QUOTE(pinksapphire @ Jan 31 2021, 02:24 PM)

I'm a newbie, and not much of a chart, bla bla person.

But, isn't this the right mentality we should have?

I know Bursa is very irrational (what I've learnt since I joined stock journey), and fundamentals seem to mean little, but I still think it will prevail, so long as we have holding power and patience to wait for years if the price doesn't go up. I'm in 30%+ losses on average for the gloves, but I'm unfazed already by now because of this. I could be wrong according to those few people who scolded me for being stupid to hold on, but...for now, I remain to my stand (and risk losing more, haha).

I welcome any thoughts about mindset change. It's a good weekend for self reflection, lol

You initiated a good topic of discussion

Someone has highlighted the point that fundamental does prevail over time, you just gotta be confident that your derivation is more likely to be correct than not.

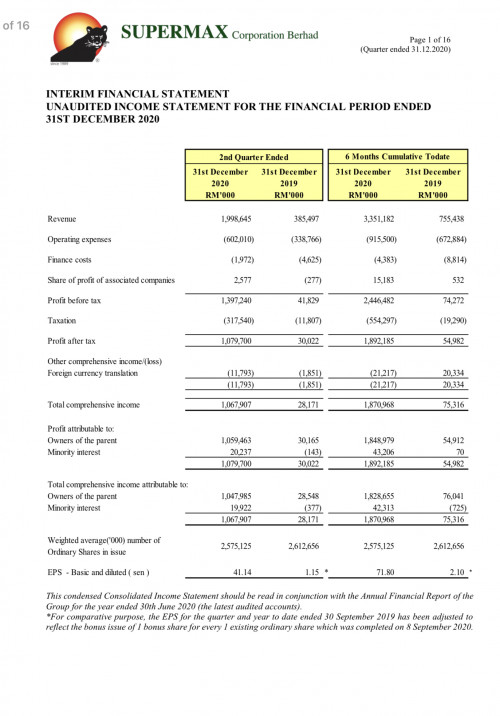

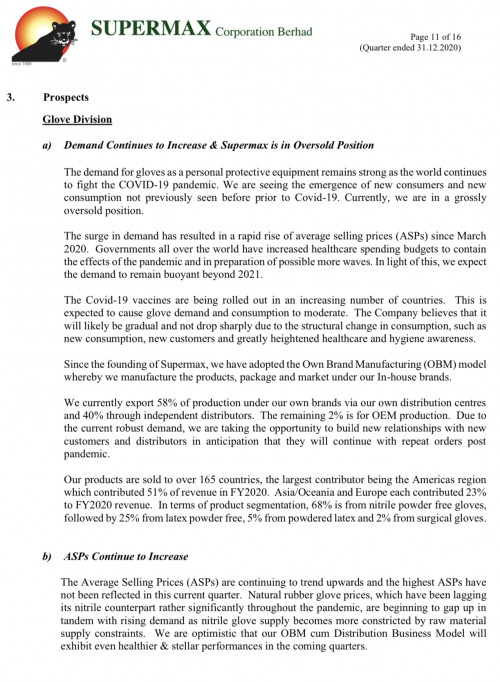

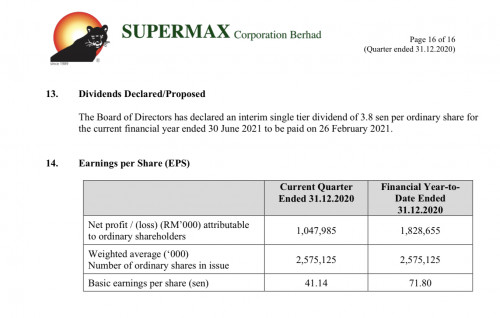

Without getting into the nitty gritty, the logic behind earning money through investing is to make sure you invest in a company that is profitable, and will continue to be so in years to come. As long as the company earns money, you will earn money..

If you really are a long term investor and hold strong conviction to the companies you invest in, please ignore the noises from naysayers..nobody would remember topglov factories closing down because of covid cases..short selling...short squeezing...yada yada..It doesn’t matter in 5..8..10 years down the road...really..investing doesn’t necessarily need to involve conspiracy theories..keep it simple between you and the company performance is suffice.

If you have the holding power..consider DCA regularly into the companies you strongly believe in as long as they remain profitable..over time as you keep investing with discipline..the average cost would flatten out..

Don’t buy into the “paria” mentality of “trapped in high floor” la, “living in penthouse” la..these terms sound really absurd in the eyes of investors who started their investing journey reading great quality books like “the intelligent investors”, “security analysis”, “one up Wall Street”. Just my 2 cents..

This post has been edited by MedElite23: Jan 31 2021, 11:12 PM

Jan 26 2021, 02:12 PM

Jan 26 2021, 02:12 PM

Quote

Quote

0.1003sec

0.1003sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled