QUOTE(Boon3 @ Aug 26 2022, 11:00 AM)

Yes, the reasons for AmBank was a known issue..

but there it was.... trading in the stock market... Ambank and Maybank... both there for the taking...

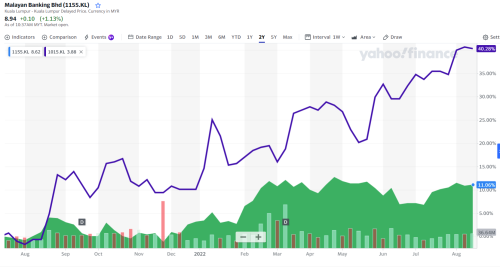

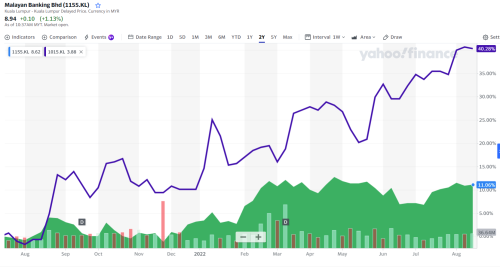

and this was exactly how much AmBank outperformed Maybank.

Is this as high as it goes?

LOL! I wouldn't know for 3 sen worth cause I wouldn't know how to bet on banking stocks...

the one and only one thing I know about Maybank is...'Where's the meat?'

Those 3 words still holding true for so many, many moons already..................

I think when it comes to Maybank, there is always that premium when it comes to the name that retailers love.but there it was.... trading in the stock market... Ambank and Maybank... both there for the taking...

and this was exactly how much AmBank outperformed Maybank.

Is this as high as it goes?

LOL! I wouldn't know for 3 sen worth cause I wouldn't know how to bet on banking stocks...

the one and only one thing I know about Maybank is...'Where's the meat?'

Those 3 words still holding true for so many, many moons already..................

Great to sit and suck on dividends. But in terms of capital appreciation meat, there are almost always better dishes elsewhere.

Don't have any banking stocks in my portfolio right now so I get to play casual bystander here.

Locally, a few equities I have looking high but am deciding against realizing the profit because nowhere to reallocate the funds to.

My China bet has turned out to be quite painful but that's part of the journey.

Aug 26 2022, 02:40 PM

Aug 26 2022, 02:40 PM

Quote

Quote

0.0749sec

0.0749sec

0.23

0.23

6 queries

6 queries

GZIP Disabled

GZIP Disabled