QUOTE(owodog91 @ Mar 25 2019, 10:55 AM)

Just redeemed two ticket of round trip Penang-London flight with 112,400 Enrich miles by just paying 1615 Ringgit tax

Economy ? Decent rateThis post has been edited by digidigi: Mar 25 2019, 11:08 AM

Loyalty Cards Frequent Flyer and Traveler Loyalty Card, Air Miles and Hotel Discussion

|

|

Mar 25 2019, 11:06 AM Mar 25 2019, 11:06 AM

Return to original view | IPv6 | Post

#41

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

|

|

|

|

|

Mar 25 2019, 12:17 PM Mar 25 2019, 12:17 PM

Return to original view | IPv6 | Post

#42

|

Senior Member

1,745 posts Joined: Jul 2015 |

QUOTE(charlesj @ Mar 25 2019, 12:12 PM) Your redemption value is ok, quite decent. As u said, if want redeem economy, use enrich.At least you get about 5 cents / mile (definitely can't compare to J class). This is especially true when you have excessive Enrich miles. Equivalent route with KF will cost 152k miles! MAS J class redemption is overpriced ~500k miles for two return tickets! I am still exploring how to best utilize the Enrich miles... Some people are just swimming in miles, they just want to pay as little upfront cash as possible. |

|

|

Mar 25 2019, 02:00 PM Mar 25 2019, 02:00 PM

Return to original view | IPv6 | Post

#43

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

|

|

Mar 25 2019, 08:07 PM Mar 25 2019, 08:07 PM

Return to original view | IPv6 | Post

#44

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

|

|

Mar 25 2019, 08:55 PM Mar 25 2019, 08:55 PM

Return to original view | Post

#45

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

|

|

Mar 25 2019, 09:20 PM Mar 25 2019, 09:20 PM

Return to original view | Post

#46

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

|

|

|

|

|

Mar 25 2019, 09:24 PM Mar 25 2019, 09:24 PM

Return to original view | IPv6 | Post

#47

|

Senior Member

1,745 posts Joined: Jul 2015 |

QUOTE(rivetindigo @ Mar 25 2019, 09:02 PM) Sigh...im just started accumulating miles from my cc for this past 3 month...really2 want to try business or first class tho Krisflyer and asiamiles, hmm enrich just forget abt it, their product is inferior compare to competitor, one things I value much is cleanliness , this is the part MH FALL WAY WAY behind other Asian carrierSo which airmiles is really worth it? |

|

|

Mar 30 2019, 09:52 PM Mar 30 2019, 09:52 PM

Return to original view | IPv6 | Post

#48

|

Senior Member

1,745 posts Joined: Jul 2015 |

QUOTE(rivetindigo @ Mar 30 2019, 09:37 PM) If i need confirm seats, means i need to get advantage? You need to check first, on sq sometimes advantage also on waitlist or not even availableSorry im really new with this airmiles thing...🙏 Currently comparing enrich 130k (business class) for tokyo vs krisflyer 140k (sq)... |

|

|

Apr 1 2019, 12:08 AM Apr 1 2019, 12:08 AM

Return to original view | Post

#49

|

Senior Member

1,745 posts Joined: Jul 2015 |

QUOTE(billywee @ Apr 1 2019, 12:05 AM) Hello guys, I'm planning to redeem Qatar business class using Asia miles, just wondering if it only show the miles needed for the route and didn't show "waitlist" means it is a confirm seat? One world alliances redemption on Aisa miles only show available seat, waitlist only on Cathay.I not yet transfer my point to asia miles just want to double confirm before transferring it and want to know does anyone redeem before Qatar flight using asia miles? Just be mind though a return ticket to Europe with Qatar using aisiamiles will cost around 3k ringgit for carrier surcharge |

|

|

Apr 2 2019, 12:12 PM Apr 2 2019, 12:12 PM

Return to original view | IPv6 | Post

#50

|

Senior Member

1,745 posts Joined: Jul 2015 |

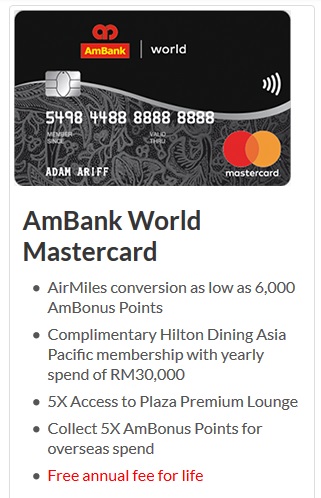

QUOTE(charlesj @ Apr 2 2019, 11:28 AM) Anyone spot it? How much ampoint per one ringgit spend? Airmiles redemption rate is reduced to 6000 from 7000. Nevertheless, it is still lower than the initial 5000. Hopefully this is not typo as the redemption catalogue is still showing 7000 (till 31-Mar). Looks like at lot people are dumping their Amb CC and they need extra effort to gain back the crowd. Haha! 1 for 1? I only saw it reward 5 point for spending made oversea... This post has been edited by digidigi: Apr 2 2019, 12:14 PM |

|

|

Apr 2 2019, 12:20 PM Apr 2 2019, 12:20 PM

Return to original view | IPv6 | Post

#51

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

|

|

May 2 2019, 10:33 PM May 2 2019, 10:33 PM

Return to original view | IPv6 | Post

#52

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

|

|

May 4 2019, 10:06 AM May 4 2019, 10:06 AM

Return to original view | Post

#53

|

Senior Member

1,745 posts Joined: Jul 2015 |

QUOTE(cybpsych @ May 4 2019, 06:07 AM) Hong Leong Bank and Emirates Skywards Partner to Launch Emirates HLB Cards This card not bad Dr Nejib Ben Khedher, Senior Vice President, Emirates Skywards, Domenic Fuda, HLB Group Managing Director and Chief Executive Officer and Perry Ong, Country Manager, Malaysia and Brunei, Mastercard during the launch of Emirates HLB Mastercard cards in Kuala Lumpur recently. · Daily spends on Emirates HLB cards earn Skywards Miles redeemable for flight rewards on Emirates and partner airlines · Welcome bonus of up to 10,000 Skywards Miles · Attractive benefits including first year anniversary bonus rewards, complimentary Emirates Lounge access, airport transfers and golf privileges Kuala Lumpur, 2 May 2019 Hong Leong Bank Berhad (“HLB” or “the Bank”), one of Malaysia’s leading financial service organisations and Emirates Skywards, the award-winning loyalty programme of Emirates and flydubai, have launched a new range of co-branded credit cards for customers in Malaysia. The Emirates HLB cards were launched in Kuala Lumpur by Domenic Fuda, Hong Leong Bank Group Managing Director and Chief Executive Officer, Dr Nejib Ben Khedher, Senior Vice President, Emirates Skywards and Perry Ong, Country Manager, Malaysia and Brunei, Mastercard. The Emirates HLB card portfolio comprises three variants - the Emirates HLB World Elite, the Emirates HLB World and the Emirates HLB Platinum card- and is designed to offer a host of exclusive benefits to customers with diverse requirements and interests. The credit cards will be supported by network provider Mastercard. Emirates HLB card holders can hit the ground running with a sign on bonus of up to 10,000 Skywards Miles after their first spend and can also earn Miles at a higher rate when purchasing flight tickets directly with Emirates and on any eligible international spends. Emirates HLB World Elite and World card customers will also be offered complimentary access to the Emirates Lounge in Kuala Lumpur and Dubai and Emirates Skywards Silver membership for one year, unlocking exclusive perks such as priority check-in, boarding and additional checked baggage allowance on Emirates flights. Subject to minimum spend criteria, World Elite and World customers will also be eligible to receive up to 160,000 bonus Skywards Miles which can be redeemed for a Business Class return ticket on Emirates between Kuala Lumpur and Europe. According to HLB Group Managing Director and Chief Executive Officer Domenic Fuda, the partnership with Emirates Skywards is part of the Bank’s strategy to accelerate the growth of its payments’ business, leveraging on the growing travel segment in Malaysia. » Click to show Spoiler - click again to hide... « Some of the unique benefits that customers can access with their Emirates HLB cards include: Earning Skywards Miles for transactions at the rate of up to 2.5 Miles per MYR 4 spent Welcome bonus of up to 10,000 Skywards Miles First anniversary Skywards Miles bonus of up to 160,000 Miles upon meeting a minimum spend criteria. The bonus Miles can be redeemed for a return Emirates Business Class ticket from Kuala Lumpur to European destinations Emirates Skywards Silver membership for one year Complimentary access to Emirates Lounges in Kuala Lumpur and Dubai Complimentary airport transfers in Malaysia and golf access privileges globally Customers can visit https://www.hlb.com.my/emirates for more information on the Emirates HLB cards and details on card application. If my understanding is correct , for the first year if I spend 300k for local spending, I will get 1 skymiles for each rm1.22 spending ? This post has been edited by digidigi: May 4 2019, 10:19 AM |

|

|

|

|

|

May 4 2019, 11:03 AM May 4 2019, 11:03 AM

Return to original view | Post

#54

|

Senior Member

1,745 posts Joined: Jul 2015 |

QUOTE(charlesj @ May 4 2019, 10:41 AM) Good move by HLB to cooperate with Emirates. Assume u spend exactly 300k locally, the miles earning power between this and Amex platinum is roughly the same.Sign-on bonus - 10k miles Spend 300k - 150k miles Anniversary bonus (spend 300k) - 10k miles (why they split into 2???) Overseas spend (1.75 miles / RM4) = 0.44 mile / RM spend Local spend (1 mile / RM4) = 0.25 mile / RM spend Assuming you spend exactly 300k locally: You get 150k + 10k + 75k (set aside welcome bonus) = 235k miles / RM300k = 0.78 mile / RM spend (almost tally with your calculation 1 mile / RM1.22 spend) Pros: Mastercard, can use anywhere Include JomPay and Gov transaction (for 300k; but not sure whether it contribute for normal local spend - 0.25 mile/RM) Not many Msia CC can redeem Emirates miles 4x Emirates KLIA lounge Cons: Only can redeem Emirates miles High income requirement - 250k (not many people can achieve this) AF RM2500 Only 1 complimentary lounge access??? (exclude 4x Emirates KLIA lounge) Conclusion: Must spend RM300k, only worth getting this card (and of course must fly Emirates) If you are ready to pay for AF, you may look into Amex The Platinum Card instead (but it is Amex card) Hopefully more CC will offer reward for JomPay and Gov spending But jom pay and government spending not counted towards rewards point, and utilities, insurance etc also have much lower earning power. So this is a good card to spend on government spending and jompay where we earn nth with Amex. |

|

|

May 4 2019, 03:12 PM May 4 2019, 03:12 PM

Return to original view | Post

#55

|

Senior Member

1,745 posts Joined: Jul 2015 |

QUOTE(charlesj @ May 4 2019, 12:14 PM) Agree, but if you can't spend rm300k, no need to think about it If government spending and jompay not count for air miles, then it create opportunity cost to use this instead of m2p.Also, provided jompay & Gov consist of a large portion. Else I think better stick to M2P. Update: - Cardholder will be enrolled under LoungeKey. Complimentary membership = unlimited entry? Why it is stated 1x lounge access / year (for World Elite, but no mention anything for World card) - Based on product sheet, Retail Transaction EXCLUDE Gov spending and JomPay. Both the above will be accumulated towards 300k annual spending, but I think not eligible for local spend (RM4 = 1 mile category) Maybe I might just get it for one year then cut it, just to experience emirate new first class |

|

|

May 5 2019, 01:19 PM May 5 2019, 01:19 PM

Return to original view | IPv6 | Post

#56

|

Senior Member

1,745 posts Joined: Jul 2015 |

QUOTE(knwong @ May 5 2019, 01:17 PM) Anyone here is a Hilton Honors member? I need favour in purchasing Hilton Honor Points as I've maxed out mine. There's a promo now. TnC: Your account need to be at least 90 days old to transfer as Gift to me U buying the point for spending at which hotel? Mind to share?You earn your CC points by transacting in USD. I earn the matching bonus Win-win for you and me. If any kind soul willing to take the risk and transact with stranger like me, do PM. |

|

|

May 5 2019, 02:06 PM May 5 2019, 02:06 PM

Return to original view | IPv6 | Post

#57

|

Senior Member

1,745 posts Joined: Jul 2015 |

QUOTE(knwong @ May 5 2019, 01:32 PM) Hilton Garden Inn and Double Tree in either SG, HK and Australia. Want to accumulate for my future travels there But most of the time the cost using point vs cash rate at those hotel is quite similar.....I've already redeemed points for my past stays in HK, SG and London. If redeem the points for 5 days consecutive, the 5th night is FREE - making the cost of stay even lower Except Conrad maldive and Waldorf Astoria maldive , but the cost of boat transfer is astonishing |

|

|

May 7 2019, 02:49 PM May 7 2019, 02:49 PM

Return to original view | IPv6 | Post

#58

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

|

|

May 7 2019, 03:20 PM May 7 2019, 03:20 PM

Return to original view | IPv6 | Post

#59

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

|

|

May 9 2019, 11:44 AM May 9 2019, 11:44 AM

Return to original view | IPv6 | Post

#60

|

Senior Member

1,745 posts Joined: Jul 2015 |

|

| Change to: |  0.0913sec 0.0913sec

0.59 0.59

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 01:46 AM |