QUOTE(Belphegor @ Mar 1 2016, 09:57 AM)

Wanna ask, what do you guys see in Eastspring? Just recently invested in, small amount though. Not really sure if that's good. Having plans in investment but not sure if which is good UT/investments to go for.

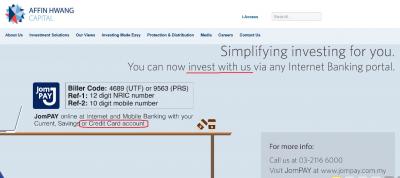

from the attached, I see many things...some I liked, some I don't like.

some are within my risk appetite, and some are not.

when got time, do read this.....while waiting for more value added responses....

http://www.fundsupermart.com.my/main/school/school.svdo

Attached thumbnail(s)

Mar 1 2016, 12:25 PM

Mar 1 2016, 12:25 PM

Quote

Quote

0.0448sec

0.0448sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled