Outline ·

[ Standard ] ·

Linear+

STOCK MARKET DISCUSSION V150

|

Questions12345

|

May 29 2021, 11:00 PM May 29 2021, 11:00 PM

|

Getting Started

|

Focus on penny stocks.

New lockdown will force people to stay at home like during MCO 1.0. Penny stocks were favoured by new retail investors back then. A lot went up few folds.

New MCO will have the same effect

|

|

|

|

|

|

Questions12345

|

May 30 2021, 12:05 AM May 30 2021, 12:05 AM

|

Getting Started

|

QUOTE(mujinkun @ May 29 2021, 11:20 PM) Got some example for Penny stock? Definition of penny stock is broad. For me, it just means shares with prices that are less than rm1. |

|

|

|

|

|

Questions12345

|

May 30 2021, 11:30 PM May 30 2021, 11:30 PM

|

Getting Started

|

QUOTE(westernkl @ May 30 2021, 11:04 PM) Which penny counter is worth to goreng in this Full Lockdown? Can look at logistics company like gdex since logistics sector benefit from mco. I m also monitoring smetric (software), mkland (property) and mediac(telecom) Trade at your own risk  |

|

|

|

|

|

Questions12345

|

May 31 2021, 11:08 AM May 31 2021, 11:08 AM

|

Getting Started

|

Rm250 million + at 1.13. Holy sheet

This post has been edited by Questions12345: May 31 2021, 11:08 AM

|

|

|

|

|

|

Questions12345

|

May 31 2021, 12:54 PM May 31 2021, 12:54 PM

|

Getting Started

|

Anyone looking at or monitoring gdex? Seems like a goreng option during mco. I might buy if it breaks 0.4

|

|

|

|

|

|

Questions12345

|

Jan 5 2022, 04:17 PM Jan 5 2022, 04:17 PM

|

Getting Started

|

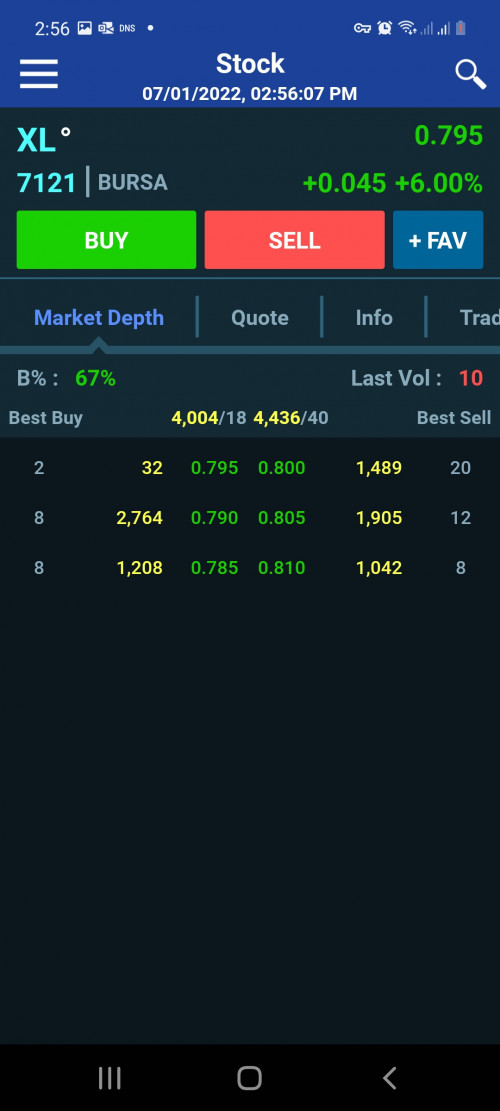

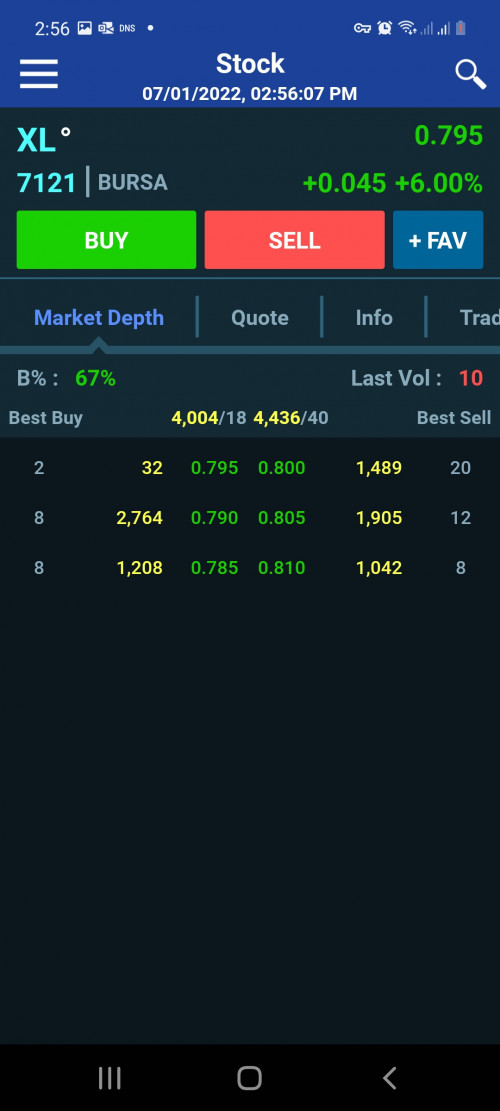

Stocks to watch. High probability to fly.

1. Awantec

2. XL

3. Encorp

4. KYM

|

|

|

|

|

|

Questions12345

|

Jan 7 2022, 02:41 PM Jan 7 2022, 02:41 PM

|

Getting Started

|

QUOTE(Questions12345 @ Jan 5 2022, 04:17 PM) Stocks to watch. High probability to fly. 1. Awantec 2. XL 3. Encorp 4. KYM Huat ahh    Still waiting fot awantec This post has been edited by Questions12345: Jan 7 2022, 02:57 PM |

|

|

|

|

|

Questions12345

|

Jan 10 2022, 01:02 AM Jan 10 2022, 01:02 AM

|

Getting Started

|

KYM still got room to fly. Prolly around 46-48 cents ish. The triangle is likely the operator draw to attract waterfish retailers once the 42 cents resistance is broken(the pivotal point of the triangle). And also likely a 9am high volume push up. Idk exactly when the push up will be. But i know it's very close  . Normally, technical analysis traders would draw a triangle like that (I dont follow any triangles or what). And wait for a breakout before jumping in. Operators been collecting KYM shares since 29 november 2021, on which they purposely break the support and collected shares from panic retailers dumping( look at the hammer in the chart). and then they did silent accumulation since 29/11 until now. As the price is not retracing and slowly creeping up, it's a sign that operator is going to push the price of KYM up soon. My trading strategy is follow operator strategy and as with any other strategies, there is no 100% accuracy. Just a matter of getting high probability trades with good risk management. TAYOR.  This post has been edited by Questions12345: Jan 10 2022, 01:20 AM This post has been edited by Questions12345: Jan 10 2022, 01:20 AM |

|

|

|

|

|

Questions12345

|

Jun 20 2023, 11:18 PM Jun 20 2023, 11:18 PM

|

Getting Started

|

looks like bursa is gonna break down lower. Expect 1350-1320 kind of range in the next few weeks. Sigh.

|

|

|

|

|

|

Questions12345

|

Jul 3 2023, 05:34 PM Jul 3 2023, 05:34 PM

|

Getting Started

|

Wow. Today got good recovery. So close to breakdown lower when bursa closed ugly on Friday. If like that, a temporary rebound is coming. Pass 1430 should be coming.  . This post has been edited by Questions12345: Jul 3 2023, 05:35 PM |

|

|

|

|

|

Questions12345

|

Jul 14 2023, 05:57 PM Jul 14 2023, 05:57 PM

|

Getting Started

|

Finally bursa rebounded. Although a temporary one. Today who enter more than rm1 tech stock sure untung.  . Most of the buy volume is there. Penny stocks are mixed. I think there will be more bull runs ahead but there will be some small correction for a few days next week before continuation. This post has been edited by Questions12345: Jul 14 2023, 06:01 PM |

|

|

|

|

|

Questions12345

|

Oct 28 2023, 10:27 AM Oct 28 2023, 10:27 AM

|

Getting Started

|

QUOTE(watabakiu @ Oct 21 2023, 12:11 AM) I'm watching this Netflix Eat the Rich series, & it got me thinking.. Can retail investors short sell in Bursa? U can short. There are 2 short methods namely idss and rss. You have to apply. Shorting is not easy especially idss. Because the operator will catch you and other idss shorties if there is too much idss shorts. They will short squeeze you by pushing up the price or maintaining it as you will be forced to buy back for intraday short selling or face 10 bids penalty by bursa. |

|

|

|

|

|

Questions12345

|

Dec 18 2023, 12:51 PM Dec 18 2023, 12:51 PM

|

Getting Started

|

Wow. Highest volume I have seen so far after so long. Rm1. 5 billion during lunch time. That's like average closing volume. Money is flowing into bursa. Feels like somewhat 2020 again.

|

|

|

|

|

May 29 2021, 11:00 PM

May 29 2021, 11:00 PM

Quote

Quote

0.1029sec

0.1029sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled