QUOTE(brotan @ Jan 15 2016, 10:21 AM)

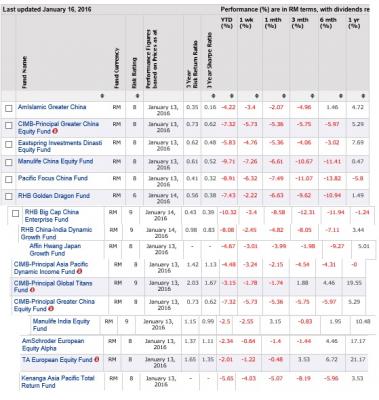

must have read this... "In order to screen out funds that meet the criterion of consistency in performance, we compare the funds’ calendar year returns against the benchmark return of 7.0%, for the period from 2011 to 2015.

The result showed that only the Kenanga Growth Fund and the Eastspring Investments Dana al-Ilham have successfully met the criterion. We have to award high commendation to the capabilities of these fund managers as they have consistently beaten our benchmark of 7.0%.

Kenanga Growth Fund and Eastspring Investments Dana al-Ilham, which are also our recommended funds, stood head and shoulders over the rest, as these funds achieved 5-year annualized returns of 17.8% and 13.4% respectively, comfortably outperforming the benchmark by 7.0% on an annualized basis.

http://www.fundsupermart.com.my/main/resea...ds-in-2015-6702

Jan 15 2016, 10:58 AM

Jan 15 2016, 10:58 AM

Quote

Quote

0.0511sec

0.0511sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled