How long do company AGMs usually last?

STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Apr 21 2021, 10:10 PM Apr 21 2021, 10:10 PM

Return to original view | Post

#1

|

Junior Member

76 posts Joined: Nov 2020 |

How long do company AGMs usually last?

|

|

|

|

|

|

Nov 14 2021, 11:42 AM Nov 14 2021, 11:42 AM

Return to original view | IPv6 | Post

#2

|

Junior Member

76 posts Joined: Nov 2020 |

What are your views on a company issuing new shares to pay off debt? I'm specifically talking about Axis Reit but feel free to discuss in a more general sense.

|

|

|

Nov 14 2021, 11:47 AM Nov 14 2021, 11:47 AM

Return to original view | IPv6 | Post

#3

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(Boon3 @ Nov 13 2021, 12:21 PM) now if the shareholders approve this resolution... then... we better siam to the outside and just smoke cigars the past week was really incredible.... AAX creditors.... TG .... SD ... SD one hor... don't they know if the don't pay their sukuk on time... Fitch will come in and do the downgrade.... yeah... still got dunno how many days... but what's the use? Fitch downgrade will hurt. so what's the thinking? shoplot rating agency? how many Sue does SD know? |

|

|

Nov 15 2021, 07:21 PM Nov 15 2021, 07:21 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

76 posts Joined: Nov 2020 |

|

|

|

Nov 16 2021, 03:19 PM Nov 16 2021, 03:19 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

76 posts Joined: Nov 2020 |

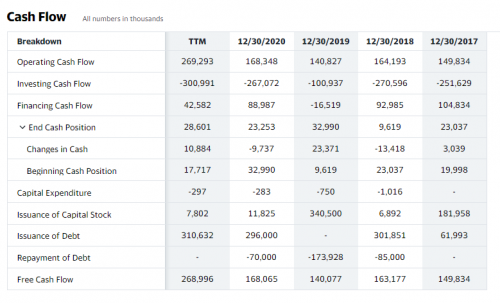

QUOTE(AthrunIJ @ Nov 16 2021, 08:16 AM) True o.o They're using it to pay off principal. They're reasoning is quite interesting, they're gearing is actually quite low (I think 37% ish) so they want to pay off the debt to allow further room for borrowing in the future to expand their portfolio. Yet this just sounds weird to me. Why not just borrow more with the extra room they have or directly use the stock capital for expansion? Why use such a roundabout way? Agree that industrial REITs weren't affected. Their cash flow for reference:If it is just to pay the interest and not including the principal then I don't think it will go up. Probably need to check whether the debt repayment includes principal debt payment also and not just the interest. Anywho, there is a good side and bad side. With this it could mean axreit has cash flow problem. Oddly enough MCO didn't affect industrial REIT that much though. 🤔  Seems quite ok so I'm really not sure what's going on. This post has been edited by jojojoget: Nov 16 2021, 03:22 PM |

|

|

May 2 2022, 11:16 AM May 2 2022, 11:16 AM

Return to original view | Post

#6

|

Junior Member

76 posts Joined: Nov 2020 |

Anyone know how to claim Petgas AGM door gift for the recently concluded AGM?

|

|

|

|

|

|

Sep 2 2022, 11:28 AM Sep 2 2022, 11:28 AM

Return to original view | IPv6 | Post

#7

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(statikinetic @ Sep 1 2022, 10:50 PM) Saw this today, sounded interesting. 0.1% brokerage fee with no minimum fee for normal customers.Standard Chartered Malaysia has launched SmartStocks, a one-stop online share trading platform, bringing clients the convenience of trading on 12 exchanges across seven global markets from Malaysia via one account. In a statement, the bank said through SmartStocks, clients will be able to access Bursa Malaysia, Singapore Exchange, the Hong Kong Stock Exchange, the New York Stock Exchange, NASDAQ, US OTC, BATS Global Markets, the Australian Stock Exchange, the Tokyo Stock Exchange and the SIX Swiss Exchange – all at a single brokerage rate, which can be as low as zero percent for the its Priority Private clients. https://www.thestar.com.my/business/busines...stocks#cxrecs_s This post has been edited by jojojoget: Sep 2 2022, 11:28 AM |

|

|

Sep 2 2022, 02:26 PM Sep 2 2022, 02:26 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(BboyDora @ Sep 2 2022, 01:24 PM) The Board of Directors have declared a single-tier first interim dividend in respect of the financial year ending 31December 2022 of 28.0 sen (30 June 2021: 28.0 sen) per ordinary share. The Board of Directors have also determined that the Dividend Reinvestment Plan will apply to the single-tier first interim dividend in which an electable portion of 7.0 sen per ordinary share can be elected to be reinvested in new ordinary shares and the remaining portion of 21.0 sen per ordinary share will be paid in cash. Pursuant to Section 8.26 of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the interim dividend will be paid no later than three (3) months from the date of declaration. The Book Closure Date will be announced by the Bank at a later date. |

|

|

Sep 6 2022, 09:38 PM Sep 6 2022, 09:38 PM

Return to original view | Post

#9

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(15cm @ Sep 6 2022, 09:30 PM) guys just wanna ask 1 question Dividend usually won't have transaction fee. In Malaysia it's dividend-withholding tax.im using maybank broker, when dividend is deposited into my account do they deduct the transaction fee from the profit? so the number i see in my maybank broker is dividend - transaction fee right? |

|

|

Sep 7 2022, 11:56 PM Sep 7 2022, 11:56 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

76 posts Joined: Nov 2020 |

|

|

|

Sep 19 2022, 08:35 PM Sep 19 2022, 08:35 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

76 posts Joined: Nov 2020 |

|

|

|

Oct 25 2022, 03:23 PM Oct 25 2022, 03:23 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(watabakiu @ Oct 25 2022, 12:31 PM) Since the thread is very quiet, would you mind enlightening this no0b? 0.22 sen x 100 = 22 sen = RM 0.22"First and final single-tier dividend of 0.22 sen per ordinary share" Assuming the holding is 1lot, what would the dividend (in terms of money received) be like? watabakiu liked this post

|

|

|

Feb 13 2023, 02:19 PM Feb 13 2023, 02:19 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

76 posts Joined: Nov 2020 |

|

|

|

|

|

|

Feb 17 2023, 08:51 PM Feb 17 2023, 08:51 PM

Return to original view | IPv6 | Post

#14

|

Junior Member

76 posts Joined: Nov 2020 |

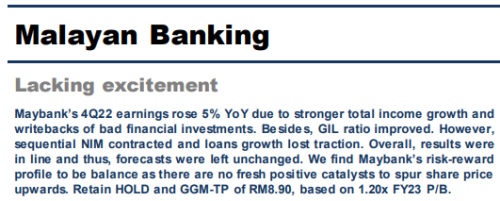

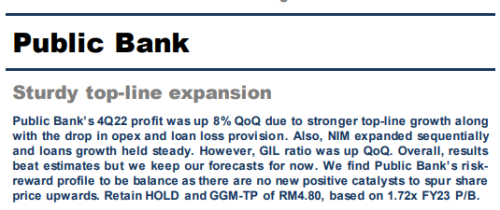

QUOTE(BboyDora @ Feb 16 2023, 09:35 AM) rarely can get lah, growth orientated will give less div and div orientated will grow less. Tbh both banks are too big to grow much more, pbb is more efficient in terms of its operations, mbb is very big with wider coverage. Pick your poison. greyPJ liked this post

|

|

|

Mar 12 2023, 11:27 AM Mar 12 2023, 11:27 AM

Return to original view | Post

#15

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(Paradigmata @ Mar 7 2023, 04:08 AM) Can anyone tell me why is pbb share price is beaten down vs maybank vs cimb? Maybe because of the founder's death but tbh, the company's fundamentals are still intact. It could just be market fluctuations.Is it a buy opportunity?  for the past one year looks like mbb and pbb are pretty much in tandem, cimb seems the odd one out and the below is HLeBroking views on the 3 banks:    This post has been edited by jojojoget: Mar 12 2023, 11:35 AM littleprawnReborn liked this post

|

|

|

Mar 15 2023, 06:19 PM Mar 15 2023, 06:19 PM

Return to original view | Post

#16

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(ragk @ Mar 15 2023, 02:53 PM) Some companies post it on their bursa announcement, top glove is an example. Otherwise u can look at past year release dates to get a rough estimate. |

|

|

May 5 2023, 07:31 PM May 5 2023, 07:31 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(MasterConfucion @ May 4 2023, 10:05 AM) With intensified deposit competition and higher cost of funds, the Bank anticipates that net interestmargin (NIM) will potentially remain flat or contract (page 33 of IAR2022). What is the management guidance for NIM in FY2023? As the central bank is expected to raise OPR back to the pre-pandemic level, how significantly can the potential rate hike cushion the impact of high funding costs on NIM? We anticipate potential NIM compression of between 5 bps and 8 bps for FY2023 given the increased deposit competition, seen mainly in Malaysia. In a rising interest rate cycle, cost of funding will increase in tandem with the rate hike and in some instances, it will exceed the rate hike given intensified deposit competition among banks as experienced currently in Malaysia. Meanwhile, the ability to reprice assets upward is limited and confined to the quantum of the rate hike. Thus, the basis for our guidance of NIM compression in 2023. From Maybank AGM, question by MSWG greyPJ liked this post

|

|

|

May 11 2023, 12:22 PM May 11 2023, 12:22 PM

Return to original view | Post

#18

|

Junior Member

76 posts Joined: Nov 2020 |

Anyone know what is the door gift for PetGas AGM?

|

|

|

Dec 29 2023, 11:59 AM Dec 29 2023, 11:59 AM

Return to original view | IPv6 | Post

#19

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(yok70 @ Dec 28 2023, 07:11 AM) Does anyone understand what does it mean by ICAP's dividend policy? I got headache after reading the article, I've zero idea what that actually means! A base rate of 1% of the NAV per share, plus 8% of the difference between ICAP’s share price and NAV. Fairly, self explanatory I think? 1% of the NAV plus 8% of the difference between price and NAV, assuming the price is less than the NAV. Goal is to push the price up. Although as it's a fund, any dividend will just cause a corresponding drop in price, so I'm not sure how it's gonna work.FYI. I didn't own any ICAP shares. I am just curious |

|

|

Mar 28 2024, 12:20 AM Mar 28 2024, 12:20 AM

Return to original view | IPv6 | Post

#20

|

Junior Member

76 posts Joined: Nov 2020 |

|

| Change to: |  0.0940sec 0.0940sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 25th November 2025 - 06:36 PM |