QUOTE(Taikor.Taikun @ Dec 9 2023, 04:12 PM)

With all the positive news and prospects, how high do you think it can go?.STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Dec 12 2023, 07:22 AM Dec 12 2023, 07:22 AM

|

Junior Member

587 posts Joined: May 2016 |

|

|

|

|

|

|

Dec 12 2023, 07:34 AM Dec 12 2023, 07:34 AM

Show posts by this member only | IPv6 | Post

#61142

|

Senior Member

1,019 posts Joined: Sep 2018 |

QUOTE(nauticat99 @ Dec 12 2023, 07:22 AM) At this point, we cannot see how far it can go. Not into technical n fundamental, it's the market sentiment. My remisier think it can go above 2 if momentum continues, projects not affected as our gov stabilised n strong.The regional supply chain n operational restructuring is ongoing, favouring SEA. Msia happens to benefit a lot from this change due to Singapore. Thats why we need HSR, special economic regions in south Johor...etc. to attract more relocations n new investments. Once we have all the infra, the biz n industrial districts n policies in place, we have higher advantage than other SEA countries. But we have our other problems under the surface too. Hope it didnt go that way. They need data centre, it needs power. U need to construct something, YTL can get involve too. We need to look at other promising counters other than YTL to diversify. Dont simply jump in, study n research carefully This post has been edited by Taikor.Taikun: Dec 12 2023, 07:37 AM |

|

|

Dec 12 2023, 07:57 AM Dec 12 2023, 07:57 AM

|

Junior Member

587 posts Joined: May 2016 |

I think going above 2 is not a problem. Just thinking of LT holding. Let’s say treating this investment as FD due to YTL consistency in giving dividends.

|

|

|

Dec 14 2023, 12:22 AM Dec 14 2023, 12:22 AM

|

Senior Member

2,382 posts Joined: Jun 2005 From: Malacca(KgLapan), Selangor(SungaiLong), KL(PuduRaya) |

market is getting better?

This post has been edited by markchan: Dec 14 2023, 12:24 AM |

|

|

Dec 16 2023, 11:18 AM Dec 16 2023, 11:18 AM

|

Junior Member

192 posts Joined: Feb 2022 |

This thread is dead?

US Fed already announced the rate ceiling and there is no activities here? Or most people gave up on Malaysians stocks? |

|

|

Dec 16 2023, 01:13 PM Dec 16 2023, 01:13 PM

|

Senior Member

3,485 posts Joined: Jan 2003 |

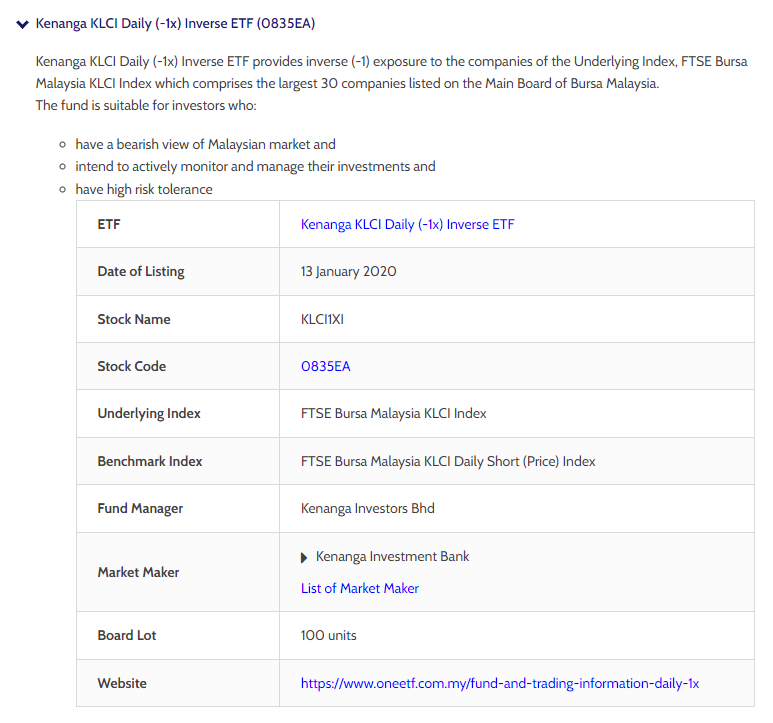

QUOTE(watabakiu @ Oct 21 2023, 12:11 AM) I'm watching this Netflix Eat the Rich series, & it got me thinking.. Can retail investors short sell in Bursa? you can short-sell the index by opening a Derivatives account and selling FKLI. however, might be risky for new-to-intermediate retail investors. alternatively, you can buy 0835EA counter, where you short-sell the index without leverage. however, very low liquidity  |

|

|

|

|

|

Dec 18 2023, 12:51 PM Dec 18 2023, 12:51 PM

Show posts by this member only | IPv6 | Post

#61147

|

Junior Member

97 posts Joined: Nov 2020 |

Wow. Highest volume I have seen so far after so long. Rm1. 5 billion during lunch time. That's like average closing volume. Money is flowing into bursa. Feels like somewhat 2020 again.

|

|

|

Dec 18 2023, 04:13 PM Dec 18 2023, 04:13 PM

|

Junior Member

552 posts Joined: Aug 2010 |

|

|

|

Dec 18 2023, 04:29 PM Dec 18 2023, 04:29 PM

|

Junior Member

552 posts Joined: Aug 2010 |

|

|

|

Dec 19 2023, 01:39 AM Dec 19 2023, 01:39 AM

|

Junior Member

587 posts Joined: May 2016 |

|

|

|

Dec 19 2023, 09:02 PM Dec 19 2023, 09:02 PM

Show posts by this member only | IPv6 | Post

#61151

|

Senior Member

2,940 posts Joined: Jan 2010 |

This thread only livens up when retailers go on a buying spree.

Still a sitting period for investors, Bursa has been rather sideways. Eating dividends rather than capital gains. |

|

|

Dec 23 2023, 03:12 PM Dec 23 2023, 03:12 PM

Show posts by this member only | IPv6 | Post

#61152

|

Senior Member

1,019 posts Joined: Sep 2018 |

|

|

|

Dec 28 2023, 07:11 AM Dec 28 2023, 07:11 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

Does anyone understand what does it mean by ICAP's dividend policy? I got headache after reading the article, I've zero idea what that actually means!

FYI. I didn't own any ICAP shares. I am just curious This post has been edited by yok70: Dec 28 2023, 07:14 AM |

|

|

|

|

|

Dec 28 2023, 10:32 PM Dec 28 2023, 10:32 PM

Show posts by this member only | IPv6 | Post

#61154

|

Junior Member

97 posts Joined: Nov 2020 |

tommorow is gonna be window dressing day. Any recommendations? especially blue chips GravityFi3ld liked this post

|

|

|

Dec 29 2023, 11:59 AM Dec 29 2023, 11:59 AM

Show posts by this member only | IPv6 | Post

#61155

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(yok70 @ Dec 28 2023, 07:11 AM) Does anyone understand what does it mean by ICAP's dividend policy? I got headache after reading the article, I've zero idea what that actually means! A base rate of 1% of the NAV per share, plus 8% of the difference between ICAP’s share price and NAV. Fairly, self explanatory I think? 1% of the NAV plus 8% of the difference between price and NAV, assuming the price is less than the NAV. Goal is to push the price up. Although as it's a fund, any dividend will just cause a corresponding drop in price, so I'm not sure how it's gonna work.FYI. I didn't own any ICAP shares. I am just curious |

|

|

Dec 29 2023, 12:19 PM Dec 29 2023, 12:19 PM

Show posts by this member only | IPv6 | Post

#61156

|

Junior Member

222 posts Joined: May 2010 |

Maybe is like this:

NAV = RM3 Market price = rm2.00 Diff = rm1.00 Div = 1% of rm3 + 8% of rm1 = 0.03+0.08 = 0.11 Correct me if I am wrong |

|

|

Dec 29 2023, 12:20 PM Dec 29 2023, 12:20 PM

Show posts by this member only | IPv6 | Post

#61157

|

Junior Member

222 posts Joined: May 2010 |

If market price > NAV, dunno how it work already

|

|

|

Dec 29 2023, 10:29 PM Dec 29 2023, 10:29 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(jojojoget @ Dec 29 2023, 11:59 AM) A base rate of 1% of the NAV per share, plus 8% of the difference between ICAP’s share price and NAV. Fairly, self explanatory I think? 1% of the NAV plus 8% of the difference between price and NAV, assuming the price is less than the NAV. Goal is to push the price up. Although as it's a fund, any dividend will just cause a corresponding drop in price, so I'm not sure how it's gonna work. It mentioned about reinvestment benefits if investors choose not to take the cash. 10% discount or something? And have to join the "fan club"? People just sell before ex date to cash out, or take the cash dividend. Then no help at all for the share price. Unless, people really love ICAP for long term, which I highly doubted at least for the coming 1-2 years, unless TTB really started perform well on ICAP. jojojoget liked this post

|

|

|

Dec 29 2023, 10:36 PM Dec 29 2023, 10:36 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(sjteh @ Dec 29 2023, 12:19 PM) Maybe is like this: Thanks! NAV = RM3 Market price = rm2.00 Diff = rm1.00 Div = 1% of rm3 + 8% of rm1 = 0.03+0.08 = 0.11 Correct me if I am wrong Assuming you are right. So ICAP's NAV is 3.61, market price is 2.80, so dividend is (3.61-2.80) * 0.08 + 2.80 * 0.01 = 0.81*0.08 + 0.028 = 0.0928 Total is "only" 3.31% yield. Can 3.31% yield trigger buying trend to push share price upwards? jojojoget liked this post

|

|

|

Jan 3 2024, 09:05 PM Jan 3 2024, 09:05 PM

|

Probation

11 posts Joined: Mar 2020 |

|

| Change to: |  0.2331sec 0.2331sec

0.95 0.95

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 10:44 PM |