Hahaha, this is very worrying. Feels like a distribution, those sectors with a lot of retailers paritcipation it is best to avoid now

STOCK MARKET DISCUSSION V150

|

|

Feb 9 2021, 09:49 AM Feb 9 2021, 09:49 AM

Return to original view | Post

#1621

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

|

|

|

Feb 9 2021, 09:54 AM Feb 9 2021, 09:54 AM

Return to original view | Post

#1622

|

Senior Member

2,282 posts Joined: Sep 2019 |

Energy index continues looking good, financial index looks like going to breakout, but again wait for clear confirmation signal

|

|

|

Feb 9 2021, 10:18 AM Feb 9 2021, 10:18 AM

Return to original view | Post

#1623

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(ChAOoz @ Feb 9 2021, 09:30 AM) Interest rate is like gravity for stocks and bonds. Bringing the rocket ship back to earth. Since you are inversing good for you. I think it is going to inflate stocks in the short run,The most funny thing is now almost everyone is expecting the 1.9T stimulus to inflate all stock, it could actually inflate interest rate even faster lol. That would be quite a pleasant surprise. I am not sure which way it will go so 50/50. In the long run, Its going to inflate commodities, gold, bitcoin (if it somehow still has more room for upside) and silver most prolly. |

|

|

Feb 9 2021, 03:28 PM Feb 9 2021, 03:28 PM

Return to original view | Post

#1624

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(joeblow @ Feb 9 2021, 03:24 PM) This market is strange. Big fund collect finish liao release newsGenting Malaysia is up for 2 days, despite it being closed down until 18th Feb, CNY rush no more. Not sure what's the catch here. TM also up 3% plus, not sure for why. 5G news or just plain stable cash cow? I guess people complain about electricity bill but not broadband. Our broadband still remains one of the slowest and most expensive in the region. https://www.theedgemarkets.com/article/mala...t-revive-travel https://www.freemalaysiatoday.com/category/...tions-for-free/ https://www.malaymail.com/news/malaysia/202...cientis/1948051 End of Feb start cucuk people already, riding the cucuk wave, but logically speaking can only finish cucuk everyone in Feb 2022 This post has been edited by HereToLearn: Feb 9 2021, 03:33 PM |

|

|

Feb 9 2021, 05:49 PM Feb 9 2021, 05:49 PM

Return to original view | Post

#1625

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(1tanmee @ Feb 9 2021, 05:31 PM) Not sure why property sector is still lagging, since the recovery plan theme is in play? Fundamental still weak for a foreseeable future, or no big news to jack the price higher? Oversupply. Until next year price wont rebound 1tanmee liked this post

|

|

|

Feb 10 2021, 09:55 AM Feb 10 2021, 09:55 AM

Return to original view | Post

#1626

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

|

|

|

Feb 10 2021, 02:58 PM Feb 10 2021, 02:58 PM

Return to original view | Post

#1627

|

Senior Member

2,282 posts Joined: Sep 2019 |

Finance index looking good, carrying KLCI.

|

|

|

Feb 10 2021, 03:03 PM Feb 10 2021, 03:03 PM

Return to original view | Post

#1628

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(lauwenhan @ Feb 10 2021, 03:02 PM) Today all retailers goreng. No foreign buying. Be careful Malaysian retailers always betray each other and dump on strength. After pump one sector, they will dump it and rotate to the next sectorNeed local institutions to start buying to show confidence This post has been edited by HereToLearn: Feb 10 2021, 03:03 PM |

|

|

Feb 10 2021, 03:16 PM Feb 10 2021, 03:16 PM

Return to original view | Post

#1629

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Feb 10 2021, 03:34 PM Feb 10 2021, 03:34 PM

Return to original view | Post

#1630

|

Senior Member

2,282 posts Joined: Sep 2019 |

KLFI reaches 15000, looks like a breakout to me.

LETS GO!! |

|

|

Feb 10 2021, 05:03 PM Feb 10 2021, 05:03 PM

Return to original view | Post

#1631

|

Senior Member

2,282 posts Joined: Sep 2019 |

KLFI broke out, time to buy at dip. QRs will be better than most expected

|

|

|

Feb 11 2021, 12:27 PM Feb 11 2021, 12:27 PM

Return to original view | Post

#1632

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Feb 11 2021, 01:07 PM Feb 11 2021, 01:07 PM

Return to original view | Post

#1633

|

Senior Member

2,282 posts Joined: Sep 2019 |

Tesla dropped 5%, Elon musk's brother sold off a bit

This post has been edited by HereToLearn: Feb 11 2021, 01:07 PM |

|

|

|

|

|

Feb 13 2021, 01:08 PM Feb 13 2021, 01:08 PM

Return to original view | Post

#1634

|

Senior Member

2,282 posts Joined: Sep 2019 |

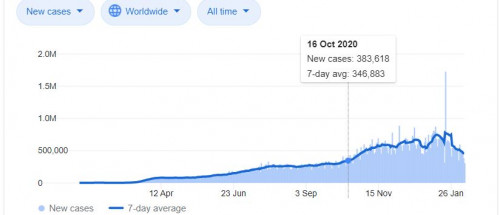

QUOTE(greyPJ @ Feb 13 2021, 06:39 AM) short sell I think he meant short sell counters that are covid-related/highly inflated stay-at-home counters because of covid cases dropping rapidly.What Is Short Selling? Short selling is an investment or trading strategy that speculates on the decline in a stock or other security's price. taming the virus i dont understand, if taming the virus, we should long buy arent we? Funds might rotate out of the these counters to recovery/get-out-home counters like restaurants, malls, casino, banks. Rally in these counters will come sooner than most expected.  Just compare the cases in UK and US with worldwide chart. I think it is pretty convincing to say that the vaccines are effective.   Vaccinating roughly 70% to 85% of a country’s population would enable a return to normalcy In the U.S., the latest vaccination rate is 1,656,452 doses per day, on average. At this rate, it will take an estimated 8 months to cover 75% https://www.bloomberg.com/graphics/covid-va...l-distribution/ |

|

|

Feb 13 2021, 04:32 PM Feb 13 2021, 04:32 PM

Return to original view | Post

#1635

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(greyPJ @ Feb 13 2021, 02:51 PM) ok thank you that makes sense liao. Political darurat ends on 1 Aug 2021, hence doesnt need darurat to stay in power.vaccine is one thing, what i worry is 18th feb mco, it cannot end coz mydin needs darurat to stay in power, darurat needs mco and high covid cases. so mydin most likely extend mco again with most businesses allow to run like now, and recovery stocks will drop like flies again once mydin make the announcement, he loves announcement. and mydin said once covid under control, we ll have election, klci gg again. current bull is a bull trap, imho. https://www.pmo.gov.my/2021/01/teks-ucapan-...n-khas-darurat/ But the MCO extension part might be true. But as long as business is allowed to run even under "MCO" condition. It is good enough. |

|

|

Feb 15 2021, 09:37 AM Feb 15 2021, 09:37 AM

Return to original view | Post

#1636

|

Senior Member

2,282 posts Joined: Sep 2019 |

Energy Index damn strong, strong evidence of early adoption of cyclical rotation

|

|

|

Feb 15 2021, 09:49 AM Feb 15 2021, 09:49 AM

Return to original view | Post

#1637

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(ChAOoz @ Feb 15 2021, 09:43 AM) Everyone is talking about the chip shortage during cny i guess haha. Mainstream news now keep going on and on about a shortage in chip with high demand recently, with Biden prioritizing semicon / foundry industry. Most are all lagging data points and stories. Not considering other sectors? Anyway this goes to show you narrative drive markets not actual fact. The actual fact is that on the ground there is already a chip demand / supply crunch on may last years, and on nov last year there is an industry wide supply chain impact hampering productions. Retailer will chase anything that goes up not knowing they might be chasing a tail end. For current I'm going to stay in bear camp for awhile, until i see a resilient Q1/Q2 FY21 report out on all those hardware giants like Apple/Intel/AMD/Nvidia etc. The dec / year end shopping season is over, this is a new year lets see is demand for consumer electronics still strong after everyone bought their fill on last year. If story has not change and demand continue to be resilient throughout the entire year then tech index 100 is not a dream. |

|

|

Feb 15 2021, 10:39 AM Feb 15 2021, 10:39 AM

Return to original view | Post

#1638

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Feb 15 2021, 10:51 AM Feb 15 2021, 10:51 AM

Return to original view | Post

#1639

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Feb 15 2021, 11:58 AM Feb 15 2021, 11:58 AM

Return to original view | Post

#1640

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

| Change to: |  0.0999sec 0.0999sec

0.99 0.99

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 11:30 PM |