QUOTE(icemanfx @ Jan 4 2021, 06:00 PM)

Noted, today closed above 1600, above the support, no clear direction, will see how tomorrow.STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

Jan 4 2021, 06:04 PM Jan 4 2021, 06:04 PM

Return to original view | Post

#1361

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

|

|

|

Jan 4 2021, 07:23 PM Jan 4 2021, 07:23 PM

Return to original view | Post

#1362

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(AVFAN @ Jan 4 2021, 07:08 PM) so very boleh... great earnings & dividends but market cap wiped off big time! Maybe because forward23 PEs are still high formy records on current qtrly annualized PER: TG 4.7 Spmx 4.7 Harta 16.4 Kossan 7.2 29 dec, EPF incr stake in TG: Harta 19.4 Topglov 16.8 When it was downtrending for the KLCI heaviest weights (banks), some KLCI banks went to forward PE 6. Still have a lot of room to drop for gloves. Harta and Topglov are still considered 'pricey' in terms of foward23 PE when compared to the banks. Regardless, the whole KLCI might continue dropping due to this + RSS combo https://www.malaysiakini.com/news/557560 This post has been edited by HereToLearn: Jan 4 2021, 07:24 PM |

|

|

Jan 4 2021, 08:22 PM Jan 4 2021, 08:22 PM

Return to original view | Post

#1363

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Syie9^_^ @ Jan 4 2021, 08:10 PM) All these guns focus on SBB, Director BB..how much pool left for market? How much is needed to reach that point though? Who want to be the last few one holding the shares though? Whats the point of holding the shares just to make the share prices go up, but cannot use because cannot sell QUOTE(Syie9^_^ @ Jan 4 2021, 08:21 PM) More reasons for KLCI to continue dropping tomorrowThis post has been edited by HereToLearn: Jan 4 2021, 08:25 PM |

|

|

Jan 4 2021, 11:00 PM Jan 4 2021, 11:00 PM

Return to original view | Post

#1364

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(skty @ Jan 4 2021, 10:57 PM) just finish long distance driving and now back to my place. Look at the bright side, if tomorrow dive another 10-15%, you will be glad you didnt buy more todaymiss this internet connection. took a look at the data, god dammit, regret never buy more today. but oh well, family gathering is precious. |

|

|

Jan 5 2021, 09:06 AM Jan 5 2021, 09:06 AM

Return to original view | Post

#1365

|

Senior Member

2,282 posts Joined: Sep 2019 |

Vix Up + RSS + ISinar + PN going out bersatu

Trade carefully |

|

|

Jan 5 2021, 12:00 PM Jan 5 2021, 12:00 PM

Return to original view | Post

#1366

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(howyoulikethat @ Jan 5 2021, 11:31 AM) When reports are out that ASPs have fallen substantially, I will cut. Otherwise, I think I can hold a year bcause my Harta is tiny sum & TG is giving dividends which beats FD. Might be too late after that. People would have dumped all in advance. No one wants to be the last few ones holding value-decaying stocks.I don't practise cut-loss when stocks drop to a certain percentage, like 15%. Why? Previously, I cut Maybank at 15%, & saw it recover above my buy price. |

|

|

|

|

|

Jan 5 2021, 12:04 PM Jan 5 2021, 12:04 PM

Return to original view | Post

#1367

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jan 5 2021, 03:00 PM Jan 5 2021, 03:00 PM

Return to original view | Post

#1368

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jan 5 2021, 03:25 PM Jan 5 2021, 03:25 PM

Return to original view | Post

#1369

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Boon3 @ Jan 5 2021, 03:09 PM) Here's a dumb question.... I will try answering them, but bro, I newbie, I am heretolearn from pros. if the gloves sector is being hit with so many RSS... 1. Does it make sense, that one should die die fight with all these RSS gangstas? 2. Do you think these RSS players got valid reason to bet against glove makers ah? 3. Do you think maybe they don't like TG boss? Is it face? Or how he talks? (I really dunno okay... this why I am asking) 4. b4 Covid19 .... Bursa already got RSS.... why during those times, ppl still can make money ah? 5. If you get into a fight ... do you wanna fight with a 500lb gorilla? or do you think it's smarter to fight with an 50lb aunty? 1. It doesnt make sense to me UNLESS it is undervalued and showing up-trending signal 2. YES la, IF they can short and make money, who doesnt want to short lol 3. No comment, I tak tau 4. why during those times, ppl still can make money ah? (I am assuming u are saying people back then can make money by buying not shorting) People are still making money now without shorting. Maybe back then less bubbles? Harder to get shorted and lose money? The SS suspension for 9 months has allowed some sectors to go into bubble-ish valuation. back then with RSS and IDSS, bubbles are harder to form? 5. QUOTE(icemanfx @ Jan 5 2021, 03:23 PM) Like goreng; timing and opportunity is critical else could lose a lot of money. I definitely agree on the bolded statement. We might see bubbles popping/deflating here and here across different sectors soon.most goreng counters are venerable to rss. rss won't be limited to gloves sector only. topg after deployed big gun of dividend distribution, what arsenal is left to defense next round of rss? if tansri believe fair value is higher than rss tp, could buy back at cheaper price later than defending it. This post has been edited by HereToLearn: Jan 5 2021, 03:27 PM |

|

|

Jan 5 2021, 03:33 PM Jan 5 2021, 03:33 PM

Return to original view | Post

#1370

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(skty @ Jan 5 2021, 03:28 PM)  don't need to worry about RSS. I am serious. if you put yourself in their shoe and think why they choose glove sector instead of other inflated sectors, there is a reason. they are very smart. One stone kill 3 bird. Can earn 3 times with one exercise. just play along. I am leveraging on their RSS for my position. Who doesnt want to short when there's money to be made? |

|

|

Jan 5 2021, 08:10 PM Jan 5 2021, 08:10 PM

Return to original view | Post

#1371

|

Senior Member

2,282 posts Joined: Sep 2019 |

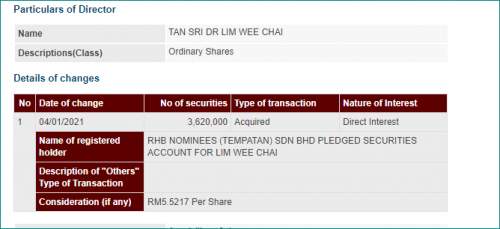

QUOTE(gapipig @ Jan 5 2021, 05:05 PM) Do you think now is a good time to enter LSTEEL ? Based on the pattern, it'll drop to around 0.63-0.64 before rebounding upwards to the realm of 0.7-0.8. Bro, very dangerous, LSTEEL loss making, no guarantee that it will turn around next q. I think steel up solely due to operators goreng. No real investors in that counter. You will get burned very painfully if you invest. Make sure set stop lossQUOTE(Boon3 @ Jan 5 2021, 06:31 PM) And this is getting messed up ... Report to SC, I am waiting below RM3.Seriously Tg boss needs a financial advisor. You simply cannot out of the blue announce a special dividend of 20%, and you go buy shares on the company on the very same day. I wonder how many will take this posting seriously. The special dividend : dated 4th Jan. https://www.bursamalaysia.com/market_inform...?ann_id=3118323 and ... checkout the boss buying on the same very date ...  MISTAKE!!! ahhh.... I have made a mistake. There's actually a chance that the boss could get those shares late in the afternoon..... and I sincerely pray that he did...  Rechecked the trading data ..... and yes , late in the afternoon, stock did trade back lower at 5.50. It's gonna be close. The guy/gal that purchased those shares for him, better have a time stamp on when he purchased the shares... as this is an extremely sensitive issue. You cannot buy the shares and then make such an announcement.... QUOTE(AVFAN @ Jan 5 2021, 07:57 PM) with this kind of news, can expect bursa to get f'ed tmr. Lai liao, more empty units. More supply, property crashing liao.FF will sell all out, short as much as they can? can't blame any menteli or DG for "extend, extend again CMCO,RMCO, EMCO" since there is actually 1-2K cases a day. and that is dependent on no. of tests they do... possible 4-5K if they test more. brace, brace... whatever counter u have or think u wanna get into! |

|

|

Jan 5 2021, 08:43 PM Jan 5 2021, 08:43 PM

Return to original view | Post

#1372

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(AVFAN @ Jan 5 2021, 08:20 PM) property already dead, going deader. Agreed, still waiting for the property correction to buy a unit the shit we r getting now is WORKPLACES. and 99% workplaces have foreign workers incl illegals. what the F will anyone do about it? btw, i know u r a big fan of BANKS... cimb, bimb, etc... did u buy them or still waiting? i also know u no like gloves, sure wait for TG rm2-3...maybe rm1?! I bought banks already last time, sold all, rebought again when KLFI tested 15000, sold a lot again end of last year (still keeping BIMB for the restructuring although I trimmed my position in some other cheap banks); I want to see the impact of RSS on all sectors before buying anything, give myself 1 week to observe. I have like 70% cash 30% equities (71% of the 30% equities in banks) I like everything that is cheap bro, thats why waiting gloves, gcb etc to drop to enter. I am waiting gloves at forward23 PE of 8, which is not too absurb la IMO. Last time, during the downtrend KLCI banks went to forward PE of 6, I got in around forward PE of 7-8 for some counters and had to die die hold until they cameback. I do realize that I possibly have to wait until next year for gloves to drop until my desired entry la I only dont like OnG, steel - even if OnG cheap I also dont dare buy because I scare RE will almost completely replace OnG sooner than expected. This post has been edited by HereToLearn: Jan 5 2021, 08:45 PM |

|

|

Jan 6 2021, 12:33 AM Jan 6 2021, 12:33 AM

Return to original view | Post

#1373

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(pinksapphire @ Jan 5 2021, 11:29 PM) Lower the price, so that the price-to-rent ratio is reasonable for entry for a cheapskate like me.QUOTE(AVFAN @ Jan 5 2021, 11:40 PM) thanks for frank comments! Looking at both subsales and auctions, none in my intended area of stay has reached my desired entry price. Can only continue waiting patiently property... i think if u look hard for subsale now, esp highrise, there are plenty of desperate sellers; landed... maybe less so. it's always nice to get something "great" at ultra low price but that does not happen all the time. for any sector, it all depends on what u believe in which is largely driven by what u read and how yr brain analyze/decipher them. e.g. if u read this one, u gotta got go all in bank stocks now, but do read the assumptions... which i dun buy at all! for gloves... i can see u repeatedly use "forward PE", which i understand to mean u definitely see ASP dropping bad in 2022. again, it depends on what and where u read them. what i read, more and more are accepting strong ASP in 2021 thru 2022, stretching into 2023, e.g: and if 12.5bil profit is probable, a desired stock price of rm3.5 will mean a PER of 2; if dividend is rm1, yield is 28% - a very bizarre scenario, dun u think? so, it is either the PAT forecasts are awfully wrong or your expectations of the stock price going that low is rather absurd for 2021-2022. however, except demigods, no one can say which scenario is right or wrong. and therein lies the challenge for any investor or bystander. of course, there is the bigger picture of global economy, local economy, local politics, natural disasters, etc. to consider as well. I just had a glance at analysts reports released for Topglov today (not going to read for each glove counter, reading one just to check if the ASP projection has changed), they did not revise the earnings forecasts - this tells me that from analysts' views, the ASP is still expected to drop in 2022 and more in 2023. They only revised the DY At 3.5 (PS: this is not my desired entry price) EPS PBB : 91.5 in 2021 and 44.2 in 2022, no data for 2023 (this use CY) MIDF: 104.4 in 2021 and 43 in 2022, 25.9 in 2023 (this use FY) I know FY and CY is different by a QR for Topglov but dont bash me for using this to get average EPS. (Yes, we should not only use data from 2 analysts, I have more data from other analysts in my excel but those are older data - one might argue those are old data releasd in Nov/Dec and hence not as valid - so I am not presenting them here, just using the latest one) Average EPS: 97.95 in 2021 43.6 in 2022 25.9 in 2023 PE using RM3.5: 3.57 in 2021 7.56 in 2022 13.5 in 2023 rm3.5 will mean a PER of 2; if dividend is rm1, yield is 28% - a very bizarre scenario, dun u think? It will mean a PER of 3.57, but still bizzare But since the PE will drop in the next 2 years (-50%, then -40%), I will not buy for its DY%. Maybe 3.5 is unlikely this year, but 3.5 next year is possible. I dont want to bet now because I foresee the stock price could be a lot lower. This post has been edited by HereToLearn: Jan 6 2021, 12:36 AM |

|

|

|

|

|

Jan 6 2021, 09:21 AM Jan 6 2021, 09:21 AM

Return to original view | Post

#1374

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Boon3 @ Jan 6 2021, 08:42 AM) When it falls that low, it would mean that the ASP would have normalised by a fair bit. At that point, what's the catalyst to drive the stock higher? What's gonna seduce others to buy? Agreed. Even with no catalyst to drive the stock higher, but I would buy and hold this FMCG counter when it is below 3 though. Slow old man method of making money |

|

|

Jan 6 2021, 09:36 AM Jan 6 2021, 09:36 AM

Return to original view | Post

#1375

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Boon3 @ Jan 6 2021, 09:31 AM) LOL! Noted with thanks. Hahaha, I will only buy when there is an uptrend signal below my FA entry. It's okay. Deep down, there's many like you, who would never agree. It is what it is. You are taught skin deep about value.... all the sexy stories you hear Warren Buffett buying of badly beaten down businesses.... You hear about the famed value investor who lost his job betting on C during the 2008 crash? He bought from 60 all the way down to the 20s.... lost millions and millions (can't remember if the tally reach billions) .... and then he got fired..... Live and die by the same sword, I guess. Anyway, you would actually run higher risks........... seen it way too many times b4.... once it goes bust, never be a smarty pants. The boom might not happen in many, many years..... you know the phrase 'all dressed up but no where to go?' but yeah ..... Lessons learnt from buying the banks last time purely based on FA. Although, still earned in the end. QUOTE(ChAOoz @ Jan 6 2021, 09:34 AM) If the glove bubble were to burst, go get Harta instead of TG. Waiting at 4One is playing stock market, one is still concentrating to win over the competition and change the industry. This post has been edited by HereToLearn: Jan 6 2021, 09:39 AM |

|

|

Jan 6 2021, 09:53 AM Jan 6 2021, 09:53 AM

Return to original view | Post

#1376

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Boon3 @ Jan 6 2021, 09:46 AM) okay... this is what I think... 3.5 is JP value le, not mine. My safe FA entry is lower than 2.6 based on forward23 PE using currently available data.if it goes to 3.50 ... on second thoughts, why so hung up on 3.50? Say 3 bucks la.... by then... we are are looking at the fact that ASP had indeed reversed back sharply to around usd70 (which actually isn't that drastic of an assumption cos pre covid, it was usd17) so fy 2019 it's 370 million. fy 2018 it's 425 million. So if covid ends and assuming no new shit virus, is there not a chance that TG would only make say 550 million profit? if so .... can understand why it's a no go at 3.50? It is possible, so I will definitely update my excel when analysts have data for FY24 NP. IF it is projected to be lower, I will definitely take that into account and use a lower FA entry. |

|

|

Jan 6 2021, 10:24 AM Jan 6 2021, 10:24 AM

Return to original view | Post

#1377

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(ChAOoz @ Jan 6 2021, 09:56 AM) Let it die first haha. For me a good time to buy is maybe more than 8 quarters of continue revenue and profit decline ? By then should shake out every one already. I am more optimistic, I think another 1-2 year should be enough to shake out most people.The glove industry as a whole might need anywhere between 2 - 5 years to shake out weaker players and normalized their margin erosion. Could be longer this round, due to the fact that other international player such as China/Thailand is looking into this industry. QUOTE(Boon3 @ Jan 6 2021, 09:56 AM) Forward PE of 8 using FY2023 NP. By 2023, earnings would have stabilized. Bukan Forward PE of 23. |

|

|

Jan 6 2021, 10:58 AM Jan 6 2021, 10:58 AM

Return to original view | Post

#1378

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(greyPJ @ Jan 6 2021, 10:50 AM) QUOTE(AVFAN @ Jan 6 2021, 10:55 AM) the earlier one is 1 week ago, comments from a local banker. Finance index now tesing 15000, if it breaks below, we will go to 14450this new one is form fitch, big global rating agency. https://www.theedgemarkets.com/article/fitc...tive-banks-2021 which one does market take heed? seriously, take a look around - how are banks going to fly if properties cannot sell... higher NPL provisions, etc.? |

|

|

Jan 6 2021, 11:02 AM Jan 6 2021, 11:02 AM

Return to original view | Post

#1379

|

Senior Member

2,282 posts Joined: Sep 2019 |

Looks like KLCI has the chance to go 1550. Trade safely guys

|

|

|

Jan 6 2021, 02:10 PM Jan 6 2021, 02:10 PM

Return to original view | Post

#1380

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Kadaj @ Jan 6 2021, 01:27 PM) Don't you guys and gals think that most of the stock prices inflated too much comparing to pre-covid era? I totally agree, especially the 'techs'. Abit too overrated. Is the stock price really reflect that the business is twofold / threefold better than pre-covid or it's just the bubble getting bigger and bigger? I am thinking of moving out of bursa and join the emerging markets that have a lot of FDI via unit trust. For techs, their PE damn... not sure why they havent start shorting these techs. If the growth is sustainable for years, then ok la, but we dont know yet lo Just few examples: Greatech FY22 estimated EPS is 25.9 UWC FY23 estimated EPS is 26 As of current price, Greatech FY22 forward PE is 36 at RM9.48 UWC FY23 forward PE is 37.5 at RM9.75 They are definitely not cheap if they cannot grow the earnings after 2023, especially when FD is raised back later. But if they can sustain their growth rate even after 2023, then definitely can consider, but now no projection data for after 2023 yet QUOTE(statikinetic @ Jan 6 2021, 01:42 PM) KLCI is higher today than a year ago before Covid. Because of contribution from Topglov and Harta, they are till up a lot compared to pre-covid. Totally carried the KLCIAnd we haven't received the vaccine yet and are averaging 2k Covid cases a day. This post has been edited by HereToLearn: Jan 6 2021, 02:14 PM |

| Change to: |  0.0912sec 0.0912sec

0.44 0.44

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 03:14 PM |