QUOTE(river.sand @ Jan 5 2016, 07:23 PM)

Don't know what fund you took profit of, but I am using Affin Hwang Select Asia (ex Japan) Quantum Fund to explain my point. See charts below...

In July 2008, just before the collapse of Lehman Brothers, the reference value was 116;

In Jan 2011, the reference value was 207.

You see, if I had this fund before 2008, and didn't take profit, I still got pretty decent return.

Of course, if I had sold in April or May 2008, and bought back in early 2009, my return would be greater. But alas, I could not foresee the imminent market crash.

And, if I took profit in Jan 2011, I would have missed the growth until 2015.

I said PM UTC, so they are Public Mutual funds. Took profit meant sold some units so that you're back to same value as initially invested. All profits switched into money market fund. I hope we are on the same page when talking about taking profit.

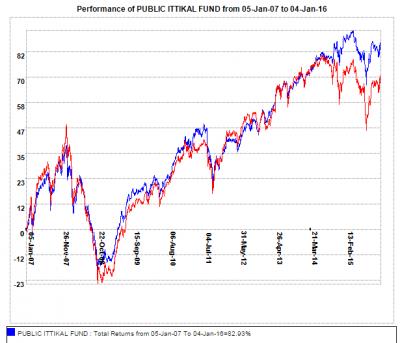

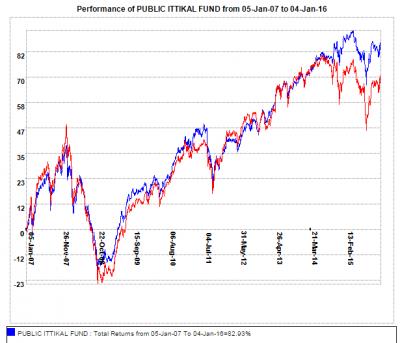

Your example using AHSAQF is not applicable as this Ponzi 1.0 fund is asia pac small cap while my funds were EPF approved funds mainly Malaysia large cap equity. Below is a good performing Public Mutual Ittikal Fund. If I just go with the ride, the fund value was stagnant for 3 years. With the switch, I made over 35% profits over the same period.

This post has been edited by kimyee73: Jan 5 2016, 11:42 PM

This post has been edited by kimyee73: Jan 5 2016, 11:42 PM

Jan 5 2016, 09:17 PM

Jan 5 2016, 09:17 PM

Quote

Quote

0.0294sec

0.0294sec

0.35

0.35

6 queries

6 queries

GZIP Disabled

GZIP Disabled