QUOTE(Boon3 @ Oct 6 2021, 10:09 AM)

I was guessing this morning, basing on assumption of fully recovery and income from newer assets, my blunt guess is 40 sen DPU expectation is not unreasonable and given that the stock hadn't really rolled off the cliff, I guess it's wise to just hold the stock.

New at this.. so would you say my reasoning is too optimistic?

QUOTE(statikinetic @ Oct 6 2021, 10:17 AM)

I would think os as well, that is what I intend to do.

REITs because I consider them as more FI it is not a stock that should be traded often. The volatility just isn't there compared to other stocks, especially the small caps, so people who get into REITs tend to sit on them for a longer period of time in comparison.

ASB made Petronas renew the lease to 2034 before they started picking up the shares so there should be some stability for the long term.

I think it will come back. It is the sitting period now. One worry with downtown KL properties is the exposure to a potential office space glut. That was a real risk before the pandemic and with all the new spaces opening up. TRX for example. With the pandemic and the WFH wave, the question now is how bad the glut will be?

PETRONAS now practices 50% WFH 50% WIO from 1 Oct onwards (latest by 1 Nov giving employees a grace period of a month), Suria KLCC traffic might be continue staying slightly lower than pre-pandemic. Not sure how much %profit coming from Suria, if it is only a small portion it could be insignificant

QUOTE(qsrt1616 @ Oct 6 2021, 04:28 PM)

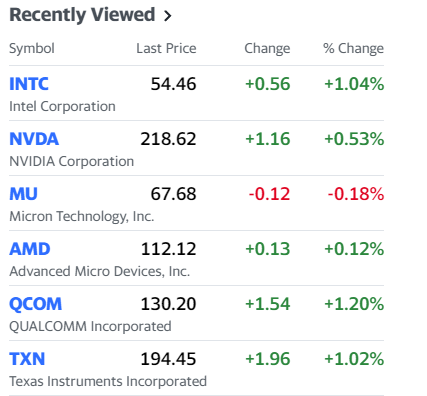

If on October 10, Bursa tech index I don't see 100, I dump almost all and keep MPI only

Haha

Where to next after 10 Oct (or earlier if it reaches 100)? Keep cash or rotate?

This post has been edited by HereToLearn: Oct 6 2021, 05:26 PM

Sep 17 2021, 05:04 PM

Sep 17 2021, 05:04 PM

Quote

Quote

0.1054sec

0.1054sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled