QUOTE(moosset @ Mar 19 2020, 07:39 PM)

proposed means, subject to shareholder approval?

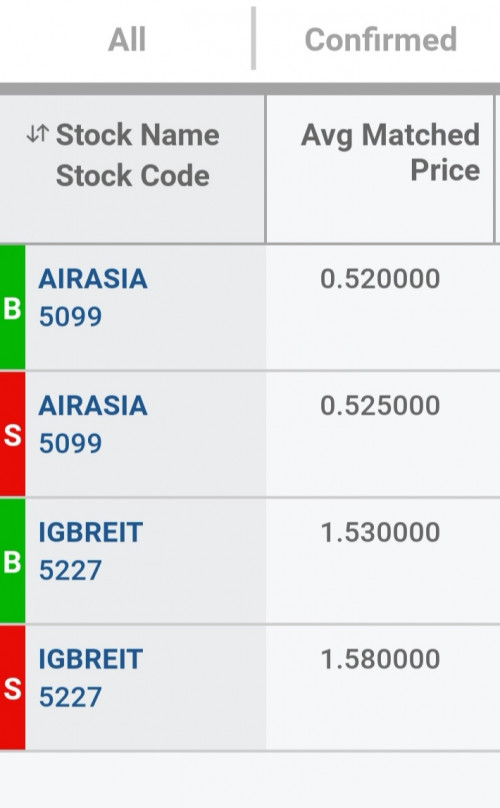

I'm also tempted to buy but given how Malaysians act to the lockdown, I fear the worst is yet to come .... (this is only virus, not yet politics, economics etc). Even IGBReit, Maybank, PBB also, I'm quite hesitant.

What do you think about the current property market (specifically those of MahSing)? Low interest rates should lead to more buyers, I guess?

Yup, stiil need tabled at agm which of course will be approved. Note that this dividend is already cut from last year's one, which was 4.5 sen.

Yes, you are right, that the worse may yet to come for the country. A lot of ppl macam not aware. Got some want to take asb loans still. But you also have to plan in case the world and this country gets over this covid-19 issue without too much lasting damage ..which I hope it will.

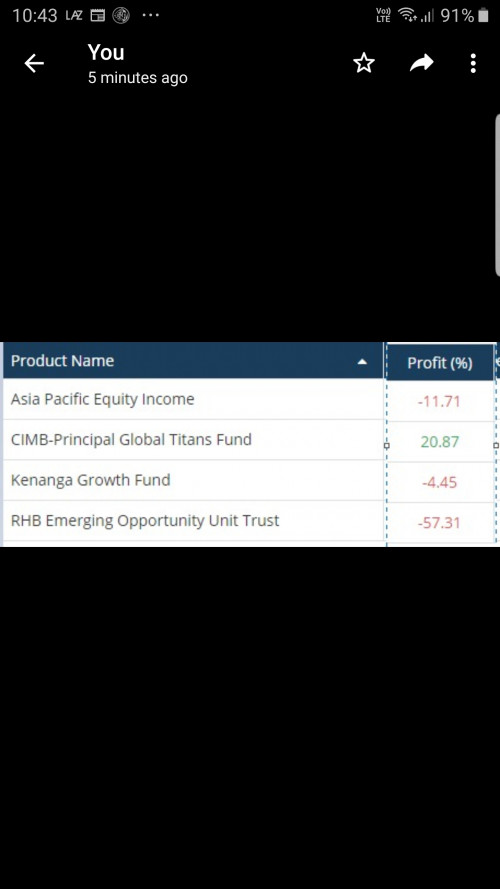

However, at the same time, I'm also prepping for worse, just in case. I always maintain a high level of USD deposits and have added more gold and Singapore govt securities (which has higher rating than US govt securities, coz Singapore is financially more prudent than US).

On Malaysia property market, not so soon. I was hoping that end of last year was the bottom, but now with the virus.. No way. But I'm hoping the CB liquidity injections n cuts will result in another property boom cycle like last time in a few years. So buy now and wait for 5 years.

This post has been edited by Cubalagi: Mar 19 2020, 08:12 PM

Mar 19 2020, 04:34 PM

Mar 19 2020, 04:34 PM

Quote

Quote

0.0215sec

0.0215sec

0.63

0.63

6 queries

6 queries

GZIP Disabled

GZIP Disabled