How's your Maybank?

Anyway, TGuan, for me, oil is the main factor.... I think u know la... but for company like TGuan, the initial higher oil prices is actually good for TGuan cos it does a have good management of its raw material inventory...blah blah blah... but such profits cannot sustain when its raw materials is based on the higher oil prices.

This one is actually one of the miss. Can't win it all.

Back in 2019... it was indeed in my watch list... 2 quarters of profit recovery ... and from a fundamental point of view... it should be worth a trade... but... it never showed......

the closest it came for me was end Oct 2019 ....

Around 2.80++ ..... was thinking ..... but hesitated ... cos it was out of my comfort setup ....

Next thing u know.... it gapped up following a very strong 2019 Q3 numbers... didn't feel like chasing....

And then of course ... March 2020 .... came.

This one was actually one of my alternate choice to whack ..... but since my mini water pistol, which only had one shot .... I gave this one a miss.

A really nice winner if one had jumped into since March...

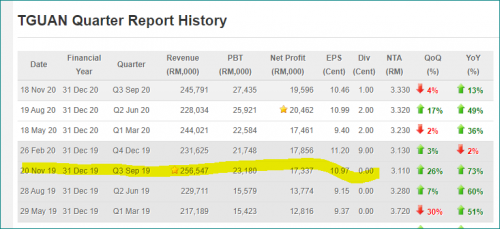

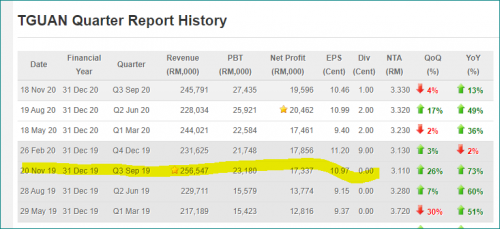

meanwhile ...the earnings since then...

The yellow one... was the earnings that popped in Nov 2019... but since then ..... earnings although good but... isn't really booming....

and oil prices.... has been up for a while already...

so moving forward... oil prices should eat into TGuan profitabilities already...

Ya... chart had to be reconstructed/adjusted for the recent bonus issue.... which now looks like this....

the main up trend from March 2020 is now gone ....

Jan 6 2021, 02:16 PM

Jan 6 2021, 02:16 PM

Quote

Quote

0.5909sec

0.5909sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled