No, I did not buy and I don't share my trades. ARB has 290+ million shares. ARB has err.. 790+ million shares. (do check the actual total) Now the problem is created when ARB PA shares can be converted 1 for 1 with a conversion price. Hence, as per market terminology, it is in the money, where you can buy the PA shares converts the PA into ordinary share by paying 20 sen. Hence you will get people buying the PA shares, convert then sell. (you can see announcements on tons of PA shares being converted on Bursa announcements) For a slightly longer time frame trader this creates a selling pressure on the stock. Whatever potential the stock has it will be limited by the conversion/selling of the stock. Now when you add on both ARB and its PA shares, this is a fairly large penny stock with 1 billion shares. And when you factor in the diluted eps caused by the PA share, ARB eps is really diluted... ... and yeah.. it's a silly stock with the preference share LARGER than the ordinary share... |

|

|

May 6 2020, 06:44 AM May 6 2020, 06:44 AM

Return to original view | Post

#90

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(abcn1n @ May 5 2020, 11:40 PM) Seems that ARB-PA price is cheaper than ARB if its 1 to 1 conversion after paying 20 cents. It's 1 for 1.The part that confuses me is this : "Description: RENOUNCEABLE RIGHTS ISSUE OF UP TO 1,008,150,000 IRREDEEMABLE CONVERTIBLE PREFERENCE SHARES ("ICPS") ON THE BASIS OF 15 ICPS FOR EVERY 1 EXISTING ORDINARY SHARE IN ATURMAJU RESOURCES BERHAD ("ARB SHARE" OR "SHARE") HELD BY THE ENTITLED SHAREHOLDERS AS AT 5.00 P.M. ON WEDNESDAY, 19 DECEMBER 2018 AT AN ISSUE PRICE OF RM0.01 PER ICPS" Why does it say every 15 ICPS for 1 ordinary share? People are saying convert 1 ARB-PA to 1 ARBB by paying 20 cents? Confused here. Tempted to get the ARB-PA but not familiar with rights here although I do have experience with USA stock options. Yeah, I did see the fund buying although this does not guarantee that price will rise. 1 good example is media prima where for a long time there was foreign buying but price kept dropping. |

|

|

May 6 2020, 08:08 AM May 6 2020, 08:08 AM

Return to original view | IPv6 | Post

#91

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(zacknistelrooy @ May 5 2020, 08:45 PM) There is also a emerging market fund that recently bought into it so potential selling pressure from there too but that doesn't mean the stock has to go down as we know from past events in Bursa Yea but the conversion of the preference shares outweighs. With the preference shares grossly outnumbering the ordinary shares and the constant conversions prior Feb was so intense... see below For any REIT holders https://www.theedgemarkets.com/article/klcc...83-sen-dividend  Such plays but traders like us at a great disadvantage. It is a clear avoid at all means for me. |

|

|

May 6 2020, 01:13 PM May 6 2020, 01:13 PM

Return to original view | IPv6 | Post

#92

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(abcn1n @ May 6 2020, 12:59 PM) Thanks. Wished I got ARB-PA instead. Nope this is not the norm. This is the first time, I've come across preference shares outweighing ordinary shares. I guess this is not the norm? Any traders who buys and just converts and then sell the ordinary shares poses as selling pressure for any traders of ARBB. This puts traders of ARBB at a great disadvantage. And when you factor in all this, ARBB is not even selling at a cheap valuation at all. |

|

|

May 6 2020, 03:23 PM May 6 2020, 03:23 PM

Return to original view | Post

#93

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(abcn1n @ May 6 2020, 01:46 PM) Thanks. Several years left before expiry date. May buy a tiny bit and sell it if profitable. Is it when expiry date, it will automatically convert for us by deducting the $ in our brokerage account? Woahh !!! Dude, what I wrote earlier can all be found on your stock trading platform. PLUS ... the screenshot that I included this morning, highlighted the listings of new ARBB shares which AROSE FROM THE CONVERSION OF the preference shares. Do some clicking.... and instead of trying to look for opportunity, understand the complex structure of ARBB and ARBB-PA shares. Do not simply get burnt! |

|

|

|

|

|

May 6 2020, 10:33 PM May 6 2020, 10:33 PM

Return to original view | IPv6 | Post

#94

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(abcn1n @ May 6 2020, 09:00 PM) Ok. Thanks Rakutwn don't have? Wah.Sigh, in my rakuten apps, don't have details for converting the preference shares to ordinary shares. Guess I will just stay out of the PA then. Perhaps you should learn how to search announcements posted on Bursa website. It's critical to know. Anyway... https://m.malaysiastock.biz/Company-Announc...aspx?id=1199995  It's one of the MANY conversion of preference shares posted. |

|

|

May 7 2020, 07:26 AM May 7 2020, 07:26 AM

Return to original view | IPv6 | Post

#95

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(abcn1n @ May 7 2020, 01:46 AM) Thanks. Actually I was asking how to go about converting the PA to ordinary shares. I haven't bought any, so was wondering if I were to buy, is there like a button I can press to say I want to convert it now or what. Have never done preference shares before so am completely new to this. Stop thinking of converting for a quick gain. It's not a sure win thing!Your attachment is also useful as although I do look at malaysiastockbiz to see the individual stock details and chart, never knew such page exist/how to get it (noticed that the website starts with m. ) Obviously still a lot to learn 1. Searching the net, googling for info. Such stuff is important. Interpretation of it is also crucial. 2. Once you find it, prior to Jan 2020, the conversion of preference shares were intense. Big lots of converted and constantly too. Hence despite the 'possible' beautiful growth story of the stock/turnaround story, the stock couldn't really fly. 3. Do not listen to stories that this is an extremely cheap pe stock. It is inaccurate. Since conversions are easy, the number of shares used to calculate the eps should be based on the fully diluted number of shares ( ie add the num of shares in the ordinary shares + preference shares together) 4. I understand that there is a lot to know... why is why I always stress that newbies should never ever trade any shares until they really know what is happening. |

|

|

May 7 2020, 11:37 AM May 7 2020, 11:37 AM

Return to original view | Post

#96

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(ChAOoz @ May 7 2020, 10:54 AM) For ARBB you see the eps vs diluted eps and judge for yourself. The simplest and clearest way (one needs to do some hardwork) is to map out the past couple months conversions on the chart.. Map out the size of it (how many shares converted) and when it was converted..and the clear picture would emerge....We must see who holds the majority preffered convertible. If management holds majority of it or their acquaintances then its not worth it for normal investors. When company shares not growing, they received fixed dividend and priority when bankcruptcy. When the share start flying, it will be converted to dilute their eps limiting stock holder their well deserved investing risk. As for PA side, that is just pure speculation on the future price and a hedge if ARBB goes down. Anyway again if management hold high preffered convertible they can effecfively control ARBB main price and gain from trading its CA and PA. The PA is in the money. Hence a fully diluted eps is a must. The PA shares is much more than the ordinary share ( lol.. I can't even understand how and why.... perhaps I got everything wrong... LOL) |

|

|

May 7 2020, 12:34 PM May 7 2020, 12:34 PM

Return to original view | Post

#97

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(abcn1n @ May 7 2020, 11:40 AM) Thank you for your concern but I'm not such a newbie that I easily fall for buying ARB-PA. I want to know how to convert PA to ordinary because its useful for this and other stock shares. Doesn't mean that I will straightaway buy the shares. I have been googling for info. but sometimes its not that easy to find what you are looking for. I just want to know is there like a button to press to convert the PA shares to ordinary shares once one have the PA shares or how to go about converting preference shares. This info is useful because next time if there's a stock that I like, I will at least know how to handle that part. Converting the shares? This is the job of the remisier. Ask them.I have been in the USA stock market years ago and know what its like to act brashly. Before coming back to the stock market again, I actually spent much time thinking about my strategy, how I will react under certain circumstances etc. And I only use a fraction of my $. If I were to go into more risky stocks, it will be a very small portion of my money. So thank you for your concern but its not really necessary here. Thanks. I too realise that. |

|

|

May 13 2020, 09:19 AM May 13 2020, 09:19 AM

Return to original view | Post

#98

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

May 13 2020, 03:27 PM May 13 2020, 03:27 PM

Return to original view | IPv6 | Post

#99

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(ChAOoz @ May 13 2020, 02:46 PM) Fundamental dint change much, glove producer all got production constraint even there is alot of demand. Prices might increase i guess but still the price paid is err too high for me. Well... exactly. But grats for those that have bought it. Good returns But then our market, those fella always tend to use BS, half baked theories to drive up a themed play. So for a pandemic, no ask question. No blink eye. Just dive deep deep as early as possible into the glove sector. Sure win. How about the story of LKL? Struggling to make money since listing. Was only 10 sen nia. Lol. Lousy mah. Hospital bed maker. Get this... B4 mco, it had a market cap of less than 50 million. At this moment? Close to a market cap of 290 million. Lol. QUOTE Managing director Lim Kon Lian says LKL has seen a surge in enquiries for its beds, medical peripherals, accessories and medical devices as hospitals look to ramp up their capabilities to cope with the increasing number of infections. “Our [financial] results were already on an improving trend prior to the Covid-19 outbreak, as reported in our 9MFY2020 [nine months ended Jan 31, 2020] results, as we continued to implement our growth strategies. The recent surge in demand is likely to contribute to double-digit growth in group revenue for the current financial year. “We have received new orders for around 600 new healthcare beds since the beginning of the Covid-19 outbreak, worth a total of RM2 million,” he says. LKL announced last month that it will supply RM6.6 million worth of PPE to the Sarawak government for onward distribution to public hospitals. One hospital bed order worth 2 million and then 6.6 million of PPE. Is it justifiable that the share go from 10 sen to 74 sen today? LOL. But then the masters will tell that Bursa no see fundamentals one. |

|

|

May 29 2020, 05:22 PM May 29 2020, 05:22 PM

Return to original view | IPv6 | Post

#100

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ May 4 2020, 02:35 PM) I guess you are seduced by the stock price. Ooops!! Let's make it Nine consecutive quarters of DECLINING earnings.... Heck at below 50 sen (was whacked down until 30 sen recently) it does seem 'seductive' ..... But here are some risks you should really consider.... 1. Firstly do please google the phrase 'Mah Sing poor quality' ..... the first 3 hits .... says what people are saying over and over again. Shitty, substandard quality from the developer. There's a poll made 'would you buy Mah Sing properties again ...... ' .... see the results.... 2. Now if you look at the chart ... just for the bigger picture.... and if you discount the current year.... and you would see that this stock has been on the killer decline many, many years ago..... i would interpret it as this stock is already in deep shit even before 19. 3. Compare it to the financial results.... just on the quarterlies already show the horror story...8 ..... EIGHT consecutive quarters of DECLINING earnings. Under performing earnings ... and delivering houses of substandard quality.... explains why the stock is in its 10 years low..... (on the long run, the market cannot be wrong... if the stock earnings performance, it reflects on the charts!) .... Lastly..... this one ..... this is a serial rights issue stock..... every few years, without fail, Mah Sing will issue rights issue to raise fund. Problem is simple. If you invested 10k into Mah Sing, you better set aside another 10k just in case Mah Sing do another rights issue. Else, if it raises another rights issue and you do not have funds to participate in the rights issue, you will get burnt! me? deep value stocks usually have deep, deep risks embedded within the stock. I hate to simply take risks which I cannot control.  |

| Change to: |  0.0700sec 0.0700sec

0.35 0.35

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 03:49 AM |