QUOTE(Brico @ Sep 19 2016, 01:29 PM)

Hi Boon , Ok found some news about CSC and his view why they are benefitting. As for my hope if my Chinwel will benefit it is not in his list of complementing companies that will benefit downstream.

Good luck!STOCK MARKET DISCUSSION V150

|

|

Sep 19 2016, 02:00 PM Sep 19 2016, 02:00 PM

Return to original view | Post

#61

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Nov 10 2016, 06:33 PM Nov 10 2016, 06:33 PM

Return to original view | Post

#62

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Nov 10 2016, 07:39 PM Nov 10 2016, 07:39 PM

Return to original view | Post

#63

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Nov 10 2016, 07:39 PM Nov 10 2016, 07:39 PM

Return to original view | Post

#64

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Nov 23 2016, 12:52 PM Nov 23 2016, 12:52 PM

Return to original view | Post

#65

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Nov 25 2016, 07:41 PM Nov 25 2016, 07:41 PM

Return to original view | Post

#66

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(nexona88 @ Nov 25 2016, 06:38 PM) Airasia Plans IPO Of ASEAN Holding Co, Eyes Bigger Investor Base Talk Kok!!!!http://www.bernama.com/bernama/v8/bu/newsb....php?id=1305885 Company is burning cash really fast again. Look at what's happening.... No see? This post has been edited by Boon3: Nov 25 2016, 07:42 PM |

|

|

|

|

|

Nov 28 2016, 08:10 AM Nov 28 2016, 08:10 AM

Return to original view | Post

#67

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(djhenry91 @ Nov 25 2016, 08:48 PM) So true. They say branding is everything and the one thing Tony has gotten right is that he's created a really solid brand name. And that's the catch isn't it? Global brand name mah... Naturally many would simply fall in luv with it.... And many times.... in most such cases... rational reasoning goes out of the window.... As we all know... brand names do not necessary make good stocks. Some do... some don't. They have their risk too and I am sure you are aware of the existence of well established brands going under as a stock. So AirAsia posted mega big profits... Stock closed unchanged. Is the market stooopid or what? Some more Tony is almost playing so many cards at one go currently.... Got AAC sale wo... Got listing plans for subs wo.... Then how come... which smartie panties threw in the privatisation rumor? (normally one card is more than cukup to send the stock terbang-ing... ) Oh... lol.... if all these so good, how come Tony has not pick up his private placement shares which are currently sitting on a paper profit of 472+ million? no money ah? |

|

|

Nov 28 2016, 06:07 PM Nov 28 2016, 06:07 PM

Return to original view | Post

#68

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(oOoproz @ Nov 28 2016, 05:03 PM) Keep that toxic site away from this forum |

|

|

Nov 28 2016, 06:09 PM Nov 28 2016, 06:09 PM

Return to original view | Post

#69

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Nov 28 2016, 06:42 PM Nov 28 2016, 06:42 PM

Return to original view | Post

#70

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Nov 28 2016, 07:50 PM Nov 28 2016, 07:50 PM

Return to original view | Post

#71

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(oOoproz @ Nov 28 2016, 06:44 PM) I am chill and I am telling you straight up... that site is toxic. Like it or not that's my 3 sen of that site. It's garbage. Simple proof. That posting. Is that writer a blardy joker or what? His first very point on depreciation. Does he know or does he not know? Me? I have never studied accounts but even I know you cannot depreciate goods you have yet to receive (in AirAsia case, aircrafts yet to be delivered) I stop right there and then. It's pointless to carry on. If you want to be serious on the stock market... avoid that site like plague! |

|

|

Nov 29 2016, 03:47 PM Nov 29 2016, 03:47 PM

Return to original view | Post

#72

|

All Stars

15,942 posts Joined: Jun 2008 |

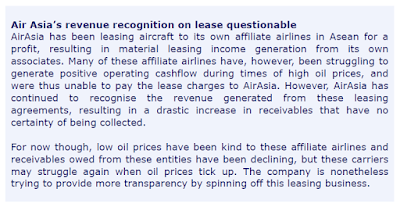

QUOTE(felixmask @ Nov 25 2016, 09:23 PM) Helicopter money by Tony..dig hole to cover another hole creating wing stock. This mean transfer Air Asia asset to new company? Aiyoh Felix!What helicopter money la? The current issue is the leasing company and how it accounts its revenue and profits. The leasing company - owned by AirAsia. AirAsia sells fei kei to Leasing Company. Leasing company leases back to AirAsia and its subsidiaries. From a local blog... The blog highlights this article: http://www.livemint.com/Companies/dXN7jGDv...Asia-India.html QUOTE One accusation (of several) is regarding the leasing of airplanes: Well, what can one expect?Other mails indicate that AirAsia India may have a received a raw deal while leasing aircraft from AirAsia Bhd. For instance, old Airbus A320s were priced almost the same as new ones. One A320, made in 2009, and registered as VT-BLR, was leased for $320,000 per month; another, VT-ATF, manufactured in 2014, was leased out for $315,788. The prices do not match the prevailing rates provided by an independent consultant. The leased cost of an Airbus A320 aircraft (February 2010 make) is about $235,000 per month. A 2013 make costs about $280,000, according to data from aviation consulting firm CAPA. Expensive aircraft can mar the costs of a start-up airline and Bhatia seems to have raised this in an email last April. These are all transactions between AirAsia and its related companies. And if you read on the blog: QUOTE CLSA wrote about the issue of revenue recognition in their CG Watch 2016 report:  Can see how cunning Tony is? So CLSA is highlighting the issue of "...drastic increase in receivables that have no certainty being collected." ie. CLSA is asking if these receivables (leasing profits) will be collected or not.... if you spend some quality time reading AirAsia reports... ending 30.9.2015 Amounts due from associates = 191.481 million. ending 31.12.2015 Amounts due from associates = 360.854 million. ending 31.3.2016 Amounts due from associates = 559.389 million ending 30.6.2016 Amounts due from associates = 647.698 million. and the latest report ending 30.09.2016 Amounts due from associates is now 706.188 million. CLSA does have a point yes? ie AirAsia is charging 'rather high leases' and that (for whatever reason) its associates is 'unable to pay' back to AirAsia.... Given this issue, how much is the leasing unit worth, if this is how it conducts its business? ps: the leasing unit profit contribution to AirAsia profit is not kacang putih too... |

|

|

Nov 29 2016, 08:39 PM Nov 29 2016, 08:39 PM

Return to original view | Post

#73

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(felixmask @ Nov 29 2016, 08:18 PM) Create accounting Business Good, all Masuk debtor money haven't collect. More like empty shell company show business good...money not collect...in Accounting. It's actually legal .....SC is sleeping..... So cannot say SC sleeping la... It's basically related party transactions... And for the investor/trader, they just need to be cautious... |

|

|

|

|

|

Jan 4 2017, 09:50 AM Jan 4 2017, 09:50 AM

Return to original view | Post

#74

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 4 2017, 09:55 AM Jan 4 2017, 09:55 AM

Return to original view | Post

#75

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 4 2017, 10:06 AM Jan 4 2017, 10:06 AM

Return to original view | Post

#76

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(foofoosasa @ Jan 4 2017, 10:00 AM) Stubborn? just in case .... for the record.... post #1887 QUOTE ps. point of the posting is not about OnG. it's about sharing how we think about stocks we trade. when stocks fall... everyone immediately throws out two things.... 1. value. 2. be greedy when everyone is scared like shit. 2 of the worst things you can do when a stock collapses.... it's not that the points itself is wrong but the implementation of it.... as bad as it is... oil has been trading around 40s... yes...some shit companies might die.... but there will be survivors... and if and when oil recovers to say 60s or maybe even 80s (above 80? errr..... ) these companies that survives today.... might do good. yes.. it's a risk... but the risk today and the risk yesteryear.... is it the same? we trade... don't we want to be better all the time? posted 5 Oct 2016. This post has been edited by Boon3: Jan 4 2017, 10:07 AM |

|

|

Jan 4 2017, 05:11 PM Jan 4 2017, 05:11 PM

Return to original view | Post

#77

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 19 2017, 08:23 AM Jan 19 2017, 08:23 AM

Return to original view | Post

#78

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 20 2017, 09:19 AM Jan 20 2017, 09:19 AM

Return to original view | Post

#79

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jan 20 2017, 09:21 AM Jan 20 2017, 09:21 AM

Return to original view | Post

#80

|

All Stars

15,942 posts Joined: Jun 2008 |

|

| Change to: |  1.4614sec 1.4614sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 02:44 AM |