QUOTE(hiyyl @ Jan 4 2022, 12:00 PM)

On those ballooning receivables, i believe we will able to get the answer from next quarter results. IMO for now is still too early to guess.

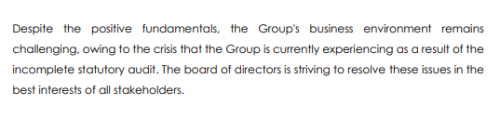

Yes, we will get a more clearer answer come next quarter but here's why this is a MASSIVE concern right now.....

1. The stock was below 2.00 early last year. Today it's only > 40.00. The ultra small number of shares in this stock made it easier to rocket.

So this stock has basically gone up heck a lot.

2. There was a placement of shares worth 17 million, priced around 3.xx ... and there was a bunch of ESOS exercised under 1.40. So there are a bunch of big players holding the stock with ultra cheap prices. If anything go wrong (like stock correct 20% or more), they can dispose without any remorse and they will still make tons of money.

So if one is late into this party, best one understand where one stand.... and with a 12 for 1 bonus issue... big players have every single reason to take profit.....

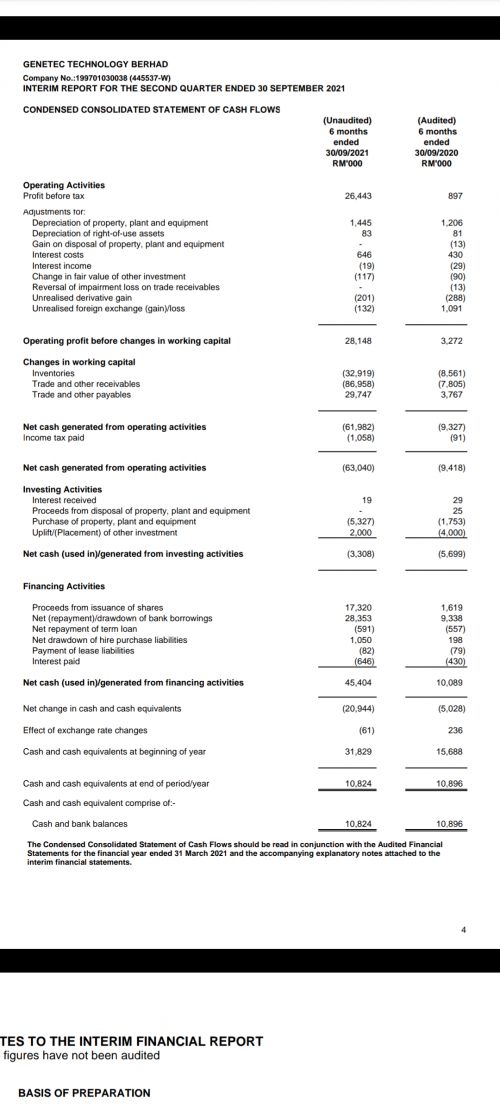

3. Despite the booming profits, we have already seen 2 quarters of booming profits with receivables ballooning and cash flow negative (yup despite a 17 million placement of shares and increase of debts). Wait another quarter? Should one take such a risk for confirmation?

4. Profits soared because of the EV sector. So said Genetec itself. In such a sector, why is the receivables ballooning for 2 quarters already? personally I cannot fathom why. It's a manufacturer? Unheard of a manufacturer to supply goods with such long credit days....

That's my thoughts... and if I have the stock, I would take the 'be safe rather than be sorry' approach anytime... not worth the risk waiting for another quarter of confirmation... but yeah, these are all my random thoughts... which I could be wrong of course.

now if I don't have the stock... I definitely will not touch it.

Jan 4 2022, 10:32 AM

Jan 4 2022, 10:32 AM

Quote

Quote

0.0764sec

0.0764sec

0.20

0.20

6 queries

6 queries

GZIP Disabled

GZIP Disabled