Sharing is caring. Fwd fr a friend, so no idea how to credit the author of this article. But my preference is still Smax from the list below.

RUBBER GLOVES - Preflop pocket aces & your opponent went all in. Do you fold?

It's now 1 week post Pfizer vaccine news. Moderna just came out with further positive news on their trial results. Vaccine is a good thing, we should celebrate that the pandemic will soon be over. But, how soon is soon? And is it game over for rubber glove play?

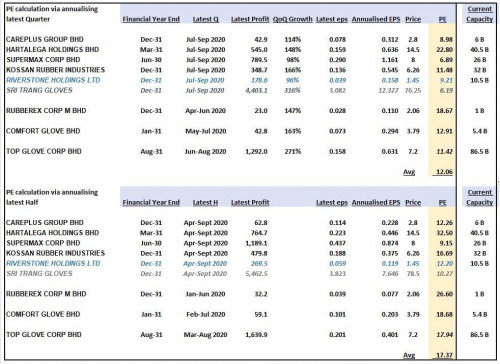

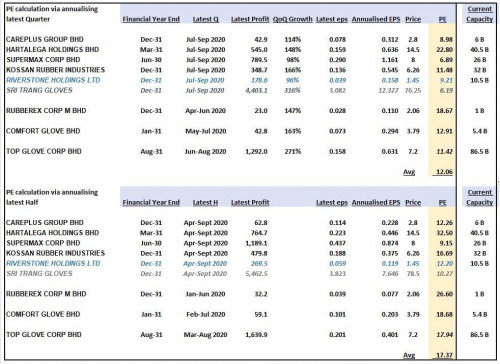

In the image attached, I have updated the latest "apple to apple" peer analysis of the first and second tier rubber glove players in Malaysia (and Sri Trang). It's divided in 2 sides, one is if we "simply" annualise (x4) the latest quarter, while the other is if we "simply" annualise the latest 2 quarters / half (x2) - an exercise to guesstimate earnings in 2021 & perhaps beyond. It's worth noting that last checked, ASP is still on the rise, as global second wave of COVID19 is happening so there may be a case to use simple annualisation on past 2 quarters.

And what do we see? We see an industry average PE of around 15x. In my opinion, this is cheap. Recall, this is an industry of which 1) we have earnings visibility of around 1 year 2) windfall of cash as deposit are paid up front to secure order 3) demand & supply imbalance that will continue to be inelastic until at least end 2022 / early 2023 4)

which will lead to prolong elevated ASP level which cause fat margin. 5) Explanation of 1-4 is sector specific and if we compare valuation of rubber glove vs some tech stocks across varying value chain - glove’s fundamental is better and it’s relatively undervalued.

Vaccine is definitely a good thing, there’s a global effort to produce is as fast as possible, but even if this is the case, when’s the earliest it can be mass produced? what about getting them administered to a sizeable portion of global population? Rubber glove is now in phase 2, the part which is the most volatile. The part where the industry will be tested agaisnt it’s biggest enemy - the test of time.

We are seeing money flowing from healthcare stocks to recovery play, this is all fine and well. I personally have diversified too, but

how many of those recovery play can be backed by a certain visible profit and cash? At the end of the day, stock investment needs to fall back to d fundamentals and in the glove industry, we are pre-flopping a pocket Aces in terms of fundamentals. Why do you think more than 15 players in KLSE are moving into glove? Willing to take hundred millions of risks of investment? It's because they would like to have a scrape of the supernormal profit, even if it's at the tail end of 2022. Rerating of glove feels like it already happened, but it's premature, in my opinion.

A note on glove newcomers, we see alot of daily trading volume in some of the names like AT system. Some names are being valued close to the 2nd tier names that's already operating with all relevant CE or FDA certifications. I personally don't believe its so easy to just plug n play. The profit estimates being flashed around are also taking the combination of the most bullish scenario. If these newcomers can achieve such profit without the economies of scale, ability to manage production without downtime and at full efficiency, best ability to negotiate with clients, etc - then by the same logic you should bet on the first tiers of making even more extraordinary gains on the basis of profit per glove! What I’m saying is, if u think u r rationally investing in some of these counters, esp those that had gone up a lot in price, your money’s worth at investing in the first tier counters at current prices makes a lot more logical investment.

Stick to the blue chip in the industry. If you have zero holding of gloves, it's a good time to buy & invest some for your portfolio. There’s a room for rubber glove in any portfolio.

There should be another round of selloff tmr from Moderna vaccine news. The fear is reaching the peak. Those trading Or having 0 position can consider to enter. Personal Top pick right now: RIVERSTONE. It’s trading at 12x PE & it has dual engine of growth. Just my 2 cents.

Demand & supply imbalance that will continue to be inelastic until at least end 2022 / early 2023 4)

The thing is almost all analysts say ASP will peak in 1H2021. I definitely agree with you that the NP for the CY2021 will be even better than this year. But in CY2022, the NP will be 1/2 of the NP in CY2021.

How many of those recovery play can be backed by a certain visible profit and cash?

No one can escape from utilities, banks and OnG.

Stick to the blue chip in the industry. If you have zero holding of gloves, it's a good time to buy & invest some for your portfolio. There’s a room for rubber glove in any portfolio.

I partially agree, there's room but not a good time to invest. To short term trade, yes. Only when the rubber gloves blue chips drop to the price such that they are trading at low PEs even in CY2022, contrarian value investors will start buying them

Nov 17 2020, 10:43 AM

Nov 17 2020, 10:43 AM

Quote

Quote

0.0861sec

0.0861sec

0.73

0.73

7 queries

7 queries

GZIP Disabled

GZIP Disabled